How to invest in Bitcoin without buying it

While purchasing Bitcoin directly is considered the most straightforward method to capitalize on its potential, it may not suit everyone's preferences or risk tolerance.

While purchasing Bitcoin directly is considered the most straightforward method to capitalize on its potential, it may not suit everyone's preferences or risk tolerance.

However, there are alternative avenues available for those interested in investing in Bitcoin without the complexities of buying and safeguarding the cryptocurrency themselves. These avenues include Exchange-Traded Funds (ETFs) and futures contracts, which offer indirect exposure to Bitcoin's price movements.

ETFs: Exchange-Traded Funds are investment funds that trade on stock exchanges, tracking the performance of underlying assets such as stocks, bonds, or commodities. Bitcoin ETFs function similarly, but instead of holding physical Bitcoin, they hold derivative contracts or other financial instruments tied to Bitcoin's price. Investors can buy and sell shares of these ETFs through their brokerage accounts, gaining exposure to Bitcoin's price without directly owning the cryptocurrency. ETFs offer convenience, liquidity, and regulatory oversight, making them a popular choice for investors seeking indirect exposure to Bitcoin.

How to start investing in Bitcoin

Before delving into Bitcoin investments, it's essential to undertake a few fundamental steps. Firstly, gaining a comprehensive understanding of Bitcoin is paramount—comprehending its mechanics, associated risks and potential gains, and the underlying technology is crucial for making informed investment choices.

Exploring various investment methods is equally important to identify the approach that aligns best with your requirements. Evaluating your risk tolerance and determining the amount of capital you're comfortable putting at stake are key considerations in this process.

Furthermore, staying abreast of the latest developments in the cryptocurrency landscape and any regulatory shifts impacting Bitcoin is vital. Given the swiftly changing market dynamics, staying informed empowers you to navigate investment decisions more effectively.

5 ways to invest in Bitcoin

Bitcoin mining

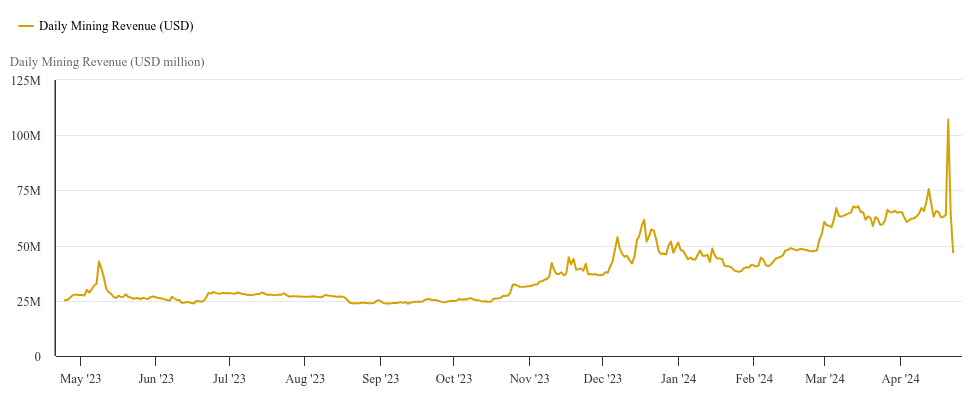

Bitcoin mining involves the creation of new Bitcoins and the validation of transactions to be added to the blockchain. It necessitates substantial initial investment in specialized hardware called application-specific integrated circuits (ASICs), tailored for mining cryptocurrencies like Bitcoin. These ASIC miners are designed to efficiently perform the required cryptographic computations.

Bitcoin mining involves the creation of new Bitcoins and the validation of transactions to be added to the blockchain. It necessitates substantial initial investment in specialized hardware called application-specific integrated circuits (ASICs), tailored for mining cryptocurrencies like Bitcoin. These ASIC miners are designed to efficiently perform the required cryptographic computations.

Due to the computational intensity of mining, it consumes a considerable amount of electricity. After acquiring the necessary hardware and infrastructure, investors must configure and set up their mining equipment. This entails connecting ASIC miners to power sources, implementing cooling systems, and configuring mining software.

Ongoing monitoring and maintenance are essential for maintaining optimal mining performance and profitability. This includes identifying and resolving hardware issues, updating software, and adjusting mining settings as required.

However, Bitcoin mining has become less lucrative for individual miners, with significant profits now concentrated among large-scale industrial miners. For average individuals, the high electricity costs and the need for sophisticated hardware make home mining unlikely to yield substantial profits.

Bitcoin ETFs and ETPs

A Bitcoin exchange-traded fund (ETF) presents an attractive option for investors seeking exposure to Bitcoin without directly purchasing the digital currency. This investment vehicle tracks the price of Bitcoin either through ownership of BTC or Bitcoin derivatives, providing investors with a means to participate in Bitcoin's price movements without holding the asset itself.

A Bitcoin exchange-traded fund (ETF) presents an attractive option for investors seeking exposure to Bitcoin without directly purchasing the digital currency. This investment vehicle tracks the price of Bitcoin either through ownership of BTC or Bitcoin derivatives, providing investors with a means to participate in Bitcoin's price movements without holding the asset itself.

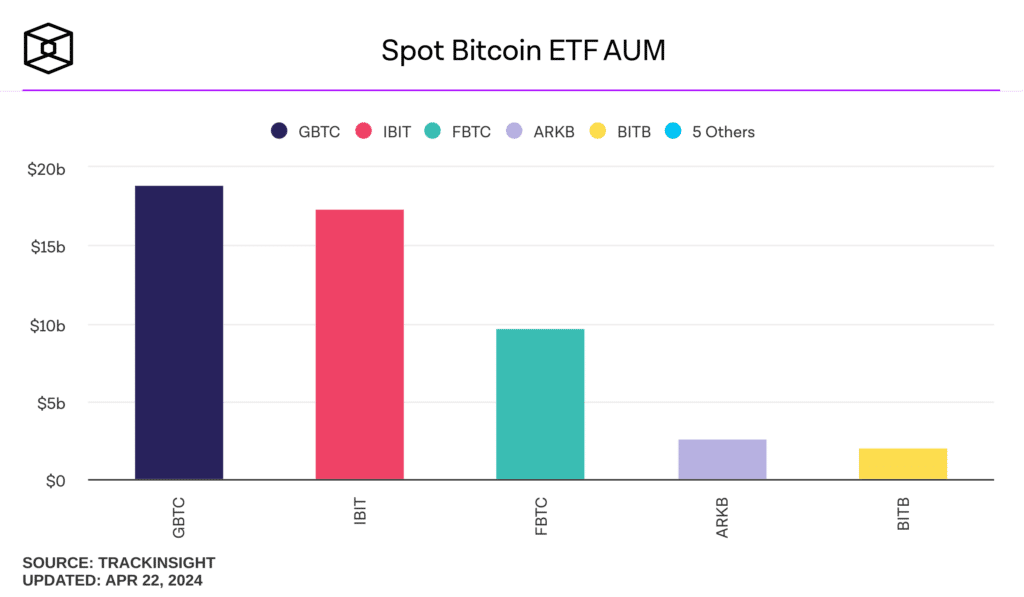

In January 2024, the U.S. Securities and Exchange Commission (SEC) granted approval for spot Bitcoin ETFs, marking a significant milestone in the cryptocurrency market. This approval sparked a notable surge in the crypto market, leading to Bitcoin surpassing its previous all-time high.

The Grayscale Bitcoin Trust (GBTC) stands as the largest Bitcoin ETF globally, while other examples include Bitwise Bitcoin ETF and the Hashdex Bitcoin ETF. Bitcoin Exchange-Traded Products (ETPs) are another option, functioning similarly to ETFs but with Bitcoin as the underlying asset. For institutional investors, investing in Bitcoin ETPs may be perceived as less risky compared to purchasing BTC directly, as ETPs operate within traditional security exchanges and do not require specialized crypto knowledge on the investor's part.

An illustration of a Bitcoin ETP is the Iconic Funds Physical Bitcoin ETP (XBTI).

Bitcoin CFDs

Investors can utilize a Bitcoin contract for difference (CFD) to engage in speculation on the price movements of BTC, leveraging their positions to potentially amplify their gains or losses. Rather than owning the actual digital currency, investors hold a CFD that mirrors the price of Bitcoin.

Trading Bitcoin as a CFD involves buying and selling the price movements of financial products tied to Bitcoin's value. This approach allows investors to capitalize on the volatile nature of the Bitcoin market, potentially profiting from both upward and downward price swings.

CFDs enable investors to enter into positions without needing to physically own Bitcoin, offering flexibility and liquidity. However, it's important to note that trading CFDs involves inherent risks, including the possibility of losing more than the initial investment due to leverage.

Bitcoin CFDs provide an avenue for investors to participate in the cryptocurrency market without the need for direct ownership of Bitcoin, leveraging price fluctuations for potential gains

Bitcoin futures and options

Bitcoin derivatives, including futures and options, offer an alternative method to gain exposure to Bitcoin in your investment portfolio. However, it's crucial to recognize that derivatives can entail higher risks compared to financial products tracking the spot price of Bitcoin, thus necessitating experience for traders and investors.

A Bitcoin futures contract is a derivative instrument enabling a buyer and seller to exchange Bitcoin at a predetermined price and date in the future, enabling speculation on Bitcoin's price without requiring ownership of the cryptocurrency. Moreover, futures trading can involve leveraging, allowing traders to participate in the futures market without paying the full value of a contract upfront.

Bitcoin options are another type of derivatives contract permitting the buyer to purchase the digital currency at a predetermined price on a specific future date. Options provide a means to capitalize on price fluctuations and are typically more cost-effective than futures contracts since traders only need to pay the option premium to wager on Bitcoin's price.

Trading Bitcoin futures and options is possible on various platforms such as CME, Binance, and FTX, among others. These derivative products offer traders and investors additional avenues to engage in Bitcoin trading, although caution and thorough understanding of the associated risks are essential.

Bitcoin stocks

Another indirect method of investing in Bitcoin involves purchasing stocks in companies that incorporate Bitcoin into their operations. For instance, tech giants like Microstrategy and Tesla have notably accumulated significant amounts of Bitcoin as part of their corporate strategies.

Investing in stocks offers transparency and familiarity, as companies adhere to clear regulatory frameworks and provide financial disclosures accessible to investors. Shareholders possess rights to review financial statements and stay informed about executive decisions.

In March 2024, MicroStrategy, a prominent American tech firm and the largest corporate Bitcoin holder, disclosed its acquisition of an additional 9,245 Bitcoins, further bolstering its substantial Bitcoin reserves. Meanwhile, Tesla, led by Elon Musk, retains a significant Bitcoin holding valued at approximately $772 million, despite selling portions during market downturns in 2021 and 2022.

Alternatively, investors can explore companies offering Bitcoin-related services, such as payment providers like PayPal, or delve into investments in Bitcoin mining firms like Riot Blockchain and Marathon Digital Holdings.

However, it's essential to recognize that stocks' performance is influenced by various factors beyond Bitcoin's price, including company fundamentals and sector dynamics. Hence, when integrating Bitcoin-related stocks into a portfolio, investors should consider the broader market context and company-specific attributes.

Risks and considerations

Investing in Bitcoin, regardless of the chosen method, demands recognition of the crypto market's inherent volatility. Prices can experience significant fluctuations within short time frames, presenting both opportunities for substantial gains and risks of considerable losses. Investors and traders must acknowledge and prepare for these sudden price swings by implementing robust risk management strategies.

Thorough research is imperative for understanding the risks associated with any investment method selected. For instance, trading Bitcoin via CFDs and futures entails the use of leverage, which amplifies both potential profits and losses. However, heightened leverage levels increase the likelihood of margin calls, wherein traders must deposit additional funds to cover potential losses or risk forced closure of their positions.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)