Prediction market in crypto | Apply the wisdom of the majority

Hot events such as the US presidential election, ETF approval, FED interest rate increases and decreases, and the upcoming Euro 2024 will help the prediction market in crypto explode.

What is a prediction market in crypto?

A prediction market in crypto is a platform that allows users to bet on the outcomes of future events without relying on a third party.

The mechanism of operation of the prediction market is as follows:

first.Create event: A future event will be created with full information including: questions, rules, processing date, results, information source announcing the results,...

2.Trading: Depending on each platform, the trading mechanism may be different, but the general title will be a set of Yes/No options in which the purchase price will represent the predicted probability of the event. there. The higher the ratio, the lower the profit ratio and vice versa

3. Get results and complete the transaction: On the processing date, the results are announced from the information source. The party who predicts correctly receives a corresponding profit rate, the party who predicts incorrectly does not receive payment.

· Choosing Yes: Buying an option predicting Yes would cost 95.8¢

· Pick No: Buying an option predicting No would cost 5.6¢

· Because the zkSync team has confirmed the token issuance time, the Yes rate is exceptionally high.

If zkSync releases a token before June 30, Yes token holders will receive 1 USD per token, equivalent to a 4.3% profit for buyers at the current price.

If zkSync suddenly does not issue tokens, buying Yes will lose all value. Buying No at the current price will bring a profit of 1,785%.

Note: The price of the option will fluctuate depending on the market situation. If there are many facts supporting the event occurring, the price of the YES option will increase and vice versa.

Apply the wisdom of the masses and opportunities from the prediction market in crypto

Benefits of prediction markets in crypto include:

1/ Avoid third party influence

Unlike traditional platforms, prediction markets in crypto are not controlled by third parties. This helps avoid fraudulent third parties not paying or adjusting rates in favor of the few.

2/ Increase user experience

Users can easily participate without providing relevant information. The profit ratio is also more optimized when there is no need to divide % to a third party.

On some platforms, such as Polymarket, options are placed in the form of tokens with a calculation mechanism based on Uniswap V2's Orderbook and AMM models. Users can buy/sell their transactions at any time instead of having to wait until the event ends. This gives users more flexibility in managing risks as well as taking profits.

3/ Apply the wisdom of the majority

Rates in the prediction market represent the beliefs of a set of users in a particular topic. The larger the group of participating users, the more comprehensive the value reflected in the prediction results. This is an effective tool to measure and evaluate community thoughts instead of just subjective feelings.

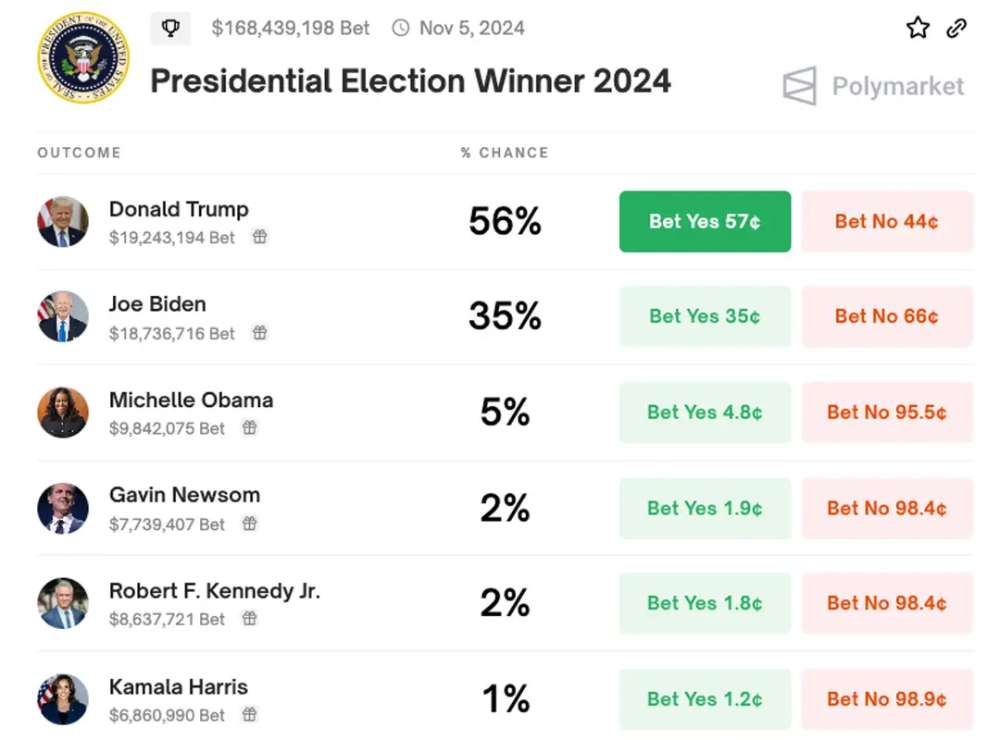

The ratio shows that Mr. Trump is the most expected to become the next president

Monitoring the prediction market will also provide signals or filters for a certain event.

For example:

At the end of May, President Trump was indicted on 34 charges related to bribery activities. However, at that time, the betting odds for the Trump box remained the same, and even increased later.

In a market where users own many tools, have knowledge of related fields and are sensitive to news or even know confidential information. Variations in betting odds can be an aid to the evaluation process.

Of course the majority opinion is not always correct. Typically, it can be seen in sports matches where strong teams can also lose against lower rated teams. Therefore, users should only use the prediction market rate as a tool for their own decision making.

Overview of the prediction market in crypto

Prediction markets are a prominent model in traditional markets and there have been quite a few projects developing along this path in crypto. Among these, there are many names that have been launched and have been operating for a long time such as Polymarket, Augur, Plot, Hedgehog,...

Although launched a long time ago, projects in the predicted market group have not attracted much value. The reason lies in poor liquidity and many limitations in the user interface. Projects that attract significant value are currently only Polymarket and Azuro. With Azuro, the project is still poor in terms of product. Most of the current attraction value comes from point programs.

Polymarket with neat products and no platform fees is gradually becoming a destination for liquidity through hot events such as: 2024 US presidential election, approval of BTC and ETH ETF, increase or decrease of interest rates of the FED and Upcoming is Euro 2024,... The project also recently announced a Series B capital round of 45 million USD with the participation of Vitalik, Founders Fund.

Looking at the volume chart on Polymarket, we can see that the project maintains a certain amount of transactions each month even before there is capital call information. With the advantages provided and the ability to receive airdrops, users with small and medium capital tend to return to using prediction markets in crypto. Users who want to invest large amounts of capital are still limited due to low liquidity.

What to expect from the prediction market in crypto?

According to statistics and predictions of Precedence Research, the traditional predicted market size in 2022 is 10.2 billion USD and is predicted to expand to 67.86 billion USD in 2032. Crypto projects with the above advantages have the opportunity to grab a piece of the market pie.

Currently, the prediction market in crypto is not yet developed due to:

· The crypto market is relatively small in size and the user base is not large enough

· Liquidity on platforms is limited

· The above two factors can be reinforced with the development of the crypto market in general.

With the advantage of transparency, data from the crypto market can be applied to provide insights to users and other platforms.

summary

The prediction market in crypto, although still small in scale, has good room for growth along with the general market. With many events taking place in 2024, prediction markets are likely to continue their growth momentum and attract more loy