The Impact of Blockchain Technology on Finance

Introduction

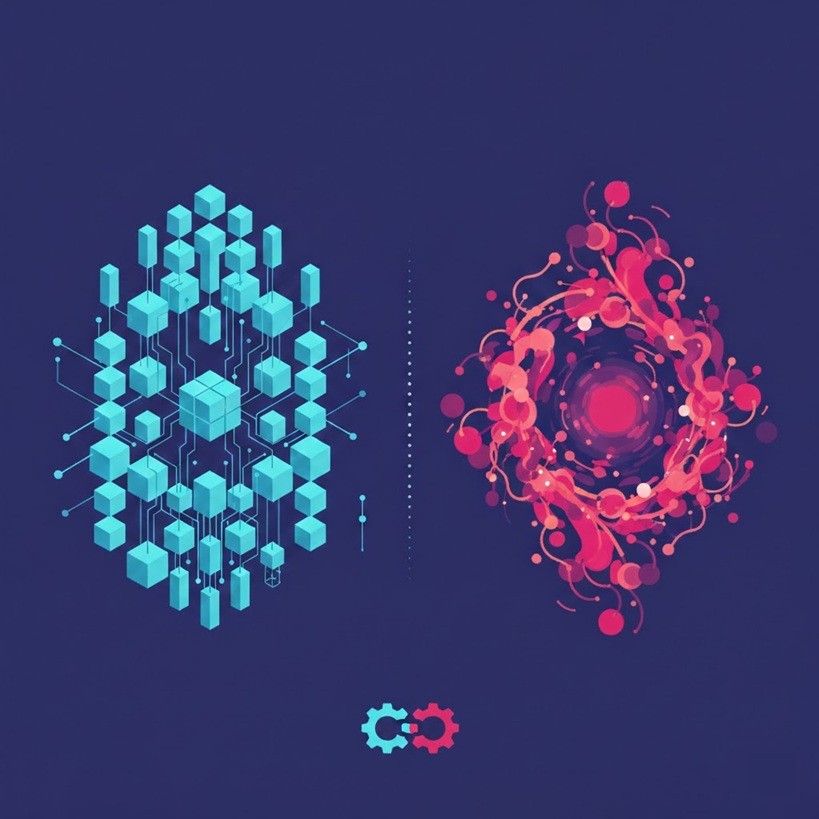

Blockchain technology has brought about significant change and transformation in the financial sector in recent years. This technology offers a decentralized, transparent, and secure data storage and transfer system, providing a different perspective on financial processes. In this article, we will delve into the detailed effects of blockchain technology on the finance sector.

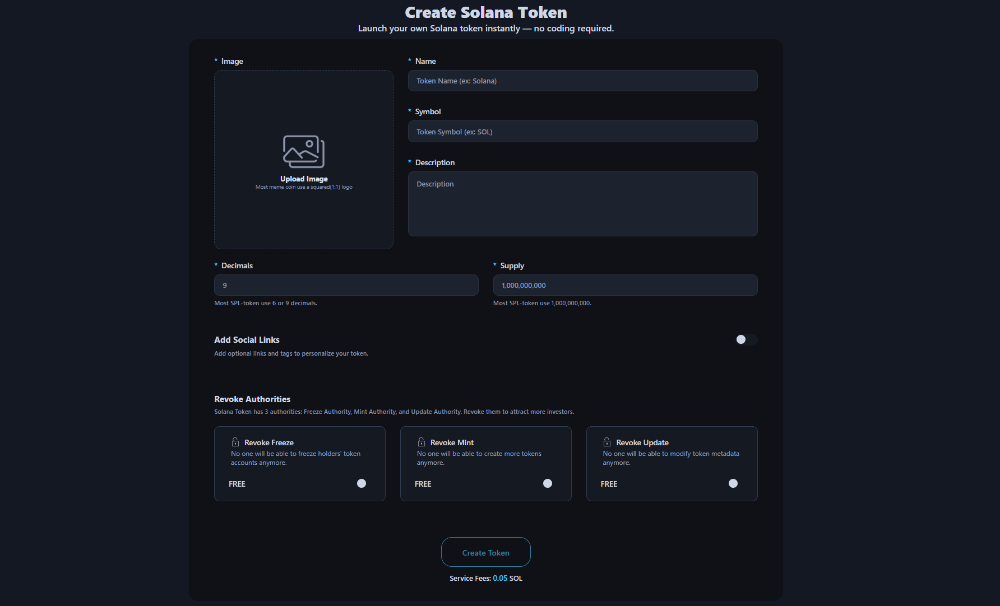

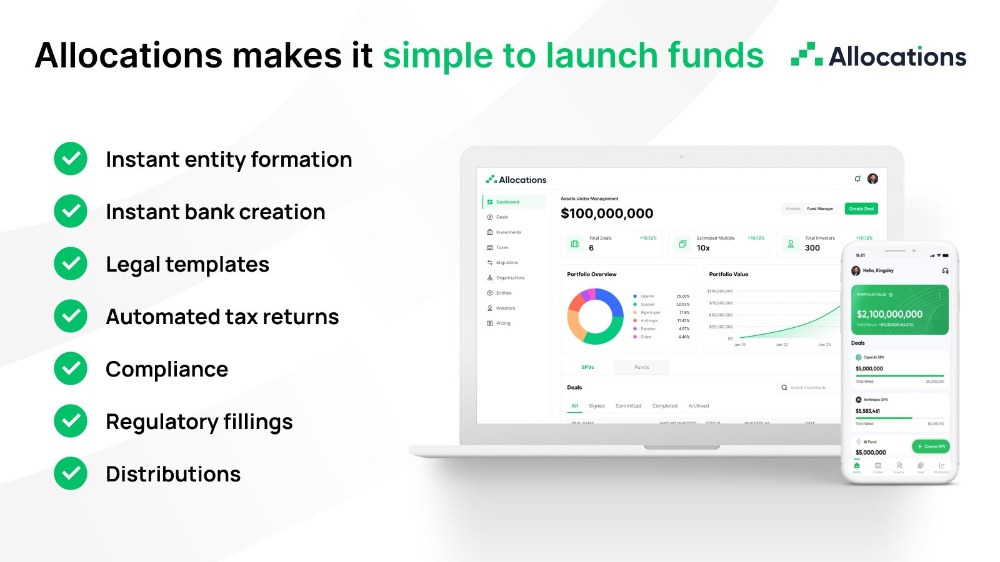

- Decentralized Finance (DeFi)

Blockchain technology enables financial transactions to take place without the need for a central authority, giving rise to the concept of Decentralized Finance (DeFi). Through smart contracts and blockchain-based protocols, DeFi facilitates lending, borrowing, trading, and other financial transactions. DeFi broadens access to financial services and eliminates intermediaries, leading to lower transaction costs.

- Instant Payments and Low Transaction Costs

Especially in international money transfers, blockchain allows for instant payments. Traditional financial systems with intermediaries can slow down transaction processes and increase costs. Blockchain technology speeds up cross-border payments and ensures low transaction costs.

- Transparency and Trust

Blockchain allows for transparent tracking of transactions. As all transactions are recorded on the blockchain, their accuracy and transparency are ensured. This reduces trust issues among financial institutions and provides consumers with a more reliable financial system, minimizing the risk of fraud and deception.

- Asset Tracking and Management

Blockchain offers significant advantages in asset management and tracking. Tokenizing financial assets on the blockchain makes them easily transferable. This enables more effective management of various assets such as real estate, stocks, and virtual assets.

- Improvements in KYC (Know Your Customer) and AML (Anti-Money Laundering) Practices

Blockchain technology can contribute significantly to identity verification and anti-money laundering efforts in the financial sector. Automating KYC and AML processes, secure sharing of data, and tracking transactions can play a more effective role in preventing financial crimes.

Conclusion

Blockchain technology has instigated profound changes in the financial sector, making future financial transactions more secure, faster, and transparent. However, challenges such as widespread adoption and the establishment of regulatory frameworks need to be addressed. As the financial industry strives to adapt to this new technology, it will progress by considering the potential advantages and risks associated with blockchain.