Solana (SOL) could aim for $133 as it attracts Asian trader interest

Solana (SOL) price has been moving slowly after breaking above the $78 support and is now finding its footing to move higher.

Solana needs more time

Solana price increased 78% between December 18 and 24, 2023, surpassing the $78 barrier. Since then, SOL has retested this barrier once on January 22, confirming the successfully turned it into support.

Considering the strong bullish move, SOL is likely to cool off and retest the $78 level once again before sideline buyers step in.

The Relative Strength Index (RSI) and Awesome Oscillator (AO) are also showing a cooling period, as they are returning to their averages. Therefore, investors can expect the price to sweep across the $78 support level before signaling the start of an uptrend.

In that case, SOL will target a retest of $133, which is the midpoint of the 96% decline seen from November 2021 to December 2022, constituting a 70% rally from support. $78.

SOL/USDT Chart – 1 Day | Source: TradingView

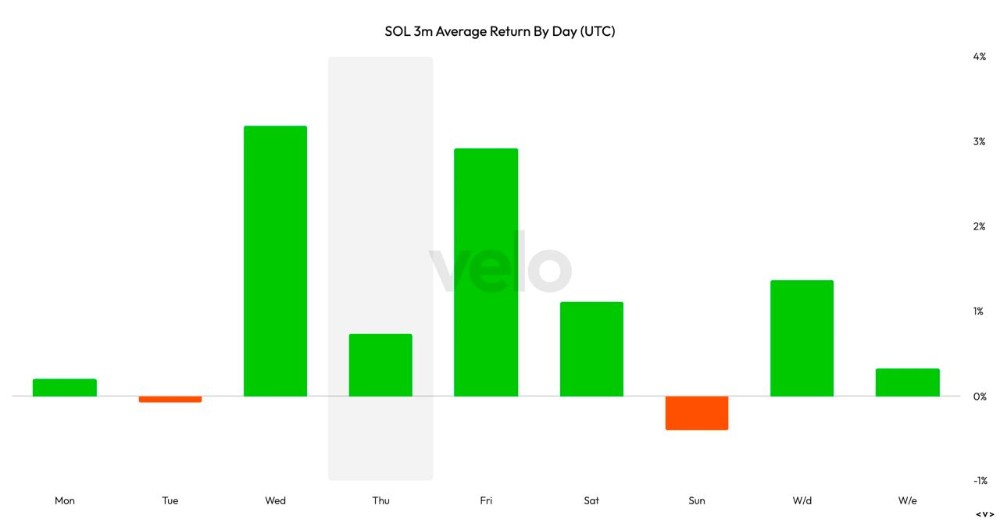

According to VeloData, SOL's three-month price action shows profits coming from weekdays, with Wednesday and Friday being the most profitable days. Sunday is usually in the red, which makes it the ideal time to buy, then take profits on Wednesday and Friday.

SOL average profit by day

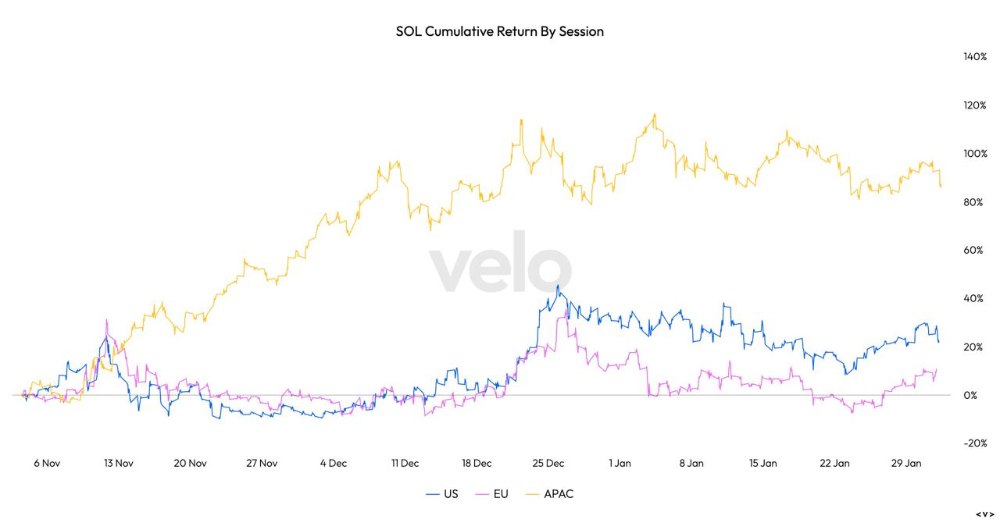

SOL's cumulative profit was highest during the Asia Pacific trading session.

Cumulative profit according to SOL trading sessions

While signs point to a rise in Solana (SOL) price, investors need to be cautious amid a spike in selling pressure. In such a case, a break below the $78 support and turning this level into resistance on the 3-day chart will invalidate the bullish thesis.

If the momentum of selling pressure remains, SOL could decline nearly 40% until it finds stable support around $47.