Bitcoin had a Barmitzvah

© Steven Boykey Sidley

© Steven Boykey Sidley

(image: Leonardo.ai)

Bitcoin became a man today. It’s been a little over 13 years since the blockchain transmitted its first transaction, about the same age that Jewish boys undertake their coming-of-age ritual to transition from childhood to adulthood under the watchful eyes of their elders. You’ll excuse me if I assume that Bitcoin is male-gendered, given its testosterone-driven history.

A stretchy metaphor, perhaps. But it is not that wild. The moment when the Securities and Exchange Commission gave its long-awaited blessing to a bunch of ETFs after market close on Jan 10, the cryptocurrency graduated from an undisciplined and volatile offspring of technological innovation to a stolid member of the tribe of financial assets, able to hold its head high among dollars, equities, gold, real estate, debt and collectibles.

Perhaps a recap is necessary — it has been a long and winding road for Bitcoin ETFs. Over a dozen different companies have applied to the SEC since 2014, but they have been roundly rebuffed. Many column inches have been spilled in trying to understand the real reasons underpinning the regulator’s firm resistance to these applications, including a colourful tapestry of conspiracy theories, which may, in the light of history, turn out to have a kernel of truth in them. No matter, those days are gone, and the SEC has opened the gates, after much wrangling, fine tuning and small print.

The companies that have been given approvals are among the largest and most established asset managers on earth — household names like Blackrock, Vanguard and Fidelity. They collectively oversee somewhere around $25 trillion in investor funds; it is hard to imagine a more powerful army of private global financial influence. Their successful ETFs represent the most important event in Bitcoin’s young life.

Why? Because these asset managers are the old guard — the risk averse, the regulation-compliant, the financially-astute. They have been doing this for a long time and, when they decide to place their money somewhere, everyone takes notice. Including the most important gatekeepers of all — the financial advisors who steer their client’s money to safe harbours.

And now Bitcoin is considered to be one of those safe harbours. Who would have thought?

It is with no small amount of satisfaction, even glee, that those of us who have long been convinced of Bitcoin’s value watch this unfold. We have felt bruised and battered by the rolly eyes, the snickering, the general derision for more than a decade. It feels good, finally, to say “I told you so”. However, there is also a smidgeon of regret as we watch Bitcoin become partially subsumed into the financial system that it was originally meant to replace.

To be sure, most people couldn’t give a damn about this entire subject. But they should, because at the very least the hundreds of billions that will flow into this new asset over the next few years has to come from somewhere, and that will be from existing assets and investments, and that will mean some value dilution of current portfolios.

How is this going to unfold? Consider this:

One of the oldest and most conservative banks in England, Standard Chartered, just released a report on the price forecast for Bitcoin over the next two years. Looking at what happened to the price of gold since the first gold ETF was launched, they conclude that the price of Bitcoin is likely to double this year and again in 2025. That is a 4x price increase. I have no idea whether this will pan out (cryptocurrency price predictions have historically been a fool’s game), but an increasing number of old-guard researchers are predicting similar figures. So those who feel that they may have missed the boat already may want to rethink. It is difficult to imagine another investment option with greater potential upside. (I’m not giving financial advice here, you understand; I am merely a columnist.)

Dan Morehead, CEO of Pantera Capital, Michael Saylor, CEO of Microstrategy and other financial leaders have all used phrases like ‘the most asymmetric trade in history’ — meaning massive upside and limited downside. I don’t know, there’s many a slip ‘twixt cup and lip and all that, but the logic is unassailable — these huge financial institutions are so sure of the pent-up demand that they have now entered a bidding war with each other as to who will offer the lowest annual fee. (Currently this is .24% from Bitwise, which is aggressive, at least when compared with your average stock brokerage fee.)

And longer term? The price will certainly settle down as it matures, although its final trajectory is a little hazy right now. It’s fair to assume that its risk profile will disappear, its youthful indiscretions will be forgotten and, as every parent hopes for their child, it will become a productive member of society, fulfilling an investment purpose unfilled by others.

But perhaps more important is the fact that these ETF approvals represent the imprimatur that most of the crypto industry has been waiting for, the general approval it has always sought. Which means that other digital assets, ranging from Ethereum’s Ether to NFT-secured property rights to real world asset tokenisation will now find themselves taking the stage, admired and respected, even emulated.

The other boys will become men too.

Steven Boykey Sidley is a professor of practice at JBS, University of Johannesburg. His new book It’s Mine: How the Crypto Industry is Redefining Ownership is published by Maverick451 in SA and Legend Times Group in UK/EU, available now. First printed in Daily Maverick

Originally published at https://stevenboykeysidley.substack.com.

Crypto

Etf

Bitcoin Follow

Follow

Written by Steven Boykey Sidley

188 Followers

·

Writer for

Coinmonks

Award-winning author of 5 novels and 2 non-fictions, playwright and columnist covering all things crypto and AI. Professor, JBS, University of Johannesburg.

More from Steven Boykey Sidley and Coinmonks

Steven Boykey Sidley

in

Generative AI

Levi Strauss and the geopolitics of artificial intelligence

Levi Strauss and the geopolitics of artificial intelligence

4 min read

·

Dec 19, 2023

51

1

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

593

2

Sovereign Crypto

Sovereign Crypto

in

Coinmonks

30–50X Altcoin Portfolio

2024 Update — Bull Run Ready Portfolio

11 min read

·

Dec 23, 2023

472

12Steven Boykey Sidley

in

DataDrivenInvestor

The curious case of Avraham Eisenberg — criminal or genius?

A long time ago I lost a great deal of money overnight on a A-rated stock, Swissair, which unexpectedly filed for bankruptcy in the dark…

4 min read

·

Feb 6, 2023

1

See all from Steven Boykey Sidley

Recommended from Medium

Michel Marchand

Michel Marchand

in

Coinmonks

The Bull Is Back? Top 10 Cryptos to Buy on Coinbase in 2024

well . . . I’M back, shouldn’t that be enough?

21 min read

·

Dec 31, 2023

343

8 Jayden Levitt

Jayden Levitt

in

Level Up Coding

Your One Job Is To Not Part With Your Bitcoin, Ethereum, or Solana Until 2025.

Getting distracted by parabolic rises in meme coins is how you mess this trade up.

·

7 min read

·

Jan 4

606

7

Lists

Staff Picks555 stories

Staff Picks555 stories

·

625

saves

Stories to Help You Level-Up at Work19 stories

Stories to Help You Level-Up at Work19 stories

·

410

saves

Self-Improvement 10120 stories

Self-Improvement 10120 stories

·

1188

saves

Productivity 10120 stories

Productivity 10120 stories

·

1085

saves

Scott Galloway

Scott Galloway

2024 Predictions

Each year, we review/make predictions re the past/coming year. Most years, we hit more than we miss. But we do miss — if we made 10…

11 min read

·

6 days ago

5.6K

79

Shantanu Gupta

Shantanu Gupta

4 Coins Under $4 are set to take center stage in 2024.

As the crypto market matures, the spotlight is shifting towards projects that solve real-world problems while remaining attractively…

4 min read

·

Jan 4

203

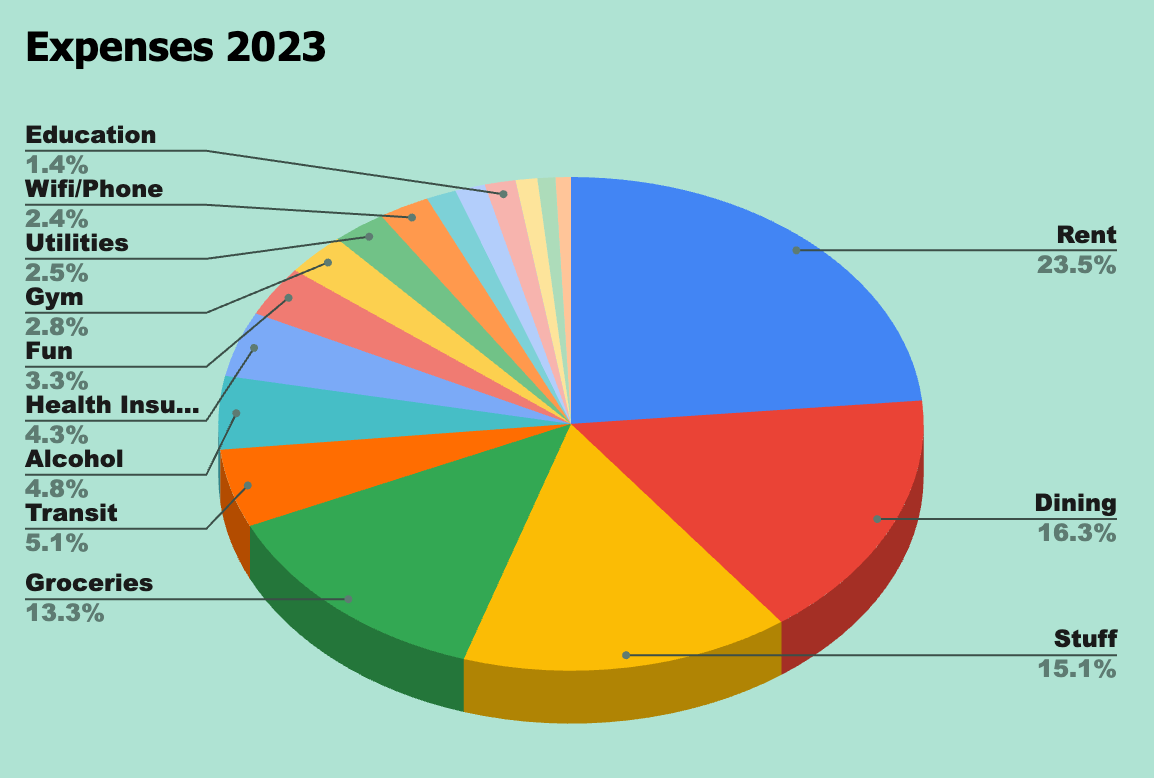

Shawn Forno

Shawn Forno

in

The Startup

Here’s Exactly How Much it Costs to Live in Spain for One Year

An honest look at our average monthly expenses in Galicia, Spain

·

12 min read

·

5 days ago

2K

44

RSBarrosPhD ⚡️Crypto & Blockchain

RSBarrosPhD ⚡️Crypto & Blockchain

ORDI Token: The Inscription on Bitcoin’s Satoshis

·

3 min read

·

6 days ago

4