AppLovin History P3 - Current Platform Products

Today we'll be looking at how the business strategy of AppLovin has evolved over time, as well as some of their past acquisitions.

History

- Who founded the company

- has management changed significantly over time

- how credible is current vs previous management

- is this a significant factor in the price of the equity i.e. will this affect growth / the multiple that the market is willing to pay

- What is their business strategy and how has it evolved?

- What has and hasn't worked in the past, and why?

- What's the company's funding history and equity makeup?

- What does their acquisition history look like?

To understand AL's business strategy, we first have to understand their core products, and how they interact with each other.

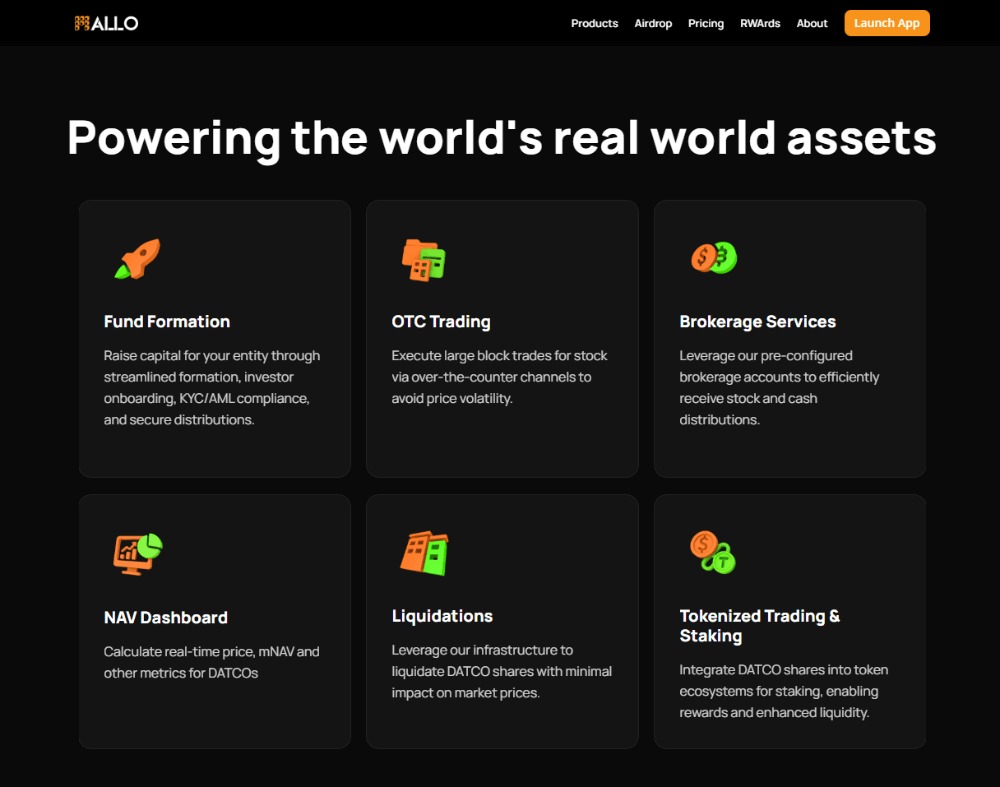

AL's business offerings (as of May 19, 2024) are made up of the following sections:

Software Platform:

AppDiscovery - the advertiser side product. AppDiscovery helps advertisers find inventory space to market their apps and encourage downloads from a set of users that's most likely to engage, as determined by the AXON algorithm. The other side of Max.

Max - The developer side product. Max helps devs monetise by auctioning off ad space in the apps (ad inventory) to advertisers. This happens in milliseconds right before the ad is shown to the user as the ad inventory becomes available. The other side of AppDiscovery. Max also takes bids from other ad platforms, which gives AL access to valuable pricing data.

^these two apps are responsible for most of AL's revenue

SparkLabs - In house ad creative team - they make AI-enhanced ads.

AppLovin Exchange - AL's ad exchange - allows real-time bidding to major add formats (video, rewarded video, playable, native, rich media and display).

The difference

Array - A suite of software solutions designed primarily for original equipment manufacturers (OEMs, think Oppo or Samsumg) and telecom carriers. Helps provide users with relevant app recommendations that can be embedded into the device setup process and throughout the lifecycle. Also offers white label app stores (app stores that other parties can customise and re-brand), and offer personalised app recommendations for users on these stores through data collected on other users (think app store recommendations).

AL also facilitates ads directly into a device's interface to recommend apps. AL has a partnership in this area with OPPO, a major cellphone manufacturer in China (mid-market - premium), and Samsung in Brazil.

Adjust - An acquired company that now operates as a subsidiary. Focused on providing mobile attribution, analytics, fraud prevention and automation solutions for clients. Provides insights to help devs build acqui and retention strategies.

Wurl - Another acquisition that focuses on connected TV (CTV) advertising and distribution. Part of AL's efforts to diversify, connects streaming channels with distributional channels globally. Works similarly to AppDescovery and Max, but thinks more traditional TV commercials rather than mobile ads.

AXON 2.0: The match-making ML algorithm that drives the products on the AL platform. This matches the advertiser to the most appropriate ad inventory from publishers (i.e. targets app-install ads to the users most likely to download those apps). There's no public information on what kind of algorithm is used here, but the general consensus seems to be that it doesn't matter as long as it performs (my personal bet is that it's some kind of deep feedforward Neural net, but that's neither here nor there).

Apps:

There's a whole deep dive that will be done on apps, which will be coming tomorrow.

Unfortunately, I do have a job to attend to tomorrow so that's all for now folks!

Price at time of writing: $82.49