SOL steadies, FET surges while Milei Moneda captivates investors

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Solana’s price sees a surge as Fetch.ai reaches an all-time high. Meanwhile, the Milei Moneda presale entices with an affordable entry point and promises of substantial returns.

With Solana (SOL), Fetch.ai (FET), and Milei Moneda (MEDA) positioning for significant gains, now is the ideal time to invest in these interesting projects. These projects have demonstrated positive momentum that analysts predict will launch their values even higher.

You might also like:

XRP’s activity surges, DOT eyes growth, Milei Moneda draws attention

Solana’s stellar performance drives interest

Solana has emerged as one of the top-performing altcoins so far this year, with its price increasing just under 39% in the past month alone. Just last week, the price of Solana recorded an impressive 8% gain, which coincided with a modest 2% rise in its overall market capitalization.

This sustained surge can be attributed to significantly rising trading activity on the Solana blockchain. Recent data from Artemis, a leading crypto on-chain analytics platform, indicates that the daily trading volume of stablecoins on Solana has consistently surpassed that of Ethereum for most of March.

As transactions continue to grow, many crypto analysts foresee Solana’s value climbing even higher in the near future. They predict the price of Solana could ascend another 20% over the coming days, riding the wave of increasing demand and usage on its platform.

You might also like:

Milei Moneda takes the spotlight amid Stellar, XRP market moves

Major protocol upgrade drives Fetch.ai’s surge

After experiencing a modest start to the year, Fetch.ai witnessed a staggering 500% pump over the past two months. In the last week alone, the trading volume has surged by an impressive 59%, propelling the price of Fetch.ai to reach a new all-time high (ATH) on March 28.

This surge in interest and demand can be attributed to the recent major protocol upgrade, v0.17, which has garnered significant attention from experts and investors alike. Additionally, the announcement of a substantial $100 million investment into Fetch Compute has further fueled positive sentiment surrounding Fetch.ai.

As a result, industry experts and investors are closely watching Fetch.ai, with many anticipating a continued appreciation in its value. Projections suggest the price of Fetch.ai could set a new peak before the end of 2024.

You might also like:

Milei Moneda, BNB, SOL, on the spotlight as whale shifts $6b BTC pre-halving

Milei Moneda unleashes investment potential

Milei Moneda presents an enticing investment opportunity for interested investors. Renowned for its economic reforms and financial autonomy, the emerging token is poised to become one of the leading cryptos to invest in today’s dynamic market.

What sets Milei Moneda apart is not only its promising fundamentals but also its thriving and enthusiastic crypto community. This community, composed of visionary individuals who value inventiveness and understand the principles of the free market, has played a crucial role in establishing Milei Moneda as one of the top altcoins available.

Moreover, the presale of Milei Moneda is currently underway, starting with Stage 1. By visiting the official website, investors can acquire MEDA tokens for $0.010. Purchasing these tokens not only grants membership within the community but also positions investors to enjoy significant benefits.

To learn more about Milei Moneda, visit the website or reach out on Telegram.

Read more:

DOT, ADA surge; Milei Moneda emerges as promising newcomer

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Ethereum Layer 2 networks to hit $1 trillion in 6 years, VanECK predicts

Global fund manager VanECK has high hopes for Ethereum Layer 2 (L2) networks, predicting that these could be valued at over $1 trillion by 2030.

Despite its ambitious targets for L2s, VanECK asserted that it remains “generally bearish” about the long-term prospects of some of these networks. The report gauged 46 L2 networks across five key areas and predicted “thousands” of more networks to emerge soon.

“At its core, Ethereum’s primary challenge is its limited capacity to process, store, and compute data in the form of financial transactions. This bottleneck in data throughput is being addressed by offloading much of the data processing and computation to Layer-2 blockchains,” analysts at VanECK wrote in the report.

The analysts estimated that Ethereum has the potential to grab 60% of the market share across all public blockchains. In such a scenario, estimating the volume of the assets within the ethereum ecosystem, the analysts predicted a $1 trillion market cap for L2 networks alone.

“Ethereum’s dominance in smart contracts faces a critical hurdle: scalability. While the network offers unparalleled security and decentralization, transaction fees and processing times soar when usage intensifies,” the analysts continued.

You might also like:

Cathie Wood’s Bitcoin ETF sets record with $243.5m daily inflow

The report stated that development on Ethereum is currently skewed towards enhancing the network’s ability to process L2 transaction data, highlighting the recent Dencun upgrade. The latest Ethereum mainnet soft fork saw L2 transaction fees lowered via the use of a specialized data-saving feature dubbed “Blobs.”

As Such, the analysts concluded that L2 networks are likely to generate “substantially more” revenues than the mainnet. They believe the Ethereum base network cannot “match” the transaction efficiency and user experience of second-layer networks.

However, the analysts remained bearish on the long-term prospects of most of these L2 networks.

“We see cutthroat competition amongst L2s where the network effect is the only moat. As a result, we are generally bearish on the long-term value prospects for the majority of L2 tokens,” they wrote.

They added that just the top seven L2 networks are responsible for a whopping $40 billion in total value locked. This metric is expected to surge as high as $100 billion as several notable projects are about to launch over the next 18 months.

The analysts also envisioned a future dominated by “thousands of use-case-specific” Layer 2 (L2) solutions, with “just a few major players” in the broader market. They also expect a “handful of general-purpose chains,” to gain prominence due to the network effect enhancing their value as more users join.

Further, they highlighted the shift towards the zero-knowledge framework (ZKU), which according to them, is inevitable for most roll-ups due to “its many advantages,” marking a pivotal evolution in the L2 ecosystem.

The fund manager’s prediction comes as it awaits a decision from the SEC regarding its Ethereum ETF filing.

Read more:

Spot Bitcoin ETFs saw $39m net inflows on April 2

Follow

Why is Solana (SOL) price up today?

Solana’s price gains today coincide with multiple upside signals: the recovery across its network’s top memecoins and its rising crypto market dominance. ALTCOIN WATCH

ALTCOIN WATCH

Own this piece of crypto history

price is up today, buoyed by a modest recovery on the broader cryptocurrency market after enduring 48 hours of sustained selling pressure.Why is Solana price up today?

Notably, on April 3, SOL's price jumped approximately 5.75% to around $192. In doing so, the cryptocurrency fared better than the overall crypto market, which rose 2.2% in the same period. SOL/USD daily price chart. Source: TradingView

SOL/USD daily price chart. Source: TradingView

Memecoin mania continues

Solana's gains today coincide with the recoveries in the market valuation of its viral memecoins, namely Dogwifhat (WIF) and Bonk (BONK).

Related: Meet the Solana memecoin that suffered two rug pulls but still survived

WIF and BONK have bounced 5.4% and 1.3% in the last 24 hours, respectively. Among the highest memecoin gainers in the Solana ecosystem are the newly launched Cat in the Dogs World (MEW) and Book of Meme (MEME), which rose 45% and 9.5% in the same period. Solana memecoins hourly, daily, and weekly performances. Source: CoinGecko

Solana memecoins hourly, daily, and weekly performances. Source: CoinGecko

Solana’s bulls have lately responded positively to the launch of memecoin projects on its blockchain, with recent Franklin Templeton research noting that these so-called joke cryptocurrencies “have a strong relationship with their native networks."

In theory, viral memecoin projects can potentially fuel speculative interest in their underlying blockchain network's native tokens. For instance, Solana's rival BNB Chain is even offering a $1 million reward to attract memecoin developers to its layer-one blockchain.

As a result, the surge in Solana-based memecoins recently has been closely aligned with a boom in the network’s total value locked (TVL); it has grown 70% so far in 2024 to reach 23.78 million SOL on April 3, indicating robust underlying demand for SOL.  Solana's TVL chart. Source: DefiLlama

Solana's TVL chart. Source: DefiLlama

Solana's market dominance is rising

Solana's upside move today further benefits from its growing market strength versus the rest of the cryptocurrencies.

Notably, the Solana Dominance Index (SOL.D), which measures SOL's market capitalization against the broader crypto market, rose 3.95% on April 3. The index has grown 28% year-to-date, indicating growing capital rotation into Solana. SOL.D daily performance chart. Source: TradingView

SOL.D daily performance chart. Source: TradingView

Institutional investors significantly contributed to Solana's rising market prominence by channeling almost $25 million into SOL-based investment funds in March, according to CoinShares' weekly report. Crypto funds net flow by assets. Source: CoinShares

Crypto funds net flow by assets. Source: CoinShares

In comparison, Ethereum

ETH

, Solana's main rival, experienced a withdrawal of $67.2 million.Solana pric technical analysis

From a technical perspective, Solana's gains today come after bouncing from the lower trendline of its prevailing ascending triangle pattern.

Traditional analysts see ascending triangles as bullish continuation patterns if they form during an uptrend. As of April 3, SOL's bounce from the triangle’s lower trendline signals a jump toward the upper trendline at around $205, up 8% from the current price levels, in the coming days. SOL/USD daily price chart. Source: TradingView

SOL/USD daily price chart. Source: TradingView

A potential break above the triangle’s upper trendline can position the price for a push toward $250 in April, up over 35% from current levels. Otherwise, the price may consolidate further inside the triangle range, eyeing $175.

This article does not contain investment advice or recommendations. Every investment and trading mov

Over $20 Million Worth of SOL Locked in Lido’s Staking Protocol

KEY POINTS:

- According to Satoshi Club, over $20M of SOL remains locked on Lido’s protocol.

- Lido formally ceased support for Solana on February 4.

- Pavel Pavlov noted that the complication stems from a glitch in Lido’s smart contract.

According to Satoshi Club, a crypto news broadcaster on X, over $20 million of SOL remains locked on Lido after its service discontinuation for Solana. In a recent post, the broadcaster noted that Lido formally ceased support for Solana on February 4, yet 112,923.29 SOL remains locked, affecting 31,585 users.

Satoshi Club

@esatoshiclub

🚨 Users struggle to withdraw #Solana from Lido's staking protocol after service discontinuation.

Lido formally ceased support on February 4, yet 112,923.29 SOL remains locked, affecting 31,585 users.

The valuation of locked $SOL is approximately $21 million. pic.twitter.com/qjoyoxdZU1

Apr 03, 2024

Lido reportedly discontinued services for Solana following a glitch within its smart contracts. As a result, users who staked SOL on the platform couldn’t withdraw their assets. According to recent revelations, the inability of users to withdraw their staked SOL on Lido is due to newly identified bugs.

Pavel Pavlov, a product manager at P2P, the organization responsible for operating Lido on Solana, alerted the community on the SOL withdrawal issues. On March 30, Pavlov noted via a Discord message that the complication stems from the “split function” employed during the withdrawal phase of the smart contract.

The product manager emphasized the complexity and time required to amend the Smart Contract. He also cited plans by the technical team to consult with Lido DAO over the issue. According to him, the planned consultation aims to discuss the next steps and establish timelines for resolving the matter.

Notably, Pavlov’s report coincides with a slump in SOL’s price that saw the cryptocurrency drop by 13% in the past four days. SOL pulled back from $204.25 on April 1, dropping to $175.89 within 48 hours. The altcoin traded for $183.12 at the time of writing, following an attempted return of the bullish trend, according to data from TradingView.

Several users have had difficulties unstaking their SOL tokens on Lido since the February 4 discontinuation of service. The process is more complex for users unfamiliar with the protocol’s command-line interface (CLI).

Coin Edition

Crypto

Read more from Coin Edition

Bitcoin Cash, Jupiter, and KangaMoon lead April’s altcoin rally

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

April’s crypto spotlight shines on Bitcoin Cash, Jupiter, and KangaMoon, three altcoins poised for potentially significant growth. With Bitcoin Cash’s bullish trend, Jupiter’s aim for new highs, and KangaMoon’s rapid presale progress, investors have exciting opportunities to diversify their portfolios.

Bitcoin Cash (BCH), Jupiter (JUP), and KangaMoon (KANG) are three top altcoins offering an alternative income source beyond traditional earnings. Bitcoin Cash’s price particularly stands out with its recent bullish momentum as it approaches a crucial resistance level. Similarly, the native Jupiter token is making waves with a bullish streak, aiming to surpass its previous all-time high (ATH) of $2 from two months ago.

Meanwhile, KangaMoon is another interesting project to keep an eye on. Having registered several milestones including crossing the $4M presale funding milestone, KangaMoon is positioning itself among the best meme coins to watch for investors seeking potential growth opportunities in April.

You might also like:

Ethereum, Solana, KangaMoon emerge as key players to consider

KangaMoon maintains increase in user base and presale revenue

The significance of the KangaMoon platform is its ability to combine the concept of GameFi and SocialFi altogether so as to give users the most improved engagement.

With over 20,000 registered community members and 5,800 KANG token holders, the current presale stage is still drawing in more users as a large number of investors prefer the additional incentives, like a 10% bonus on every KANG purchase, thus adding to the financial influx of the startup. The analysts expect the token KangaMoon to be listed on tier 1 exchanges by the second quarter of 2024.

After surging by 291% from $0.005 to $0.0196, experts’ prediction for the year suggests that KangaMoon will rise to $1. That would be a remarkable feat in both the meme coin market and the blockchain gaming industry at the same time.

Overall, KangaMoon basically offers a more sustainable part to the monetization of blockchain gaming. Notably, players can showcase their skills, engage in battle contests, and be rewarded for their successes, similar to what spectators could do by predicting matches for prizes. KangaMoon is unarguably one of the leading crypto picks this year by investors who are ready to catch the bulls by their horns.

You might also like:

XRP, Toncoin shine; KangaMoon presale eyes massive growth

Bitcoin Cash sees monumental rise

Barely 14 days away, Bitcoin Cash recovered from a declining position below its weekly and monthly support of $455.97. However, after experiencing few rebounds, Bitcoin Cash was able to price above its support again and it has been on a bullish pattern ever since.

Rising by over 32% in the past week and over 41.95% in the past month, Bitcoin Cash has seen impressive gains. Bitcoin Cash price is now holding in a weekly range of $472.61 and $696.91.

Jupiter sees all green

Jupiter token, on the other hand, plunged below its weekly support price of $1.34 at the beginning of this past week. However, Jupiter didn’t take time to recover from this decline as it started another positive momentum trending upwards to resistance areas.

In the past four weeks alone, Jupiter had been able to grow by 179.47%, and over 29.00% in the past week. And with a weekly price range of $1.25 and $1.83, Jupiter is poised to hit an ATH very soon surpassing its $2 ATH, two months ago.

To learn more about Kangamoon, visit the Kangamoon website or join their telegram community.

Read more:

APT maintains bullish trends, BCH rolls on; KangaMoon presale shi

Bitcoin long-term holders sell as new investors enter

Long-term Bitcoin (BTC) holders have started selling their holdings to a wave of new investors, sparking a fresh surge in the cryptocurrency’s price and realized capitalization.

Long-term Bitcoin (BTC) holders have started selling their holdings to a wave of new investors, sparking a fresh surge in the cryptocurrency’s price and realized capitalization.

Per an April 2 analysis report from Glassnode, Bitcoin’s recent rise in price discovery above new all-time highs has tempted holders who were already high into profits to distribute to a fresh investor cohort.

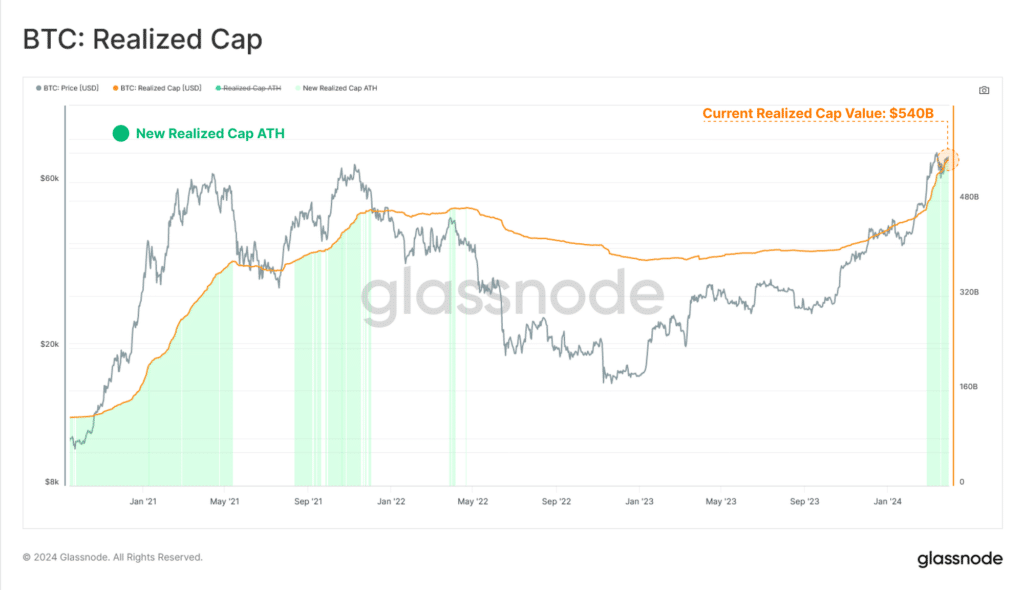

Glassnode employs the Realized Cap metric, which logs the transaction price for each Bitcoin to determine the proportion of holders making a profit or a loss. The metric has reached an all-time high (ATH), indicating a significant market milestone, according to Glassnode.

“This results in spent coins generally being revalued from a lower cost-basis, to a higher one. As these coins change hands, we can also consider this to be an injection of fresh demand and liquidity into the asset class.”

This mechanism is neatly depicted by the Realized Cap statistic, which tracks the total USD liquidity ‘stored’ in the asset or class. The Realized Cap has reached a new ATH value of $540 billion and is growing at an unprecedented rate of more than $79 billion each month.

Source: Glassnode

Source: Glassnode

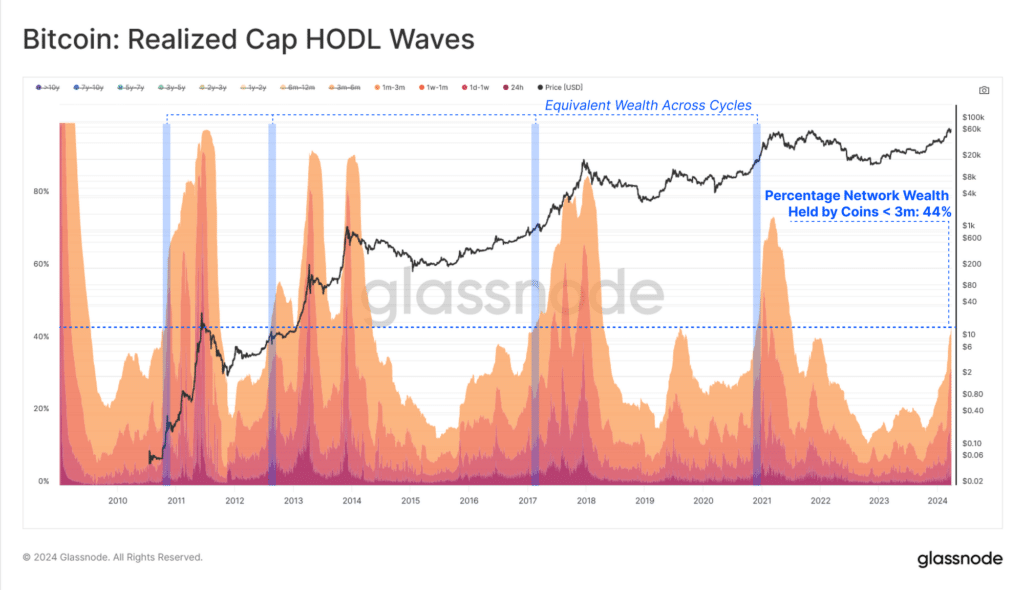

According to Glassnode, 44% of all BTC in circulation are now held by newer addresses that have been active for less than three months. According to the firm’s statistics, rising above the 44% threshold is generally associated with mid-stage bull markets.

“If we segregate for coin-ages younger than 3 months, we can see a sharp increase over recent months, with these newer investors now owning ~44% of the aggregate network wealth.” Source: Glassnode

Source: Glassnode

It determined that there has been a “distinct shift in investor behavioral patterns.”

“Long-Term Holders are well into their distribution cycle, realizing profits, and re-awakening dormant supply to satisfy new demand at higher prices.”

You might also like:

Spot Bitcoin ETFs saw $39m net inflows on April 2

According to Glassnode researcher Checkmatey,’ the realized cap is increasing as old coins are revalued higher, with GBTC accounting for approximately 30% and HODLers selling the remainder.

However, the analysis was conducted when Bitcoin approached an all-time high for the second time, and markets began to fall earlier this week. BTC reached a high of $73,734 on March 14, fell by about 17%, and recovered to $71,550 on March 28 before resistance proved too powerful.

It fell slightly below $65,000 during the Wednesday morning Asian trading session, reaching $64,573 before rising to $66,111 at the time of writing, per CoinMarketCap. Bitcoin is currently down 10% from its all-time high price. BTC 24-hour price chart | Source: CoinMarketCap

BTC 24-hour price chart | Source: CoinMarketCap

The overall market capitalization is down 1% on the day to $2.5 trillion, or approximately 20% lower than its all-time peak set in November 2021.

Aside from a few hyped meme coins, altcoins haven’t moved much in this market cycle.

Today, most of them are all down, with XRP down 2.3% to $0.576 and Dogecoin down 2.7% to $0.180.

Read more:

Leading Bitcoin miners witness dip in 2024 production, CryptoQuant says