Blur NFT Marketplace Review 2024: Leader in NFT Trading

Few phenomena in the cryptoverse have captured the imagination quite like non-fungible tokens (NFTs), a term that entered the common man's lexicon after Twitter (now X) co-founder Jack Dorsey sold his first-ever tweet as an NFT for $2.9 million (currently with an offer to sell for $3,159)

Initially hailed as a groundbreaking innovation, NFTs surged into the mainstream, captivating investors, artists, and collectors with promises of digital ownership and unprecedented creative expression.

However, amidst the tumultuous fluctuations of the crypto market, NFTs seemed to fade into the background during the so-called "crypto winter," leaving many to wonder if the hype had fizzled out.

In 2022, as NFT volumes showed signs of softening, an NFT marketplace was born that would go on to become the largest such venue within a span of a few months.

In this Blur NFT Marketplace review, we delve into Blur's key offerings and what sets it apart from competitors.

Blur NFT Marketplace Review Summary:

Blur is the leading NFT marketplace that can integrate with multiple marketplaces, has advanced transaction features and its Blend platform allows for easy trading of your favourite NFTs.

The Key Features of Blur NFT Marketplace Are:

- Sweeps: Blur enables users to swiftly acquire the lowest-priced listings within any collection with a single click. Refine your search with customizable filters to tailor your sweep to perfection.

- Bidding: Transparency reigns supreme on Blur, offering users insights into pricing dynamics through bidding. Easily track bid volumes across different price levels for informed decision-making.

- Trader View and Collector View: Whether you're a trader seeking charts or a collector craving detailed insights, Blur has you covered. Seamlessly toggle between views to gain a comprehensive understanding of the market before making significant purchases.

The State of the NFT Market

After peaking in the spring of 2022, the NFT market faced a major downturn. That has changed recently, however.

The NFT market has been witnessing a notable resurgence in recent months, and this upward trajectory persisted into January, with a reported trading volume of $1.5 billion, according to DappRadar. While the figure reflects a 16% decline from December 2023, it is still indicative of substantial activity within the space.

The number of NFT transactions recorded in January stood at 5 million, signalling a modest 3% decrease from the previous month. The count of unique traders participating in NFT trading activities in January totalled 903,479, representing a slight drop of 2.9% compared to the preceding month.

In March 2024, as Bitcoin's price was within striking distance of its all-time high, someone spent 4,500 ether, or over $16 million at the then-current prices, for a CryptoPunk NFT.

What is Blur NFT Marketplace?

Blur is an NFT marketplace that offers a streamlined experience free of clutter and distractions. Here, you'll find only the finest NFTs alongside relevant statistics, without the need to sift through countless pages of questionable listings or distracting banners.

What sets Blur apart is its decentralized nature — it operates as an app on the Ethereum blockchain. Additionally, Blur features its own governance token (BLUR), empowering the community to shape the platform's future through democratic decision-making.

But the real magic of Blur lies in its ability to track trends, identify top projects, and effortlessly navigate collections. Acting as both a standalone marketplace and an NFT aggregator, Blur brings together billions of dollars worth of listings, allowing users to thoroughly analyze the market before making informed trades.

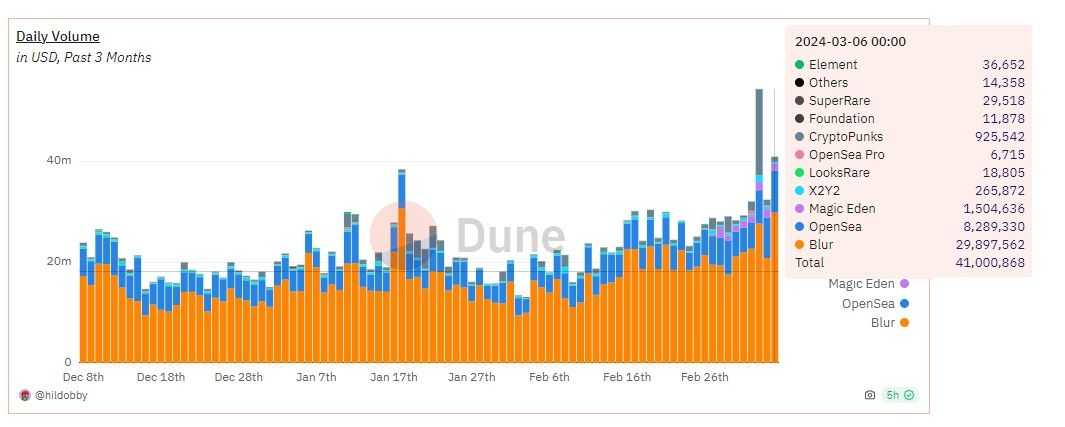

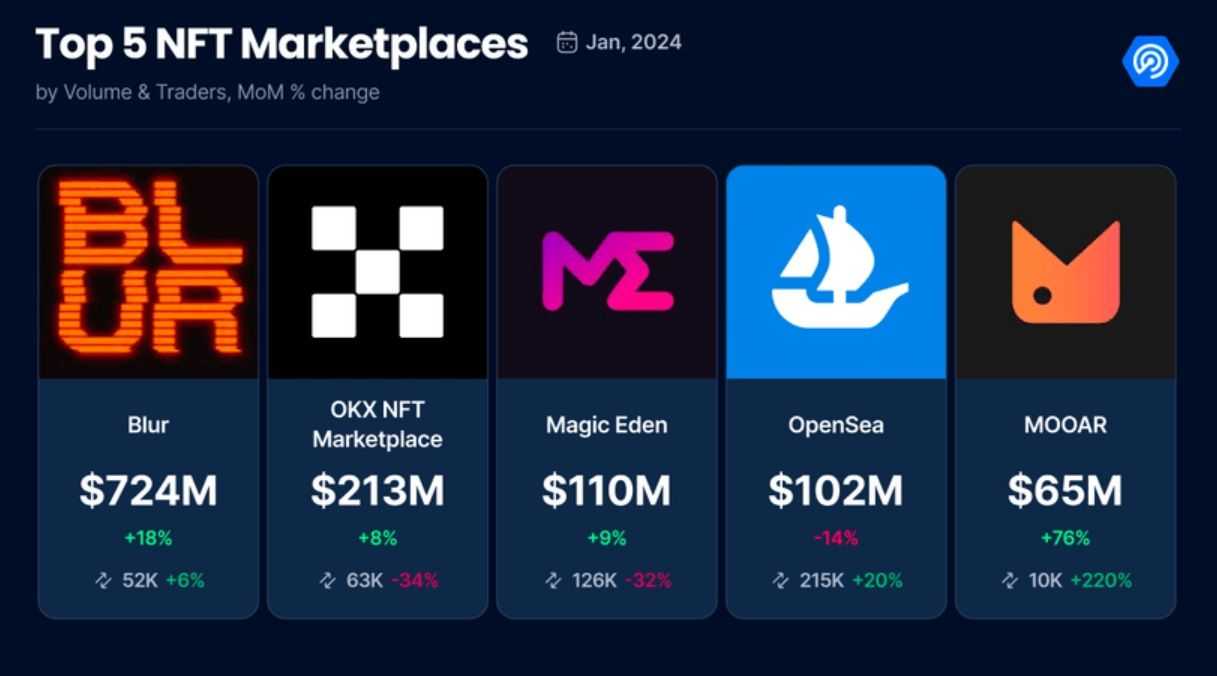

The platform has quickly gained traction, outpacing competitors. Currently, Blur's NFT trading volume more than triples that of OpenSea. Blur also commands an over 66% market share of the NFT marketplace

Today, Blur is the leader in NFT trading. However, it's worth noting that Blur only accounts for a mere 4% of NFT sales, suggesting a focus on facilitating the trading of high-value NFT collections. The average price of an NFT on the Blur platform reached $3,260 in January, an 11% increase from the previous month.

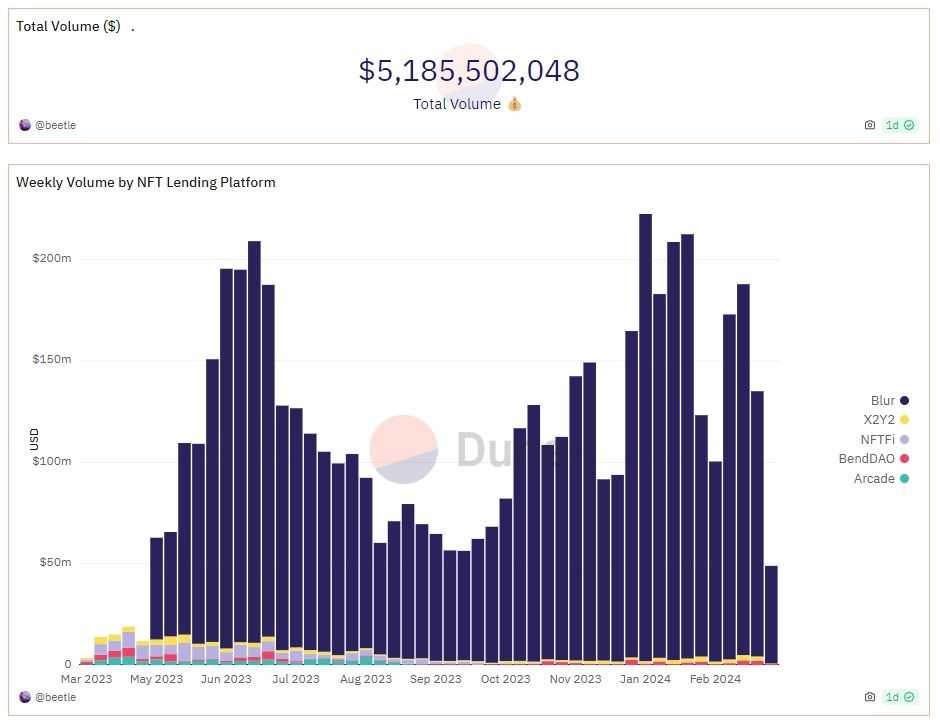

What is Blur's Blend?

Blend is a peer-to-peer perpetual lending protocol that introduces a novel approach to collateralized lending, particularly with a focus on NFTs. The protocol is designed to operate without reliance on oracles, avoiding the need for external price references for NFT valuation or interest rate determination.

Additionally, Blend eliminates the concept of loan expiries, allowing borrowing positions to remain open indefinitely until liquidated, thereby streamlining the borrowing process and reducing gas costs for borrowers.

The key features of Blend include:

- Market-Determined Interest Rates: Blend matches borrowers seeking loans against their NFT collateral with lenders offering competitive rates through an off-chain offer protocol. Interest rates and loan-to-value ratios are determined by the terms offered by lenders.

- Flexible Borrowing: Borrowers have the flexibility to repay their loans at any time, while lenders can exit their positions through a refinancing auction mechanism, triggered either by expiration or by the lender's decision to terminate the loan.

- Refinancing Auctions: In case of non-repayment or lender termination, a refinancing auction is conducted to find a new lender willing to take over the loan at a new interest rate. If the auction fails, the borrower is liquidated, and the lender takes possession of the collateral.

- Continuous Loans: Blend allows for indefinite borrowing periods, with loans continuing until interacted with by users. Interest accumulates continuously, and borrowers can adjust their borrowing amount or seek better rates by atomically initiating new loans against their collateral.

- Governance Considerations: While Blend minimizes reliance on governance for collateral valuation and loan parameters, certain protocol parameters such as fees, maximum interest rates, and auction formulas can be adjusted by BLUR governance after a waiting period to ensure optimal protocol performance.

Buying an NFT on Blur

Buying an NFT is a fairly straightforward affair with one major caveat.

Blur is exclusively compatible with the Ethereum network, meaning that connecting with a budget-friendly network with Arbitrum will be met with disapproval. Nevertheless, this limitation aligns with the fact that NFTs on Blur operate solely on the Ethereum blockchain. For serious traders and collectors, a higher gas fee may be a negligible cost when dealing with million-dollar NFTs.

Blur offers several features to buyers:

- Price Feeds: Blur sources pricing directly from the blockchain, ensuring up-to-date information on NFT listings.

- Sort by Price: Although the sorting mechanism may be cumbersome, users can arrange NFTs by price within collections, albeit not site-wide.

- Sweeps: Blur facilitates bulk purchases within collections, allowing users to acquire up to 30 NFTs at once and apply filters to refine their selection.

- Scores: Each NFT on Blur is assigned a rarity score based on its traits and rarity within the collection, providing valuable information for traders.

- Bidding: Engaging in bidding on Blur not only offers the chance of securing a better deal but also potentially earning BLUR tokens.

- Transparency: Blur provides transparency by revealing bid amounts and buyer demand, offering insight into the true value of NFTs.

- Flagged NFTs: Blur includes a toggle to display or hide NFTs flagged by OpenSea as potentially stolen, offering added security for buyers.

- Bookmarks: Users can bookmark collections of interest for easy access, streamlining the browsing experience.

- Filtering Feature: Users can easily search and filter NFTs based on specific features, enhancing the browsing experience.

Selling an NFT on Blur

To initiate the sale of an NFT, simply navigate to the portfolio tab to view your available listings. Blur streamlines the process by filtering out spam NFTs and trading-position NFTs, ensuring a clutter-free environment where you can easily manage your collection.

It's important to reiterate that NFTs from collections unsupported by the platform won't be displayed. Additionally, nonEthereum-based NFTs, such as those on Polygon, won't appear either.

For Blur-supported NFTs, you're good to go. You can set the price and establish a floor price for specific traits. The listing interface conveniently displays the current floor price for your collection.

You can choose from a range of listing durations, from as short as one hour to as long as six months. Additionally, you have the option to cross-list your NFTs on platforms like LooksRare and OpenSea to maximize exposure.

Blur NFT Marketplace Fees

For years, OpenSea dominated the NFT trading landscape, commanding a 2.5% royalty fee on every sale. High-profile collections reaped millions of dollars in monthly revenue through the platform.

However, Blur disrupted the status quo by enticing traders with bonuses tied to platform activity and introducing an alluringly low royalty fee of 0.5%. Initially met with resistance due to concerns about diminishing creators' earnings, Blur's move forced other marketplaces to follow suit.

BLUR Token

BLUR operates as an ERC-20 token, serving as the governing mechanism for essential aspects of both the Blur marketplace and the Blend lending protocol.

These parameters are pivotal in determining the value accrual and distribution within the protocols. Voting rights are directly tied to the quantity of BLUR tokens held by a user or delegated to them. To activate their voting power, users must delegate their token balance to a designated address, be it their own or that of another participant.

BLUR Tokenomics

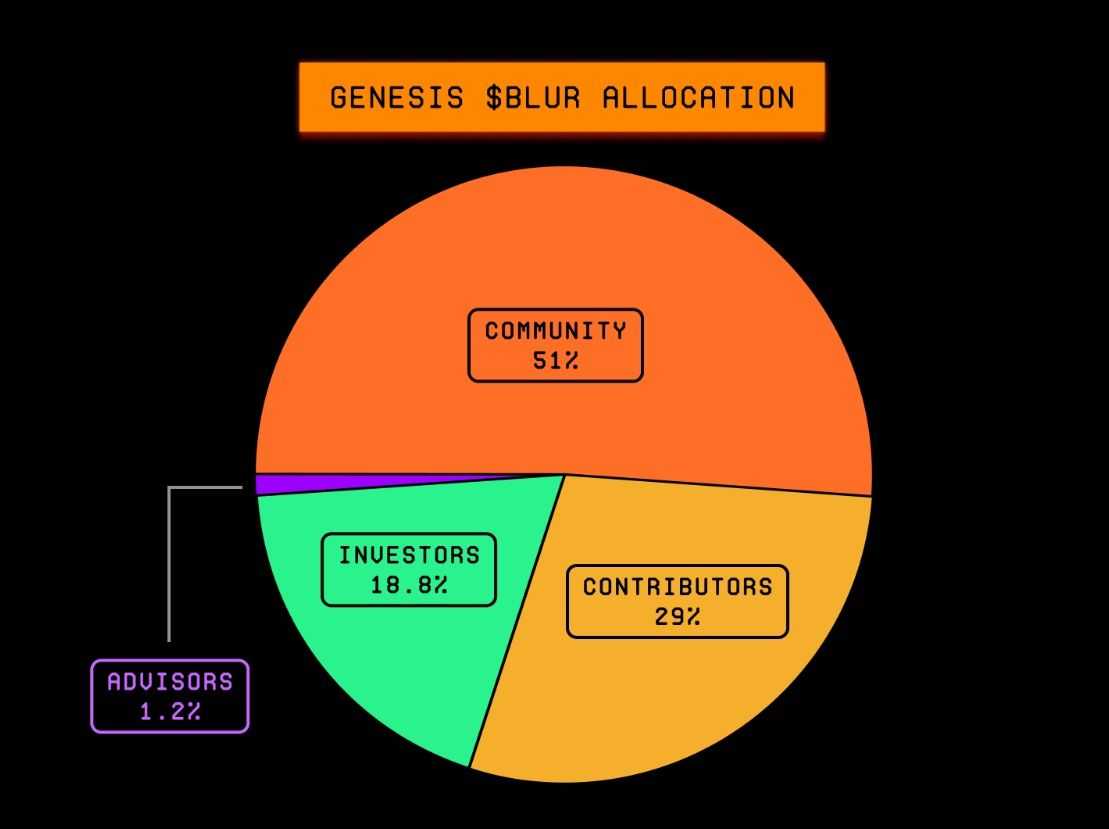

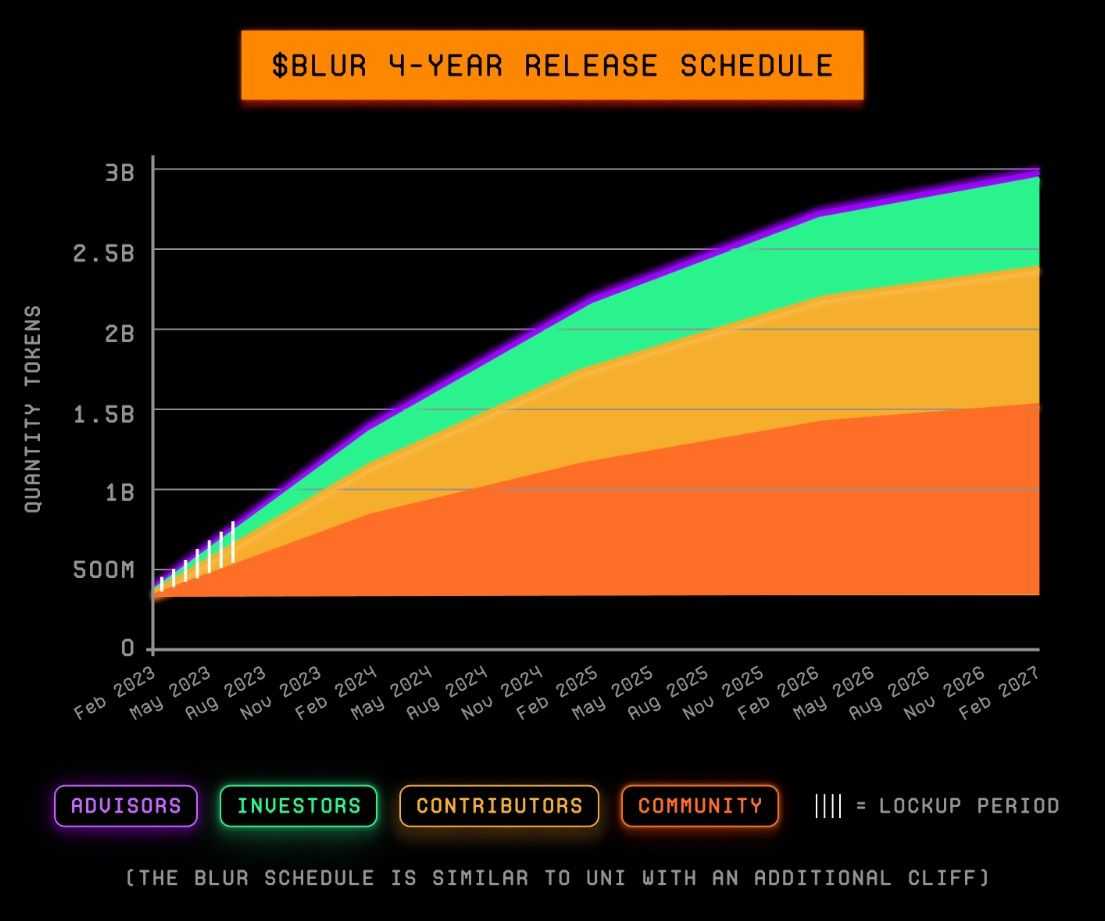

The genesis minting of 3 billion BLUR tokens is set to be gradually accessible over four to five years. The initial allocation breakdown is as follows:

- 51% allotted to Blur community members, totalling 1,530,000,000 BLUR.

- 29% designated for past and future core contributors, subject to a four-year vesting period, amounting to 867,601,888 BLUR.

- 19% earmarked for investors, also with a four-year vesting period, comprising 565,633,826 BLUR.

- 1% allocated to advisors, with vesting extending over four to five years, totalling 36,764,286 BLUR.

The Community Treasury is endowed with 12% of the total BLUR supply, equating to 360 million BLUR. This portion could be claimed immediately by all NFT traders across any marketplace from Oct. 19, 2022, to Feb. 14, 2023, as well as by historical users of Blur who are entitled to Care Packages, and creators.

With 12% of tokens available for historical and prospective community members to claim, the community treasury possesses 39% of the total BLUR supply for distribution among the community through various means such as contributor grants, community initiatives, and incentive programs.

The vesting of BLUR tokens to the Community Treasury will occur continuously according to the following schedule:

Core contributors and launch partners' BLUR allocations will undergo a vesting process following a uniform schedule, featuring an additional four-month cliff specifically for transfer activities. On the other hand, advisors' BLUR allocations will vest gradually over a span of 48 to 60 months, incorporating a cliff period ranging from four to 16 months.

Where to Buy BLUR Token

If you're looking to get your hands on BLUR tokens, you can check out centralized exchanges like Bybit, MEXC, Binance, Gate.io and Kraken. Also, head over to your article where we highlight the best crypto exchanges.

BLUR Airdrops

Blur garnered significant attention in February 2023 when its BLUR native token was introduced to the market. Approximately 12% of the coin's circulating supply was distributed to users via an airdrop, signalling the conclusion of Season 1 of its incentivization program.

Active participants who contributed to liquidity provision and engaged in trading activities were generously rewarded with Care Packages. These packages held substantial value for users with some recipients finding themselves in possession of tokens valued in the millions of dollars.

In November 2023, Blur concluded Season 2 of its highly anticipated airdrop, distributing 300 million BLUR tokens, valued at $107 million at the time. One user claimed $11 million in BLUR rewards.

Blur vs OpenSea

Shortly after its launch, Blur started chipping away at its competitors' market shares. CoinGecko data revealed that shortly after its debut, Blur accounted for 4.2% of the market with a total trade volume of $23.39 million. Within two months, Blur's share ballooned to 23.5%, surpassing Magic Eden to claim the title of the world's second-largest NFT marketplace. It surpassed OpenSea as the largest NFT a few months later.

OpenSea responded to Blur's rise by implementing various tactics. Initially, OpenSea barred NFT collections minted on its platform from appearing on Blur due to the latter's flexible approach towards creator royalties. Unlike Blur, OpenSea's model enforces creator royalties as mandatory.

Closing Thoughts

With its streamlined interface, decentralized governance, and innovative features like Sweeps and Blend, Blur offers a compelling platform for traders and collectors alike. Its rapid ascent to market dominance is a testament to its appeal and disruptive potential within the NFT ecosystem.

What sets Blur apart is not just its functionality but its ethos—a commitment to transparency, user empowerment, and technological advancement. Through decentralized governance and innovative features, Blur empowers users to take control of their digital assets, fostering a sense of ownership in the digital realm.