Scallop lending protocol on Sui calls for 3 million USD

Scallop Protocol said it has raised 3 million USD from many large investment funds, continuing to strengthen its position as the leading lending protocol on the Sui blockchain.

On the afternoon of March 3, Scallop Protocol announced the end of the strategic capital round for Q1/2024, raising a total of 3 million USD.

The project has received the support of many famous investment funds in the cryptocurrency market, including CMS Holdings, 6th Man Ventures, Kucoin Labs, Blockchain Founders Fund, Oak Grove Ventures, Side Door Ventures, UOB Venture Management, Signum Capital, Cypher Capital, Mysten Labs, Kyros Ventures, Criterion, 8186 Capital, 7UpDao, LBank Labs, ViaBTC, Cetus Protocol, AC Capital, and Zellic.

Scallop is a lending protocol deployed on the Sui blockchain in July 2023, and then widely received thanks to its user-friendly UI, high security and many advanced features. The recent project reached the highest TVL ever of 156 million USD, with a total value of borrowed and loaned assets of 15 billion USD, and more than 2 billion USD in flash loan volume. These achievements have made Scallop the #1 DeFi project on Sui.

With the newly raised funds, Scallop will continue to build and integrate features that serve users and become an “all-in-one” DeFi protocol.

In the coming days, Scallop will turn a new page in its development roadmap with the token issuance event. Scallop's SCA token IDO will take place on the Cetus Protocol launchpad platform, the project's exclusive partner.

About Scallop

Scallop is a lending marketplace on the Sui Network and the first DeFi protocol to receive funding from the Sui Foundation.

Scallop Protocol is developed based on institutional standards, promoting compatibility and security to create a flexible currency market, providing affordable interest rates, AMM and other management tools for users. use. Scallop is currently offering a 20% APR for major asset pools.

What is Scallop (SCA)?

Scallop is a pioneering project in the lending field on the Sui blockchain and is also the first DeFi protocol to receive official funding from the Sui Foundation. The project will provide users with high lending interest rates, low loan fees, AMM, cryptocurrency self-management tools on a unified platform, and provide SDK for professional traders.

Scallop Highlights:

· Pioneering the exclusive Compound V3+ lending/borrowing model on non-EVM chain

· Equipped with 2 Layers SDK suitable for professional traders

· User interface for arbitrage trading, no coding skills required

· X-oracle: Supports Multi-oracle strategy

· Team with extensive experience in network security

· Some achievements that Scallop has achieved:

Achieved top spot in Sui Builder House Seoul Hackathon June 2023 (Scallop Tools).

· Win the Move Hackathon by WebX Circle in July 2023.

· Achieved 3rd place for the Best Overall category in the Sui x Kucoin Labs Summer Hackathon in July 2023.

· The largest and fastest growing currency market in the Move ecosystem.

Why is Scallop developing on the Sui blockchain?

Sui blockchain has the following advantages:

Scalability and instant confirmation: Sui supports horizontally scalable processing and storage, delivering high transaction processing speed and low latency.

Secure smart contract language: Sui provides a secure smart contract language for developers.

Narwhal technology, Bullshark DAG memory pool and Byzantine fault-tolerant consensus mechanism: Sui uses Narwhal DAG technology and Bullshark as a memory pool and Byzantine fault-tolerant consensus mechanism to ensure reliability and consistency of transaction.

Parallel execution: Sui can execute multiple transactions in parallel, reducing latency and increasing processing speed.

Scallop's operating model

Scallop operates under a stratified interest rate mechanism based on collateral value, creating favorable conditions for both lenders and borrowers. Besides, using Scallop's SCA token will bring many preferential interest rates and other benefits to users.

Similar to Compound's collateral model, Scallop also tokenizes user debt on the protocol in the form of sCoin (Scallop Market Coins). sCoin is similar to liquid staking derivatives instruments, in that users receive tokens as proof of ownership of the collateral they deposited. sCoin can then be used for financial derivatives, such as debt obligations.

Scallop uses a Trilinear Interest Rate model that provides three distinct interest rate levels, each activated at different capital utilization levels. As borrowers use more leverage, Scallop ensures that liquidity providers are compensated with higher yields to match the increased risk of default and subsequent liquidation.

Borrowers tend to deposit stable assets to borrow a more volatile asset for short-term trading. Similarly, borrowers often quickly reduce leverage when borrowing costs increase. So, the role of a Scallop is to strike a balance between one's risk tolerance and the opportunity cost associated with the primary asset allocation. Scallop's Trilinear Interest Rate model is therefore optimized to give lenders and borrowers a greater degree of responsiveness to changes in market conditions.

Scallop's liquidation mechanism

Scallop uses a soft liquidation mechanism to create a flexible and fair environment for both lenders and borrowers. When collateral drops below a certain threshold, Scallop will trigger a grace period notification, giving the borrower the opportunity to increase collateral or pay off part of the loan to bring the collateral level back to normal. safe balance.

If the borrower fails to increase collateral or repay part of the loan, Scallop will begin the liquidation process. A portion of the borrower's collateral will be sold on the market to repay the lender and the protocol. The liquidation process continues until the loan is paid off or the collateral value reaches a specific threshold.

Scallop incentivizes liquidators by giving them discounts when buying mortgaged assets from borrowers, while also penalizing borrowers if they do not comply with the contract. This penalty will be collected upon sale of the borrower's mortgaged property.

When liquidating, the penalty is often greater than the reward, with the project's treasury picking up the difference. For example, the penalty is 10% while the reward is only 5%, meaning the liquidation reserve ratio is 5%.

Scallop's operating situation

Parameters of the protocol's performance:

· Reached TVL of more than 40 million USD - the largest currency market at the moment on the Sui ecosystem

· 1.4 million wallet addresses use Sui products

· The protocol has been integrated with OKX DeFi (Top 5 Stablecoin Pool)

· Other protocols such as Typus, Kai Finance, SuiPearl are built based on Scallop technology

With the Lending feature, Scallop is currently supporting users with 5 different tokens including: SUI, USDC, USDT, CETUS, vSUI. Among them, SUI is the type of asset that most users lend to.

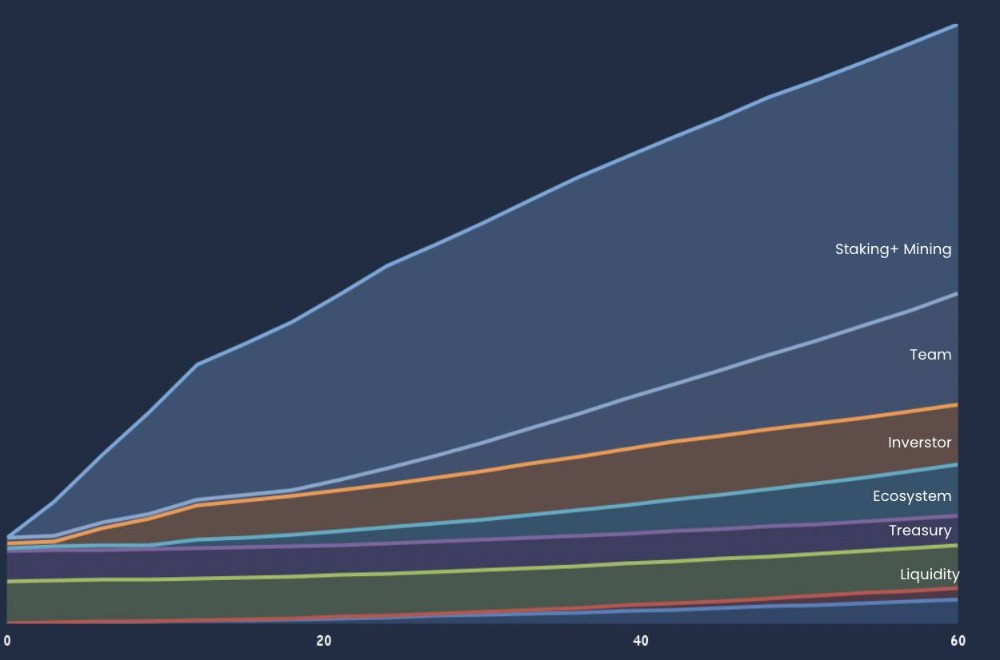

Token Allocation

SCA token distribution chart

· Liquidity Mining: 45%

· Members contribute to the project: 18.5%

· Dev & Operations: 4%

· Advisor: 2%

· Strategic partners: 10%

· Ecosystem/Community/Marketing: 8.5%

· Liquidity: 5%

· Treasury: 7%

Token Release Schedule

What is SCA token used for?

· Vote on governance proposals

· Reduced fees when using Scallop features

Wallet stores SCA tokens

You can store this token on the following wallets: Sui Wallet, Martian Wallet, Ethos, OKX Wallet,...

Development roadmap

Q1 2024

· TGE

· Launch of Scallop Tools V2

· Launched Telegram/Discord Bot

· Launch of Synthetic Assets Pools

· Launch of Isolate Pools

Q2 2024

· Launch of Collateralize RWA

· Launch on other chains

· Launched Cross-chain Lending feature

Development team

Scallop was developed by a team with experience in many different fields such as: DeFi, cybersecurity, quantitative trading,...

Investors

Scallop has received investment from many different investment funds and projects: MystenLabs, Sui Foundation, Comma3 Ventures, Supra Oracles,...

summary

Scallop is a lending solution developed on the Sui blockchain. The token of this project is not currently listed on exchanges. Through this article, you probably have some basic information about the project to make your own investment decision.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)