Decoding the Trader's Mind: Psychology and the Path to Success

The world of finance is often romanticized as a realm of quick profits and astute individuals making fortunes overnight. However, the reality of trading paints a different picture. At its core, trading is a demanding mental game, where understanding and mastering your own psychology is just as crucial as understanding the market itself.

The Battleground: Emotions vs. Logic

The human mind is wired for survival, not market dominance. This inherent bias often leads to emotional decision-making, hindering the ability to think rationally and strategically. Some of the most common emotional pitfalls traders face include:

- Fear: The fear of missing out (FOMO) can lead to impulsive buying, while the fear of losing can trigger premature selling, both hindering long-term profitability.

- Greed: The desire for excessive returns can cloud judgment, causing traders to hold onto losing positions for too long or overextend their risk tolerance.

- Overconfidence: Past successes can breed a false sense of invincibility, leading to neglecting risk management and ignoring market signals.

Building the Right Mindset: Pillars of Success

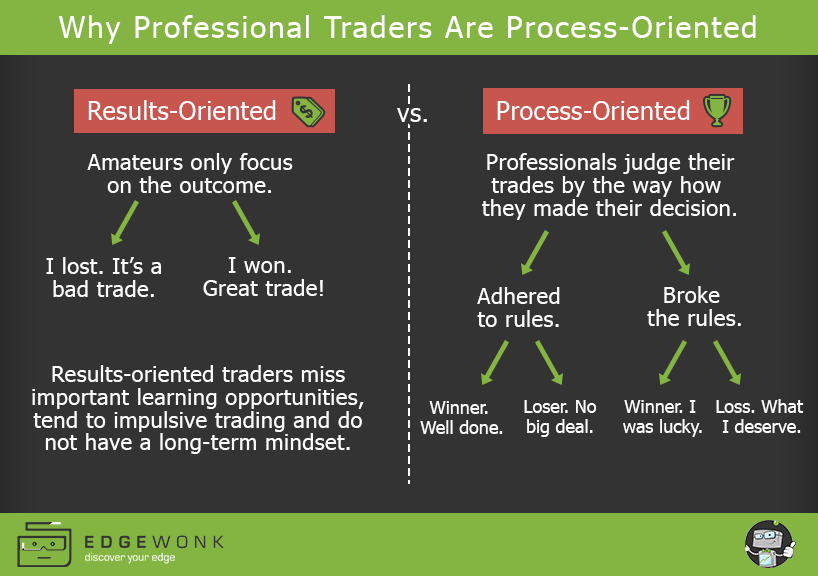

To navigate the emotional minefield of the market, traders need to cultivate a specific mindset characterized by:

- Discipline: Sticking to a well-defined trading plan and predefined risk parameters, even when emotions fluctuate.

- Patience: Accepting that losses are inevitable and understanding that consistent, sustainable profits are built over time.

- Objectivity: Maintaining a detached view of your trades, analyzing them from a logical standpoint rather than allowing emotions to cloud your judgment.

- Humility: Recognizing that the market is always learning and adapting, and being open to adapting your strategies and accepting mistakes as learning opportunities.

Cultivating the Winning Trader Mindset

Mindset

Developing a sound trading psychology is a continuous journey of self-awareness and discipline. Here are some practical steps you can take:

- Self-reflection: Identify your emotional triggers and how they influence your trading decisions. Develop coping mechanisms to manage those emotions effectively.

- Develop a trading plan: Define your risk tolerance, entry and exit points, and money management strategies. Backtest your plan on historical data to refine it before deploying real capital.

- Practice mindfulness and emotional management techniques: Techniques like meditation and journaling can help you become more aware of your emotions and develop healthy coping mechanisms.

- Seek guidance from mentors and communities: Surround yourself with experienced and successful traders who can offer valuable insights and support.

Remember, mastering the market starts with mastering your mind. By understanding your own psychology, developing emotional resilience, and adopting the right mindset, you can equip yourself for the challenges and opportunities that the trading world presents.