Brightpool Finance

Brightpool Finance

Every crypto user knows very well the costs related to trading their favorite digital assets. In the era of trending DeFi projects and decentralized solutions, there is an exchange that turns the approach to fees upside down.

Brightpool is a revolutionary trading platform where you earn rewards on each order and enjoy zero-commission trading – we do not charge any fee on the transactions placed on our platform!

Brightpool has been developed by Dark Pool One – the software house which aims to provide innovative solutions for platforms with digital assets based on blockchain. Outstanding specialists in mathematics, smart contracts and blockchain technology, as well as analysts and financiers, were engaged to work on the construction of our protocol.

As you probably already know by now, Brightpool is the first exchange that pays users for placing orders. For example, when you place an order to buy or sell BTC within a certain timeframe, you’ll receive BRI tokens as an incentive just for placing the order.

The number of tokens you will receive for the placed order will be clearly visible in the order field.

If the order is not executed because the coin pair did not reach the user-defined target price, the order value will be refunded to your wallet. What’s more, you’ll still keep the order rewards described above despite your order not having been filled. However, if the user cancels an order early, they have to pay the new estimated value of BRI tokens (calculated at the current market rate). BRIs returned to Brightpool in the form of canceled orders will be burnt.

BRI tokens are fully stakable tokens on the Brightpool exchange. BRI token utility is not only for placing and executing orders on the Brightpool platform but will also be available for purchase and sale on other exchanges.

The amount of BRI tokens you receive depends on the size, timing, and execution of your order.

BRI will not have a fixed supply; there will be 200 000 000 of preminted tokens, and any tokens besides this 200M will be created according to the ‘PoB’ mechanism. New tokens are released into circulation through traders’ hands as BRIs are minted by placing orders — with each bid.

The exchange splits the profit, generated by the price divergence between user orders and the current price of the trading pair, as follows:

- 10% of the profit is transferred to the staking pool to reward stakers,

- 80% to the Treasury Pool, which contains Brightpool’s native Liquidity Pool,

- 10% for protocol development.

Simply holding BRI in your wallet is not an activity that yields any rewards.

Instead, you will be rewarded for:

- Staking BRI on Brightpool,

- Adding liquidity to external exchanges,

- Staking LP tokens from external exchanges on Brightpool.

In order not to freeze the value of the Treasury Pool, the exchange offers passive investing, which generates additional profits and also increases your staking reward.

The Black-Scholes model is a mathematical market model describing the price dynamics of financial instruments over time, and it is primarily used to value derivatives.

Brightpool’s order pricing and valuation mechanism deploys an algorithm derived from the Black-Scholes model, which was awarded the Nobel Prize in Economic Sciences in 1997. To this day, the largest investment banks in the world rely on variations of this model.

In one of our forthcoming publications, we will explain in further detail why the above model balances the risk profile of investments.

Tokenomics

Brightpool’s token creation procedure follows a fair approach. Let’s go over all the most important aspects that define our tokenomics.

An innovative approach that Brightpool brings to the table in regard to the operation of the platform is the token release mechanism.

Initially, tokens are minted through Proof of Stake (PoS). However, there is an additional, unique mechanism: the Proof Of Bid, thanks to which the BRI token will be released from the BRI Pool to users only when an order gets placed on the platform. 80% of the BRI tokens that get released into circulation will have an associated and corresponding order by the general order reward release mechanism. This creates a fundamental value for BRI.

Once these orders get settled after the maturity period, the platform will earn revenue from volatility based on the BSM algorithm.

The revenue earned by exchanges is transferred to the Brightpool internal pools, Staking Pool and Treasury Pool. Every BRI token minted and distributed by POB is covered by the platform revenue in the form of Staking Rewards or through the Treasury Pool.

Token Supply and Release

The pie chart below shows the token supply distribution, where 4.5% goes for the private sale, 6.5% goes to the foundation, 1.5% goes for liquidity, mm & lm, 0.5% is intended for the IDO, 1% goes to advisors, 1% goes for marketing & partnerships, 5% goes for development and 80% goes to order rewards.

Brightpool will cover the expense of marketing, development, salaries and operations with the funds raised through strategic and public sale. The same fund will also be used for BRI liquidity on external DEXs. Besides, the liquidity share will be used to add liquidity to the platform and as a reward for users who provide liquidity.

At the time of the initial token listing, the BRI token’s listing price will be $0.20. The fully diluted market capitalization is estimated at $40 million.

804 million BRI tokens will be released based on the ‘Proof of Bid’ mechanism to the users.

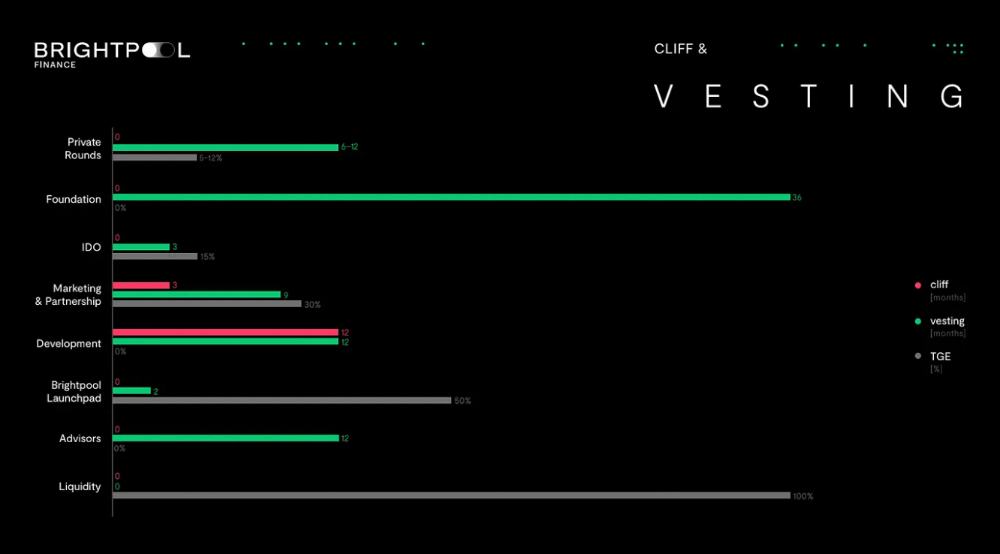

Cliff and Vesting

As for cliff and vesting, a total of 196 million tokens are distributed across the development team, advisors, and investors during the initial public and strategic sale.

All of the tokens that get released during the funding rounds, which excludes airdrops, are subject to a cliff-period and will be released in accordance with the linear vesting periods.

https://medium.com/@Brightpool.finance