Narrative 2024: DePIN (Decentralised Physical Infrastructure)

DePIN is an old narrative, but the term has only become popular with the Solana ecosystem. DePIN = Decentralised Physical Infrastructure.

It's about real-world infrastructure being run decentrally, in a way that incentivises people around the world. Instead of relying on big centralised companies like Telkom, Apple, Google, etc. to build infrastructure, DePIN incentivises us with tokens.

Decentralisation here is not just a "gimmick" for the sake of decentralisation. It means participation from a wide range of people, and has the potential to be competitive.

Some examples are:

- 5G: Although 5G is faster than 4G, the higher frequencies used cannot travel far. This means that expanding 5G infrastructure requires cell towers in denser locations. DePIN incentivises everyone around the world to run the infrastructure, and this could be faster than a centralised company (especially in remote rural areas).

- Mapping: Companies like Google hire teams to map locations around the world. A decentralised network allows ANYONE to map the world just by buying a car dashcam and driving around.

- Rendering: People all over the world have idle GPUs, and someone else needs to do the rendering work. If you pay attention to Nvidia's earnings call (and last week's Monday AI narrative episode), GPUs are in high demand for AI. How about utilising a global network for idle GPUs?

DePIN has no problem on the supply side (incentivise tokens and people will come). The real problem is on the demand side, does anyone want to use it?

Crypto makes it easy to bootstrap a network like this, but it's useless if there is no demand from users. Of course, the infrastructure can be developed further in the future. But the core question: Why use decentralised Google Maps? Instead of the usual Google Maps, people just use it to find the nearest vegetables...

Well, we'll answer that here!

1. HELIUM

Seeking to build a decentralised physical wireless communication infrastructure. Helium does this by incentivising people to deploy hardware in their homes or offices, carried over ISPs.

Helium used to compete with Pollen in this DeWi field, but since the PCN token got a hard cap, incentives and network growth have been limited.

Helium itself migrated from its own blockchain to Solana. The main reason is because L1 itself consumes too much core devs' time and leaves little resources to work on the actual product.

Helium also has several tokens, and integration with DEXes in Solana makes entering the DeFi market more seamless, rather than bridging.

The Breakpoint conference includes big announcements, recaps, and other highlights about this! For those who want to request an in-depth technical discussion of Helium, please comment below. Due to video time constraints, I focused on the Helium and DePIN metrics in Solana since the migration.

Since the April migration, Helium device owners have printed ~1JT NFTs in Solana (compressed). These NFTs are used for identification and tracking purposes, allowing Helium to know the addresses of entities that should be paid and rewarded. When people pay to use the Helium network, hotspot owners get rewarded, and these NFTs facilitate operational tasks very cheaply.

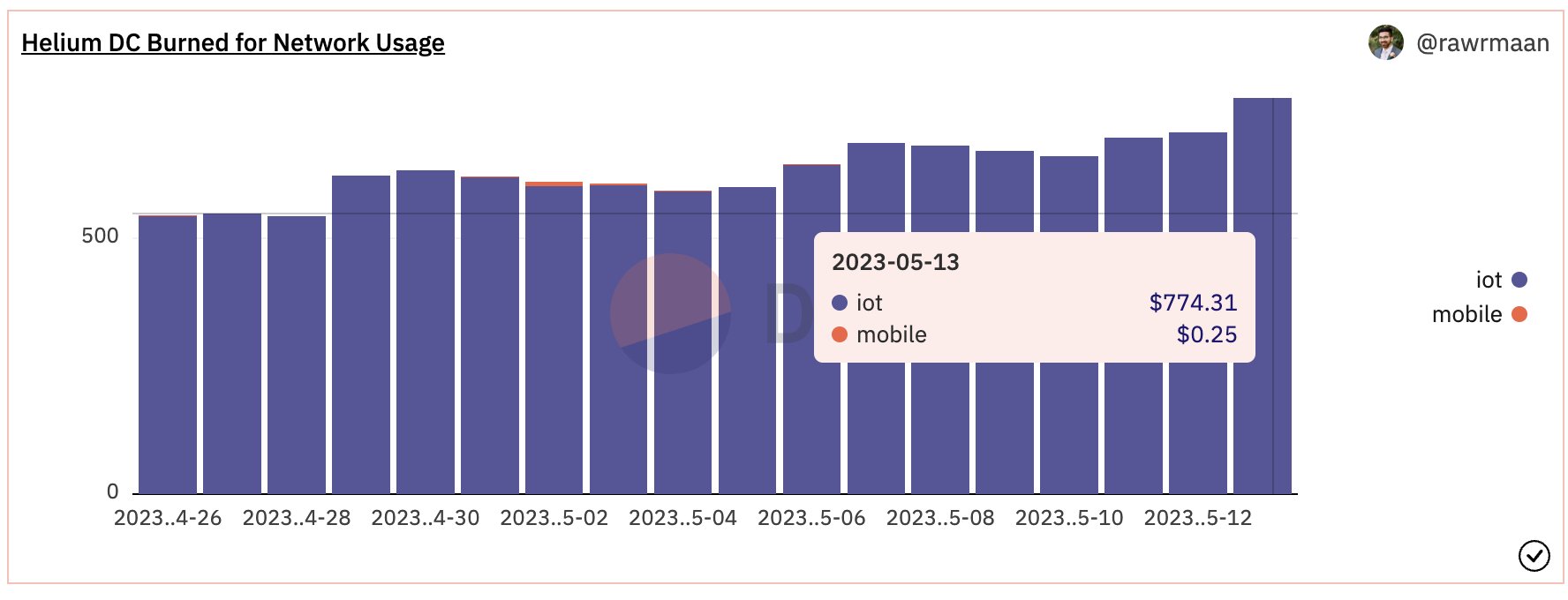

In terms of demand, it is not significant yet. But there are some people paying to use IOT, because ~$700 Data Credits (DC) are burned every day to use Helium's IOT network.

This amounts to ~$0.61/year for an average hotspot that costs ~$120, so the demand for Helium needs to increase considerably.

Otherwise it will depend on token inflation. Helium's latest focus is on their mobile 5G network, after IOT was less adopted. There is a potential synergistic relationship with Saga Solana mobile phones, and the 5G infrastructure thesis is interesting. Let's give them time!

Helium's move to Solana will allow focus on building the network, without worrying about the underlying infrastructure. Give Helium time, there is still a journey to self-sustain.

2. HIVEMAPPER

Hivemapper has mapped approximately 90 million KM of roads in total in its first year, more than 6JT KM that is unique. This steady progress represents 10% of the world's roads, a significant mark of achievement in its mission to accurately map the world.

With more than 8,000 dashcams deployed around the world, drivers are daily helping to build the world's freshest map. All thanks to the effectiveness of the network, the enthusiasm of the community, and its increasing adoption.

Hivemapper is building a decentralised map. Contributors buy a dashcam for ~$300, start driving around, and make some sweet HONEY. So far, ~14,500 contributors have mapped predominantly the US and Western Europe.

The Hivemapper Map AI is also operational, autonomously generating map features from street images. More than 2,000 AI Trainers actively validate the system's output every month.

A few weeks ago, the system processed 4.2 million reviews, a huge jump from 500,000 weekly reviews in September.

HONEY is printed for map contributors (drivers) with various scales:

- Coverage: Less mapped regions yield more

- Updates: How fresh is the mapped region data?

- Quality: Is the quality of the map image good?

There are rewards for ensuring quality and for operations (validating images, saving images, adding caption notes, etc.), but ~90% goes to drivers. So far, contributors have generated ~$700RB of HONEY tokens based on current prices.

Similarly, the supply side is easy to bootstrap with tokens. Map contributor drivers are paid. But who will use this "decentralised map" and pay HONEY?

Mostly organisations that have to pay companies like Google for their product integration. Since there are only a few companies doing mapping (mostly Google and Apple), the market is an oligopoly. There are other issues with centralised maps too, apart from outdated maps, there is also data mining, invasion of privacy of ordinary people, and government censorship.

Using Hivemapper, so far someone is willing to pay ~$4,400 for map access. A low figure, but within expectations for their initial stage. As the network continues to increase coverage, we will see if the demand can increase as well.

Map subscribers can set "HONEY Burst" bounties for contributors who target specific regions. In November, Hivemapper implemented Bursts in specific cities to fulfil a need. The response was very positive - coverage exceeded 90%.

Similar to Helium, Hivemapper also has something to do with Solana. The frequency with which they print and burn HONEY tokens is high. Hivemapper has done ~10JT onchain transactions over the past 3 months, which is not very practical for most blockchains.

With a $0.0001 transaction fee on Solana, this is much more likely, as those 10JT transactions only cost ~$1,000. They could build their own appchain, but it would be like Helium in the beginning, complicated with infrastructure and having to integrate bridging or exchanges. Ethereum's L2 also doesn't work as claimed. Transaction fees are still above >$0.1 and can be dozens to tens of dollars when congested (during the PEPE mania it cost $1-$2 to exchange assets on L2, and during the inscription attack on Arbitrum it cost up to $50).

Solana is a simple solution that is ready today.

3. RENDER

Render is one of the hot projects and tokens, because of the AI narrative as well (watch last week's Monday video). Essentially, Render allows idle GPUs to be rented out and monetised to creators around the world who need computing power. Think artists, game developers, mechanical engineers, etc.

Render is a distributed marketplace for GPU-intensive rendering jobs. By entering the Render network, those who demand GPUs will find affordable rendering computing. People like us can become providers if we have more capacity.

GPU providers already received $958,000 in November, up 82% month-on-month, and up 898% year-on-year. This is because artists and other creators are spending more money on rendering work, and the price of RNDR tokens is also increasing.

(Note that payments from OTOY to GPU providers are often delayed, so this spike may be due to a spike in payments from the previous month).

Source: Dune Analytics (@ericwallach)

Source: Dune Analytics (@ericwallach)

There were 326 Render node operators that received payments in November. This is up 36% month-on-month and 11% year-on-year, which is relatively constant and reflects the fact that OTOY is limiting supply (to balance demand). The average monthly payout per Render node operator is now at ATH $35,256, which is up 34% month-on-month and 797% year-on-year.

Render Network upgraded its core infrastructure from Ethereum to Solana in November 2022. Now RNDR token holders are being asked to migrate from Ethereum to Solana using the Wormhole cross-blockchain protocol.

Although Render didn't start on Solana, its community recently voted and agreed to this network migration for several reasons:

- Print/burn modules (similar to Helium and Hivemapper) are not practical on low performance blockchains

- Utilises compressed NFTs for rendering purposes

- Preference of Rust over Solidity, for security and similar codebase to their GPU rendering

- Helium to Solana migration success story

- Solana security and decentralisation in general

At least from these initial 3 examples we know, for speculation into the DePIN narrative, SOL could be the main blockchain coin to watch in this category.

4. DIMO

DIMO is an open platform for vehicle relationships, related to car health information, driving behaviour, and of course there is the $DIMO token reward.

These token rewards are used for automotive services such as insurance, servicing, repairs, or charging electric vehicles.

Since its launch in Q4 2022, there have been >24k vehicles added to the network and >7,300 drivers, with an average of 3.4 cars connected to each user. 72% of the cars are connected with inbuilt software, the other 28% use DIMO hardware devices connected to the car's OBD2 plugs.

Source: Dune Analytics (@olreliable)

Source: Dune Analytics (@olreliable)

The DIMO platform began distribution of $DIMO tokens in December 2022, rewarding users for their maintenance of vehicle and network connections.

Users can also earn rewards by using service providers available on the DIMO Marketplace. Vehicle Genius is a service that provides emergency support and automotive servicing. In the past year, they rewarded drivers with >53k $DIMO tokens for beta testing their new mobile app.

Source: Dune Analytics (@jdbender128)

Source: Dune Analytics (@jdbender128)

The DIMO Macaron is installed in the car's OBD2 plug and printed onchain as an NFT for identity configuration. The DIMO smart contract registry can be found in the Polygon block explorer, and tracks transactions related to the registration of DIMO hardware devices.

One manufacturer, Hashdog, has minted over 5k devices on the network, burning >120k $DIMO tokens in the process. In this transaction, 20 new Macarons were minted.

5. ARWEAVE

Arweave is a decentralised protocol that allows permanent data storage. Arweave users pay once upfront to store data forever.

Arweave is already experiencing an explosion of activity to ATH 325JT monthly transactions in December 2023. This represents a growth of over 159% month-on-month and around 9.4x year-on-year.

Source: ViewBlock

Source: ViewBlock

Arweave currently adds about 170 data points to the network per second. Despite the increasing transaction volume, Arweave's fees have remained stable. In total, Arweave has accumulated 1.69M transactions since its birth. This ~1.2M transactions in 2023.

There is currently more than 142 TiB of data stored in Arweave (weave size). This weave size is growing at around 28% year-on-year.

Source: ViewBlock

Source: ViewBlock

This is a bundle of transactions over Irys, L2 and scalability solutions for Arweave, which includes 5000 individual data transactions. Irys has been a key driver of transactions in Arweave, totalling over 1.5M transactions (~90% of all Arweave transactions) and 82.45 TB of data since launch. Irys functions and works similarly to L2s in other ecosystems.

6. AKASH

Akash is a decentralised cloud service that combines various clouds (public and private) onto one platform. So there is a market for computing commerce, including hard-to-get GPUs like the NVIDIA H100 and A100, which are essential for AI tasks.

In essence, Akash is now Render's main rival.

Since launching GPUs, Akash's revenue has increased by 37% of its overall revenue, up 147% monthly over the past 3 months. Akash currently earns around $1,600 per day, signalling the growing demand for GPUs on decentralised networks.

Source: Cloudmos - Akash

Source: Cloudmos - Akash

Akash's daily GPU utilisation is currently 80%, indicating a healthy demand for available GPUs on the network.  Source: Cloudmos - Akash

Source: Cloudmos - Akash

CPU capacity on Akash has also set a new record with over 3,000 CPUs active on the network, driving a 57% utilisation rate. This surge has been fuelled by PoW miners using Akash for privacy and censorship resistance purposes.

Digital Foundry (a subsidiary of Digital Currency Group) is the first well-known crypto mining company, which wants to repurpose its GPUs from mining to AI with Akash.

Will this all work out? Only time will tell. Crypto clearly needs a way to provide a useful product, expanding from the bubble of gajelas token trading on the internet.