Understanding the Cash Flow Quadrant - Achieving Financial Freedom

Title: Exploring the Cash Flow Quadrant: A Guide to Financial Independence

Introduction:

In the realm of personal finance and wealth creation, understanding the Cash Flow Quadrant is akin to unlocking a treasure chest of financial wisdom. Coined by renowned author and entrepreneur Robert Kiyosaki in his groundbreaking book "Rich Dad Poor Dad," the Cash Flow Quadrant provides a framework for categorizing different income-earning activities. This article aims to delve into the four quadrants of the Cash Flow Quadrant, shedding light on their distinct characteristics, benefits, and how they contribute to achieving financial independence.

The Four Quadrants:

The Cash Flow Quadrant is divided into four distinct categories, each representing a different approach to earning income:

1. Employee (E):

Individuals in the Employee quadrant are those who work for others. They exchange their time and skills for a fixed salary or hourly wage. While this quadrant offers stability and predictable income, it often lacks control and may cap the potential for financial growth. Employees typically have limited control over their schedules and may find it challenging to achieve true financial freedom.

2. Self-Employed (S):

In the Self-Employed quadrant, individuals work for themselves, often as freelancers, consultants, or small business owners. While this quadrant allows for more control and autonomy, it can also demand long hours and a strong personal involvement in the business. Success in this quadrant often depends on the individual's ability to sell their expertise and manage all aspects of their business.

3. Business Owner (B):

The Business Owner quadrant involves creating and owning systems that generate income. Business owners hire employees or manage teams to run their operations, allowing for scalability and the potential for passive income. This quadrant is marked by building assets that generate wealth even when the owner isn't directly involved in day-to-day operations.

4. Investor (I):

Investors in the Investor quadrant make money by putting their capital to work. This can involve investing in stocks, real estate, bonds, or other income-generating assets. The Investor quadrant offers the potential for significant returns and passive income, but it requires a solid understanding of investment strategies and a willingness to take calculated risks.

Moving Through the Quadrants:

Achieving financial independence often involves transitioning from the Employee and Self-Employed quadrants to the Business Owner and Investor quadrants. This shift requires a change in mindset, a commitment to learning, and the willingness to take calculated risks. As individuals progress through the quadrants, they aim to create multiple streams of income, reduce dependency on active work, and focus on building wealth that can sustain their desired lifestyle.

Benefits of Understanding the Cash Flow Quadrant:

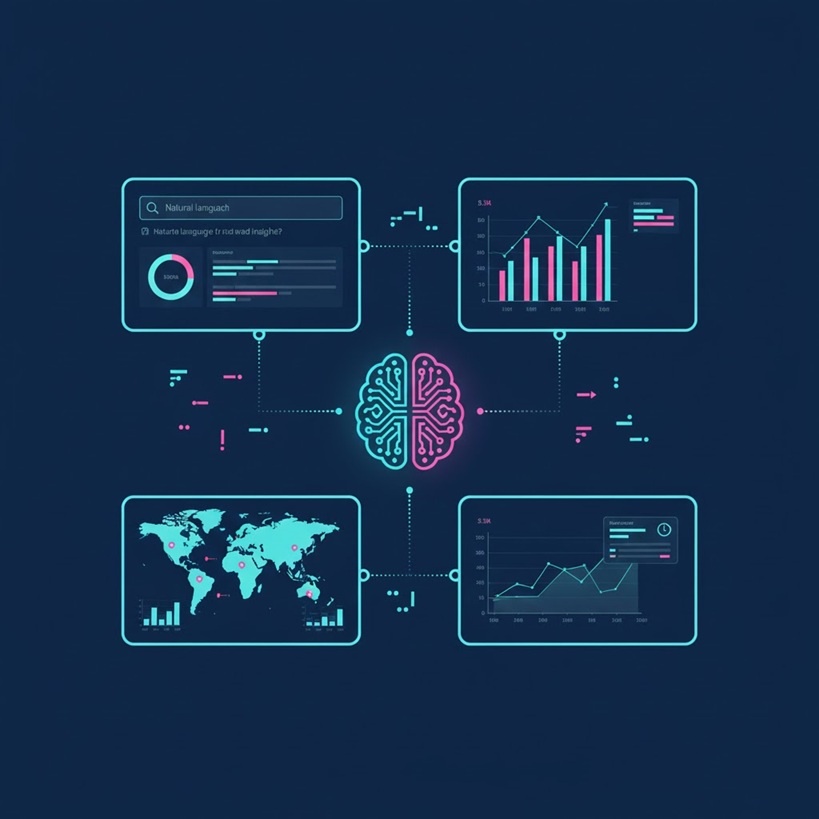

1. Enhanced Financial Literacy: The Cash Flow Quadrant encourages individuals to become more financially literate, understanding the different ways income is generated and the associated risks and rewards.

2. Goal Clarity: By identifying their current quadrant and desired quadrant, individuals can set clear financial goals and create a roadmap to achieve them.

3. Diversification: Understanding the quadrants helps individuals diversify their income sources, reducing vulnerability to economic fluctuations.

4. Mindset Shift: The Cash Flow Quadrant promotes a shift from being an employee to becoming a creator of value, fostering a proactive and entrepreneurial mindset.

Conclusion:

The Cash Flow Quadrant serves as a powerful tool for navigating the complex world of personal finance. It offers insights into how different income-earning activities contribute to financial independence and empowers individuals to make informed decisions about their financial future. By understanding the quadrants and strategically moving through them, individuals can take control of their financial destiny and work towards achieving lasting wealth and prosperity.