Discover the Secrets Behind the Most Powerful Trading Indicators

This is where indicators come into play, those mysterious and powerful tools that the most successful traders use to unravel the market's enigmas. But what are the most popular indicators? And what strategies are hidden behind them?

The Enigma of Indicators

From the famous RSI (Relative Strength Index) to the intriguing MACD (Moving Average Convergence and Divergence), trading indicators have captured the imagination of novice and experienced traders alike. But what makes them so powerful?

The answer lies in its ability to reveal hidden patterns in market data. These indicators are like flashlights in the dark, illuminating investment opportunities that would otherwise go unnoticed. But how to make the most of its potential?

The Strategies That Transform Newbies into Trading Masters

Behind each indicator is a unique strategy, a secret formula that turns numbers into profits. From identifying trends to detecting potential entry and exit points, these strategies are the heart and soul of successful trading.

For example, the RSI not only indicates whether an asset is overbought or oversold, but it can also be used to forecast possible trend reversals. Likewise, the MACD not only shows the difference between two moving averages, but can also signal changes in market direction.

The Power of Information and Strategy

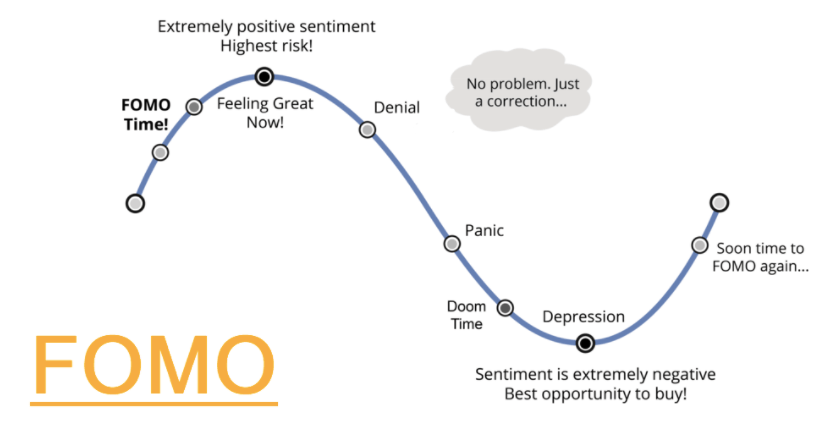

But here's the real secret: indicators are just tools. Without a solid strategy and careful market analysis, they are little more than toys to distract the unwary.

The true power of trading lies in the combination of information, strategy and discipline. The best traders do not blindly rely on a single indicator, but rather use a variety of tools to confirm their decisions and minimize risk.

Here are some examples of popular indicators on TradingView:

Simple Moving Average (SMA): This indicator calculates the average of closing prices over a specific period. It is useful for identifying general market trends.

Relative Strength Index (RSI): The RSI measures the speed and change of price movements. It is used to determine whether an asset is overbought or oversold, which can indicate possible reversal points.

MACD (Moving Average Convergence and Divergence): This indicator shows the relationship between two moving averages of an asset. It is used to identify changes in price direction and possible entry and exit points.

Bollinger Bands: These bands consist of a moving average and two standard deviation bands above and below the mean. They are used to measure market volatility and identify potential turning points.

Stochastic: This indicator compares the closing price of an asset with its price range over a specific period. It is used to identify possible overbought or oversold areas.

In short, indicators are the trader's compass in a sea of uncertainty. But to truly dominate the market, you need more than just tools. It takes knowledge, skill and a pinch of intuition.

So, the next time you find yourself lost in the trading maze, remember: indicators can be your most powerful allies, but only if you know how to use them correctly.

References

https://www.ig.com/en/trading-strategies/10-trading-indicators-every-trader-should-know-190604

https://www.investopedia.com/articles/active-trading/041814/four-most-commonlyused-indicators-trend-trading.asp

https://www.dailyfx.com/education/technical-analysis-tools/4-effective-trading-indicators-every-trader-should-know.html

https://www.investopedia.com/articles/active-trading/011815/top-technical-indicators-rookie-traders.asp

https://www.investopedia.com/top-7-technical-analysis-tools-4773275

https://www.axi.com/int/blog/education/trading-indicators