What is the Bitcoin Halving? What it Means For BTC!

Central banks are tasked with managing the supply and demand of fiat currency, among other things. Actions by central banks have the power to influence economies.

Unlike cryptocurrencies such as Bitcoin, which are governed by algorithms and capped supplies, fiat currencies like the US dollar or the Euro are subject to the decisions of central banking authorities. Nowhere is this power more evident than in times of crisis, such as the unprecedented challenges posed by the COVID-19 pandemic.

With the world coming to a halt and economies suffering major losses, central banks had to act fast. The pandemic-induced economic downturn prompted central banks to initiate large-scale quantitative easing programs. In a bid to mitigate the looming threat of recession and deflation amid muted economic activity, these institutions embarked on a spree of money creation, effectively flooding the economy with fresh cash.

According to the International Monetary Fund, central banks in 17 advanced economies, 55 emerging markets and 31 low-income countries pulled various levers to shore up their economies. For its part, the US Federal Reserve printed trillions of dollars. So, how much are we talking about? $3.3 trillion in 2020 alone.

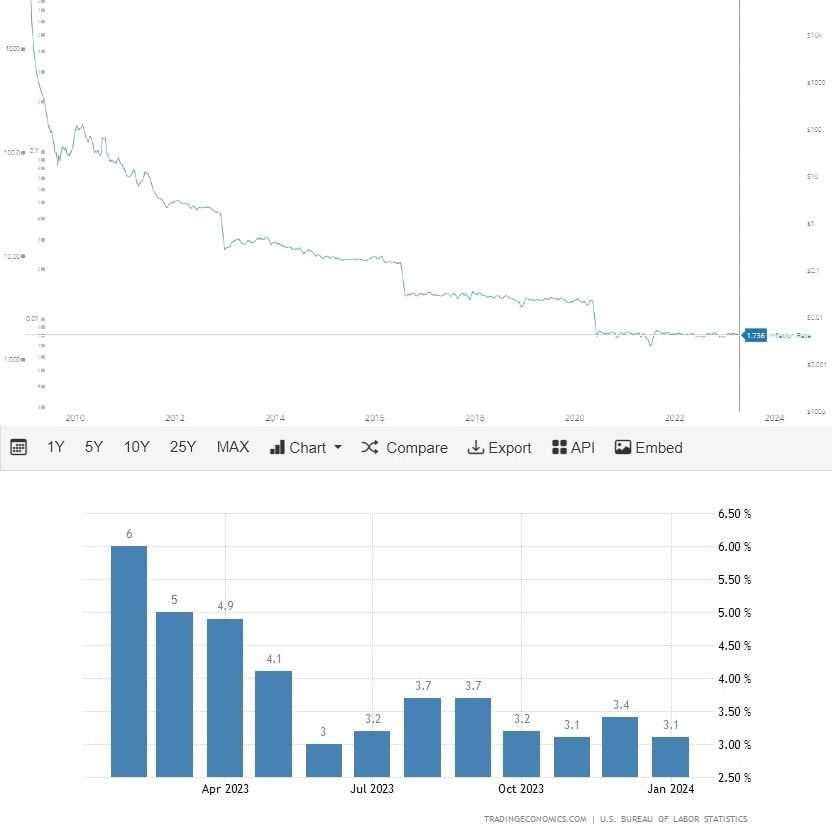

These actions have consequences, however. The continuous injection of liquidity into the economy leads to inflationary pressures over time. The balance between supplying enough money to stimulate growth and preventing an inflationary surge is a challenge central banks perpetually grapple with. This phenomenon was on full display in the post-pandemic recovery as the American economy faced stubborn inflation and high interest rates.

Enter Bitcoin

As central banks expand and contract the money supply at will, digital assets such as Bitcoin present a stark contrast.

Unlike fiat currencies, which can be printed ad infinitum, Bitcoin operates on a fixed and immutable supply schedule. The total supply of Bitcoin is capped at 21 million coins, a hard limit programmed into its underlying protocol; it's simple unalterable mathematics. This scarcity is enshrined in the code itself, rendering Bitcoin immune to the inflationary pressures that typically plague fiat currencies.

Bitcoin's limited supply and issuance mechanism imbues the digital currency with a store of value proposition similar to gold. A phenomenon that occurs every four years drives this value proposition home.

In this article, we'll discuss what is Bitcoin halving, its significance, and how it affects the issuance of new bitcoins. We'll also analyze previous Bitcoin halving events, examine the effects of Bitcoin halving on miners and speculate about the long-term implications of the halving event.

What is Bitcoin Halving?

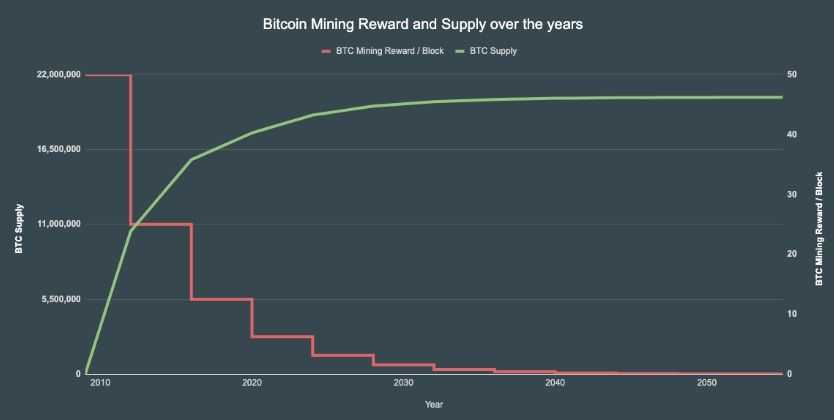

Cryptocurrencies like Bitcoin, utilizing the Proof-of-Work (PoW) consensus, are generated by miners utilizing specialized computers to solve mathematical problems and facilitate the creation of new blocks. In return for their efforts, miners are rewarded with newly minted Bitcoin. The initial block reward for Bitcoin miners was 50 BTC, which gradually reduced over time. Here's a handy Bitcoin halving chart.

Approximately every four years, after the mining of 210,000 blocks, the block reward granted to miners for processing Bitransactions undergoes a halving. This reduction, programmed into the Bitcoin protocol, serves to gradually decrease the rate of new Bitcoin issuance, thereby contributing to its deflationary nature.

The Bitcoin halving event is considered one of the most important events in the cryptocurrency calendar because it directly impacts the rate at which new Bitcoins are created and introduced into circulation.

The last Bitcoin halving date was May 12, 2020. As the Bitcoin blockchain reached the designated halving block, the protocol executed the halving event, immediately reducing the block rewards provided to miners. Looking ahead, while the next Bitcoin halving date remains unconfirmed, projections indicate that it is slated to occur in April 2024.

How Does Bitcoin Halving Work?

The mechanism behind Bitcoin halving is straightforward: it's a built-in feature designed to gradually decrease the issuance of new coins over time. This scarcity model is integral to Bitcoin's design and is intended to mimic the scarcity of precious metals like gold.

The halving event is significant because it not only impacts miners' revenues directly by reducing their block rewards, but it also has broader implications for the entire Bitcoin ecosystem. It highlights the finite nature of Bitcoin's total supply, capped at 21 million coins, and underscores the decentralized governance of the network, as no single entity can arbitrarily alter the issuance schedule.

Despite the reduction in block rewards, Bitcoin halving is crucial for sustaining network security and incentivizing miners to continue validating transactions. As the block reward diminishes over time, miners will have to increasingly rely on transaction fees paid by users for their services. This transition to fee-based rewards ensures that miners remain incentivized to participate in securing the network even as the issuance of new bitcoins approaches its limit.

Will miners feel fairly incentivized just through transaction fees? Will costs go up too much for some miners? We cover that later on in this article.

Why Does Bitcoin Halving Occur?

The economic rationale behind Bitcoin halving is simple: It is aimed at preserving its value proposition and ensuring its long-term sustainability. At its core, Bitcoin halving operates as a mechanism to manage the rate of new coin issuance, ultimately bolstering the digital asset's scarcity and fostering an environment conducive to price appreciation.

With a total supply of 21 million BTC, the concept of scarcity has been hard-coded into Bitcoin's DNA. By systematically reducing the block rewards granted to miners through halving roughly every four years, Bitcoin introduces controlled inflation, mirroring the supply dynamics of precious commodities like gold. This has a twofold effect — it not only imbues Bitcoin with intrinsic value but also instils confidence among investors, positioning BTC as a store of value.

But what about the miners whose computational efforts underpin the security and integrity of the Bitcoin blockchain? Block rewards will continue to halve until the year 2140.

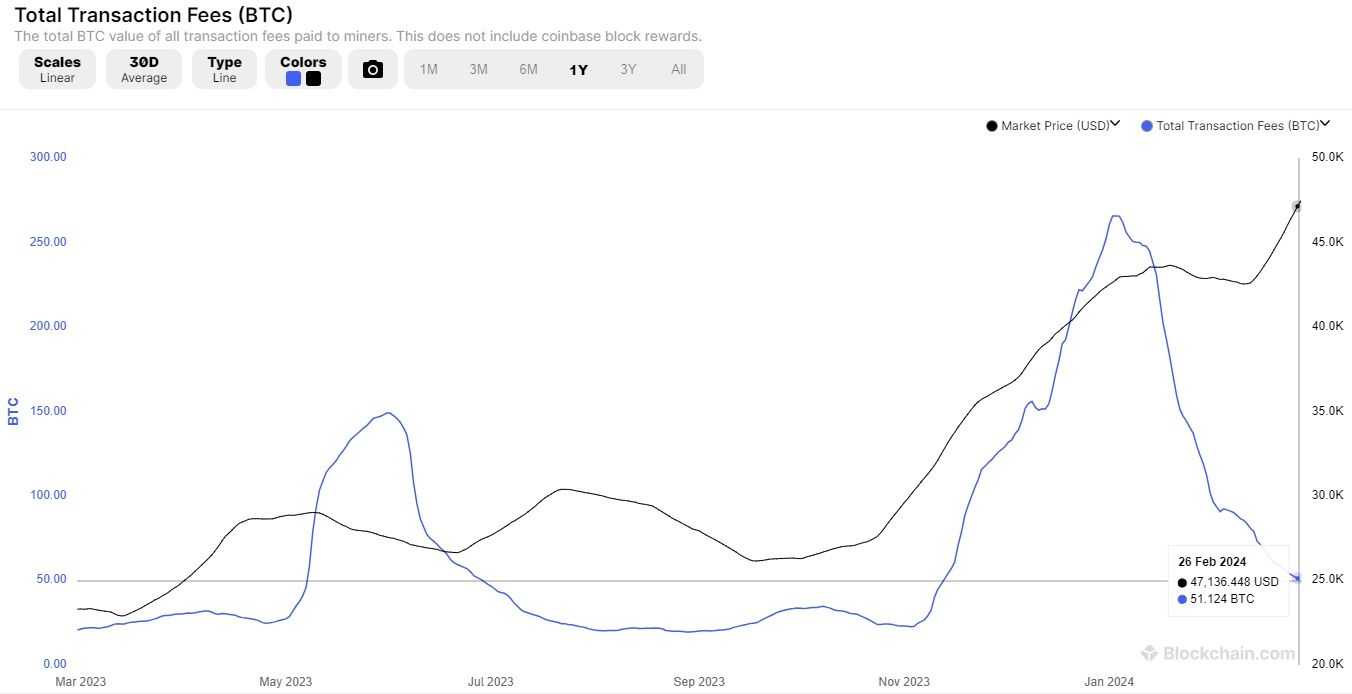

As block rewards stop, miners will have to rely on fee-based rewards. Does this mean some mining setups may close shop as the rewards no longer top the cost of running a Bitcoin mining rig? That's a possibility, but one that is becoming more unlikely as we have seen transaction fees increase with the advent of Ordinals and the ability to inscribe data into Bitcoin blocks which should be enough to compensate the miners for their work even after future halving dates.

All in all, the economic implications of Bitcoin halving extend beyond price dynamics, encompassing broader macroeconomic narratives. It essentially serves as a litmus test for Bitcoin's viability as a deflationary currency and a hedge against inflationary pressures.

Analysis of Past Bitcoin Halvings

Now, we'll explore how the three halvings that have happened so far affected Bitcoin's price.

The First Halving

Following the first halving in November 2012, which halved the block reward to 25 BTC from 50 BTC, Bitcoin's price witnessed a meteoric ascent. In less than a year, the coin's price rose to an eye-popping $1,032 from a mere $12, marking a surge of over 8,500%. This price action, largely propelled by mounting investor interest, put the spotlight on the cryptocurrency's value proposition.

The Second Halving

As the 420,000th block was mined, the block reward once again underwent a halving, plummeting to 12.5 BTC from 25 BTC. Bitcoin, trading at $651 at the time, witnessed a momentary dip post-halving, preceding an exponential surge. Within 526 days, Bitcoin soared to a then-all-time high of $20,089.

The Third Halving

Amid tumultuous market conditions catalyzed by the COVID-19 crisis, at the 630,000th block, the block reward was halved to 6.25 BTC from 12.5 BTC, with Bitcoin trading at approximately $8,787 per BTC. What followed was a remarkable rally, culminating in Bitcoin reaching an unprecedented peak of a little over $69,000 in November 2021.

Bitcoin Halving and its Effect on Miners

Bitcoin's halving significantly impacts miners as each halving event eats into their reward, and by extension, their profitability.

What Happens to Miners When the Reward is Halved?

When the block reward is halved, miners must deal with several consequences:

- Decreased Revenue: The most immediate impact is a reduction in miners' revenue. With the block reward cut in half, miners receive fewer bitcoins for securing the network. This can pose challenges for miners, particularly those with high operational costs.

- Increased Competition: As block rewards diminish, competition for the remaining rewards will heat up. The reduction in rewards may prompt some miners to seek the exit door, while others may ramp up their mining efforts to compensate for the decrease in revenue.

- Incentive Structure: Despite the reduction in block rewards, Bitcoin halving events are designed to maintain miners' long-term incentive to participate in securing the network. As the supply of new bitcoins dwindles over time, miners are expected to rely more heavily on transaction fees to sustain their operations. This transition to fee-based rewards ensures that miners remain incentivized to continue validating transactions.

- Operational Adjustments: In response to the Bitcoin halving, miners may need to adjust their operational strategies to adapt to the changing economic landscape. This may involve optimizing their mining hardware, negotiating lower electricity costs, or exploring alternative revenue streams within the cryptocurrency ecosystem.

- Market Dynamics: Bitcoin halving events can also influence broader market dynamics, impacting the supply and demand of the cryptocurrency. Historically, halving events have been associated with periods of increased volatility and price appreciation as supply constraints come into focus. This can have both positive and negative implications for miners, depending on their exposure to market fluctuations.

Will Bitcoin Mining Still Be Profitable After Future Halvings?

This topic is of considerable debate and speculation within the crypto community.

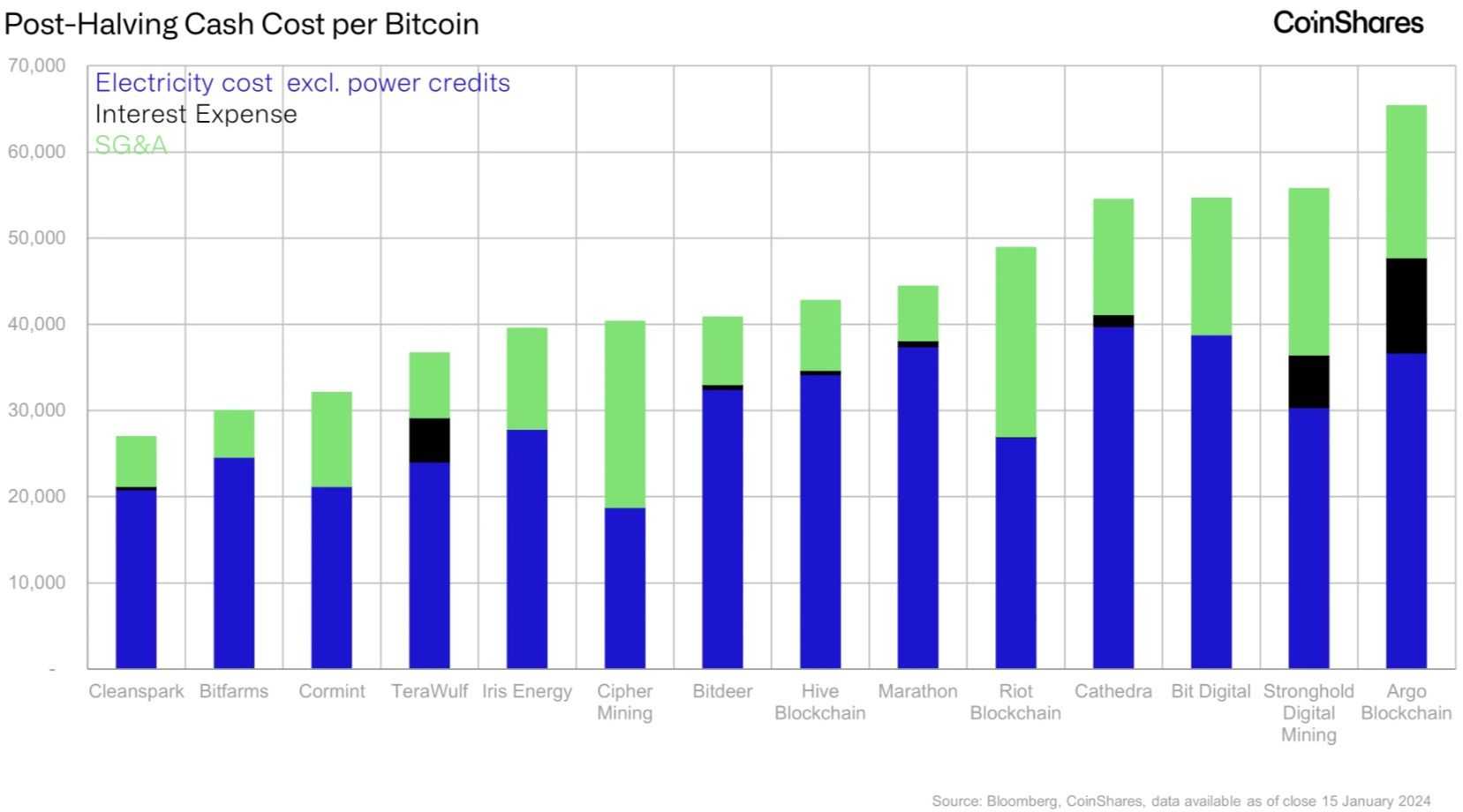

According to CoinShares, a vast majority of miners will have to contend with high costs, forcing them to reduce costs in a bid to maintain profitability. All in all, only a handful of miners will remain profitable post-having if Bitcoin's price remains above $40,000, which it has blown past in anticipation of the halving.

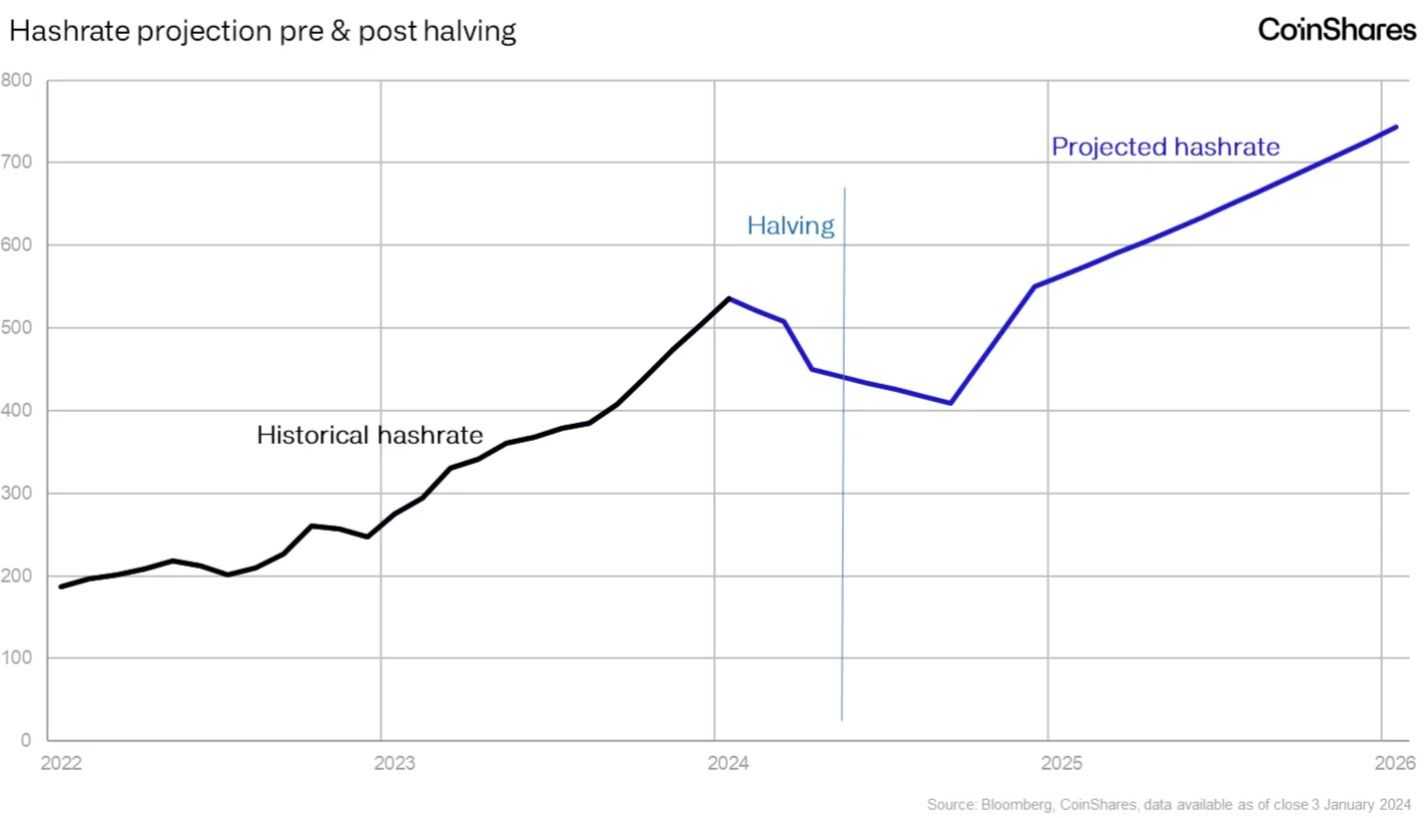

In 2023, the Bitcoin network witnessed a remarkable surge in hashrate, indicating a 104% rise in the computational power dedicated to mining BTC. According to the CoinShares report, the average production cost per Bitcoin for individual miners following the halving event is estimated to be $37,856.

Miners' potential profitability post-halving has several moving parts:

- Price of Bitcoin: One of the most significant factors influencing mining profitability is the price of Bitcoin. As the block reward decreases, miners will rely increasingly on transaction fees and the value of mined bitcoins to remain profitable. If the price rises sufficiently to offset the reduction in block rewards, mining can remain profitable. However, if prices move in the other direction, miners may struggle to cover their operational costs.

- Mining Difficulty: Bitcoin's mining difficulty adjusts approximately every two weeks to maintain a consistent block production rate. If mining difficulty increases significantly post-halving, miners may find it more challenging to solve blocks and earn rewards.

- Operational Costs: The cost of electricity, hardware, cooling, and other operational expenses significantly impacts mining profitability. Miners located in regions with low electricity costs and favourable regulatory environments are more likely to remain profitable compared to those operating in high-cost jurisdictions. Visual Capitalist has a sweet, albeit a bit outdated, chart on the cost of mining Bitcoin in 198 countries.

- Technological Advances: Bitcoin mining has come a long way. It first started as CPU mining, then GPU mining (which drove GPU prices through the roof), to the current ASIC devices, which are designed solely for mining crypto. Miners who invest in state-of-the-art equipment and optimize their operations may remain profitable even after future halvings.

- Transaction Fees: As the block reward diminishes, transaction fees will become perhaps the only source of revenue for miners. Miners can prioritize transactions with higher fees to maximize their earnings. Who knows, perhaps the adoption of Bitcoin for everyday transactions would contribute to higher transaction fee income for miners?

Long-Term Implications of Bitcoin Halving

The long-term implications of Bitcoin halving events extend beyond immediate market fluctuations that come with it.

Effect on Price

As each halving event reduces the rate at which new bitcoins are generated, it effectively introduces scarcity into the Bitcoin supply. This scarcity is a fundamental aspect of Bitcoin's value proposition, positioning it as a deflationary asset and store of value over the long term.

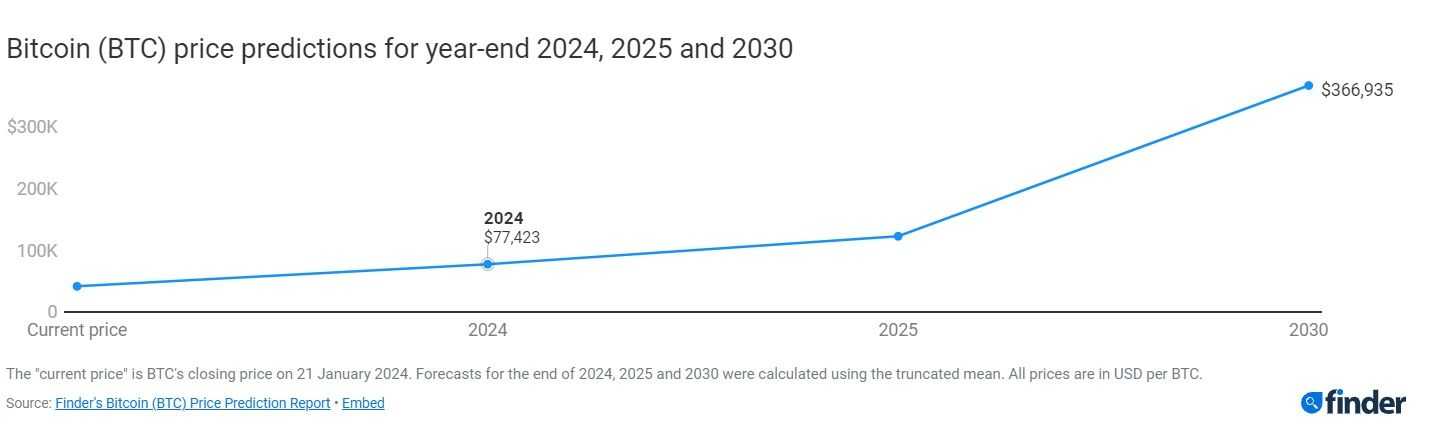

In addition, Bitcoin halving events have historically been associated with significant price appreciation. The previous halvings saw Bitcoin hit highs, with the coin exceeding the $1,000 price following the 2012 halving and $20,000 after the 2016 halving. Following the most recent halving in 2020, the digital currency hit its all-time high of over $69,000.

These price appreciations don't happen overnight; they typically take several months. For example, Bitcoin hit its all-time price in 2021, roughly a year after the most recent halving. Thus far in 2024, Bitcoin has breached the $54,000 mark, but Finder predicts it could peak at $77,000 by the end of 2024.

A favourable price movement after a halving event isn't a done deal, however, Grayscale argues, noting other cryptocurrencies with similar halving mechanisms don't always see price spikes post-halving.

“This suggests that while scarcity does sometimes influence price, other factors also play a role.” - Grayscale

Miners' Misery

The "Bitcoin rush," as CoinShares put it, leading up to the halving boosts mining difficulty. It forecasts a post-halving hashrate surge to potentially reach 550 exahashes per second (EH/s) by 2024's end. This means smaller players will be unable to keep up as costs rise. All this is music to big miners' ears.

All this is music to big miners' ears.

Marathon Digital, the largest publicly traded miner by hashrate, said in December 2023 that it was sitting on over $800 million of dry powder. It intends to use this money on “strategic opportunities, including industry consolidation” arising from the Bitcoin halving event. Cleanspark has $170 million in cash to “take advantage of opportunities the halving may present."

“A combination of declining revenue and increasing costs could put many miners in a tense position in the near term.” - Grayscale

Despite the potential challenges posed by the halving, miners have been actively preparing for its financial impact, Grayscale said. In late 2023, a noticeable trend emerged as miners sold their Bitcoin holdings on-chain, likely to increase liquidity ahead of the reduction in block rewards. These proactive measures indicate that Bitcoin miners are equipped to handle the upcoming changes, at least in the short term.

Additionally, any reduction in miner participation could prompt a corresponding adjustment in mining difficulty, potentially benefiting remaining miners by reducing costs per coin and maintaining network stability.

Although the decrease in block rewards presents a challenge, the emergence of ordinal inscriptions and Layer 2 projects in the Bitcoin ecosystem has offered promising solutions. These innovations could potentially boost transaction throughput and transaction fees, providing a silver lining for miners.

If you're interested to know more about Bitcoin's L2 projects, head over to our article where we explore the ecosystem beyond the Lightning Network.

The Future of Bitcoin Mining and Network Security

Best of luck trying to hack Bitcoin!

Due to the current cost of capital and operational expenses, attackers no longer have feasible methods to sustain a continuous attack and achieve 51% control of the network, according to Coin Metrics.

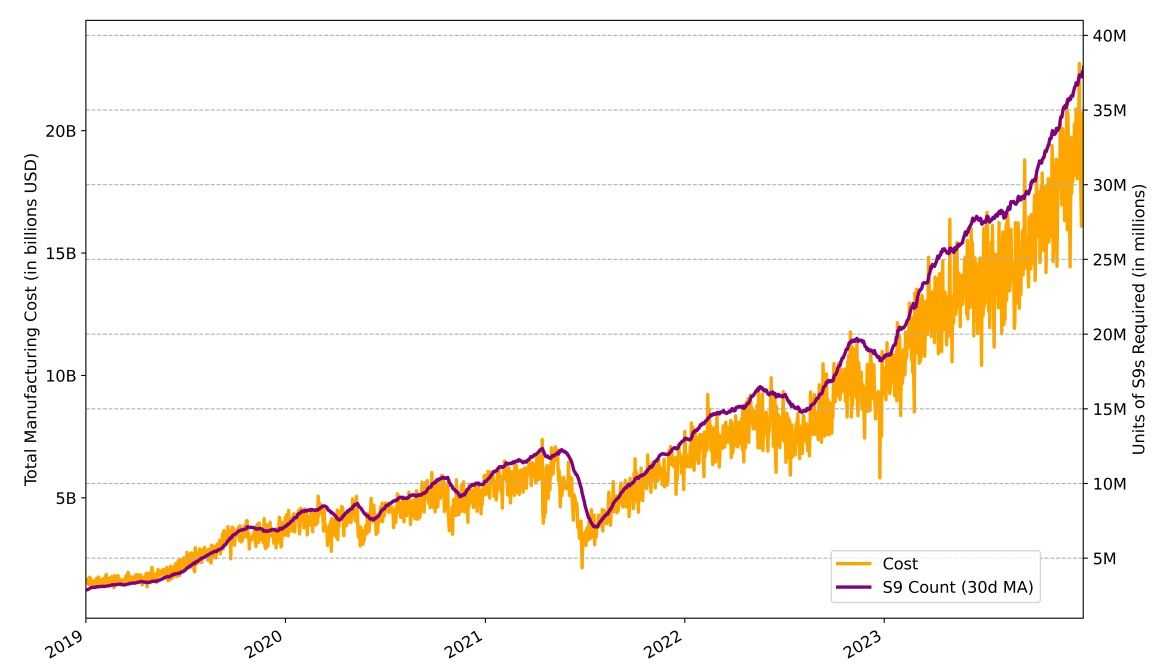

Analyzing secondary market data and real-time hash rate output, the report determined that executing a 51% attack on Bitcoin would require purchasing approximately 7 million ASIC mining rigs, totalling around $20 billion. What if the attacker could manufacture their own rigs? Even in this scenario, it would cost over $20 billion, with the Bitmain AntMiner S9 being the only feasible device for reverse engineering.

When Satoshi Nakamoto mined the first Bitcoin block in 2009, he didn't need any specialized equipment. Instead, Bitcoin's pseudonymous creator relied solely on his personal computer. Then came the era of Graphics Processing Units (GPUs). Built mainly for gaming applications, these GPUs were repurposed to perform various mathematical computations needed for mining BTC.

Today, GPUs have become a thing of the past, having been replaced by highly efficient Application-Specific Integrated Circuits (ASICs). Critics argue that even ASICs have hit their limit in terms of efficiency. Without groundbreaking new technology, Bitcoin miners may soon shift from competing based on hardware. If mining hardware becomes standardized, miners will seek competitive advantages elsewhere, such as in energy sourcing, financial planning, or product diversification.

We've touched on how miners will have to increasingly rely on fee-based revenue as each halving shaves off how many BTCs they can earn. It wouldn't be wrong to think that some miners may choose to exit the business. Where does that leave Bitcoin's security?

It depends on who you ask.

Diminishing rewards for miners could weaken the security of the Bitcoin network, potentially leading to large-scale double-spend attacks targeting exchanges, AVA Labs CEO Emin Gün Sirer told Crypto News. To counter this threat, exchanges may extend confirmation times, but attackers with significant hashpower could still exploit vulnerabilities, posing a risk to transaction security.

“I give Bitcoin at most 3 more halvings, that is 12 years, before the rewards given to the miners drop to the point where intervention is necessary.” - Crypto News

To solve this issue, Gün Sirer suggests that Bitcoin’s supply cap be removed.

Then, there's Kraken's director of business development, Dan Held, who says transaction fees should be enough to keep miners incentivized.

“And as the block reward value grew massively, we’ve seen transaction fees as a percentage of the block reward continue to grow as well, demonstrating that long term security should be fine with only transaction fees.” - Crypto News

Recent data, however, shows that transaction fees have been on a somewhat downward trajectory as of late.

Closing Thoughts

Bitcoin halving events have far-reaching implications for miners, investors, and the broader cryptocurrency ecosystem.

These events highlight its deflationary nature and reinforce its scarcity-driven value proposition. By systematically reducing block rewards, halving events introduce controlled inflation into the Bitcoin supply, akin to the supply dynamics of precious commodities like gold. This scarcity is not only hard-coded into Bitcoin's protocol but also contributes to its intrinsic value and positioning as a hedge against inflationary pressures.

While Bitcoin halving events may initially present challenges for miners, such as decreased revenue and heightened competition, they also catalyze adaptation and innovation within the mining sector. Miners are incentivized to optimize their operations, negotiate favourable electricity costs, and explore alternative revenue streams to maintain profitability in the face of diminishing block rewards.

Overall, Bitcoin's halving events serve as critical milestones in the evolution of the cryptocurrency, shaping its economic dynamics and reinforcing its status as a decentralized digital asset with enduring value.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)