Here are the top 10 indicators on TradingView

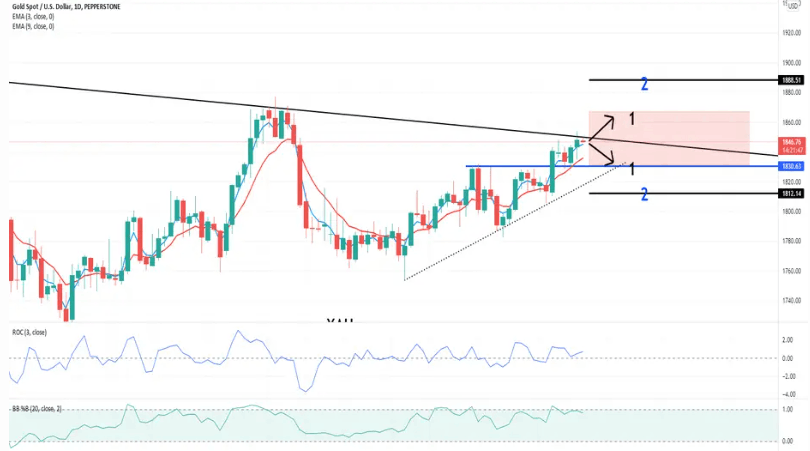

Moving Average (MA): The Moving Average indicator helps identify trends by smoothing out price data over a specified period. It is widely used to determine support and resistance levels.

Relative Strength Index (RSI): The RSI measures the speed and change of price movements. It oscillates between 0 and 100, indicating overbought or oversold conditions.

Bollinger Bands: Bollinger Bands consist of a middle band (MA) and two outer bands that represent standard deviations from the MA. They help identify volatility and potential trend reversals.

MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of an asset's price.

Stochastic Oscillator: The Stochastic Oscillator compares an asset's closing price to its price range over a specified period, indicating overbought or oversold conditions.

Volume Profile: Volume Profile displays trading activity over a specified period at different price levels, helping identify areas of high or low volume.

Fibonacci Retracement: Fibonacci Retracement is a tool used to identify potential support and resistance levels based on the Fibonacci sequence.

Ichimoku Cloud: The Ichimoku Cloud is a comprehensive indicator that provides information about support and resistance levels, trend direction, and momentum.

Average True Range (ATR): ATR measures market volatility by calculating the average range between high and low prices over a specified period