PayPal's Stablecoin PYUSD Surpasses $1 Billion in Market Cap

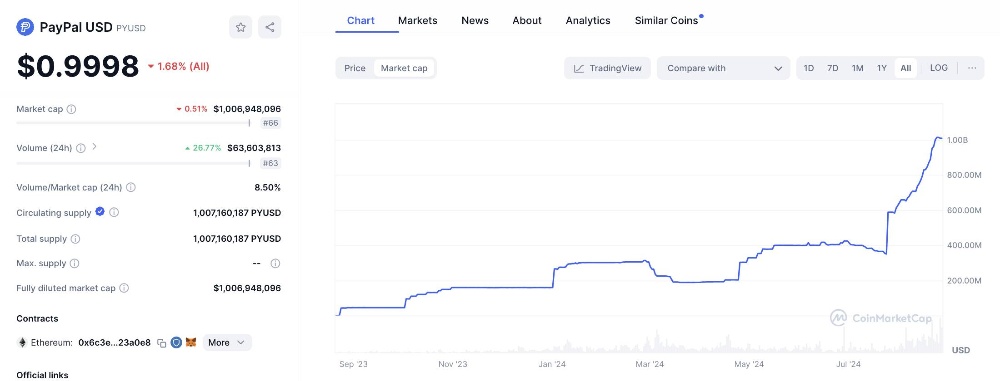

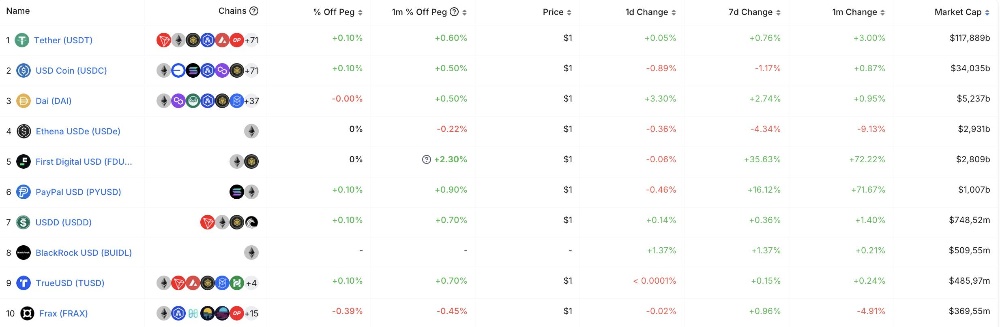

Just a few months after expanding to the Solana blockchain, PayPal's stablecoin PYUSD has quickly surpassed the $1 billion market cap mark, cementing its position among the top 6 largest stablecoins in the market.

According to data from Coinmarketcap, the PayPal USD (PYUSD) stablecoin has officially reached the $1 billion market cap mark after more than 1 year of launch with more than $1.007 billion PYUSD currently circulating on the Ethereum and Solana networks.

Launched in August 2023, PYUSD had a slow start on Ethereum's layer-1, reaching only $42 million in market cap. However, Paxos' efforts to increase PYUSD's visibility, such as integrating it into the Triple-A payment platform and supporting international payments, have helped the stablecoin's market cap grow steadily.

At the time of the announcement of its launch on Solana in May this year, PYUSD's market cap had reached $398 million, a 9x increase from its initial figure and a 46% increase from $273 million in January 2024 with the news that Aave had begun considering integrating PYUSD into its protocol.

The strategic move to expand to Solana has been a strong boost for PYUSD's development. At that time, Solana emerged as a popular blockchain with a transaction volume surpassing Ethereum, making the network a fertile ground for stablecoin projects looking to break out and increase their market recognition.

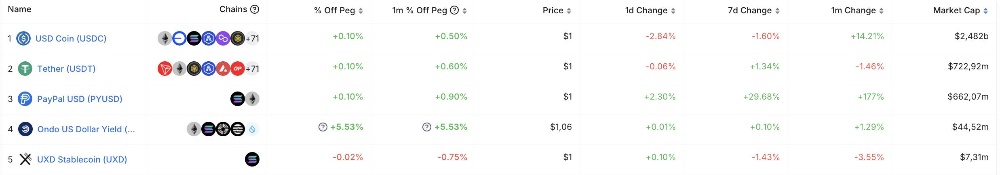

In just 3 months, PYUSD's supply on Solana has increased from 0 to over $650 million, quickly surpassing the supply on Ethereum and helping this stablecoin double its total supply since June 2024. Over the past month, PYUSD's market cap on Solana has skyrocketed 171%, moving closer to catching up with Tether's USDT stablecoin on this layer-1.

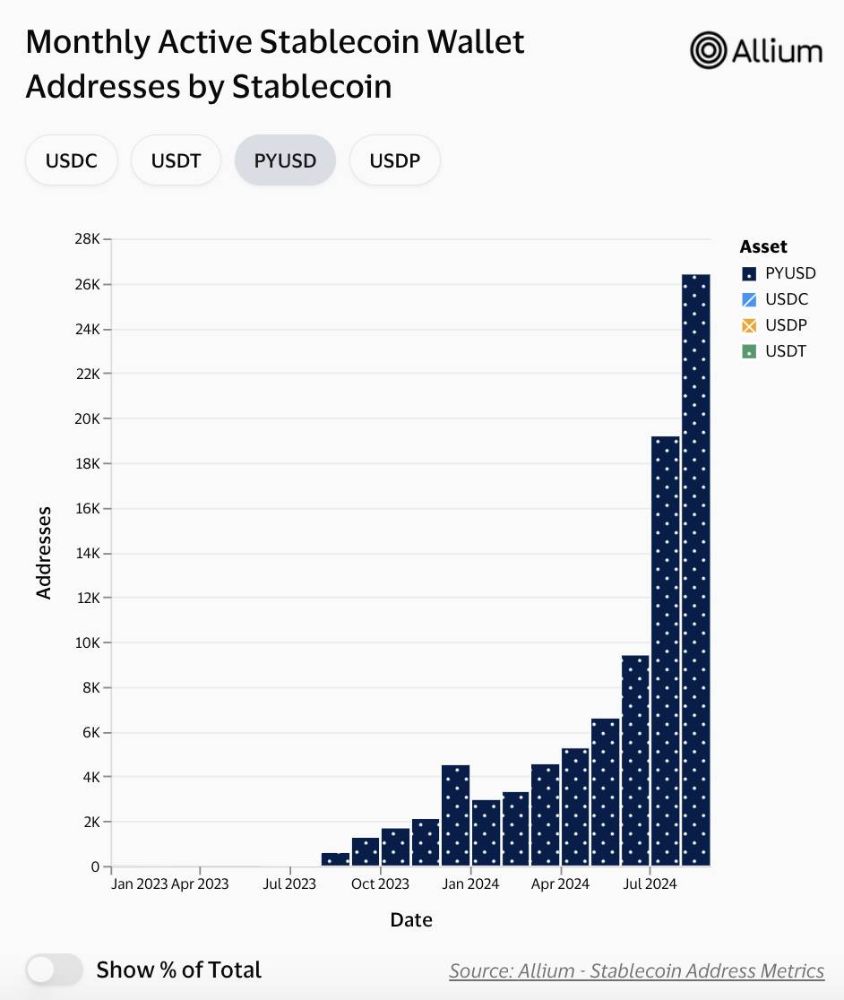

The number of monthly wallets using PYUSD has also skyrocketed from 9,400 in May 2024 to over 25,000 in July 2024.

Explaining the impressive growth of PYUSD in recent times, Tom Wan, strategist and business developer at 21.co, said:

"User incentive programs have played a very important role in the recent strong growth of PYUSD. In addition, integration with DeFi protocols on Solana has also been an important factor driving this growth."

Since its launch on Solana, PYUSD has been collaborating with DeFi protocols such as Kamino, Drift, and marginfi, offering incentives for users to use PYUSD as collateral with attractive annual yields. In addition, PYUSD has partnered with Anchorage Digital to attract institutional investors, offering a reward program for projects and businesses holding large amounts of PYUSD.

However, many analysts are concerned about the sustainability of PYUSD's growth after these incentives gradually disappear. David Shuttleworth, partner at research firm Anagram, said:

"These incentives are not sustainable because they are not designed to bring long-term benefits. The main goal is to bring more PYUSD onto the network and encourage users to use PYUSD in the Solana ecosystem."

Despite some success, PYUSD’s $1 billion milestone is still too small to compare with leading stablecoins such as USDC or USD Coin (USDC). Currently, USDT and USDC still dominate the market with capitalizations of $117.5 billion and $34 billion, respectively. PYUSD is only ranked 6th among the top stablecoins by capitalization, showing that there is still a big gap to overcome to be able to compete with these “giants”.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)