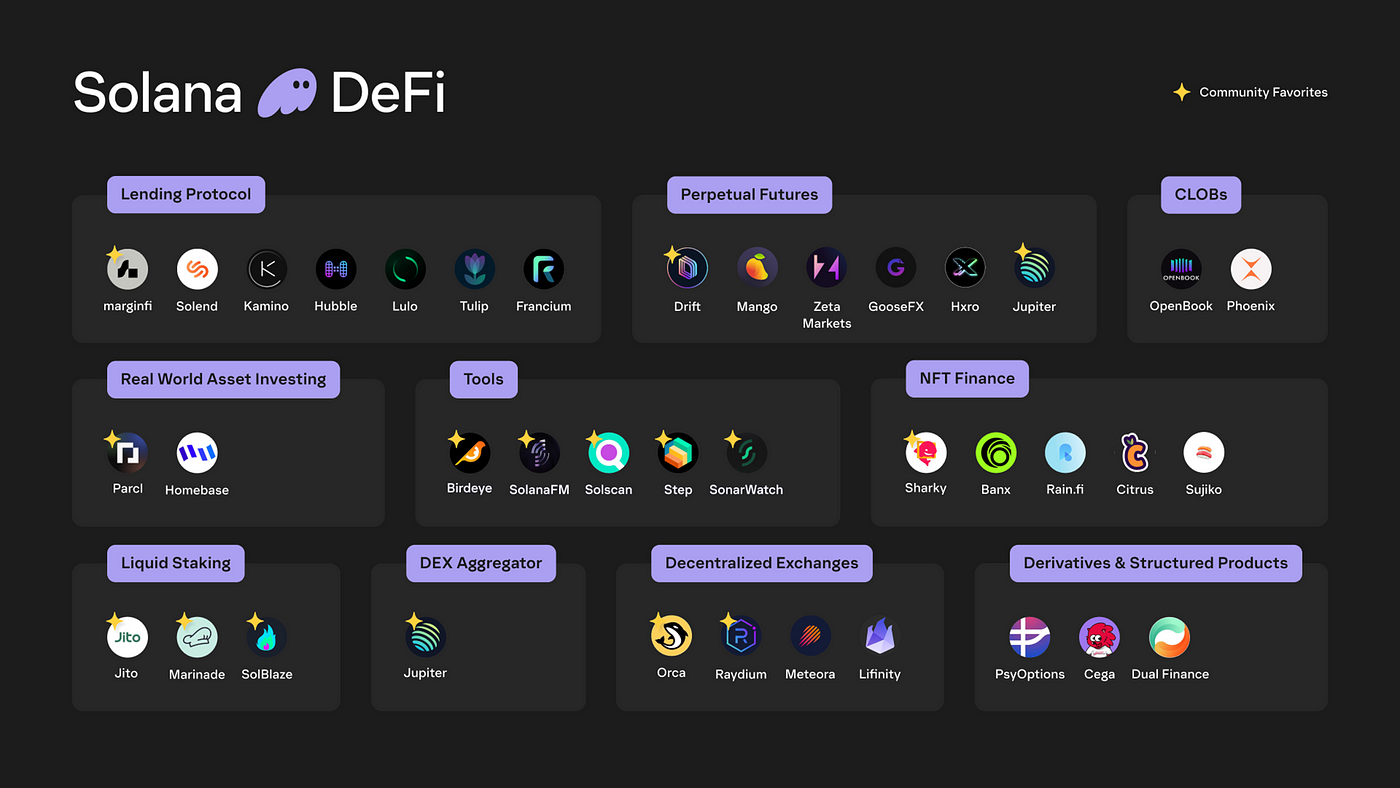

Best Solana DeFi Protocols Coming into 2024

As we stride into 2024, the decentralized finance (DeFi) landscape on Solana continues to grow, offering opportunities for both seasoned investors and newcomers alike. In a follow-up to last week’s deep dive into the best Solana liquid staking token, I will shed light on the broader Solana DeFi ecosystem as a whole. Whether you’re looking to maximize your staking rewards, engage in savvy token swaps, explore lending and borrowing options, delve into the vibrant world of NFTs, or dabble in the high-stakes arena of derivatives, Solana’s ecosystem has something to cater to every investor’s needs.

Staking SOL

I wrote about the best liquid staking tokens (LSTs) in Solana last week if you want to check that out here. If not, here is the basic recap:

- If you want the least amount of risk: stick with staking directly to validators, gives you higher yields than most LSTs (~7.5% APY)

- The highest LST APY: Marginfi has 8.74% APY on their website. They are taking advantage of Jito’s MEV boost and 0% commission staking validators to get this type of APY

- If you want to lend/borrow: Marginfi is giving the best Lending APY for any of the LSTs (.14–2.5% APY)

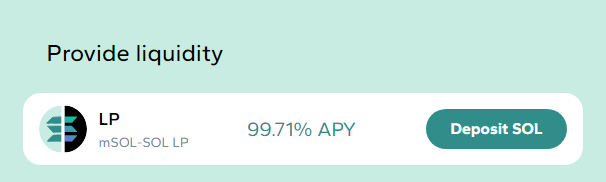

- If you want the highest APY: Marinade Finance has a LP giving 99% APY on mSOL / SOL

Marinade Liquidity Pool

Marinade Liquidity Pool

Bonus: You can boost your LST APY by lending, looping, or depositing into liquidity pools (LPs). My previous article talks more about it here.

Decentralized Exchanges (DEXs)

If you are looking for the best place to swap your tokens, the best answer is usually always the largest DEXs. In this case, it is Orca and Raydium with $189M and $131M in TVL, respectively. By having the largest liquidity pools, they can offer the best swap prices.

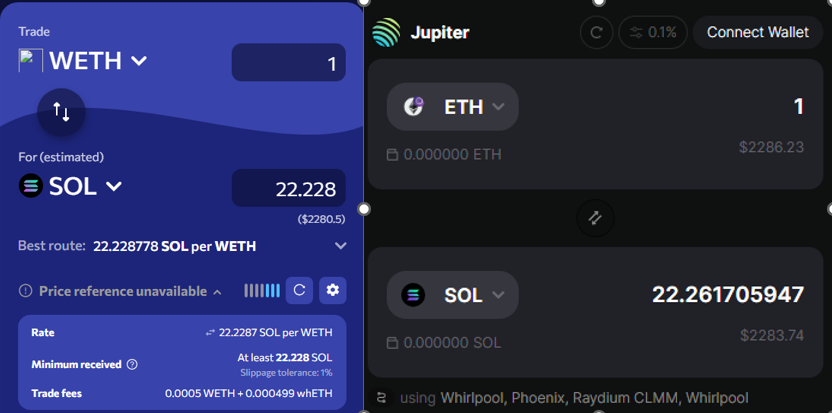

Bonus: Just make sure to check against a couple of DEXs before making a trade. Just because the DEX is large, doesn’t mean it can swap your exact tokens for a good price. See example below:

Marginfi (right) was offering a better ETH to SOL trade than Orca (left).

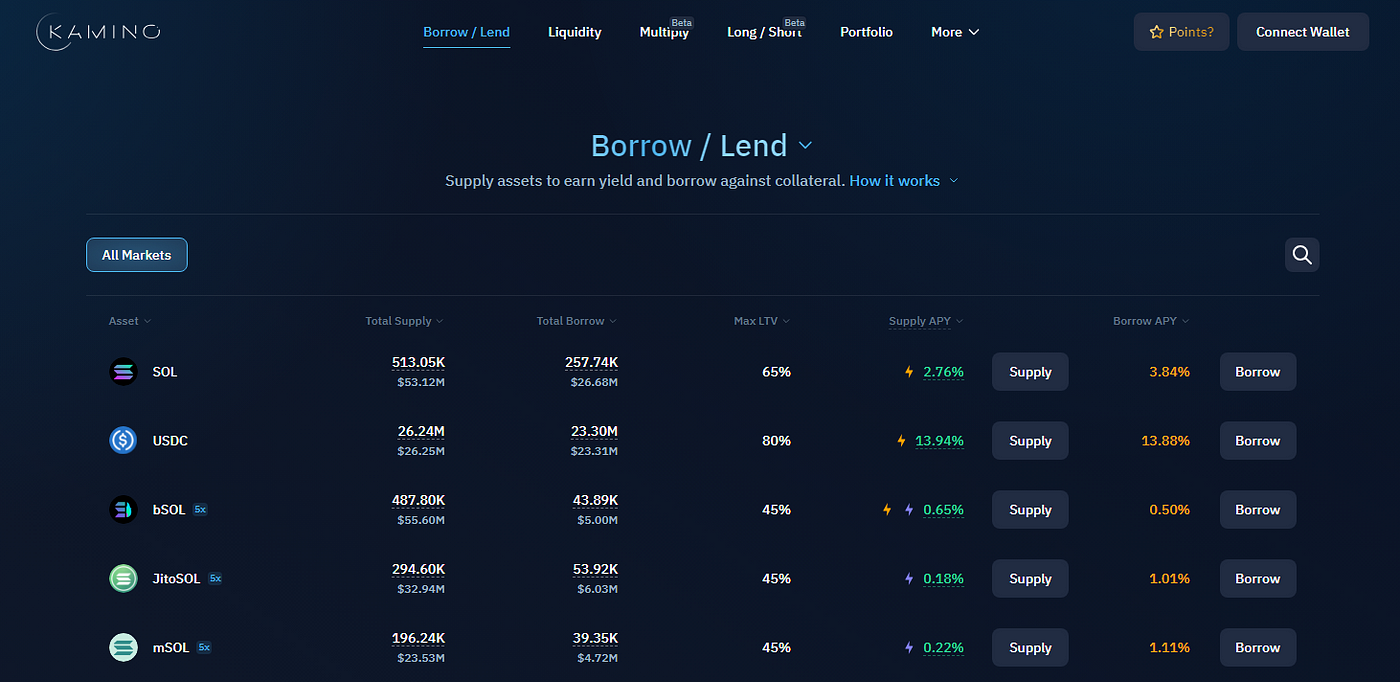

Lending/Borrowing

If you want to deposit your crypto to earn a little extra APY or you want to borrow, then there are really only three major players in Solana right now:

- Kamino: #1 on the list because of its ease of use and better yield / lower borrow rates. If you are used to lending protocols like Aave, then you will feel right at home with Kamino. Simple and straight forward. Kamino is also offering the best APY and borrow rates for most of the crypto assets compared to the others.

- Marginfi: #2 on the list because it is similar to Kamino in the user interface. Marginfi has the highest TVL at $332M but a tiny bit lower rates than Kamino.

- Solend: #3 but last on the list because of the user interface. It is not as intuitive to figure out what pool you should deposit your funds in, if it is actually a liquidity pool, or where to go to see your deposited assets. They really need to make this better before I’d consider depositing into it.

Bonus: Marginfi will probably have an airdrop in the future so staking/depositing/borrowing in that protocol will yield you points towards that airdrop

NFTs

If you have or are looking for some new NFTs to add to your collection, there are four main areas to go for NFTs on Solana:

Just take a look at all of them to see which marketplace is easiest for you and has the best collection. I’m not going to tell you which one is best because it really depends on what you are looking for.

Derivatives

For the Degens trying to yeet it…. You can trade derivatives or add leverage to your trades if you are looking for big pay offs. For the derivatives market, the best is Drift. To enter the app you need to acknowledge you know the risks so this is definitely the right place for Degenerate gamblers. Drift

Drift

Another place to look is Kamino to go long / short on a position or if you want to multiply your staking yield.

Conclusion

This was just a quick and dirty synopsis to help you navigate through the chaos and start you off in the right direction. My advice is to check out as many protocols as you can. Just look around and see what interests you. If you want the cheat sheet to find the best protocols, use DefiLlama. They are incredible for figuring out what protocols are where and how best to navigate DeFi.

-Just Another Crypto Analyst

Doing this for fun but if you want to leave a tip: 0xa33aE4207466cD866D13fA587067B1F824C06d4A

2

Solana Network

Ethereum

Defi

Cryptocurrency

Crypto

2

Follow

Follow

Written by Just Another Crypto Analyst

8 Followers

·

Writer for

Coinmonks

Crypto Analyst sharing what I've learned over the years

More from Just Another Crypto Analyst and Coinmonks

Just Another Crypto Analyst

Just Another Crypto Analyst

in

Coinmonks

What is the Best SOL Liquid Staking Token?

Introduction

6 min read

·

Dec 23, 2023

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

668

2

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

38K

1018 Just Another Crypto Analyst

Just Another Crypto Analyst

in

Coinmonks

Navigating Chaos: Why Cryptocurrency is Emerging as a Preferred Asset Class

Introduction

8 min read

·

Nov 13, 2023

See all from Just Another Crypto Analyst

Recommended from Medium

0xAnn

0xAnn

in

Crypto 24/7

What we know about Bitcoin ETFs so far

It’s finally here, so how is the first impression?

·

5 min read

·

5 days ago

94

3

Scott Galloway

Scott Galloway

2024 Predictions

Each year, we review/make predictions re the past/coming year. Most years, we hit more than we miss. But we do miss — if we made 10…

11 min read

·

Jan 6

8.7K

119

Lists

data science and AI39 stories

·

43

saves

Modern Marketing52 stories

Modern Marketing52 stories

·

368

saves

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

623

saves

Zoran Spirkovski

Zoran Spirkovski

in

DuckDAO

Welcome to DuckDAO

Everything you need to know about our community in one article

6 min read

·

Jan 1

14

2 Airdrop X Meta

Airdrop X Meta

TOP BEST AIRDROP 2024

- POLYHEDRA

6 min read

·

Jan 9

175

Abdus Salaam Muwwakkil

Abdus Salaam Muwwakkil

in

Rather Labs

The Top 10 Blockchain Trends in 2024 that Everyone Must Be Ready For

Exploring BaaS, DeFi Expansion, Scalability Solutions, and Regulatory Trends in Blockchain’s Enterprise Adoption through 2024.

12 min read

·

Jul 18, 2023

739

18

Brett Hornung

Brett Hornung

My Web3 Thoughts for 2024

Not just another 2024 list, here’s 7 unique predictions for you!

6 min read

·

Jan 5

133

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)