Understanding Impermanent Loss

This article is compiled from a long-form Twitter thread. Read the original here: https://x.com/inv515/status/1869639214041850246

Impermanent Loss & Risk Liquidity

Liquidity Pools are part of the de-fi ecosystem.

LPs allow users to deposit token pairs to enable trading. They are managed by Automated Market Makers (AMMs), which use algo's to set prices based on the token supply in the pool. 1/11

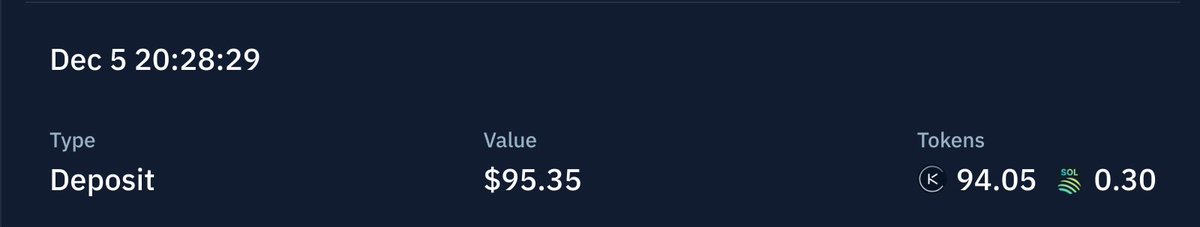

Initial Investment

We deposited 94 KMNO and 0.3 JUPsol into the KMNO-JUPsol pool. The goal was to provide liquidity & earn from trading fees as we did with JITOSol. However, price changes & market conditions can, on occasion, lead to what's known as impermanent loss. 2/10

Now, we have 344 KMNO and 0.08 JUPsol. This change in holdings reflects how the pool has adjusted to market dynamics, particularly the price changes between KMNO & JUPsol as well as the market's recent retraction 3/11

Understanding Impermanent Loss

Impermanent loss occurs when the price ratio of the tokens in our pool diverges from when we deposited them. If we withdraw our liquidity when the price changes, we may end up with less value than if we had just held the tokens ourselves. 4/11

Rebalancing

Say KMNO's price increased significantly compared to JUPsol. As traders buy KMNO from the pool, the algorithm adjusts, reducing the KMNO amount & increasing JUPsol to maintain balance. This rebalancing can lead to impermanent loss if the prices don't revert. 5/11

Real World

If KMNO's price surged, the pool would have more JUPsol after rebalancing. Now with 355 KMNO but only 0.08 JUPsol, we have more KMNO but less JUPsol than initially. When this occurs, it can leave some newcomers a little confused. 6/11

Why Impermanent?

It's called "impermanent" because if the price ratio returns to our entry point, the loss can become a gain again. But, if we withdraw our liquidity when prices are imbalanced, the loss becomes permanent. So, our loss won't be realized until this point 7/11

Mitigate

Kamino uses strategies like auto-rebalancing to minimize the risk of IL. By adjusting the range where your liquidity is effective, it tries to optimize your position for both earning fees & reducing losses. It won't eliminate all risks, but it's still helpful. 8/11

While there's a risk of IL, you still earn trading fees for providing liquidity. If this exceeds the potential loss from price divergence, we could still be profitable. In good conditions, the value from fees can offset or even surpass the impermanent loss. 9/11

Remember

Investing in pools like KMNO-JUPsol involves accepting some risk around things like impermanent loss. While it can be mitigated through strategies & fee earnings, the best way to reduce the level of risk is through careful management of your portfolio 10/11

Have a Go

A great way to learn is by giving it a shot. So, grab some KMNO and add some to the KMNO-SOL liquidity. Then, stake some KMNO to multiply your reward points. Got Questions? Join the discord. https://discord.com/invite/kaminofinance… This is the end of the thread. 11/11