Understanding Finance: An Essential Guide to Managing Money

Finance is a fundamental aspect of modern life that influences virtually every aspect of our personal and professional endeavors. Whether it's managing personal budgets, investing for the future, or running a multinational corporation, understanding finance is essential for making informed decisions and achieving financial success. In this article, we'll explore the basics of finance, its key principles, and how it impacts individuals, businesses, and the global economy.

### What is Finance?

At its core, finance is the management of money and assets. It involves the allocation, acquisition, and utilization of funds to achieve specific goals, whether it's maximizing profits, minimizing risks, or optimizing resource allocation. Finance encompasses a broad range of activities, including budgeting, investing, lending, borrowing, and financial planning.

### Key Concepts in Finance:

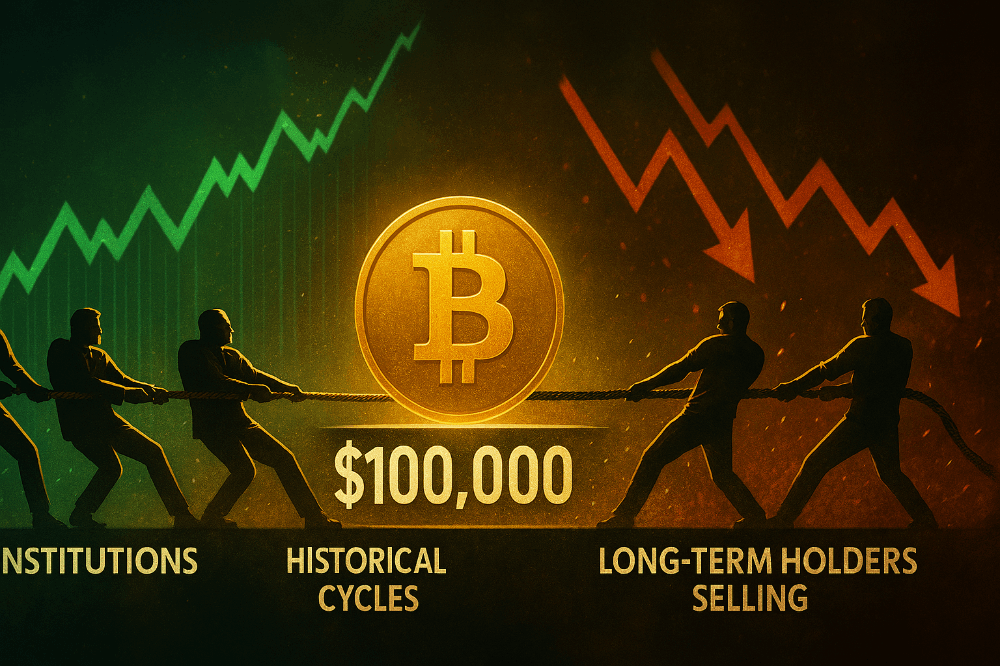

1. **Financial Markets:** Financial markets facilitate the buying and selling of financial assets such as stocks, bonds, currencies, and commodities. They provide liquidity, price discovery, and capital allocation, allowing investors to invest in a wide range of assets and securities.

2. **Financial Institutions:** Financial institutions, including banks, credit unions, investment firms, and insurance companies, play a crucial role in the financial system. They provide essential services such as lending, borrowing, investment management, and risk mitigation.

3. **Risk and Return:** Finance is inherently concerned with managing risk and maximizing return. Investors must balance the trade-off between risk and return when making investment decisions, choosing investments that offer an acceptable level of risk for the potential return.

4. **Time Value of Money:** The time value of money is a fundamental concept in finance that states that a dollar today is worth more than a dollar in the future. This principle underlies various financial calculations, including present value, future value, and discounted cash flow analysis.

5. **Financial Analysis:** Financial analysis involves evaluating the financial performance and health of individuals, businesses, and investment opportunities. It includes techniques such as financial ratio analysis, cash flow analysis, and financial statement analysis to assess profitability, solvency, and efficiency.

6. **Capital Budgeting:** Capital budgeting is the process of evaluating and selecting long-term investment projects. It involves estimating cash flows, assessing risks, and determining the viability and profitability of investment opportunities.

### Importance of Finance:

Understanding finance is essential for individuals, businesses, and policymakers for several reasons:

- **Personal Finance:** Managing personal finances effectively is crucial for achieving financial security, building wealth, and achieving financial goals such as homeownership, retirement, and education funding.

- **Business Finance:** Finance plays a vital role in business operations, including raising capital, managing cash flow, making investment decisions, and evaluating performance. Effective financial management is essential for business survival and growth.

- **Economic Stability:** Finance contributes to economic stability and growth by facilitating investment, entrepreneurship, and innovation. Sound financial systems and institutions are essential for allocating resources efficiently and promoting economic development.

- **Global Finance:** In an increasingly interconnected world, global finance influences international trade, investment flows, exchange rates, and economic policies. Understanding global finance is essential for navigating the complexities of the global economy.

In conclusion, finance is a multifaceted discipline that permeates every aspect of our lives. Whether you're managing your personal finances, running a business, or participating in the global economy, understanding finance is essential for making informed decisions and achieving financial success. By mastering key financial concepts and principles, individuals and organizations can effectively navigate the complexities of the financial world and pursue their financial goals with confidence.