The Wyckoff Trading Method

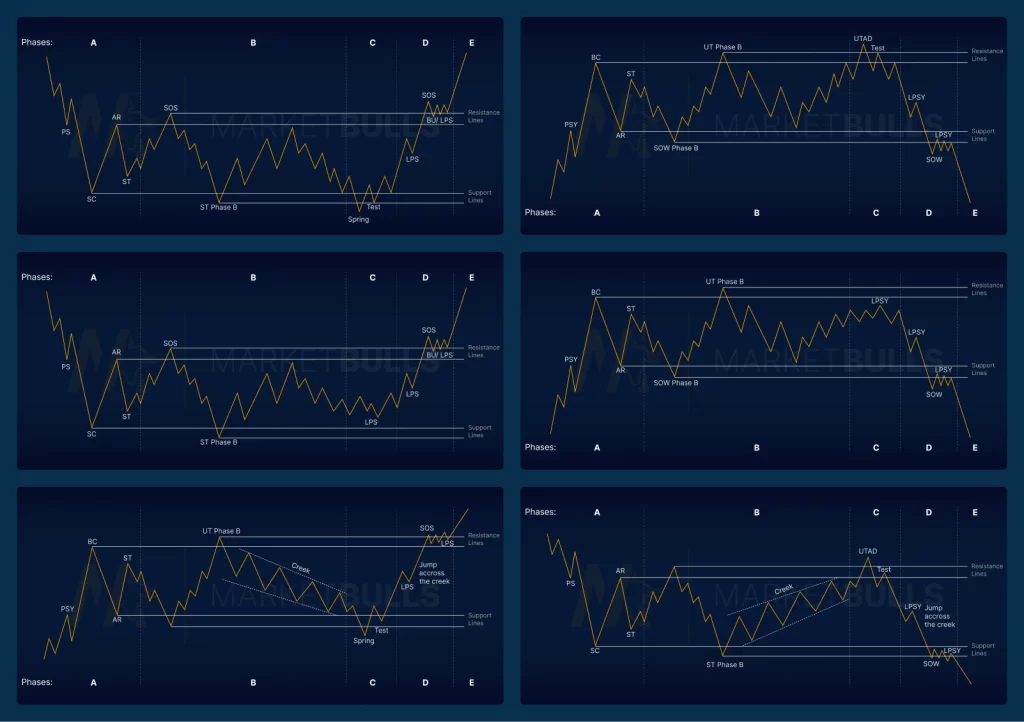

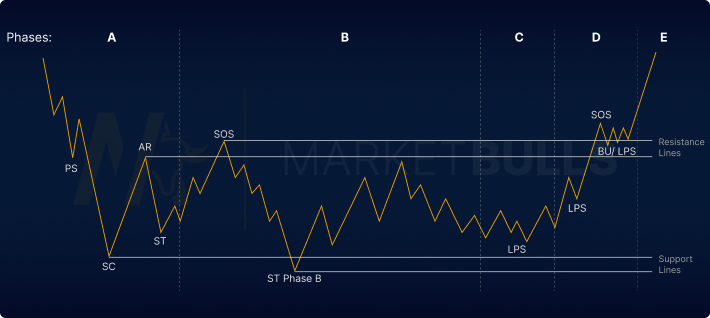

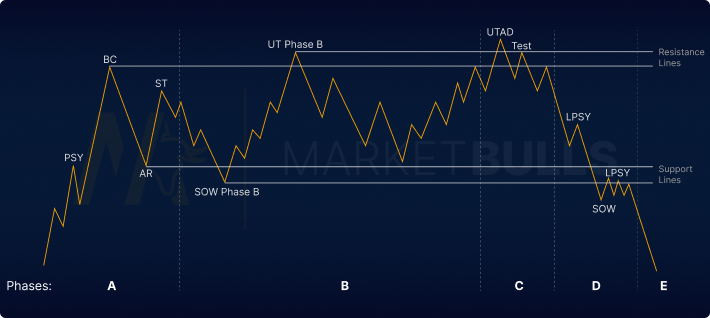

Accumulation & Distribution Schematics

The Wyckoff Trading Method, developed by Richard D. Wyckoff in the early 20th century, remains a foundational framework for understanding market dynamics and identifying potential trading opportunities. At its core, the Wyckoff Method focuses on identifying accumulation and distribution phases within financial markets, providing insights into market sentiment, supply and demand dynamics, and potential price movements.

The Wyckoff Trading Method, developed by Richard D. Wyckoff in the early 20th century, remains a foundational framework for understanding market dynamics and identifying potential trading opportunities. At its core, the Wyckoff Method focuses on identifying accumulation and distribution phases within financial markets, providing insights into market sentiment, supply and demand dynamics, and potential price movements.

Accumulation Phase

The accumulation phase, also known as the markup phase, represents a period of accumulation by informed market participants (smart money) before an anticipated uptrend. During this phase, prices consolidate within a trading range as smart money accumulates positions at lower price levels. Volume tends to be relatively low during accumulation, indicating decreased selling pressure and a potential imbalance between supply and demand. The breakout from the accumulation range signals the beginning of a new uptrend, as smart money begins to distribute their accumulated holdings to less informed market participants (the public).

Distribution Phase

Conversely, the distribution phase occurs after an extended uptrend and represents the distribution of assets by smart money to unsuspecting market participants (the public). Prices consolidate within a trading range or exhibit signs of topping patterns as smart money begins to offload their holdings at higher price levels. Volume may increase during the distribution phase, indicating increased selling pressure and a potential shift in market sentiment. The breakdown from the distribution range signals the end of the uptrend and the beginning of a potential downtrend, as less informed market participants begin to panic sell their positions.

Key Principles of the Wyckoff Method

- Supply and Demand: The Wyckoff Method emphasizes the importance of supply and demand dynamics in driving price movements. Understanding the interplay between supply (selling pressure) and demand (buying pressure) allows traders to identify potential accumulation and distribution phases within the market.

- Volume Analysis: Volume plays a crucial role in the Wyckoff Method, providing insights into the strength of price movements and the participation of market participants. An increase in volume during price advances or declines may signal the presence of smart money activity and potential trend reversals.

- Market Structure: Wyckoff traders analyze market structure, including support and resistance levels, trading ranges, and trendlines, to identify potential accumulation and distribution phases and anticipate future price movements.

- Price Spread: The spread between the high and low prices within a trading range provides valuable information about market sentiment and the presence of smart money activity. Narrow price spreads may indicate accumulation or distribution, while wide price spreads suggest increased volatility and potential trend reversals.

The Wyckoff Trading Method offers traders a comprehensive framework for understanding market dynamics, identifying accumulation and distribution phases, and making informed trading decisions. By analyzing supply and demand dynamics, volume patterns, market structure, and price spread, traders can gain valuable insights into market sentiment and anticipate potential price movements. While mastering the Wyckoff Method requires experience and practice, its principles can enhance traders' ability to navigate financial markets and identify profitable trading opportunities.

Thank you!

_________________________________

Your most valuable asset is your time. Invest him properly!

DYOR

Not your keys, Not your crypto!

Find useful articles to read: HERE

My referal links:

Images from: market-bulls.com