The Future of Cryptocurrencies: Unveiling the Next Chapter

Cryptocurrencies have taken the world by storm since the inception of Bitcoin in 2009. Over the years, they have transformed the financial landscape, challenging traditional systems and offering decentralized alternatives. As we gaze into the crystal ball of technological advancement, it's intriguing to explore what the future holds for cryptocurrencies. In this blog post, we'll delve into the potential developments and changes that lie ahead, shaping the future of digital currencies

- Mainstream Adoption: Cryptocurrencies have already gained significant traction, but the future promises even broader acceptance. As more individuals and businesses recognize the benefits of cryptocurrencies, we can expect a surge in mainstream adoption. Digital wallets and crypto payment gateways will become commonplace, seamlessly integrating cryptocurrencies into our daily lives.

- Interoperability and Standardization: The current crypto ecosystem is fragmented, with numerous blockchains and protocols competing for dominance. However, the future will likely bring greater interoperability and standardization. Efforts like cross-chain bridges and interoperability protocols will enable seamless communication between different blockchain networks, fostering a unified crypto landscape. This will enhance liquidity, ease of use, and promote innovation across the industry.

- Central Bank Digital Currencies (CBDCs): Central banksi are exploring the potential of CBDCs, which are government-backed digital currencies. These CBDCs will coexist with traditional fiat currencies and aim to provide the benefits of cryptocurrencies while maintaining regulatory control. In the future, we can expect to see CBDCs gaining traction, potentially revolutionizing the way we transact, store value, and interact with financial systems.

- Enhanced Scalability and Efficiency: One of the significant challenges facing cryptocurrencies is scalability. Bitcoin's limited transaction throughput and high fees have sparked debates around the need for scaling solutions. The future will likely bring advancements in scalability, such as the implementation of layer-2 solutions like the Lightning Network and the adoption of new consensus algorithms. These improvements will enhance transaction speed, reduce costs, and enable cryptocurrencies to handle a higher volume of transactions.

- Privacy and Security: Privacy has always been a topic of concern in the cryptocurrency space. In the future, we can expect enhanced privacy features, offering individuals greater control over their financial data. Advancements in zero-knowledge proofs, ring signatures, and other cryptographic techniques will empower users to transact anonymously while ensuring compliance with regulations. Additionally, robust security measures and advancements in blockchain technology will strengthen the overall security of cryptocurrencies, making them more resistant to attacks.

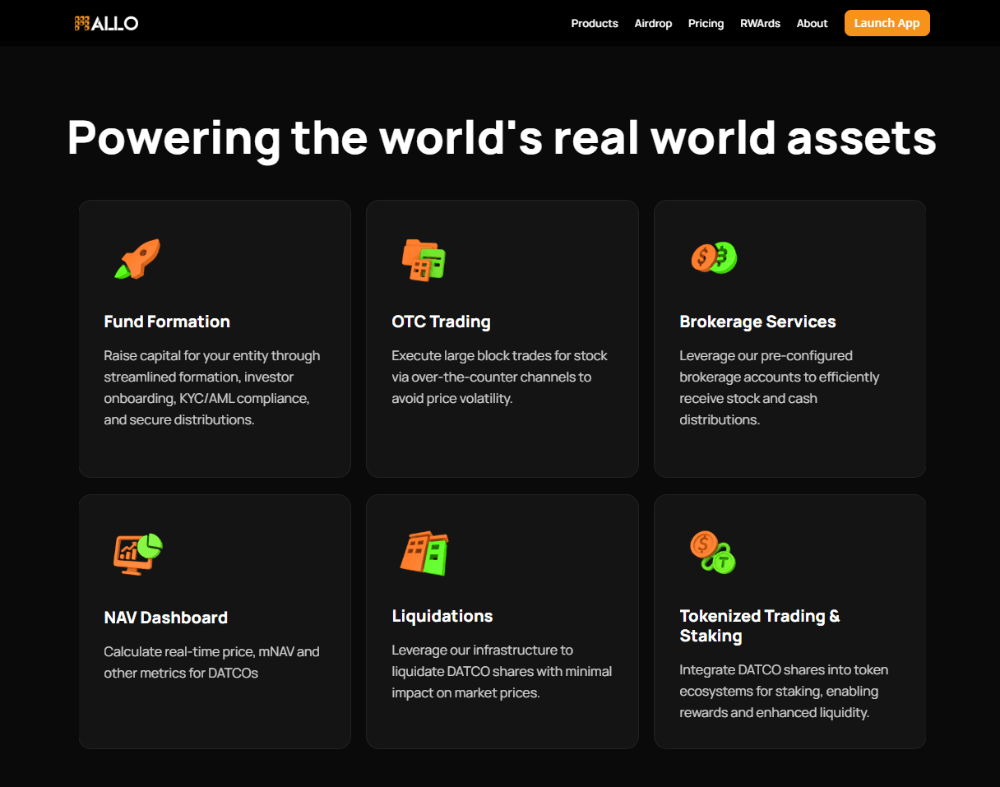

- Integration with Real-World Assets: The future of cryptocurrencies will likely witness increased integration with real-world assets. Through tokenization, physical assets such as real estate, artworks, and commodities can be represented on the blockchain. This will unlock new opportunities for fractional ownership, increased liquidity, and easier transferability of assets. Tokenized securities may also emerge, revolutionizing traditional financial markets and democratizing access to investment opportunities

7.Decentralized Finance (DeFi) Evolution:

DeFi has emerged as a game-changer, offering decentralized alternatives to traditional financial services. In the future, we can expect the DeFi ecosystem to expand further, encompassing a broader range of financial products and services. This may include decentralized lending and borrowing platforms, insurance protocols, prediction markets, and more. As DeFi becomes more accessible and user-friendly, it has the potential to disrupt traditional financial intermediaries and empower individuals with greater control over their finances.

8.Sustainability and Green Initiatives:

The environmental impact of cryptocurrencies, particularly Bitcoin, has drawn attention in recent years. To address this concern, the future of cryptocurrencies will likely witness a shift towards more sustainable practices. The development of eco-friendly consensus mechanisms, such as proof-of-stake (PoS), will reduce energy consumption and carbon footprints. Furthermore, initiatives for offsetting emissions and the integration of renewable energy sources into mining operations will contribute to a greener crypto ecosystem.

9.Regulatory Frameworks:

As cryptocurrencies gain mainstream adoption, governments and regulatory bodies will establish clearer frameworks to govern their use. While maintaining the essence of decentralization, regulations will focus on areas such as investor protection, anti-money laundering (AML), and know-your-customer (KYC) requirements. Regulatory clarity will bring greater confidence and trust to the cryptocurrency space, attracting institutional investors and facilitating wider acceptance.

10.Artificial Intelligence (AI) Integration:

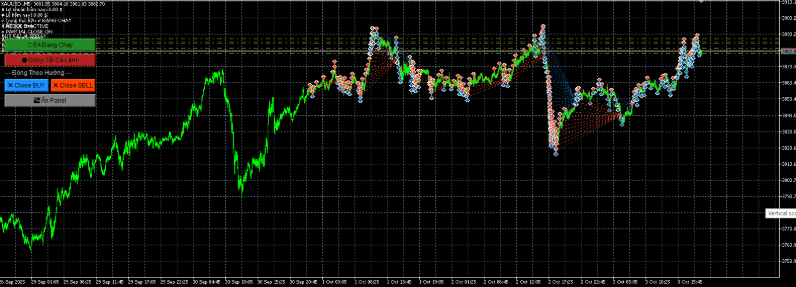

The convergence of cryptocurrencies and artificial intelligence holds immense potential for the future. AI can be leveraged to enhance security, identify patterns and anomalies in transactions, and improve fraud detection. Smart contract platforms may integrate AI algorithms for more efficient and automated contract execution. Additionally, AI-powered trading bots and predictive analytics can provide valuable insights for cryptocurrency investors, aiding in decision-making and risk management.

11.Global Financial Inclusion:

Cryptocurrencies have the power to bring financial services to the unbanked and underbanked populations around the world. In the future, we can expect increased efforts to leverage cryptocurrencies for global financial inclusion. By providing individuals with access to a secure and decentralized financial system, cryptocurrencies can empower those who have been excluded from traditional banking services. This has the potential to drive economic growth and reduce poverty on a global scale.

12.Evolution of User Experience:

As cryptocurrencies become more integrated into our lives, user experience will play a crucial role in their adoption. User-friendly interfaces, intuitive mobile applications, and improved wallet security will contribute to a seamless and convenient user experience. Additionally, educational initiatives will be essential in increasing crypto literacy and enabling users to navigate the complexities of the cryptocurrency landscape confidently.

- Cross-Border Transactions and Remittances: Cryptocurrencies have the potential to revolutionize cross-border transactions and remittances. Currently, sending money across borders can be costly, time-consuming, and subject to various intermediaries. In the future, cryptocurrencies can streamline this process, enabling near-instantaneous, low-cost, and secure cross-border transactions. Blockchain technology can eliminate the need for intermediaries, reducing fees and increasing efficiency. This will benefit individuals, businesses, and migrant workers who heavily rely on remittances.

- Augmented Reality (AR) and Virtual Reality (VR) Integration: The convergence of cryptocurrencies with augmented reality (AR) and virtual reality (VR) technologies presents exciting possibilities. In the future, we may witness the emergence of blockchain-based virtual worlds and immersive experiences where users can interact with digital assets and currencies. AR technology can enhance real-world transactions by overlaying cryptocurrency payment information onto physical objects, creating a seamless blending of the digital and physical realms.

The future of cryptocurrencies is dynamic and holds immense potential for transformative changes in finance, technology, and society as a whole. As the world continues to embrace digital currencies, we can anticipate advancements in scalability, privacy, and interoperability. The integration of cryptocurrencies with real-world assets, the growth of decentralized finance, and the development of sustainable practices will shape the landscape. Coupled with regulatory frameworks and the integration of AI, cryptocurrencies have the power to foster financial inclusion and revolutionize global financial systems. Embracing these opportunities while addressing challenges will be crucial as we witness the exciting evolution of cryptocurrencies in the years to come.The future of cryptocurrencies is brimming with potential. As these digital currencies continue to evolve and mature, we can expect widespread adoption, interoperability, and enhanced efficiency. Central bank digital currencies will likely play a significant role in the future financial landscape, while advancements in scalability, privacy, and security will address the current limitations of cryptocurrencies. Furthermore, the integration of real-world assets onto blockchain platforms will open up exciting avenues for innovation and investment. As we embark on this transformative journey, it is crucial to remain vigilant, adapt to change, and embrace the incredible opportunities that lie ahead in the world of cryptocurrencies.