$BTC Liquidity Analysis: A Comprehensive Overview

Bitcoin ($BTC), the pioneer of cryptocurrencies, has garnered massive attention from investors, institutions, and regulators alike. Beyond its price volatility lies a critical metric that shapes market dynamics: liquidity. Understanding $BTC liquidity provides valuable insights into the market's health, trading efficiency, and investor sentiment.

This article delves into the core aspects of Bitcoin liquidity, examining its determinants, challenges, and implications for market participants.

What Is Liquidity in the Context of Bitcoin?

Liquidity, in the simplest terms, refers to how easily an asset can be bought or sold in the market without significantly affecting its price. In the case of Bitcoin, liquidity is a measure of how smoothly trades can occur, given the demand and supply dynamics.

Key Features of Liquidity:

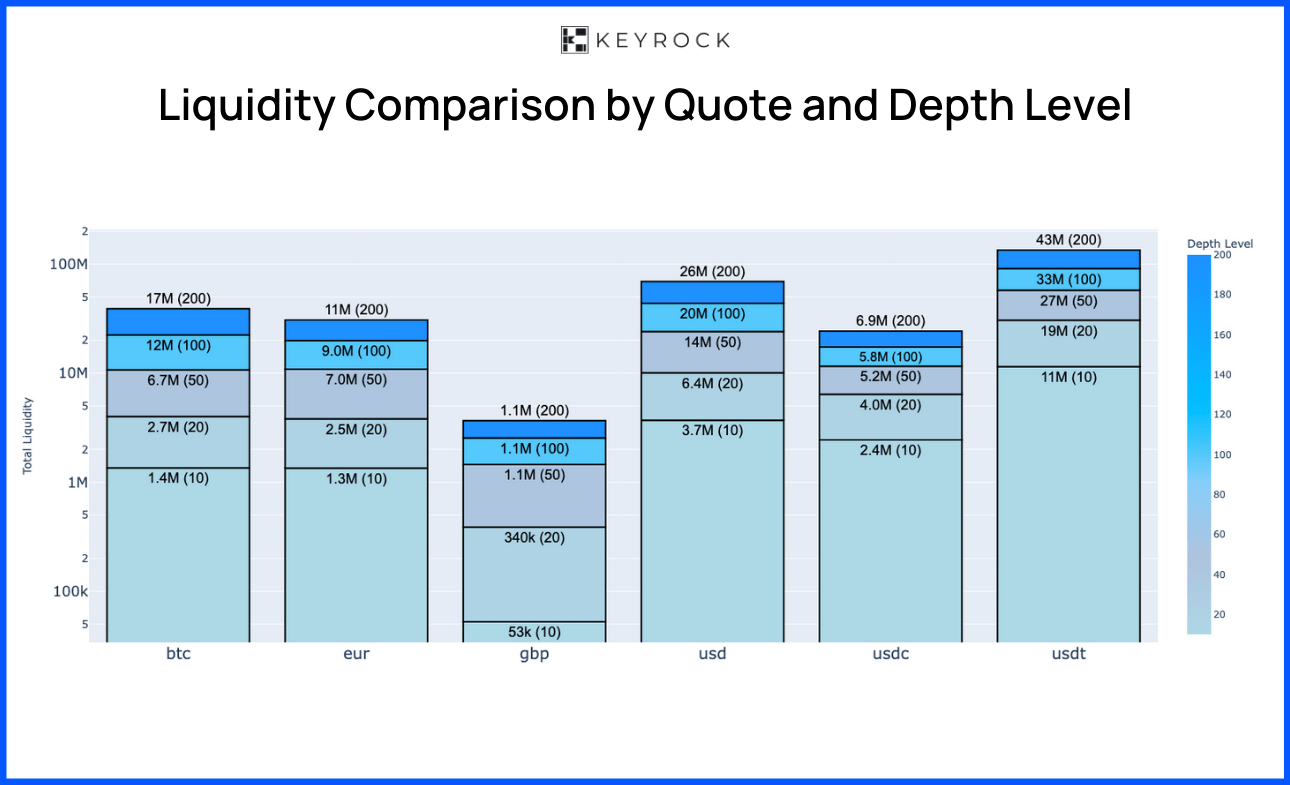

- Market Depth: A liquid market has a substantial number of buy and sell orders across various price levels, minimizing price slippage.

- Trading Volume: High trading volumes often indicate robust liquidity, making transactions faster and less costly.

- Tight Bid-Ask Spread: A narrow spread between the highest bid and lowest ask price signals healthy liquidity.

Understanding liquidity is critical because it affects trading efficiency, price stability, and the overall trust in the market. For Bitcoin, this is particularly crucial due to its global and decentralized nature.

Determinants of Bitcoin Liquidity

Bitcoin liquidity is influenced by several interconnected factors that reflect both macroeconomic trends and crypto-specific dynamics.

Exchanges and Trading Pairs:

Cryptocurrency exchanges play a pivotal role in providing liquidity. Platforms like Binance, Coinbase, and Kraken offer multiple trading pairs with $BTC, such as BTC/USD and BTC/ETH, increasing access and trading opportunities.

Institutional Involvement:

The influx of institutional players like MicroStrategy and Tesla has significantly boosted Bitcoin liquidity. Institutional adoption brings large volumes and fosters market stability through long-term holdings and strategic trading.

Market Sentiment:

Positive news, such as regulatory acceptance or technological advancements, tends to attract more participants, enhancing liquidity. Conversely, negative sentiment can cause liquidity to dry up as investors pull back.

Geopolitical and Economic Events:

Bitcoin has emerged as a hedge against inflation and currency devaluation. During times of global uncertainty, liquidity often surges as investors flock to it as a safe haven.

Decentralized Finance (DeFi):

The integration of Bitcoin into DeFi platforms through tokenized BTC (like WBTC) has opened new avenues for liquidity. DeFi protocols enable lending, borrowing, and yield farming, further enriching Bitcoin's liquidity landscape.

Challenges in Bitcoin Liquidity

Despite its growing adoption, Bitcoin faces several liquidity challenges that hinder its evolution into a fully mature asset class.

Fragmented Markets:

Unlike traditional financial markets, Bitcoin trading is highly fragmented across numerous exchanges. This fragmentation can lead to inconsistent pricing and reduced liquidity on smaller platforms.

Regulatory Uncertainty:

Unpredictable regulations in various jurisdictions often create hurdles for market participants. A sudden ban or restriction on exchanges can disrupt liquidity and trigger market volatility.

High Volatility:

Bitcoin’s price swings, while attractive to traders, can deter institutional investors seeking stable and predictable assets. This volatility often results in uneven liquidity during extreme price movements.

Liquidity Crises:

During market sell-offs, liquidity can evaporate rapidly, leading to significant slippage and panic selling. Such crises expose the vulnerabilities of the crypto ecosystem.

Implications for Market Participants

Understanding Bitcoin liquidity has far-reaching implications for various stakeholders, including traders, investors, and policymakers.

For Traders:

- Liquidity directly impacts transaction costs and execution speed. High liquidity ensures tighter spreads and minimal slippage, enabling efficient trading strategies.

- Traders can use tools like order books and market depth charts to assess liquidity before executing large trades.

For Investors:

- Liquidity is a critical factor in portfolio management. Liquid markets allow investors to enter and exit positions seamlessly, reducing risks associated with holding illiquid assets.

- Monitoring liquidity trends can also provide insights into market sentiment and potential price movements.

For Institutions:

- Institutional players need deep liquidity to execute large trades without impacting prices significantly. Collaborating with liquidity providers and using over-the-counter (OTC) desks can help in this regard.

For Policymakers:

- Understanding liquidity dynamics helps regulators develop frameworks that promote market stability while fostering innovation in the crypto space.

Conclusion

Bitcoin liquidity is a cornerstone of its market efficiency and long-term viability as an asset class. While the cryptocurrency ecosystem has made significant strides in improving liquidity, challenges such as regulatory uncertainties and market fragmentation persist. For traders, investors, and institutions, understanding liquidity dynamics is essential for informed decision-making. As the adoption of Bitcoin and blockchain technology continues to grow, enhancing liquidity will remain a key focus for stakeholders across the crypto spectrum.

References

- Investopedia: Liquidity in Cryptocurrency Markets

- CoinDesk: Bitcoin Trading Volume Analysis

- Binance Academy: Understanding Liquidity

- The Block: Institutional Adoption of Bitcoin

- Glassnode: Bitcoin On-Chain Liquidity Metrics

- Decrypt: The Role of DeFi in Bitcoin Liquidity

- CryptoSlate: Challenges in Bitcoin Market Liquidity

- CoinTelegraph: Bitcoin Volatility Analysis

- Kraken Intelligence: How Market Depth Reflects Liquidity

- Messari: The State of Bitcoin Liquidity