Analyst Predicts Solana (SOL) Bounce Amid Network Congestion Problems

Solana (SOL) faced difficulties the past week after the network’s transaction failure rate reached over 75%. Since then, Solana’s core contributors have been working to find the congestion problems.

SOL’s price tumbled 7.8%, and users seemed worried about the network’s state. Despite this, some analysts predict a more optimistic performance for SOL soon.

Related Reading: Paradigm Drives $225M Funding Round For Monad Labs, Blockchain Rival To Ethereum, Solana

Is Solana Poised For A Bounce?

According to crypto analyst Bluntz, Solana’s drop has reached its bottom. When the news of network congestion broke, the analyst predicted that SOL’s price would likely fall to $160 before seeing a bounce.

According to his chart, the performance was starting to show an ABC zig-zag pattern. At the time, the token was trading around the $184 price range, which meant that the C wave of $160 had yet to be confirmed.

The analyst remained open to the “possibility of a sideways correction.” Nonetheless, he considered it “would make no sense for sol/usd to sweep down lower below 160.”

On Wednesday, SOL reached a low of $162, sweeping the “A wave low.” To the analyst, this seems to be the bottom for SOL’s price despite being $2 short of his prediction. As a result, Bluntz considers that the token’s price will go “higher from here.”

ABC pattern on the SOL monthly chart. Source: Bluntz

Another analyst, Immortal Crypto, pointed out that SOL has shown a “good range” between $210 and $160. According to the analyst, “a deviation from here is a fat long, 100%.”

Despite the possible bounce forecast, analyst Altcoin Sherpa expects SOL to drop to $140, a level it has not seen in almost a month.Will The Network Upgrade Help SOL?

In the last 24 hours, Solana’s price has risen 6%, recovering from the drop to the $162 range. Despite a 7.8% drop in the past week, the price surged 13.5% in the last 30 days.

Similarly, the daily trading volume increased by 28% in the past 24 hours, suggesting a surge in the token’s market activity.

Nonetheless, investors remain concerned about the network as the problems continue, with some suggesting that the token’s price won’t start pumping until the “tech is sorted out.”

Solana is widely recognized for its fast transactions and low fees. However, the current on-chain failure rate presents problems for both users and developers.

Responding to the critics and concerns, Austin Federa, Head of Strategy at the Solana Foundation, gave insights into the problem.

Developers from Anza, Firedancer, Jito, and other core contributors are working diligently (and not sleeping much) to shore up Solana's networking stack to meet the unprecedented demand the network is seeing today.

There's been a lot of threads on what exactly is causing the…

— Austin Federa | 🇺🇸 (@Austin_Federa) April 10, 2024

According to Federa, developers from the core contributors to the Solana chain are “working diligently to shore up Solana’s networking stack to meet the unprecedented demand the network is seeing today.”

The developer explained that “the implementation of a software system is today not robust enough to handle the amount of traffic being thrown at it.” As a result, the core protocol developers are working to test and implement improvements, leaving “increasing fees as a last resort.”

At the time of this writing, SOL is trading at $174.57.

Related Reading: Solana Open Interest Drops $370 Million Amid Network Troubles, $200 Still Possible?

Solana performance in the weekly chart. Source: SOLUSDT on Tradingview

Featured Image from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: Crypto analystsSolSolanaSolana networkSolana price forecastSOLUSDT

Bitcoin Back Above $70,000 Despite Negative Taker Volume

Bitcoin has surged back above the $70,000 level during the past day despite the negative Net Taker Volume for the asset.

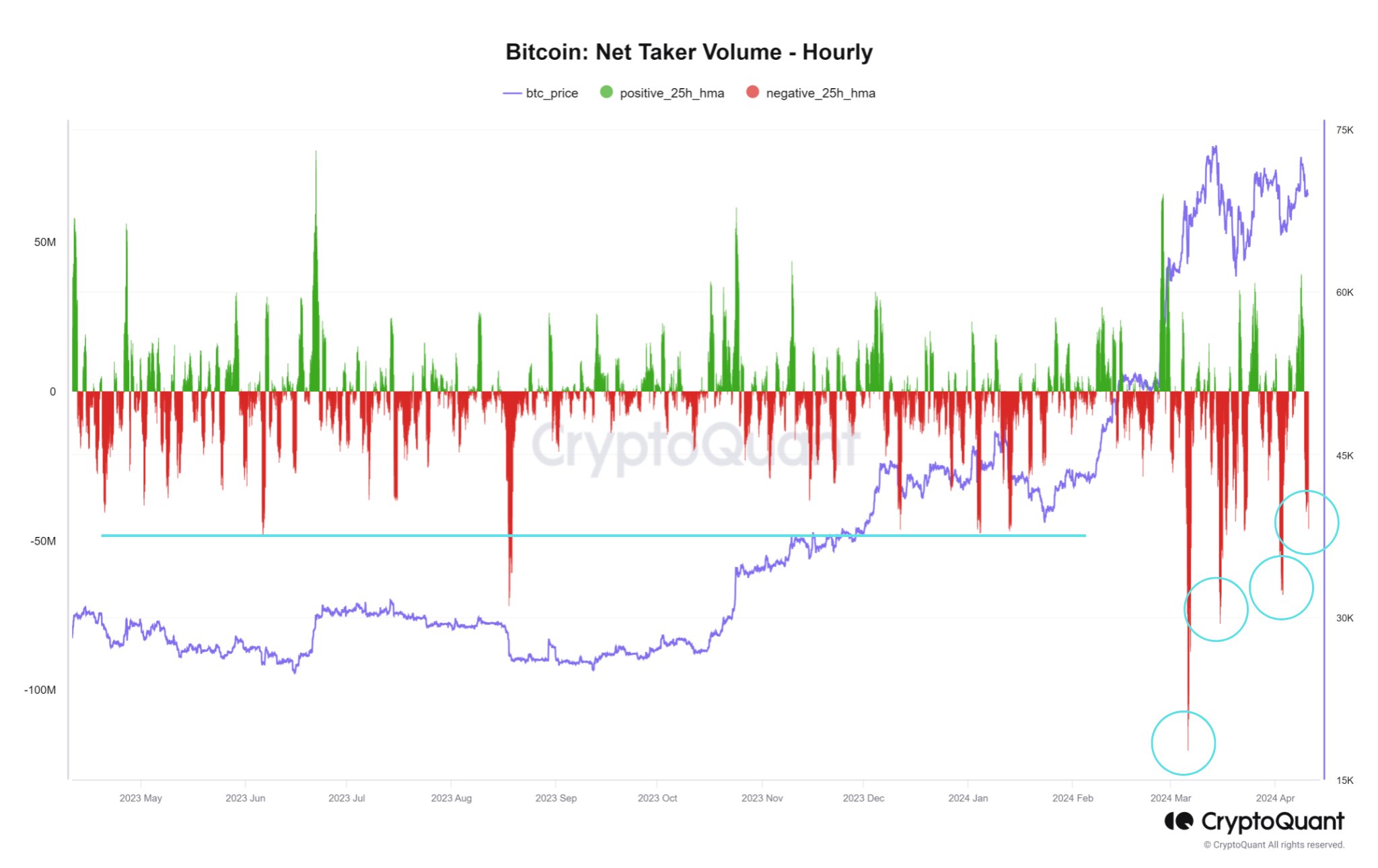

Bitcoin Net Taker Volume Has Seen Some Large Negative Spikes Recently

As explained by CryptoQuant Netherlands community manager Maartunn in a post on X, selling spikes of a significantly heavier scale than before have recently appeared in the Bitcoin Net Taker Volume.

Related Reading: Bitcoin 2 Months Through “Euphoria Wave,” How Long Was The Last One?

The “Net Taker Volume” is an indicator that keeps track of the difference between the Bitcoin taker buy and taker sell volumes in perpetual swaps. How can the sell and buy volumes be different? As CryptoQuant explains in its data guide:

This concept is often confusing because every trade requires both a buyer and a seller of the given underlying asset. However, depending on whether the order taker is a buyer or seller (whether a transaction occurs at the ask price or the bid price), you can distinguish between long volume from taker seller volume.

When the value of this metric is positive, it means that the taker buy volume is overwhelming the taker sell volume right now. Such a trend implies a bullish sentiment is shared by the majority.

On the other hand, the negative indicator suggests that more sellers are willing to sell the coin at a lower price, a sign that a bearish mentality is the dominant one.

Now, here is a chart that shows the trend in the Bitcoin Net Taker Volume over the past year:

The value of the metric seems to have been quite red in recent days | Source: @JA_Maartun on X

As the above graph shows, the Bitcoin Net Taker Volume has recently registered a sharp negative spike, implying that the taker sell volume has been higher than the taker buy volume.

The Net Taker Volume has been seeing some large red spikes for a while, as the analyst highlighted in the chart. “Bitcoin is being hammered down massively, with selling spikes on the Net Taker Volume significantly heavier than before,” says Maartunn.

Interestingly, despite this bearish sentiment in the market, the Bitcoin price has managed to hold up relatively well. Obviously, the coin’s bullish momentum has gone while these negative Net Taker Volume spikes have taken hold, but the fact that BTC has shown strength against any sustained drawdowns is still impressive.

Related Reading: Dogecoin Slows Down: What Needs To Happen For New DOGE Highs?

A pattern that’s perhaps visible in the chart is that although the Net Taker Volume has continued to see red spikes recently, their scale has gradually decreased.

Thus, if this trend continues, it’s possible that the bearish mentality will eventually run out, and buying pressure will take over Bitcoin. It now remains to be seen how the indicator develops shortly.

BTC Price

Bitcoin declined below $68,000 just yesterday, but today, the asset has already bounced back and is now trading around $70,800.

Looks like the price of the coin has made some recovery over the past 24 hours | Source: BTCUSD on TradingView

Featured image from Jievani Weerasinghe on Unsplash.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: bitcoinbitcoin rallyBitcoin Selling PressureBitcoin Taker Buy/Sell VolumeBitcoin Taker Volumebtcbtcusd

DAI Circulation Approaches 5 Billion As MakerDAO Unleashes Key Updates

In a recent announcement on the social media platform X (formerly Twitter), MakerDAO, the Ethereum-based protocol responsible for issuing the DAI algorithmic stablecoin, provided insights into the performance of the Maker Protocol following recent changes.

Over the past few weeks, MakerDAO has implemented significant updates to the protocol and the DAI stablecoin.

Introducing the Accelerated Proposal and the direct deposit module (D3M) to Spark’s Metamorpho Vault has notably impacted the ecosystem.mand

Looking at key metrics that demonstrate the effects of these changes to the protocol, the DAI supply in circulation currently stands at nearly 5 billion, reflecting a growth of approximately 300 million over the past month. This growth indicates continued demand for the stablecoin.

Related Reading: XRP Sees An Alarming 1,800% Surge In Liquidations, Whats Going On?

On the other hand, the Dai Savings Rate has significantly increased since implementing the Accelerated Proposal.

Approximately 1.54 billion DAI are currently deposited in the Dai Savings Rate, of which approximately 976 million DAI are sDAI, representing an increase of roughly 400 million DAI in deposits.

The Maker Protocol’s total value locked (TVL) amounts to approximately $8.4 billion across various vault types. This TVL growth can be attributed to strategic deployments in D3M modules, significant contributions from Ethereum-based collaterals, and the integration of real-world assets. These developments have enhanced the protocol’s diversification and resilience.

MakerDAO Ethereum Vaults Thrive

A notable addition to the MakerDAO ecosystem is the Morpho DM3, which enables the Morpho Vault to mint DAI. Currently, the lending pool has deployed 200 million DAI.

According to the protocol’s post, this allocation is projected to generate approximately 50 million in annual income for the Maker Protocol, making it the second-largest core vault in terms of annualized fees. It will play a significant role in generating revenue and contributing to the Maker Protocol’s sustainability.

Among the Ethereum vault types within the MakerDAO ecosystem, the ETH-C vault stands out with the largest value locked in crypto collateral at approximately $1.88 billion.

This vault generates approximately $43 million in annual fees, underscoring its importance within the Maker ecosystem and contribution to the protocol’s revenue streams.

Related Reading: Cardano At Risk Of Crashing To $0.4 As Important Metrics Turn Bearish

Another important component is the Spark D3M, which is supplied with around 970 million DAI. This module is projected to generate an annual income of approximately 28 million.

These recent changes have positively impacted the Maker Protocol. The increase in DAI supply, growth in the Dai Savings Rate, expansion of collaterals, and introduction of different vault types have contributed to the protocol’s growth and development. The 1-D chart shows MKR’s price trending downwards over the past two weeks. Source: MKRUSD on TradingView.com

Despite the growth in the MakerDAO ecosystem, the native token MKR has experienced a continuous 5.9% price decline over the past fourteen days.

In the last seven days alone, the token has recorded a significant 17% price drop, resulting in its current trading price of $3,355.

However, despite the price decline, Token Terminal data reveals positive trends. The protocol’s market capitalization currently stands at $3.3 billion, reflecting a notable 28% increase over the past 30 days.

Additionally, trading volume for the MKR token has experienced a substantial surge, reaching $5.9 billion, representing a 119% increase over the same time frame.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Crypto Analyst Predicts Shiba Inu Price Will Reach $0.0001 If This Happens

A crypto analyst has raised the possibility of Shiba Inu (SHIB) rising to as high as $0.0001. As part of his analysis, he highlighted certain factors that could contribute to the meme coin experiencing this parabolic price surge.

Shiba Inu To Rise To $0.0001 If History Repeats Itself

Crypto analyst Bunchhieng suggested in his analysis that SHIB could attain such a price level if history were to repeat itself, and SHIB mirrors its bullish pattern from the 2021 bull run. He affirmed that based on the patterns that he observed from the previous bull market, it was “quite possible” for SHIB to hit $0.0001.

Related Reading: Crypto Experts Predict Massive Price Surge For XRP Price, Is $20 Possible?

Source: Tradingview.comThe analyst also tried to clear the doubts of those who believe that such a price surge isn’t likely considering SHIB’s market cap, stating that anything was possible in the crypto world. Meanwhile, he added the SHIB burn rate, which has continued to increase exponentially, as another factor that could have a “positive effect” on the meme coin’s value.

Bunchhieng’s price prediction also looks feasible when one considers crypto analyst Rekt Capital’s recent analysis, in which he suggested that SHIB was already mirroring its price action from 2021. Back then, he revealed that SHIB, similar to 2021, had successfully retested the $0.000026041 price as a new support level.

In a more recent update, Rekt Capital also suggested that SHIB was showing enough strength to make a similar run to the one in 2021, stating that SHIB’s current support level served as resistance for the meme coin in early 2022.

SHIB Could Indeed Hit $0.0001

Bunchhieng isn’t the only crypto analyst who believes that SHIB can hit $0.0001. Crypto analyst Javon Marks also predicted that the meme coin could rise to $0.0001553 once it hits the $0.000081 price range. Interestingly, these aren’t even the most bullish predictions for Shiba Inu.

Related Reading: Analyst Says Bitcoin Halving Influence Is No Longer Driving Price, Here’s What Is

Crypto analyst Armando Pantoja, who recently outlined his price targets for different crypto tokens, predicted that the meme coin could rise to $0.001 after the Bitcoin Halving. Meanwhile, crypto analyst Ali Martinez predicted that SHIB could rise to $0.011, although he didn’t give a specific timeline for when this unprecedented price surge will occur.

Despite the varying price predictions, it is, however, clear that SHIB is more than likely to hit a new all-time high (ATH) in this bull run. Pseudonymous crypto analyst and trader Xanrox believes this could happen as soon as July, predicting that the crypto token would rise to $0.00008854 by then.

SHIB price starts recovery trend | Source: SHIBUSDT on Tradingview.com

Featured image from CoinGape, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)

![[LIVE] Engage2Earn: Doubling down on Dickson](https://cdn.bulbapp.io/frontend/images/0dea4715-4791-404e-acff-82013adb11e1/1)