CEX or DEX: Which is Better for Traders?

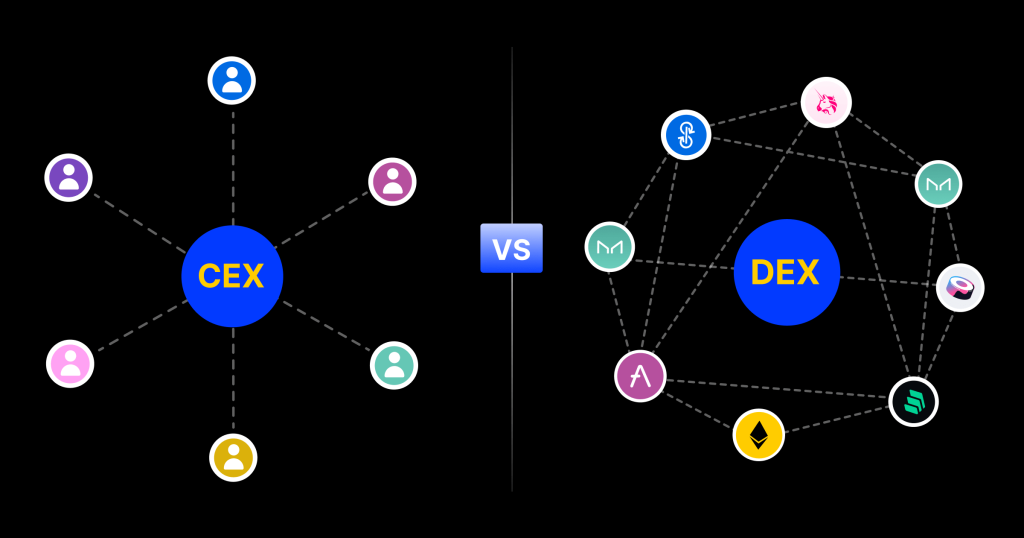

Cryptocurrency trading has introduced two main types of platforms: centralized exchanges (CEX) and decentralized exchanges (DEX). Each offers distinct advantages, depending on the trader's goals, risk tolerance, and security concerns. With the crypto market constantly evolving, understanding the differences between these platforms is crucial for investors and enthusiasts who want to make informed decisions about where and how they trade.

This article breaks down the main aspects of CEXs and DEXs, highlighting the core benefits and drawbacks of each, and explores which might be better suited to your trading needs.

Understanding CEXs: Centralized Exchanges

Centralized exchanges, or CEXs, are the traditional model of cryptocurrency trading platforms. Operated by centralized entities, these platforms resemble stock exchanges in terms of structure and regulation. Some of the most popular CEXs include Binance, Coinbase, and Kraken.

These exchanges facilitate trades by matching buyers with sellers and overseeing the transactions within a centralized infrastructure.

Liquidity and Volume

One of the standout features of CEXs is liquidity. With more users and substantial trading volume, CEXs generally offer deeper liquidity, meaning traders can execute large orders without significantly affecting market prices. High liquidity also ensures quick order fulfillment, allowing traders to take advantage of market movements effectively.

User-Friendly Interface

CEXs are typically designed for ease of use, catering to both new and experienced traders. They often come with features like margin trading, futures, and other advanced trading options, making them suitable for a wide variety of trading strategies. Additionally, CEXs often provide customer support, which can be invaluable for beginners who may need assistance.

Security and Custodial Risks

Centralized exchanges take custody of users' assets, holding funds in wallets controlled by the exchange itself. While this arrangement is convenient, it also makes CEXs attractive targets for hackers. Incidents like the Mt. Gox and Bitfinex hacks underscore the risks associated with custodial solutions, where user assets are vulnerable if the exchange's security is compromised.

Regulatory Compliance

CEXs are generally more compliant with regulatory requirements, making them safer and more attractive to investors who prioritize legal protections. However, this compliance often means that users must complete Know Your Customer (KYC) verification, which can compromise privacy.

Advantages of DEXs: Decentralized Exchanges

Decentralized exchanges, or DEXs, operate without a central authority and are built on blockchain technology. Unlike CEXs, DEXs facilitate peer-to-peer transactions directly between users, typically without intermediaries. Examples include Uniswap, SushiSwap, and PancakeSwap, which have surged in popularity, especially with the rise of decentralized finance (DeFi) in recent years.

Privacy and Control

One of the main appeals of DEXs is the autonomy they offer. Users retain control over their funds, reducing custodial risks associated with centralized platforms. Additionally, DEXs often don’t require KYC verification, allowing traders to maintain greater privacy.

Security Benefits

Because assets remain in users’ wallets and are only transferred during transactions, DEXs generally offer higher security against hacking attempts. However, while the non-custodial model enhances security, users are solely responsible for their funds. If they lose their private keys or send funds incorrectly, recovery is often impossible.

Greater Access to Assets

DEXs provide access to a broader range of digital assets, including newer or smaller projects that may not meet the listing criteria of larger CEXs. This advantage is particularly appealing to early adopters and those interested in high-risk, high-reward investments, as well as traders seeking exposure to niche or emerging tokens.

Potential Drawbacks

Despite their appeal, DEXs often have lower liquidity than CEXs, which can make it challenging to trade large volumes without affecting market prices. Additionally, due to their decentralized nature, DEXs may have slower transaction speeds, especially during high network congestion periods on the underlying blockchain, such as Ethereum.

Security Comparisons: CEXs vs. DEXs

The question of security is central to the CEX versus DEX debate. Both types of exchanges face distinct security challenges, and traders should carefully consider these factors when choosing a platform.

CEX Security Risks

CEXs hold users' assets in their own wallets, which can attract hackers looking for large-scale targets. However, established CEXs have made significant improvements in security, including multi-signature wallets, cold storage, and insurance funds to protect users. Many also adhere to strict regulatory standards, which can add a layer of trust and protection.

DEX Security Advantages

DEXs, on the other hand, use smart contracts to facilitate trades, and users maintain control over their private keys. This approach reduces the risk of centralized theft but introduces risks related to smart contract vulnerabilities. If a DEX’s code is compromised, it could lead to loss of funds for all users relying on that contract.

Self-Custody and Responsibility

The self-custodial nature of DEXs means that users are fully responsible for securing their assets. This setup can be advantageous for those who prefer to control their funds, but it also means a greater risk of loss due to user error or malicious smart contracts. Traders must weigh the pros and cons of taking on full responsibility for their assets.

Which is Better for You? Choosing Between CEX and DEX

There isn’t a one-size-fits-all answer when it comes to choosing between a CEX and a DEX. The “better” option depends on your trading style, risk tolerance, and goals.

For Beginners

If you’re new to cryptocurrency trading, CEXs might be more user-friendly and secure, offering guidance, easy-to-navigate interfaces, and customer support. The regulatory backing of CEXs can also be reassuring, especially for those who prefer to avoid the technical aspects of wallet management.

For Privacy Enthusiasts

DEXs are a better choice for traders who prioritize privacy and autonomy. These platforms offer greater anonymity, as they typically don’t require identity verification. However, they come with higher responsibility for securing funds and require more technical knowledge to operate safely.

For Advanced Traders

CEXs and DEXs each have unique offerings for advanced traders. Those seeking high liquidity, margin trading, and quick order execution might favor CEXs. Conversely, advanced users who are comfortable managing their private keys and are interested in DeFi assets may prefer DEXs for the broader asset range and greater control.

Ultimately, there is a growing trend of hybrid exchanges that combine elements of both CEXs and DEXs, aiming to provide users with the benefits of each model. These platforms, known as semi-decentralized exchanges, could offer a balanced approach for traders looking for security, liquidity, and privacy in one place.

Conclusion

Both CEXs and DEXs come with unique benefits and challenges. Choosing between them depends largely on individual preferences, technical expertise, and the level of security one is comfortable with. CEXs offer simplicity, liquidity, and security through custodial arrangements, making them appealing to most users, particularly newcomers. Meanwhile, DEXs appeal to privacy-conscious traders and those looking to control their assets fully, albeit at the expense of liquidity and simplicity.

Before deciding on a platform, consider your priorities carefully. For traders who value ease of use and high liquidity, CEXs remain the preferred choice. However, for those seeking control over their funds, anonymity, and access to a wider array of tokens, DEXs provide a compelling alternative.

References:

- Binance Exchange Overview

- Kraken Security Standards

- Coinbase Features and User Guide

- Uniswap Protocol Documentation

- PancakeSwap User Guide

- Risks of Centralized Exchanges

- DeFi Market Overview

- Understanding Custodial Wallets

- Smart Contract Security Best Practices

- [Benefits of Hybrid Exchanges](https://www.coindesk.com/crypto-exchange

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)