Parallel currencies

Parallel currency refers to the system where a country or a business operates with more than one currency in parallel. In the context of financial accounting, parallel currency allows for valuations and closing operations to be portrayed in the local currency as well as in additional currencies. This is particularly useful for multinational corporations that need to record financial transactions and produce financial reports in several currencies due to their operations across different countries.

For example, a company might use its local currency for standard operations but also manage transactions in a foreign currency for international business. This setup enables the company to perform accounting according to different principles and in different currencies simultaneously. Parallel currencies are often used in SAP systems to facilitate such multi-currency accounting.

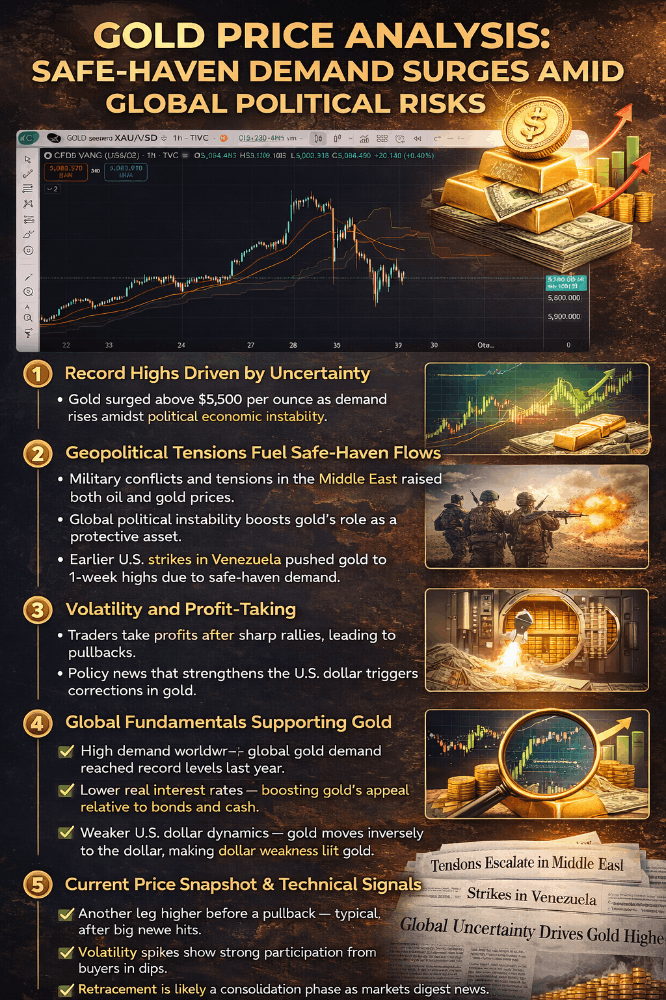

Parallel currencies can be introduced in various scenarios, often as a response to economic challenges. Here are some historical and contemporary examples: Greece Greece Greece: During its financial crisis, there was discussion about Greece introducing a parallel currency for domestic transactions while keeping the euro for bank deposits and foreign transactions.

California: In 2009, California issued IOUs that temporarily circulated as a parallel currency to the US dollar during a budget crisis.

South American Countries: Some South American countries have used the US Dollar as a parallel currency alongside their national currency to stabilize their economies.

Cuba: Cuba used a US dollar-backed parallel currency called “Peso Convertible” until 2015.

Germany: After reunification, there was a proposal to keep the East German currency, Ostmark, as a parallel currency to the Deutschmark, but it was not implemented.

Parallel currencies can serve various purposes, such as facilitating trade, stabilizing the economy, or transitioning to a new currency system. They can also be a tool for monetary policy, allowing governments to influence both domestic and foreign economies through targeted policies. However, managing parallel currencies can be complex, requiring careful consideration of exchange rates, legal tender status, and potential impacts on the economy