SIP startegy for future benefits

A SIP (Systematic Investment Plan) strategy is a method of investing a fixed sum of money at regular intervals, regardless of market conditions. This strategy is most commonly used in traditional investments such as mutual funds, but it can also be applied to newer investment options such as cryptocurrencies.

The key advantage of a SIP is that it allows investors to invest small amounts regularly, rather than a lump sum, making it an accessible investment option for individuals with limited funds. The SIP strategy is based on the principle of Rupee Cost Averaging, which states that by investing a fixed sum of money at regular intervals, regardless of market conditions, an investor can average out the cost of the investment over a period of time. This helps to reduce the impact of market volatility on the investment, and allows the investor to benefit from the long-term growth potential of the asset.

For example, let's say an individual wants to invest in a mutual fund with a NAV (Net Asset Value) of 100. They decide to invest a fixed sum of Rs. 5000 every month through a SIP. If in the first month, the NAV of the fund increases to 110, the individual's investment will be worth Rs. 5500. But if in the next month, the NAV drops to 90, the individual's investment will be worth Rs. 4500. By investing a fixed sum of money every month, regardless of market conditions, the individual is able to average out their investment cost over time.

Similarly, a SIP strategy can also be applied to investing in cryptocurrencies. An investor would invest a fixed sum of money, for example, $100, at regular intervals, for example, monthly, into a cryptocurrency of their choice. This can be done through a cryptocurrency exchange or a digital wallet.

For example, let's say an individual wants to invest in Bitcoin using a SIP strategy. They decide to invest $100 every month into their Bitcoin account. If in the first month, the price of Bitcoin is $10,000, the individual's investment will be worth 0.01 BTC. But if in the next month, the price of Bitcoin drops to $9,000, the individual's investment will be worth 0.01111 BTC. By investing a fixed sum of money every month, regardless of market conditions, the individual is able to average out the cost of their Bitcoin investment over time.

The advantages of using a SIP strategy for investing in cryptocurrencies include:

- Diversification: By investing small amounts of money at regular intervals, an investor can diversify their portfolio and spread their risk across multiple cryptocurrencies.

- Cost averaging: By investing a fixed sum of money at regular intervals, regardless of market conditions, an investor can average out the cost of their investment over time. This can help to reduce the impact of market volatility on their investment.

- Consistency: By committing to a regular investment schedule, an investor is more likely to stick to their investment plan and not be swayed by short-term market fluctuations.

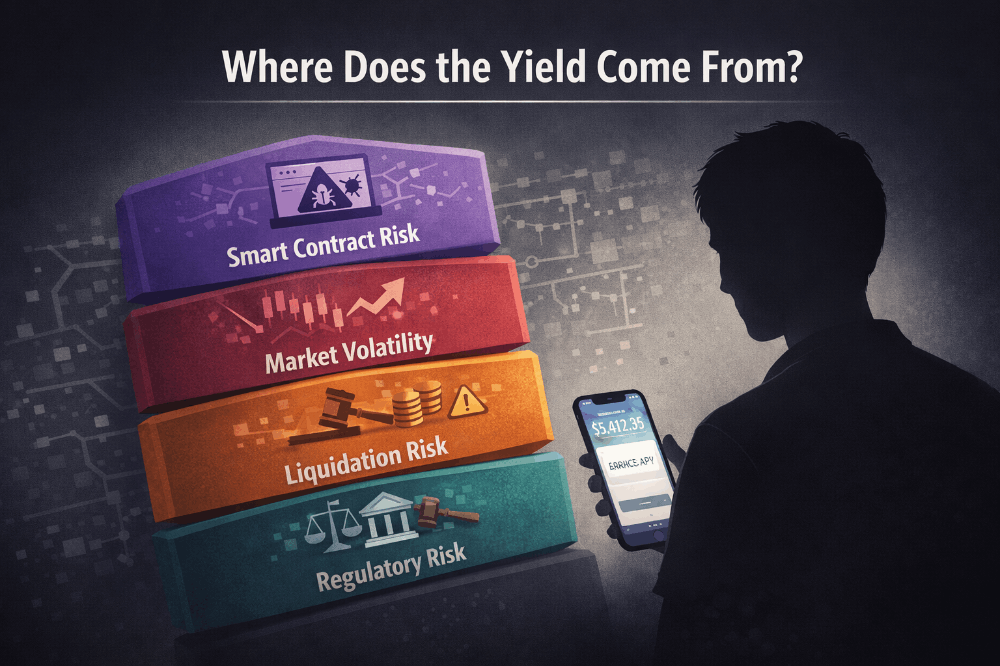

However, it's worth noting that investing in cryptocurrencies carries a higher degree of risk than traditional investments, due to the volatility and regulatory uncertainty surrounding the market. It's important for an investor to thoroughly research and understand the risks before investing in cryptocurrencies. It's also recommended to consult a financial advisor or professional before making any investment decisions.

In conclusion, a SIP strategy can be an effective way to invest in traditional assets such as mutual funds as well as newer assets like cryptocurrencies. By investing small amounts of money at regular intervals, investors can take advantage of the principle of Rupee Cost Averaging, helping to reduce the impact of market volatility on their investment and benefit from the long-term growth