Navigating the Highs and Lows

Early Bull Runs and the Pain of Corrections

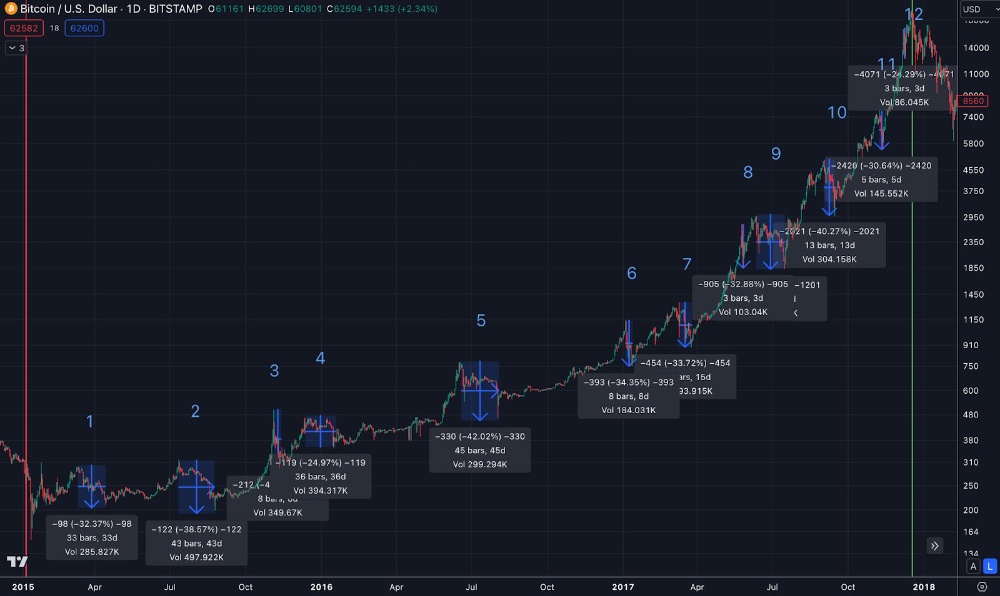

In the beginning, every bull run felt like a wild ride. The thrill of seeing Bitcoin's price surge was often tempered by sudden, sharp corrections. I remember the first time I experienced a -20% drop. It felt like the end of the world. My heart would race, and doubts would creep in. Was this the beginning of the end for Bitcoin? What if the naysayers were right and this whole thing was just a bubble waiting to burst?

As the market matured, these corrections became more pronounced. A -25% drop here, a -30% crash there—each time it happened, the market was flooded with FUD. Negative news articles, skeptical analysts, and panicked investors all contributed to a sense of doom. It was easy to get swept up in the fear, and I often found myself second-guessing my investment.

However, as the years passed and I experienced more bull runs, I started to notice a pattern. After every correction, the market would eventually recover, often reaching new all-time highs. This realization was a turning point for me. I learned to see corrections not as catastrophic events, but as natural parts of the market cycle.

During the early days, my response to FUD was often reactionary. I'd read a negative article and immediately feel a wave of anxiety. But with time, I learned to filter out the noise. I began to trust my research and my understanding of Bitcoin's fundamentals. I also started to appreciate the value of holding through the dips. Panic selling during a correction often meant locking in losses, whereas holding on could lead to significant gains once the market rebounded.

FOMO has been another constant companion on this journey. During the early stages of a bull run, it's easy to get caught up in the excitement. Watching the price skyrocket, I would often feel an overwhelming urge to buy more, fearing I'd miss out on the next big surge. This emotional response can be just as dangerous as FUD, leading to impulsive decisions and over-leveraging.

My early experiences taught me the importance of having a plan and sticking to it. Rather than chasing the highs, I focused on strategic entry and exit points. I also diversified my investments to mitigate risk. This approach has helped me stay grounded during both the euphoric highs and the devastating lows.

Now, with years of experience under my belt, I face -25%, -30%, or even -35% corrections with a much cooler head. I've seen it all before, and I know that volatility is part of the game. Instead of panicking, I see these corrections as opportunities. They are chances to reassess my strategy, potentially buy more at a discount, and reinforce my long-term belief in the value of Bitcoin.

I've also come to understand the cyclical nature of the market. Every bull run is followed by a correction, and every correction sets the stage for the next bull run. This perspective has given me the patience and confidence to weather the storms. I'm no longer swayed by FUD or driven by FOMO. Instead, I stay focused on my long-term goals and the bigger picture.

Being in Bitcoin since the early 2010s has been an incredible journey. I've experienced the thrill of bull runs and the despair of corrections. Through it all, I've learned invaluable lessons about market psychology, the importance of patience, and the power of resilience.

Today, I face market corrections with a seasoned perspective, knowing that each dip is just another step on the path to greater heights.

My experiences have made me a better investor, and I'm excited to see where this journey will take me next.

Thank you!

_________________________________

- Your most valuable asset you own is your time. Invest him properly!

- DYOR

- Not your keys, Not your crypto!

Find useful articles to read: HERE

My referal links:

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)