Cross-Chain Bridges and Their Benefits on BlockChain!!

image

DeFi (Decentralized Finance) become one of the most interesting, versatile and exciting segments of the digital asset space. With its ecosystem growing at such an exponential rate, DeFi is firmly established as a naturally past financial system disruptive technology that seeks to completely reshape the financial situation and revolutionize the way individuals conceptualize value.

At a time when Decentralized Applications (dApps) are changing the face of financial infrastructures as we have always known them, it is more important than ever for independent blockchains to communicate and share data with each other.

While projects like Cosmos, Kusama, Polkadot, Avalanche, Algorand-Solana are experimenting with the concept of cross-chain interoperability and networkability, DeFi users simply want to be able to move assets from one chain to another, interchange dApps, and make services more efficient by leveraging other DeFi. Therefore, there seems to be a widespread desire for inter-blockchain communication, and while blockchain infrastructures have remained fairly isolated until very recently, one of the most viable solutions can be found in cross-chain bridges.

image

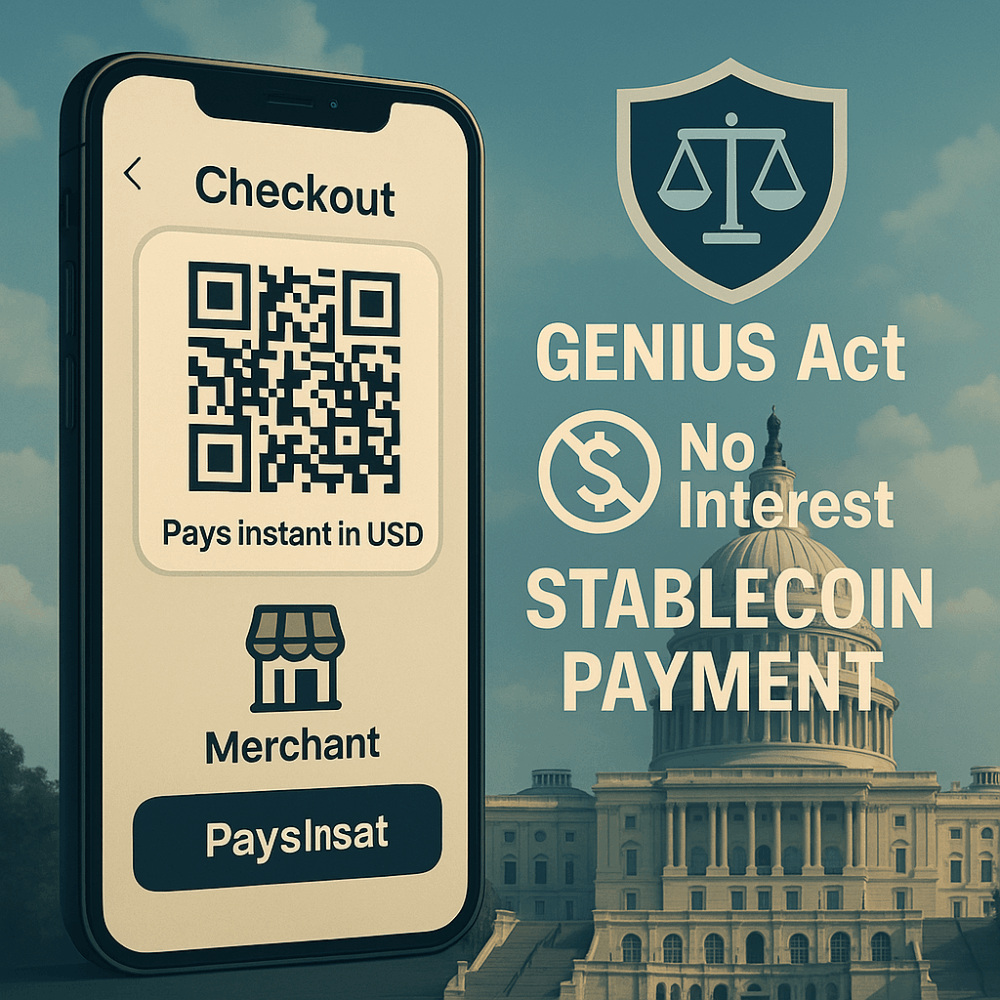

-What are cross-chain bridges?

Cross-Chain Bridges provide interoperability and communication between many different networks and between a main blockchain and its subchain known as a sidechain that operates under different consensus rules or inherits its security from the main blockchain. Just like in the Kusama parachains known as Polkadot and its subchain.

-Cross-Chain Interoperability

While decentralized finance has skyrocketed since the beginning of 2020, the demand for cross-chain composable systems in the DeFi space is currently at an all-time high. In essence, this is because today’s DeFi networks remain isolated within their own ecosystems and cannot reliably communicate with each other to exchange meaningful amounts of value.

The solution to this lies in cross-chain interoperability as it allows projects to collaborate effectively with each other and cross the boundaries that separate their respective infrastructures.

However, most existing solutions that enable inter-blockchain communication are either too complex, risky, overloaded, or likely involve a third-party environment. The act of a third party as escrow during the inter-chain transfer completely deprives the blockchain of its innate philosophy of decentralization and, by its very nature, completely defeats the purpose of its technology.

To fix this, cross-chain bridges provide the underlying architecture for blockchain projects to securely develop interoperability and interact reliably with other chains, while eliminating the need for a third-party environment.

image

How Do Cross Chain Bridges Work?

Moving your Solana to Algorand starts with sending an amount to a specific address on the source blockchain (Solana). This information is transmitted to the bridge and triggers the creation of an equal amount of tokens on the other blockchain.

Withdrawing your locked tokens also follows the same process. You send tokens to an address on the non-local blockchain, while your original deposit on the initial blockchain is sent to your address.

Here is an example to help you understand:

Let’s say you have Sol but you need Algo participate in a DeFi staking program. So, you send 30 solana to the address of the bridge on the Solana blockchain. When you have proof of your deposit, a so-called “guardian” prints 20 “wrapped” solana (xSol) on the Algorand blockchain.

These newly minted tokens are compatible with Ethereum so you can use them however you want.

If you want to withdraw your locked Sol, you need to send xSol to an address on Algorand to burn. Next, the saver unlocks the solanas you sent earlier and deposits them to your address on the Bitcoin blockchain.

-Popular bridges include:

- Polygon Bridge

- xDAI

- Arbitrum Bridge

- Terra Bridge

- Binance Chain Bridge

- Solana Bridge

image

Benefits of Cross-Chain Bridges

Cross-chain bridges are popular for helping users seamlessly move assets between separate blockchains. As DeFi continues to boom, cross-chain bridges are opening the ecosystem to more people. As seen in our previous example, users can quickly convert assets to take advantage of different earning mechanisms such as yield farming, betting and lending.

However, cross-chain bridges are also useful for more than just asset transfers. With greater interoperability between blockchains, users can switch between platforms to take advantage of unique benefits such as faster transactions or lower costs.

For example, by switching from a layer 1 network (Ethereum) to a layer 2 network (Polygon), you can take advantage of the latter’s higher throughput and cheaper gas fees. This not only improves the user experience, but also makes it easier for you to perform blockchain transactions.

Cross-chain bridges make it easy to use a decentralized application (dApp) on different blockchains.

Sometimes, using a particular dApp like Aave on its native blockchain (Ethereum) can be problematic, especially if the network is congested. In this case it may be better to use dApp (Aave) on a faster layer-2 network like Polygon. With a bridge you can convert your ETH to MATIC tokens and start using Aave on Polygon.