10 Tips for Successful Venture Capital Funding

Venture capital funding can be a game-changer for startups, providing the necessary capital and support to fuel growth and innovation. However, securing venture capital is a competitive and complex process. In this article, we'll explore 10 valuable tips to help entrepreneurs increase their chances of securing successful venture capital funding.

1. Craft a Compelling Pitch Deck:

Put together a killer pitch deck that grabs the attention of venture capitalists. Make sure to highlight your unique value proposition, market opportunity, business model, and growth potential. Keep it concise, visually appealing, and compelling.

2. Research and Target the Right Investors:

Do your homework to identify venture capital firms that are a good fit for your industry, stage of growth, and investment thesis. Tailor your pitch to resonate with their investment criteria and portfolio.

3. Build a Strong Network:

Networking is key in the world of venture capital. Attend industry events, join startup communities, and connect with potential investors. Leverage your network to get warm introductions and build relationships.

4. Demonstrate Traction and Milestones:

Investors want to see that you're making progress. Showcase key milestones, customer acquisition, revenue growth, partnerships, or product development to demonstrate your startup's potential.

5. Prepare for Due Diligence:

Be ready for the due diligence process. Have your financials, legal documents, and other relevant information organized and readily available. Be transparent and responsive during this stage.

6. Build a Strong Team:

Investors often invest in the team behind the idea. Assemble a talented and experienced team that complements your skills and demonstrates the ability to execute your business plan.

7. Understand Your Market and Competition:

Have a deep understanding of your target market, its size, growth potential, and competitive landscape. Clearly articulate how your solution stands out and addresses market needs better than competitors.

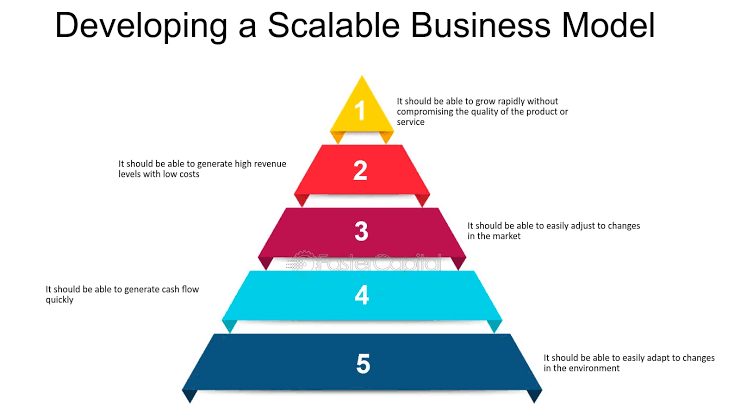

8. Have a Scalable Business Model:

Investors are looking for startups with scalable business models that can generate substantial returns. Clearly explain how your business can grow and scale, and how you plan to monetize it.

9. Be Realistic with Valuation:

Valuation is a critical aspect of the funding process. Be realistic and open to negotiations. Consider factors such as market conditions, growth potential, and investor expectations.

10. Build Relationships, Even After Funding:

Remember that securing venture capital funding is just the beginning of a long-term partnership. Foster strong relationships with your investors by providing regular updates, seeking their guidance and expertise, and involving them in key decisions. Show your appreciation for their support and keep them engaged in the growth and success of your startup.

Remember, it's all about crafting a compelling pitch, targeting the right investors, building strong relationships, and demonstrating your potential for growth.

But it doesn't end there! After securing funding, continue to nurture those relationships and keep your investors involved in your journey. I'm confident that with your determination and these tips, you'll be well on your way to securing the venture capital you need to take your startup to new heights.