"Heading Towards Bitcoin Halving 2024: Everything Investors Need to Prepare For"

Bitcoin halving, also known as "halving," is an event where the reward for Bitcoin mining is cut in half compared to the previous reward.

This event is estimated to occur approximately every four years. The policy mechanism is encoded in the Bitcoin mining algorithm to address inflation while maintaining scarcity. Historically, the reduction in Bitcoin emission rates has led to an increase in BTC prices after halving.

Fourth Bitcoin Halving in 2024

Historically, three halvings have occurred on November 28, 2012, July 9, 2016, and May 11, 2020. According to the countdown on the Coinmarketcap website, the fourth halving is expected to take place around 113 days from the date of this article (January 2, 2024), which is April 17, 2024.

It is important to note that the mentioned date is not exact, as the halving event is not based on a fixed calendar but rather on the speed of the Bitcoin network in producing transaction blocks. The faster the Bitcoin network produces blocks, the sooner the halving occurs.

Technically, halving occurs every 210,000 Bitcoin transaction blocks formed. Transaction blocks on the Bitcoin network are estimated to be formed every 10 minutes on average. This results in an estimated halving occurrence every 2,100,000 minutes, which, when converted to years, is approximately 3.99 years, or close to 4 years.

The fourth halving in terms of transaction blocks will occur at transaction block number 840,000. According to the Blockchair explorer website, the current Bitcoin transaction block is 823,974 (January 2, 2024). This leaves 21,032 transaction blocks until the fourth halving. Miner rewards will be reduced to 3,125 BTC per block, down from the previous 6.25 BTC per block.

BTC Price Predictions from Historical Halving Data

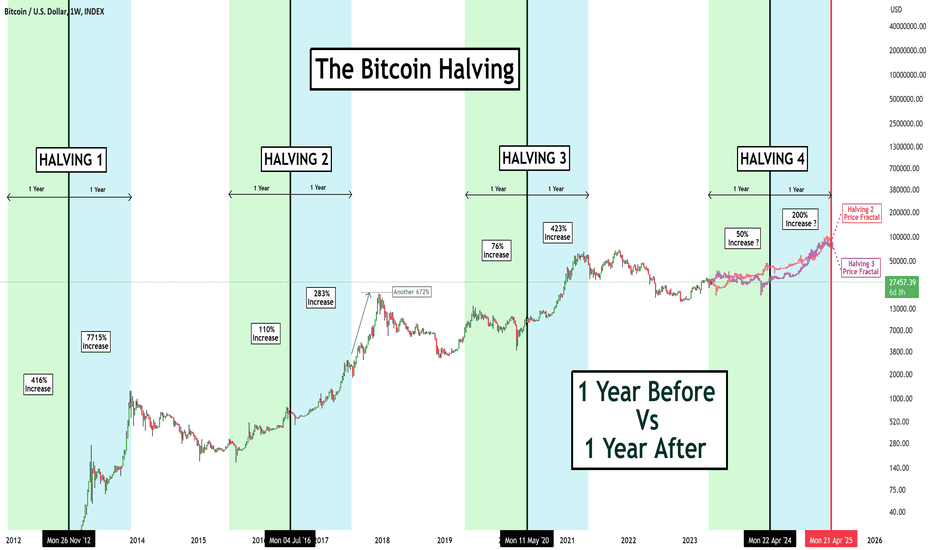

Before discussing Bitcoin price predictions during halving, historical data on how Bitcoin prices moved before and after previous halving events will be presented.

So far, there have only been three Bitcoin halvings, making it difficult to draw conclusions about BTC performance before and after halving due to limited data. However, a consistent trend observed from the previous halvings is that one month before each of the three Bitcoin halvings, the Bitcoin price was lower than during the halving. Additionally, six months after each halving, the Bitcoin price was always higher than the price during halving.

If observed in cycles, there are two phases after halving: a bull market and a bear market, as well as one phase before halving known as the accumulation phase. The three previous halvings successfully triggered a bull market after the accumulation phase, with data indicating that the bull market will reach its peak in mid to late 2025.

Investor and Retail Preparations for Halving 2024

Bitcoin halving in 2024 is estimated to occur approximately five months from now. Based on the halving cycle, the five months before halving still fall within the accumulation phase. The dollar-cost averaging (DCA) method can be applied during this phase.

The selection of cryptocurrencies to be purchased also needs attention. In this case, Bitcoin is considered a safer choice than altcoins, considering the price performance before and after halving.

DCA towards altcoins may be a good option with hopes for higher profits, but it is essential to choose altcoins with a promising project outlook, a compelling narrative, and project developments.

From historical data, it is evident that BTC prices consistently experience an increase one month before halving. Therefore, for investors and retailers looking to increase their purchases at a specific time, one month before halving is an opportune time to buy Bitcoin."

*Disclaimer:

This content aims to enrich reader information. Always conduct independent research and use disposable income before investing. All buying, selling, and crypto asset investment activities are the reader's responsibility.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)