Tokenization of Assets in Cryptocurrency: A Detailed Overview

Tokenization of assets in cryptocurrency refers to the process of converting rights to an asset into digital tokens on a blockchain. This concept has gained significant attention in recent years as it offers numerous benefits, including increased liquidity, fractional ownership, and accessibility to a wider range of investors. Here's a detailed breakdown of various factors related to tokenization of assets in cryptocurrency:

- Definition and Concept:

- Tokenization involves representing ownership of assets digitally through cryptographic tokens on a blockchain.

- Traditional assets such as real estate, stocks, bonds, and commodities can be tokenized.

- Technology:

- Blockchain technology underpins asset tokenization by providing a decentralized and immutable ledger.

- Smart contracts are often utilized to automate token issuance, distribution, and compliance with regulatory requirements.

- Benefits:

- Liquidity: Tokenization enables fractional ownership, allowing investors to buy and sell small portions of an asset, thereby increasing liquidity.

- Accessibility: Tokenization can democratize access to investment opportunities by lowering entry barriers and enabling global participation.

- Transparency: Transactions on a blockchain are transparent and traceable, enhancing trust and reducing fraud.

- Lower Costs: By eliminating intermediaries and automating processes, tokenization can reduce transaction costs.

- 24/7 Trading: Cryptocurrency markets operate round-the-clock, providing investors with continuous trading opportunities.

- Regulatory Considerations:

- Regulatory frameworks vary across jurisdictions, and token issuers must comply with securities laws, anti-money laundering (AML), and know your customer (KYC) regulations.

- Compliance measures may include restricting token trading to accredited investors or implementing whitelists and blacklists.

- Types of Tokenization:

- Asset-backed tokens: Tokens representing ownership of physical assets such as real estate or commodities.

- Security tokens: Tokens that represent ownership of financial assets, such as stocks, bonds, or derivatives, and often subject to securities regulations.

- Utility tokens: Tokens that provide access to a product or service within a platform or ecosystem.

- Challenges:

- Regulatory Uncertainty: Lack of clear regulations and compliance requirements can hinder widespread adoption.

- Security Concerns: Security vulnerabilities in smart contracts or blockchain networks may expose assets to hacking or theft.

- Liquidity Risks: Tokenized assets may face liquidity challenges, especially if there's limited demand or trading volume.

- Use Cases:

- Real Estate: Tokenization enables fractional ownership of properties, allowing investors to diversify their portfolios and access real estate markets globally.

- Venture Capital: Startups can tokenize equity or revenue streams, providing liquidity to early-stage investors and facilitating fundraising.

- Art and Collectibles: Tokenizing artwork or collectibles can unlock liquidity for illiquid assets and enable fractional ownership.

- Future Outlook:

- Mainstream Adoption: As regulatory clarity improves and infrastructure matures, tokenization could become a mainstream method for asset ownership and investment.

- Interoperability: Interoperability between different blockchain networks and standards may facilitate seamless transfer and trading of tokenized assets.

- Integration with Traditional Finance: Collaboration between traditional financial institutions and blockchain firms could accelerate the adoption of tokenization in mainstream finance.

In conclusion, tokenization of assets in cryptocurrency represents a transformative innovation with the potential to revolutionize the way assets are owned, traded, and accessed. However, it also poses challenges related to regulation, security, and liquidity that must be addressed for widespread adoption. Despite these challenges, the future outlook for asset tokenization is promising, with continued advancements in technology and growing acceptance from regulators and investors.

- Technology:

- Blockchain Protocol: Different blockchain protocols offer varying features and capabilities for asset tokenization. Ethereum, for instance, is a popular choice due to its support for smart contracts, which automate token-related processes.

- Interoperability: Interoperability between blockchain networks is crucial for facilitating seamless transfer and trading of tokenized assets across different platforms and ecosystems. Projects like Polkadot and Cosmos are working on interoperability solutions.

- Scalability: Scalability is essential for handling a large volume of transactions efficiently. Layer 2 solutions like sidechains and state channels, as well as advancements in consensus mechanisms (e.g., proof of stake), aim to improve blockchain scalability.

- Regulatory Considerations:

- Compliance Frameworks: Regulators worldwide are grappling with how to classify and regulate tokenized assets. Some jurisdictions have developed specific frameworks for security tokens, while others are still in the process of formulating regulations.

- Jurisdictional Arbitrage: Variations in regulatory approaches across jurisdictions can lead to jurisdictional arbitrage, where token issuers choose to operate in regions with favorable regulations.

- Compliance Solutions: Compliance solutions such as decentralized identity verification and on-chain compliance protocols aim to streamline regulatory compliance while preserving user privacy.

- Security and Custody:

- Smart Contract Audits: Auditing smart contracts for vulnerabilities is critical to ensure the security of tokenized assets. Third-party audit firms specialize in reviewing smart contract code for potential exploits.

- Custodial Solutions: Custodial services play a crucial role in safeguarding tokenized assets, especially for institutional investors who require secure storage solutions. Cold storage wallets and multi-signature wallets are commonly used for custody.

- Market Infrastructure:

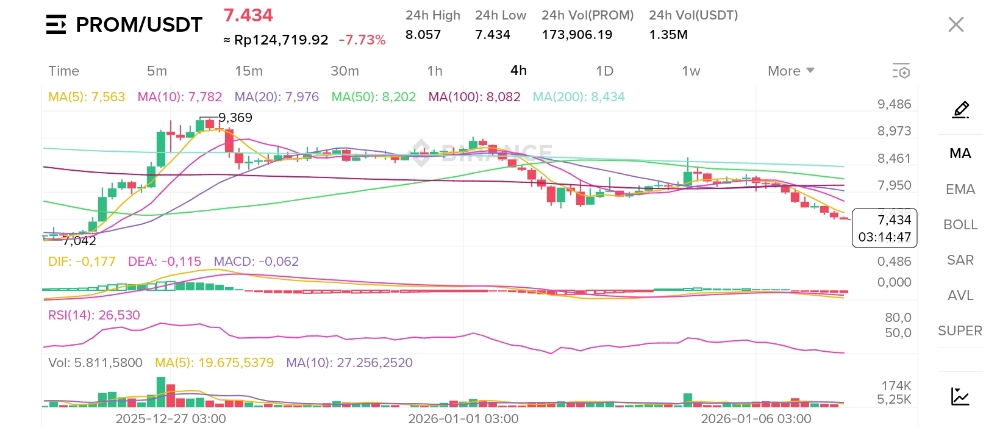

- Exchanges: Cryptocurrency exchanges provide platforms for trading tokenized assets. Both centralized exchanges (CEXs) and decentralized exchanges (DEXs) facilitate the buying and selling of tokens, with varying degrees of liquidity and security.

- Token Standards: Token standards such as ERC-20, ERC-721, and ERC-1155 define the rules and functionalities of tokens on the Ethereum blockchain. These standards ensure interoperability and compatibility across different applications and platforms.

- Tokenization Ecosystem:

- Tokenization Platforms: Companies specializing in asset tokenization offer platforms and services for issuing, managing, and trading tokenized assets. These platforms often provide tools for compliance, governance, and investor relations.

- Tokenization Marketplaces: Online marketplaces connect token issuers with investors, enabling the primary issuance and secondary trading of tokenized assets. These marketplaces may focus on specific asset classes or cater to a broad range of offerings.

- Legal and Governance Structures:

- Legal Documentation: Issuers of tokenized assets must draft legal documentation such as token sale agreements, prospectuses, and terms of service to define the rights and obligations of token holders.

- Governance Mechanisms: Governance mechanisms, such as voting protocols and decentralized autonomous organizations (DAOs), empower token holders to participate in decision-making processes related to asset management and governance.

- Tokenization Adoption and Trends:

- Tokenization of Everything: The concept of "tokenization of everything" envisions a future where virtually all assets, from real estate to intellectual property, are represented as tokens on a blockchain, unlocking new possibilities for ownership and investment.

- Institutional Participation: Increasing interest and participation from institutional investors, including banks, asset managers, and family offices, signal a growing acceptance of tokenized assets as a legitimate asset class.

- Regulatory Evolution: Regulatory developments, such as the emergence of security token exemptions and regulatory sandboxes, aim to foster innovation while ensuring investor protection and market integrity.

In summary, the tokenization of assets in cryptocurrency encompasses a wide range of technological, regulatory, security, and market-related considerations. As the ecosystem continues to evolve, addressing these factors will be essential for unlocking the full potential of asset tokenization and realizing its benefits for investors, issuers, and the broader financial system.