ETH Price Targets -2024/2025

Ethereum price targets and analysis for the coming bull run Mount ETH.

Mount ETH.

Ethereum is proving to be the apex smart contract predator. The entire narrative of “ETH Killers” has gone the way the Walkman: all the rage for a short while, but old news and completely pointless once CD’s hit market. (Yes, vintage reference).

No longer are projects looking to replace ETH, but instead many erstwhile ETH killers are now transitioning to ETH Layer 2s, instead opting to join Ethereum and build upon, contribute and benefit from the Ethereum ecosystem.

Put simply, Ethereum is here to stay and will continue to retain the lion’s share of users and TVL. A handful of competitors with unique selling points will solidify their positions as successful competitors in specific niche markets (eg Solana for gaming and NFTs), but ETH has finally attained the status of an OG coin that is here to stay.

ETH Price Targets:

Let’s get right down to it. I will use a handful of methods to evaluate the potential price of ETH during the coming bull run, with a view to creating a range of likely price outcomes. Frankly though, this should be considered some number crunching, logical analysis and a little bit of crypto astrology (TA), so take it all with a grain of salt. Also, these predictions are based on data crunching combined with some assumptions.

Method 1: ETH Cycles

Using the 2017 vs 2021 Bull cycle ETH prices to predict 2025 price targets. The low number of data points gives a higher potential margin of error, however it also gives some solid context on potential price movements based on the last two cycles.

i) ATH to ATH Target: $16,565

Jan 2018 ATH of $1,420 to Nov 2021 ATH of $4,850 yields a 3.42X from ATH to ATH. If this were to repeat, we would see an ETH ATH of $16,565 before accounting for burn.

ii) ATL to ATH Target: $53,350

This is obviously outlandish, as it is based on ETH’s first true cycle which saw outsized drawdowns. ATL in Dec 2018 of $80 to the ATH in Nov 2021 of $4,850. Consider this an ultra bull scenario for your daily dose of daydreaming.

Method 2: ETH to BTC Ratio

In this method we will use the BTC multiples in previous cycles to determine a predicted BTC price in 2025, and then apply an ETH:BTC ratio to it. My assumptions here are two-fold: ETH dominance increases and the ETH:BTC ratio closes in on 0.10, while BTC performs similar to the last cycle at about 3.5X ATH to ATH.

ETH at 0.1BTC (ATH to ATH): $23,930

Uses BTC 2017 ATH $19,865 to 2021 ATH $68,950 which yields a 3.47x multiple, giving a BTC ATH in 2025 of $239,320. I believe this is a strong possibility, if perhaps somewhat on the optimistic side. I have also discounted the ATL to ATH as it was heavily skewed by the Covid crash and would yield an outlandish (though not impossible) $341,000 BTC and $34,100 ETH.

Method 3: Crypto Market Share

This method utilizes the total crypto market cap and applies the predicted ETH dominance. 2017 ATH crypto MC was approx. $1T and in 2021 reached $3T. Applying the same multiple yields a total crypto MC of $9T in 2025.

ETH at $9T Crypto MC: $15,000

Assumes 20% ETH dominance, $9T MC and 120M ETH issuance/circulating.

Summary:

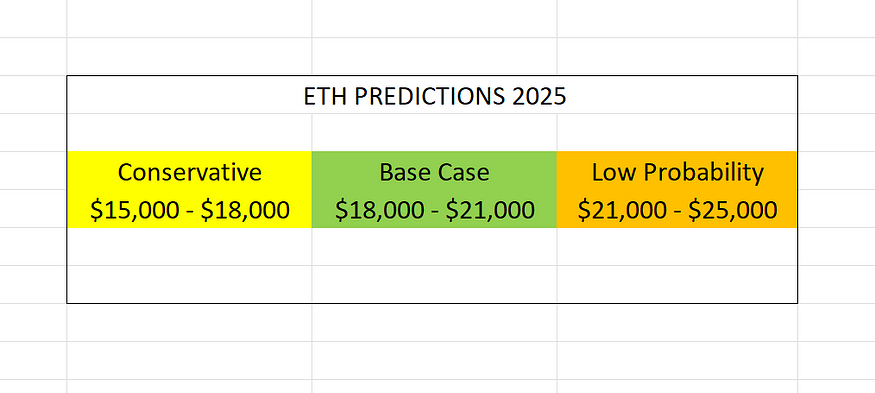

If we discount the outlier predictions, we get a range of ballpark ETH prices of anywhere from $15,000 to $23,930 without adjustments for market conditions.

Given the record low exchange balances, a burn mechanism that could make ETH materially deflationary, increasing staking rates, and ETF approvals on the horizon, it is my expectation that ETH achieves or exceeds the higher end of these predictions. See my current predictions below, as well as the primary reasons I believe ETH will have such a successful 2024 & 2025 bull run.

- ETH staking is trending higher , currently above 20% of all ETH.

- ETF applications for ETH have been submitted, and will likely follow BTC ETF approvals very closely

- Low exchange balances

- Deflationary burn mechanism that will take off with bull run blockspace usage.

- L2 narrative building

- Web3 Gaming adoption will spike blockspace usage

- Macro pivot leading to risk-on markets in mid/late 2024

- Infrastructure has come a long way, account abstraction may finally allow for mass adoption.

ETH 2025 Predictions

ETH 2025 Predictions

Conclusion:

These predictions may seem a tad optimistic given the extended bear market we have endured over the last year and a half. The reality is, there have been a multitude of very bullish developments in that time, a flushing of the lettuce hands tourists, and a macro setup that I believe will act like a huge tailwind to the entire sector. You can only hold a beachball under water for so long, and when it bounces back it is going to fly much higher than most expect.