Almost no one uses Bitcoin as currency, new data proves. It’s actually more like gambling

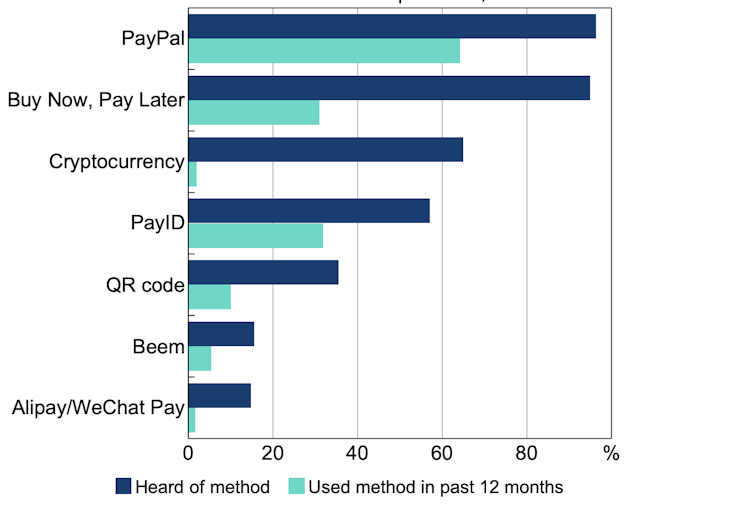

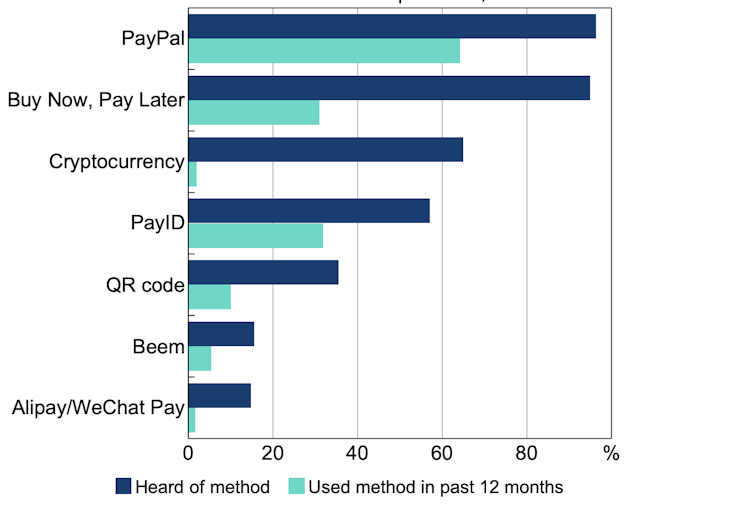

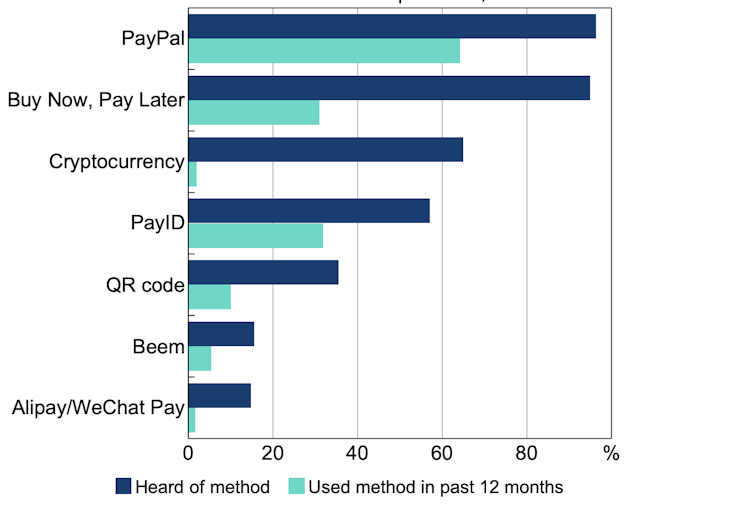

Alternative payment methods, share of all respondents, 2022

Reserve Bank calculations of Australians' awareness vs use of different payment methods, based on Ipsos data.

By contrast more recent innovations, such as “buy now, pay later” services and PayID, are being used by around a third of consumers.

These findings confirm 2022 data from the US Federal Reserve, showing just 2% of the adult US population made a payment using a cryptocurrrency, and Sweden’s Riksbank, showing less than 1% of Swedes made payments using crypto.

The problem of price volatility

One reason for this, and why prices for goods and services are virtually never expressed in crypto, is that most fluctuate wildly in value. A shop or cafe with price labels or a blackboard list of their prices set in Bitcoin could be having to change them every hour.

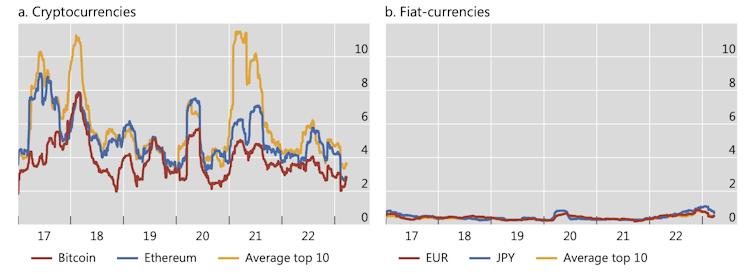

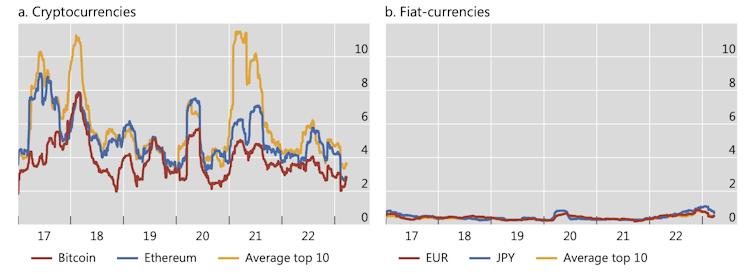

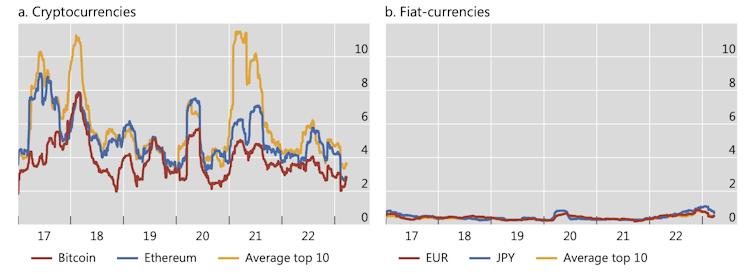

The following graph from the Bank of International Settlements shows changes in the exchange rate of ten major cryptocurrencies against the US dollar, compared with the Euro and Japan’s Yen, over the past five years. Such volatility negates cryptocurrency’s value as a currency.

Cryptocurrency’s volatile ways

90-day rolling standard deviation of daily returns for major cryptocurrencies compared with the Euro and Yen. The Crypto Multiplier, BIS Working Papers, No. 1104, CC BY

There have been attempts to solve this problem with so-called “stablecoins”. These promise to maintain steady value (usually against the US dollar).

But the spectacular collapse of one of these ventures, Terra, once one of the largest cryptocurrencies, showed the vulnerability of their mechanisms. Even a company with the enormous resources of Facebook owner Meta has given up on its stablecoin venture, Libra/Diem.

This helps explain the failed experiments with making Bitcoin legal tender in the two countries that have tried it: El Salvador and the Central African Republic. The Central African Republic has already revoked Bitcoin’s status. In El Salvador only a fifth of firms accept Bitcoin, despite the law saying they must, and only 5% of sales are paid in it.

Read more: One year on, El Salvador's Bitcoin experiment has proven a spectacular failure Reserve Bank calculations of Australians' awareness vs use of different payment methods, based on Ipsos data.

Reserve Bank calculations of Australians' awareness vs use of different payment methods, based on Ipsos data.

By contrast more recent innovations, such as “buy now, pay later” services and PayID, are being used by around a third of consumers.

These findings confirm 2022 data from the US Federal Reserve, showing just 2% of the adult US population made a payment using a cryptocurrrency, and Sweden’s Riksbank, showing less than 1% of Swedes made payments using crypto.

The problem of price volatility

One reason for this, and why prices for goods and services are virtually never expressed in crypto, is that most fluctuate wildly in value. A shop or cafe with price labels or a blackboard list of their prices set in Bitcoin could be having to change them every hour.

The following graph from the Bank of International Settlements shows changes in the exchange rate of ten major cryptocurrencies against the US dollar, compared with the Euro and Japan’s Yen, over the past five years. Such volatility negates cryptocurrency’s value as a currency.

Cryptocurrency’s volatile ways 90-day rolling standard deviation of daily returns for major cryptocurrencies compared with the Euro and Yen. The Crypto Multiplier, BIS Working Papers, No. 1104, CC BY

90-day rolling standard deviation of daily returns for major cryptocurrencies compared with the Euro and Yen. The Crypto Multiplier, BIS Working Papers, No. 1104, CC BY

There have been attempts to solve this problem with so-called “stablecoins”. These promise to maintain steady value (usually against the US dollar).

But the spectacular collapse of one of these ventures, Terra, once one of the largest cryptocurrencies, showed the vulnerability of their mechanisms. Even a company with the enormous resources of Facebook owner Meta has given up on its stablecoin venture, Libra/Diem.

This helps explain the failed experiments with making Bitcoin legal tender in the two countries that have tried it: El Salvador and the Central African Republic. The Central African Republic has already revoked Bitcoin’s status. In El Salvador only a fifth of firms accept Bitcoin, despite the law saying they must, and only 5% of sales are paid in it.

Read more: One year on, El Salvador's Bitcoin experiment has proven a spectacular failure Reserve Bank calculations of Australians' awareness vs use of different payment methods, based on Ipsos data.

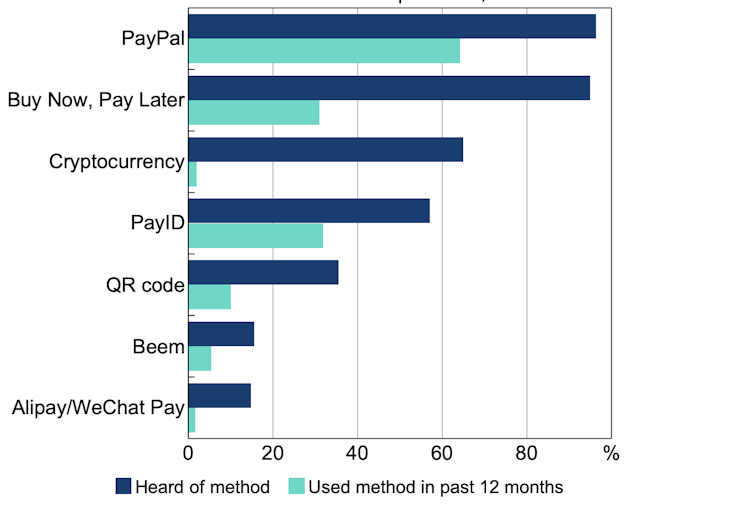

Reserve Bank calculations of Australians' awareness vs use of different payment methods, based on Ipsos data.

By contrast more recent innovations, such as “buy now, pay later” services and PayID, are being used by around a third of consumers.

These findings confirm 2022 data from the US Federal Reserve, showing just 2% of the adult US population made a payment using a cryptocurrrency, and Sweden’s Riksbank, showing less than 1% of Swedes made payments using crypto.

The problem of price volatility

One reason for this, and why prices for goods and services are virtually never expressed in crypto, is that most fluctuate wildly in value. A shop or cafe with price labels or a blackboard list of their prices set in Bitcoin could be having to change them every hour.

The following graph from the Bank of International Settlements shows changes in the exchange rate of ten major cryptocurrencies against the US dollar, compared with the Euro and Japan’s Yen, over the past five years. Such volatility negates cryptocurrency’s value as a currency.

Cryptocurrency’s volatile ways 90-day rolling standard deviation of daily returns for major cryptocurrencies compared with the Euro and Yen. The Crypto Multiplier, BIS Working Papers, No. 1104, CC BY

90-day rolling standard deviation of daily returns for major cryptocurrencies compared with the Euro and Yen. The Crypto Multiplier, BIS Working Papers, No. 1104, CC BY

There have been attempts to solve this problem with so-called “stablecoins”. These promise to maintain steady value (usually against the US dollar).

But the spectacular collapse of one of these ventures, Terra, once one of the largest cryptocurrencies, showed the vulnerability of their mechanisms. Even a company with the enormous resources of Facebook owner Meta has given up on its stablecoin venture, Libra/Diem.

This helps explain the failed experiments with making Bitcoin legal tender in the two countries that have tried it: El Salvador and the Central African Republic. The Central African Republic has already revoked Bitcoin’s status. In El Salvador only a fifth of firms accept Bitcoin, despite the law saying they must, and only 5% of sales are paid in it.

Read more: One year on, El Salvador's Bitcoin experiment has proven a spectacular failure Reserve Bank calculations of Australians' awareness vs use of different payment methods, based on Ipsos data.

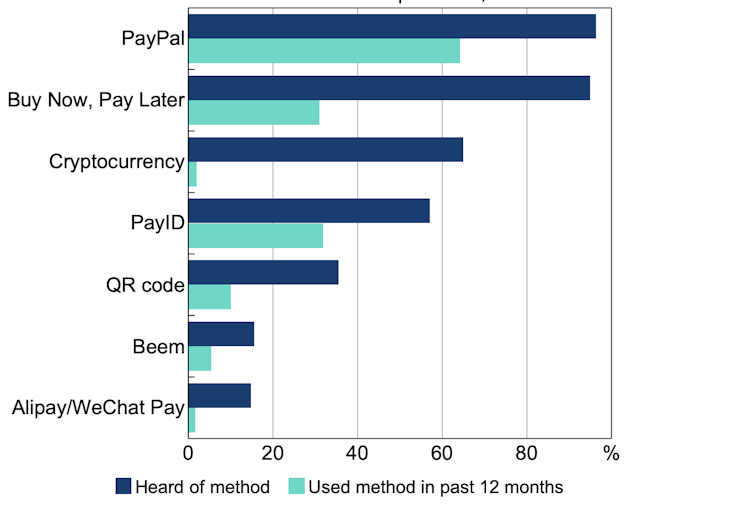

Reserve Bank calculations of Australians' awareness vs use of different payment methods, based on Ipsos data.

By contrast more recent innovations, such as “buy now, pay later” services and PayID, are being used by around a third of consumers.

These findings confirm 2022 data from the US Federal Reserve, showing just 2% of the adult US population made a payment using a cryptocurrrency, and Sweden’s Riksbank, showing less than 1% of Swedes made payments using crypto.

The problem of price volatility

One reason for this, and why prices for goods and services are virtually never expressed in crypto, is that most fluctuate wildly in value. A shop or cafe with price labels or a blackboard list of their prices set in Bitcoin could be having to change them every hour.

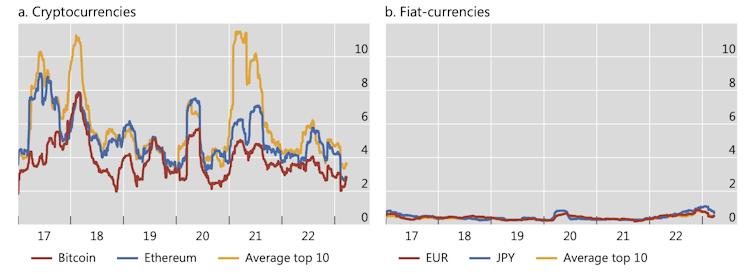

The following graph from the Bank of International Settlements shows changes in the exchange rate of ten major cryptocurrencies against the US dollar, compared with the Euro and Japan’s Yen, over the past five years. Such volatility negates cryptocurrency’s value as a currency.

Cryptocurrency’s volatile ways 90-day rolling standard deviation of daily returns for major cryptocurrencies compared with the Euro and Yen. The Crypto Multiplier, BIS Working Papers, No. 1104, CC BY

90-day rolling standard deviation of daily returns for major cryptocurrencies compared with the Euro and Yen. The Crypto Multiplier, BIS Working Papers, No. 1104, CC BY

There have been attempts to solve this problem with so-called “stablecoins”. These promise to maintain steady value (usually against the US dollar).

But the spectacular collapse of one of these ventures, Terra, once one of the largest cryptocurrencies, showed the vulnerability of their mechanisms. Even a company with the enormous resources of Facebook owner Meta has given up on its stablecoin venture, Libra/Diem.

This helps explain the failed experiments with making Bitcoin legal tender in the two countries that have tried it: El Salvador and the Central African Republic. The Central African Republic has already revoked Bitcoin’s status. In El Salvador only a fifth of firms accept Bitcoin, despite the law saying they must, and only 5% of sales are paid in it.

Read more: One year on, El Salvador's Bitcoin experiment has proven a spectacular failure Reserve Bank calculations of Australians' awareness vs use of different payment methods, based on Ipsos data.

Reserve Bank calculations of Australians' awareness vs use of different payment methods, based on Ipsos data.

By contrast more recent innovations, such as “buy now, pay later” services and PayID, are being used by around a third of consumers.

These findings confirm 2022 data from the US Federal Reserve, showing just 2% of the adult US population made a payment using a cryptocurrrency, and Sweden’s Riksbank, showing less than 1% of Swedes made payments using crypto.

The problem of price volatility

One reason for this, and why prices for goods and services are virtually never expressed in crypto, is that most fluctuate wildly in value. A shop or cafe with price labels or a blackboard list of their prices set in Bitcoin could be having to change them every hour.

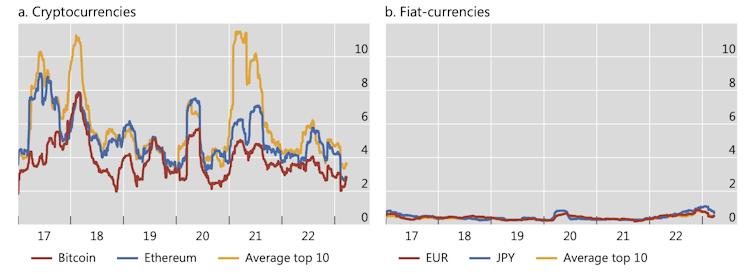

The following graph from the Bank of International Settlements shows changes in the exchange rate of ten major cryptocurrencies against the US dollar, compared with the Euro and Japan’s Yen, over the past five years. Such volatility negates cryptocurrency’s value as a currency.

Cryptocurrency’s volatile ways 90-day rolling standard deviation of daily returns for major cryptocurrencies compared with the Euro and Yen. The Crypto Multiplier, BIS Working Papers, No. 1104, CC BY

90-day rolling standard deviation of daily returns for major cryptocurrencies compared with the Euro and Yen. The Crypto Multiplier, BIS Working Papers, No. 1104, CC BY

There have been attempts to solve this problem with so-called “stablecoins”. These promise to maintain steady value (usually against the US dollar).

But the spectacular collapse of one of these ventures, Terra, once one of the largest cryptocurrencies, showed the vulnerability of their mechanisms. Even a company with the enormous resources of Facebook owner Meta has given up on its stablecoin venture, Libra/Diem.

This helps explain the failed experiments with making Bitcoin legal tender in the two countries that have tried it: El Salvador and the Central African Republic. The Central African Republic has already revoked Bitcoin’s status. In El Salvador only a fifth of firms accept Bitcoin, despite the law saying they must, and only 5% of sales are paid in it.

Read more: One year on, El Salvador's Bitcoin experiment has proven a spectacular failure Reserve Bank calculations of Australians' awareness vs use of different payment methods, based on Ipsos data.

Reserve Bank calculations of Australians' awareness vs use of different payment methods, based on Ipsos data.

By contrast more recent innovations, such as “buy now, pay later” services and PayID, are being used by around a third of consumers.

These findings confirm 2022 data from the US Federal Reserve, showing just 2% of the adult US population made a payment using a cryptocurrrency, and Sweden’s Riksbank, showing less than 1% of Swedes made payments using crypto.

The problem of price volatility

One reason for this, and why prices for goods and services are virtually never expressed in crypto, is that most fluctuate wildly in value. A shop or cafe with price labels or a blackboard list of their prices set in Bitcoin could be having to change them every hour.

The following graph from the Bank of International Settlements shows changes in the exchange rate of ten major cryptocurrencies against the US dollar, compared with the Euro and Japan’s Yen, over the past five years. Such volatility negates cryptocurrency’s value as a currency.

Cryptocurrency’s volatile ways 90-day rolling standard deviation of daily returns for major cryptocurrencies compared with the Euro and Yen. The Crypto Multiplier, BIS Working Papers, No. 1104, CC BY

90-day rolling standard deviation of daily returns for major cryptocurrencies compared with the Euro and Yen. The Crypto Multiplier, BIS Working Papers, No. 1104, CC BY

There have been attempts to solve this problem with so-called “stablecoins”. These promise to maintain steady value (usually against the US dollar).

But the spectacular collapse of one of these ventures, Terra, once one of the largest cryptocurrencies, showed the vulnerability of their mechanisms. Even a company with the enormous resources of Facebook owner Meta has given up on its stablecoin venture, Libra/Diem.

This helps explain the failed experiments with making Bitcoin legal tender in the two countries that have tried it: El Salvador and the Central African Republic. The Central African Republic has already revoked Bitcoin’s status. In El Salvador only a fifth of firms accept Bitcoin, despite the law saying they must, and only 5% of sales are paid in it.

Read more: One year on, El Salvador's Bitcoin experiment has proven a spectacular failure

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Shayne Neumann MP Blair boost](https://cdn.bulbapp.io/frontend/images/d0ae7174-2ceb-4eed-9844-e1c262a4013e/1)