Most Money Advice is Keeping You Poor – Here’s What the Rich Actually Do

Money advice is everywhere. From financial gurus on YouTube to well-meaning family members, everyone has an opinion on how you should manage your money. The problem? Most of this advice is designed to keep you in a cycle of mediocrity rather than help you build real wealth. The truth is, the rich follow an entirely different set of financial principles than the average person. If you want to break free from financial struggle and start accumulating serious wealth, you need to start thinking and acting like the wealthy. In this article, we’ll uncover the flawed money advice that is keeping you poor and explore the financial strategies that the rich actually use to grow and protect their wealth.

The Problem with Traditional Money Advice

Traditional financial advice is often based on the principles of saving, frugality, and risk aversion. While these ideas aren’t necessarily wrong, they don’t pave the way to significant wealth. Here are some common money myths that keep people poor:

1. “Save, Save, Save”

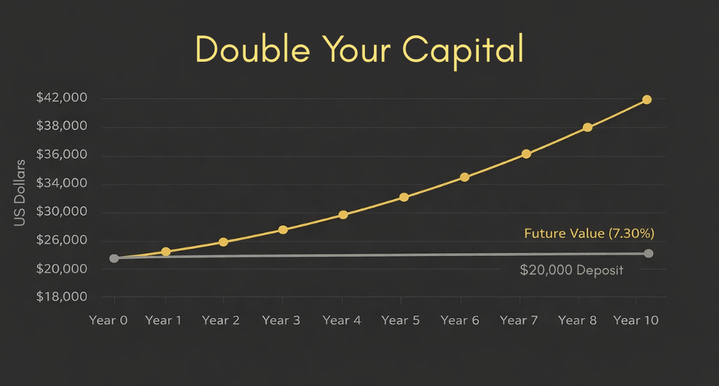

One of the most common pieces of advice is to save as much as possible. While having an emergency fund is important, excessive saving without a clear investment strategy is a slow path to financial success. The problem is that inflation erodes the value of saved money over time, meaning your hard-earned cash loses purchasing power every year.

The rich don’t just save money; they invest it. They understand that money sitting in a low-interest savings account is essentially losing value. Instead of hoarding cash, they put it to work in high-yield investments that generate passive income and appreciation over time.

2. “Live Below Your Means”

While avoiding unnecessary debt and reckless spending is wise, the idea of “living below your means” often promotes a scarcity mindset. This mindset focuses on cutting costs rather than increasing income, which is a major flaw.

The wealthy focus on expanding their means rather than restricting their lifestyle. Instead of simply cutting out their daily coffee or skipping vacations, they prioritize earning more through investments, businesses, and leveraging opportunities. By focusing on growth rather than austerity, they build a financial foundation that allows them to enjoy life while still growing their wealth.

3. “Get a Good Job and Work Hard”

Most people are taught that working hard in a stable job is the key to financial security. However, jobs have inherent limitations—your income is capped by your salary, and you’re trading time for money. No matter how hard you work, there are only so many hours in a day.

The rich don’t rely on one job for their income. They create multiple income streams through investments, entrepreneurship, and passive income sources. They understand that financial freedom comes from having money work for them rather than continuously working for money.

4. “Pay Off All Debt Immediately”

While paying off high-interest consumer debt is a smart move, not all debt is bad. In fact, the rich use debt strategically to build wealth. They leverage low-interest loans to invest in appreciating assets like real estate or businesses. This type of debt, often referred to as “good debt,” can be a powerful tool for financial growth.

Instead of avoiding debt altogether, the wealthy use it to create more income. They borrow at low rates to invest in cash-flowing assets that not only cover their debt payments but also generate profit.

What the Rich Actually Do to Build Wealth

Now that we’ve debunked common money myths, let’s explore the financial habits that actually create wealth. Here’s how the rich think about money and what they do differently:

1. They Prioritize Income Growth

The wealthy understand that cutting expenses can only go so far. Instead of fixating on saving money, they focus on increasing their earning potential. This could mean negotiating higher salaries, starting side businesses, investing in high-growth industries, or acquiring new skills that enhance their earning power.

They also understand the power of networking and mentorship. Surrounding themselves with successful individuals allows them to learn new strategies and discover opportunities that the average person never encounters.

2. They Invest in Appreciating Assets

Instead of letting their money sit in a bank account, the rich invest in assets that grow in value over time. Some of their favorite investment vehicles include:

- Real Estate: Properties provide rental income and appreciate over time, making them a powerful wealth-building tool.

- Stocks and Index Funds: The stock market has consistently outperformed savings accounts and inflation in the long run.

- Businesses: Many wealthy individuals either own businesses or invest in startups that have high growth potential.

- Alternative Investments: This includes commodities, cryptocurrencies, and private equity, all of which can offer high returns when approached strategically.

3. They Understand and Use Leverage

Wealthy individuals know how to use leverage to their advantage. Whether it’s taking out loans to buy real estate, using margin to invest in stocks, or employing other people's time and money in business ventures, leverage allows them to multiply their wealth without solely relying on their own capital.

4. They Focus on Cash Flow

Instead of relying solely on capital appreciation, the rich prioritize cash flow—money that comes in consistently without requiring them to work for it actively. This could be through:

- Rental properties generating monthly income

- Dividend-paying stocks

- Businesses that run without their direct involvement

- Royalties from intellectual property like books, music, or patents

This cash flow provides financial security and allows them to reinvest into more wealth-generating assets.

5. They Minimize Taxes Legally

One of the biggest secrets of the rich is tax efficiency. They use legal strategies to minimize their tax burden, allowing them to keep more of their earnings. This includes:

- Investing in tax-advantaged accounts

- Utilizing real estate depreciation to reduce taxable income

- Setting up business entities that offer tax breaks

- Taking advantage of charitable contributions for deductions

6. They Invest in Themselves

Wealthy people prioritize self-education. They read books, attend seminars, hire coaches, and constantly seek ways to improve their knowledge and skills. Personal development is seen as an investment rather than an expense, as it provides the knowledge and mindset necessary to achieve financial success.

Conclusion: The Path to Wealth is Different

Most conventional money advice is designed to maintain financial stability, not create wealth. If you want to achieve financial freedom, you need to adopt the mindset and strategies of the rich. This means focusing on income growth, investing in appreciating assets, leveraging debt wisely, prioritizing cash flow, and minimizing taxes legally.

Breaking away from traditional money myths and embracing these wealth-building strategies can change your financial future. The key is to take action—start learning, start investing, and start thinking like the rich. Wealth isn’t just for a select few; it’s available to those willing to challenge the status quo and implement smarter financial strategies.

You May Like :

How to File Your Taxes Online For Beginners (Turbotax vs Accountant)

Robert Kiyosaki’s Health & Wealth Secrets REVEALED!

This Article Will Make You Rethink Everything You Know About Money