Meta Pool: More than a staking protocol

Congratulations to Meta Pool for #2YearsOfMetaPool!

From a base of staking across now 3 chains (Ethereum included) they're building a central hub for funding and liquidity.

More than liquid staking

More than a governance token

Let's dig into why this is such an innovative protocol in crypto and how you can get involved.

https://www.metapool.app/

Providing Liquidity

Liquid Staking

You can liquid stake across 3 chains: stNEAR, stAUR and mpETH. Currently it boosts one of the highest APYs for staked ETH.

Multichain liquid staking isn't new; there's a growing number of providers, but it's what else Meta Pool does that sets it apart.

https://www.metapool.app/stake

Protocol Liquidity

You can add liquidity to the underlying protocol pools to garner a share of the unstake fees.

Essentially you can directly participate in the protocol's main revenue model.

A better than rewarding in protocol tokens (aka Lido, RocketPool etc...) that may not may not see yields...

https://www.metapool.app/liquidity

Governance

Voting Power

You buy and lock the protocol token, $META, in order to participate in the voting on Meta Pool.

Longer locks get you more voting power.

https://www.metapool.app/vote/dashboard

Community Initiatives

Initiatives are proposals sourced from the community with the aim of growing the Meta Pool protocol and the wider NEAR ecosystem.

https://www.metapool.app/ambassadorvote

New proposals can be submitted via the Discord

https://discord.gg/9DzPZCzzxp

Voting for Validators

Votes can also be used to vote for NEAR validators and Meta Pool offers a detailed dashboard to make your choice of validator.

https://www.metapool.app/stakevote

Alternative fund raising

In traditional investing you risk all your funds in whatever investment vehicle you choose. This is especially high risk when it comes to fund raising for start ups and early stage projects.

Meta Pool has taken a different approach. They let you invest only your staking yield in new projects leaving your capital untouched.

Launchpad

Via Launchpad (also known as Meta Yield) you can invest your staking rewards (not the underlying staked assets) in start up projects.

It's essentially seed investing but as you only risk your staking rewards it's a much lower risk to investors by design.

https://www.metapool.app/yield

Meta Bonds: A seed funding marketplace

Bonds is the same idea as Launchpad only as a marketplace instead of separate campaigns.

You can sell your bonds from Launchpad projects here as well.

You bond your staked assets to exchange yield for early access to new project tokens.

At present the project is on hold with Meta Pool (as confirmed from Meta Pool in their Discord).

https://www.metapool.app/bonds

Some potential alpha...

In talking with the the team on Discord they confirmed that both Meta Yield (Launchpad) and Meta Bonds (Bonds) have been audited for Ethereum and Aurora, but we're yet to see them actively pushed out to new projects in those markets.

Here we're mainly referring to Ethereum as that is the largest liquidity market in crypto today.

The team hinted there may well be some news soon so make sure you're subscribed to stay up to date with the latest news.

Twitter: https://twitter.com/meta_pool

Telegram chat group: https://t.me/MetaPoolOfficialGroup

Blog: https://blog.metapool.app/

Medium: https://medium.com/@meta_pool

TikTok: https://www.tiktok.com/@meta_pool_app

YouTube Channel: https://www.youtube.com/c/MetaPoolNEARliquidstaking

LinkedIn: https://www.linkedin.com/company/meta-pool

NEAR Social: https://social.near.page/u/meta-pool-official.near

Learn NEAR Club: https://learnnear.club/author/meta-pool-official-near/

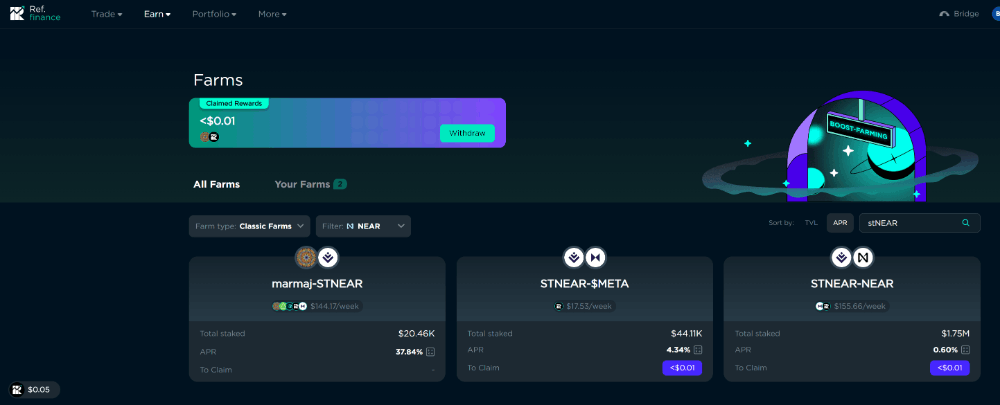

stNEAR & META on Ref Finance

It would be remiss of me not to mention that you can use your stNEAR and META in LPs (liquidity pools) on Ref Finance.

Rates will vary over time as will rewards but it's often a good way to earn more yield from your held assets.

It is important to note that LPs expose you to the very real risk of IL (impermanent loss) which is usually a higher risk than the smart contract risk and slashing risk liquid staking represents so bear that in mind when deciding on your asset allocations.

https://app.ref.finance/v2farms

Learn More. Earn More.

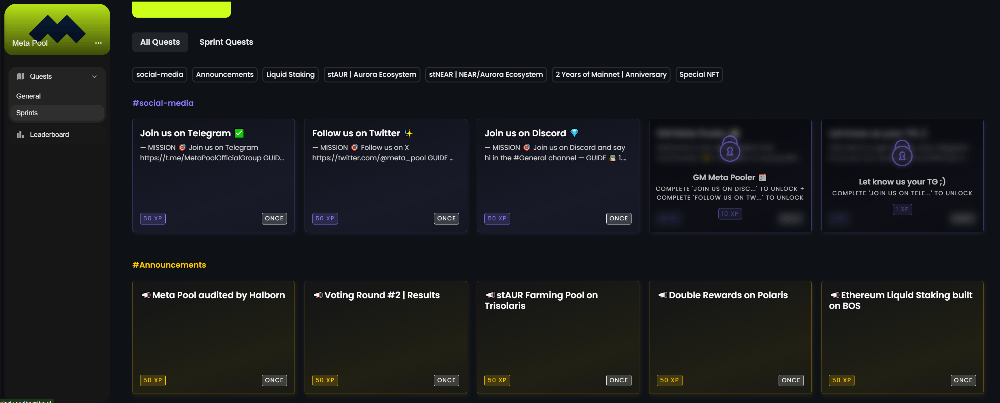

If you want to learn more about Meta Pool and the NEAR ecosystem why not join up to the Meta Pool Zealy campaign?

If you want to learn more about Meta Pool and the NEAR ecosystem why not join up to the Meta Pool Zealy campaign?

Sprints quests end Sept 21st so don't delay!

https://zealy.io/c/meta-pool/invite/kuwHURB8d7pdaDaMcCyyL

I'm really enjoying their Zealy campaign. It's got all the hallmarks of a well though out and executed project.

Let's dig in a little to see why it's so good (and how you can use these ideas in your own campaigns).

Get the basics right

The basics for a Zealy campaign are:

- Get your audience engaged with your core social platforms

- Get your core messaging amplified by your community

In this respect Meta Pool have hit all the right notes.

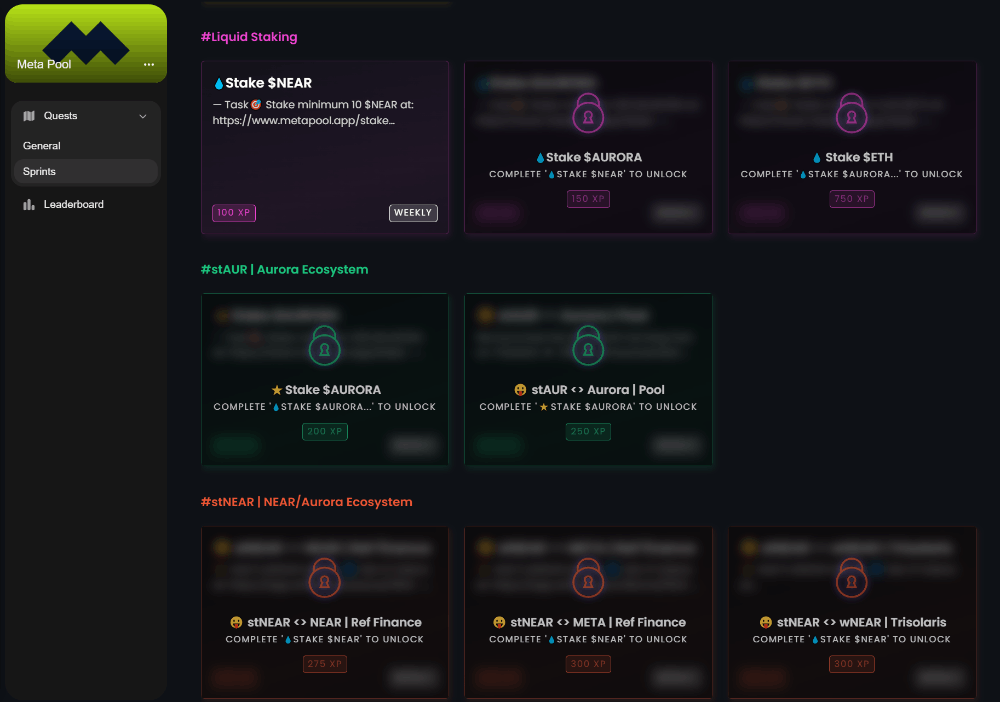

Focus on the product

The goal of a Zealy is to educate and engage your audience with your product. In this respect Meta Pool have again done a great job by creating a wide range of basic protocol interactions.

Make each campaign unique

You want to make each of your Zealy campaigns feel unique and to this end Meta Pool have done a great job theming this campaign around their 2 year anniversary by adding a set of quests devoted to this theme.

It's still really early days for Meta Pool which means there is lots of chances to get involved. Joining up to the Discord and engaging with the Zealy campaign is a great way to start.

If you're interested in the NEAR defi ecosystem more broadly check my BULB post about it here https://www.bulbapp.io/p/6b0fcb17-bbd5-4f40-8f1e-4830bb45af84/core-near-defi-infrastructure?s_id=8c185f20-97c2-4dde-902f-98525630bfee

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)