Bitcoin has shot up 50% since the new year, but here’s why new lows are probably still ahead

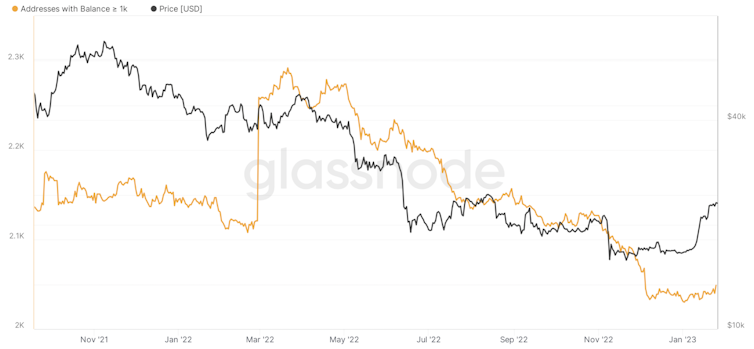

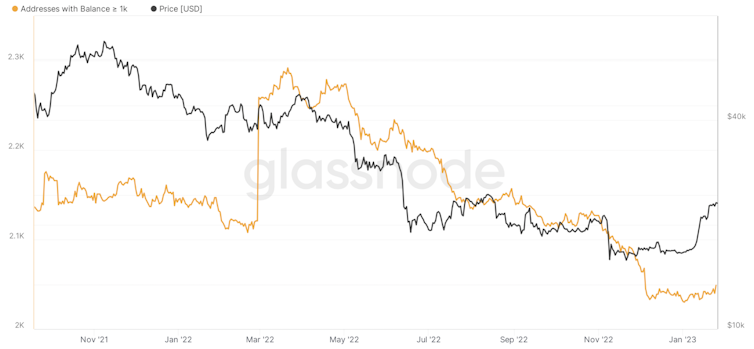

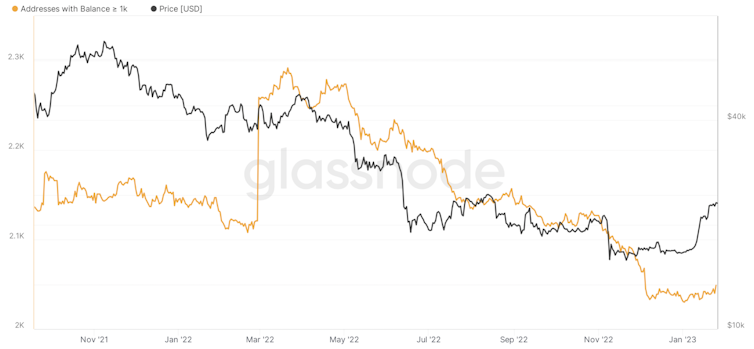

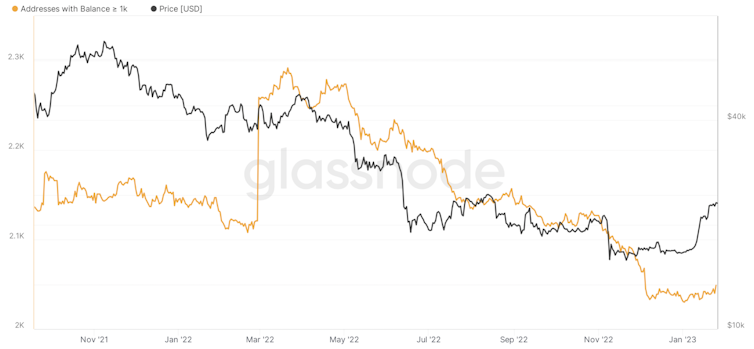

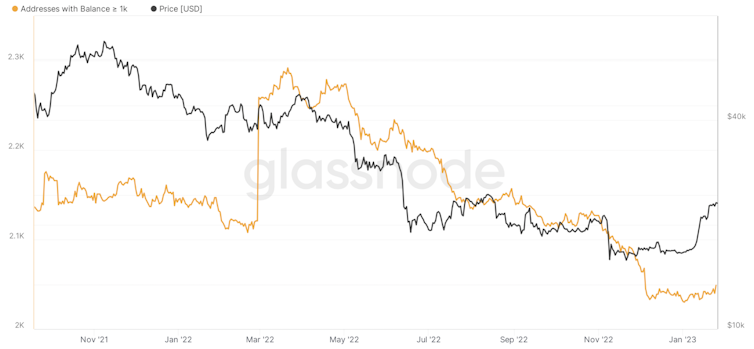

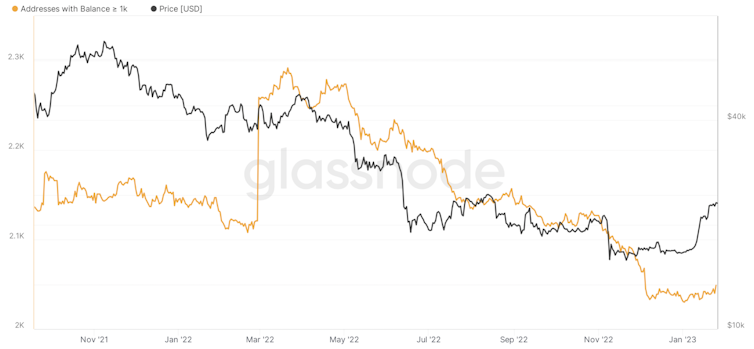

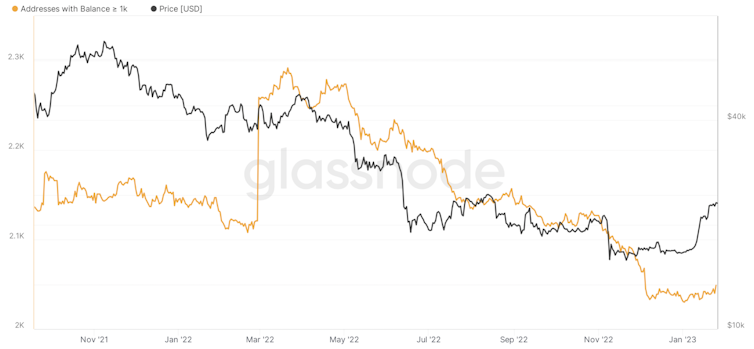

This chart shows all wallets that hold at least 1,000 BTC. Glassnode

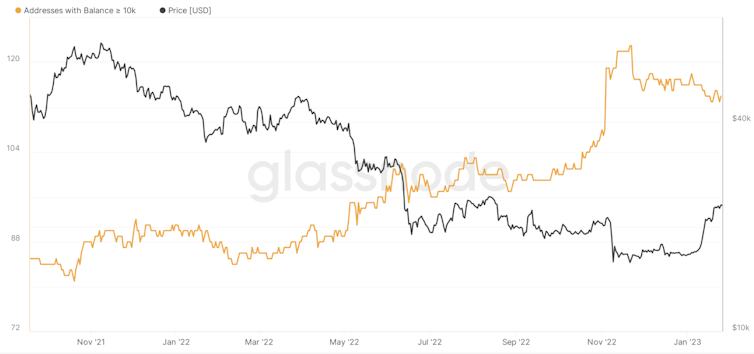

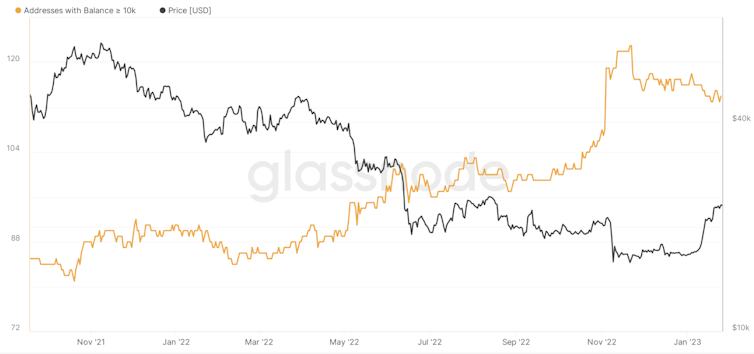

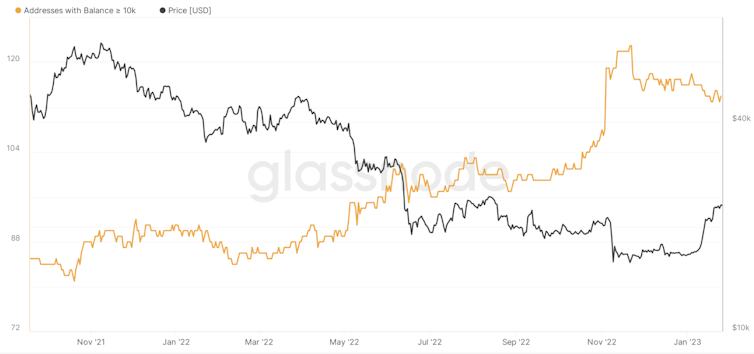

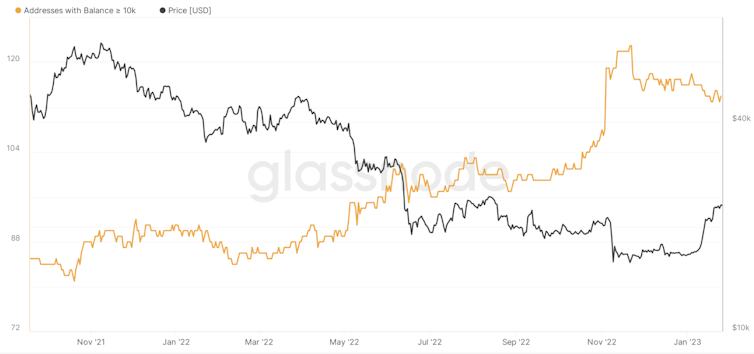

Institutional investor behaviour pt 2

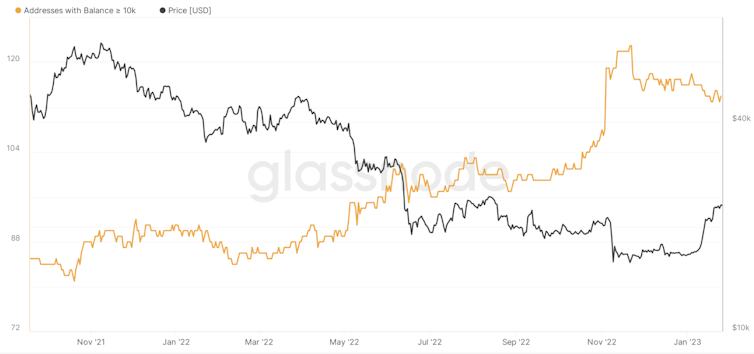

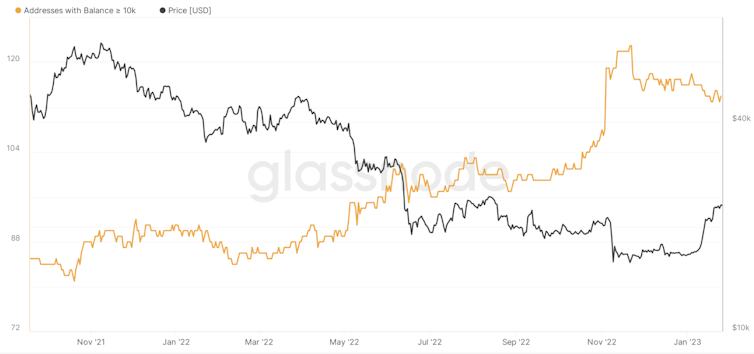

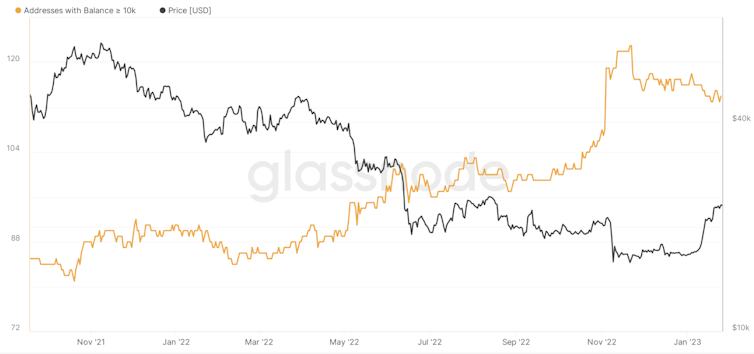

This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This shows that since the FTX scandal back in November, which led to the world’s second-largest crypto exchange collapse, retail investors have been buying bitcoin aggressively, resulting in the highest number of addresses holding at least one BTC ever. On the other hand, the biggest institutional investors have been offloading. This suggests that the institutional investors agree with our analysis.

Where we’re heading

There are those who argue that bitcoin is a bubble and that ultimately cryptocurrencies are worthless. That’s a separate debate for another day. If we assume there is a future for blockchains, which are the online ledgers that enable cryptocurrencies, the key question is when bitcoin will reach the accumulation phase that typically ends a bear phase in any market.

Known as Wyckoff accumulation, this is where the price of the asset repeatedly tests two areas: the upper bound where traders previously sold heavily enough for the price to stop rising (known as resistance), and the lower bound where traders bought heavily enough that the price stopped going down (known as support).

At the point where institutional investors decide the lower bound has proved to be sufficiently resilient – in other words, they think the price is cheap at that level – they will start buying the asset again. That moment is only likely to come after there has been a capitulation.

Of course, history does not repeat itself exactly. It may be this is the first time that retail investors have outsmarted the large institutions, and that the only way is now up.

More likely, however, there is more pain on the way. With a recession on the cards, unprecedented job layoffs and weak retail data coming out of the US, it doesn’t point to the kind of optimism that tends to move markets higher. It would therefore make sense to brace yourself for another plunge in the price of bitcoin and the rest of the crypto market. This chart shows all wallets that hold at least 1,000 BTC. Glassnode

This chart shows all wallets that hold at least 1,000 BTC. Glassnode

Institutional investor behaviour pt 2 This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This shows that since the FTX scandal back in November, which led to the world’s second-largest crypto exchange collapse, retail investors have been buying bitcoin aggressively, resulting in the highest number of addresses holding at least one BTC ever. On the other hand, the biggest institutional investors have been offloading. This suggests that the institutional investors agree with our analysis.

Where we’re heading

There are those who argue that bitcoin is a bubble and that ultimately cryptocurrencies are worthless. That’s a separate debate for another day. If we assume there is a future for blockchains, which are the online ledgers that enable cryptocurrencies, the key question is when bitcoin will reach the accumulation phase that typically ends a bear phase in any market.

Known as Wyckoff accumulation, this is where the price of the asset repeatedly tests two areas: the upper bound where traders previously sold heavily enough for the price to stop rising (known as resistance), and the lower bound where traders bought heavily enough that the price stopped going down (known as support).

At the point where institutional investors decide the lower bound has proved to be sufficiently resilient – in other words, they think the price is cheap at that level – they will start buying the asset again. That moment is only likely to come after there has been a capitulation.

Of course, history does not repeat itself exactly. It may be this is the first time that retail investors have outsmarted the large institutions, and that the only way is now up.

More likely, however, there is more pain on the way. With a recession on the cards, unprecedented job layoffs and weak retail data coming out of the US, it doesn’t point to the kind of optimism that tends to move markets higher. It would therefore make sense to brace yourself for another plunge in the price of bitcoin and the rest of the crypto market This chart shows all wallets that hold at least 1,000 BTC. Glassnode

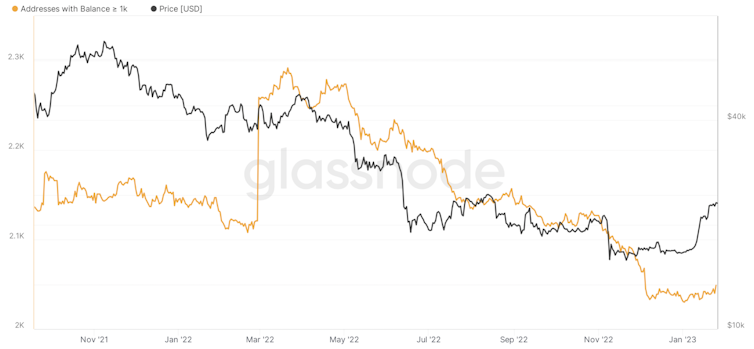

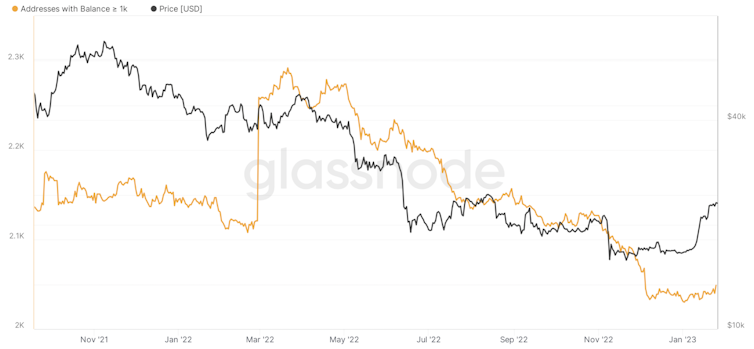

This chart shows all wallets that hold at least 1,000 BTC. Glassnode

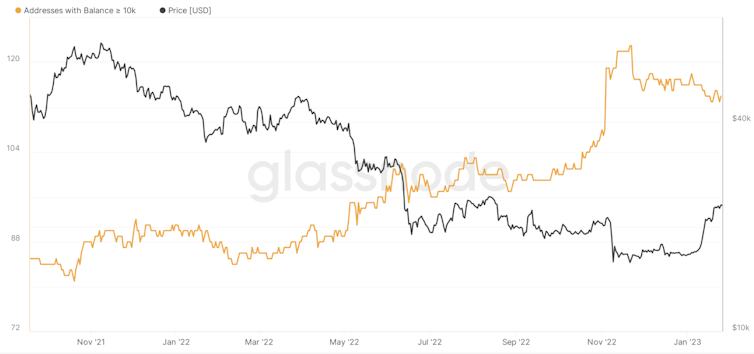

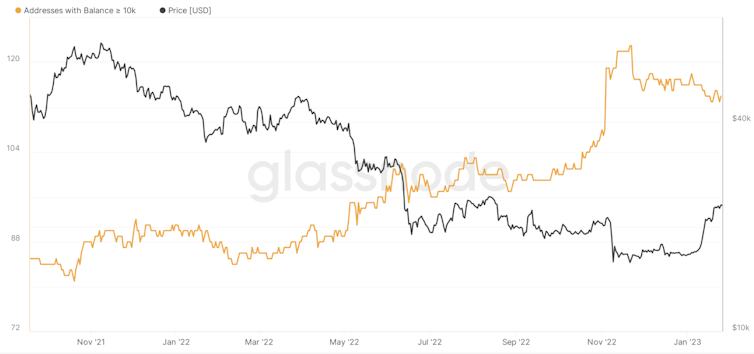

Institutional investor behaviour pt 2 This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This shows that since the FTX scandal back in November, which led to the world’s second-largest crypto exchange collapse, retail investors have been buying bitcoin aggressively, resulting in the highest number of addresses holding at least one BTC ever. On the other hand, the biggest institutional investors have been offloading. This suggests that the institutional investors agree with our analysis.

Where we’re heading

There are those who argue that bitcoin is a bubble and that ultimately cryptocurrencies are worthless. That’s a separate debate for another day. If we assume there is a future for blockchains, which are the online ledgers that enable cryptocurrencies, the key question is when bitcoin will reach the accumulation phase that typically ends a bear phase in any market.

Known as Wyckoff accumulation, this is where the price of the asset repeatedly tests two areas: the upper bound where traders previously sold heavily enough for the price to stop rising (known as resistance), and the lower bound where traders bought heavily enough that the price stopped going down (known as support).

At the point where institutional investors decide the lower bound has proved to be sufficiently resilient – in other words, they think the price is cheap at that level – they will start buying the asset again. That moment is only likely to come after there has been a capitulation.

Of course, history does not repeat itself exactly. It may be this is the first time that retail investors have outsmarted the large institutions, and that the only way is now up.

More likely, however, there is more pain on the way. With a recession on the cards, unprecedented job layoffs and weak retail data coming out of the US, it doesn’t point to the kind of optimism that tends to move markets higher. It would therefore make sense to brace yourself for another plunge in the price of bitcoin and the rest of the crypto market This chart shows all wallets that hold at least 1,000 BTC. Glassnode

This chart shows all wallets that hold at least 1,000 BTC. Glassnode

Institutional investor behaviour pt 2 This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This shows that since the FTX scandal back in November, which led to the world’s second-largest crypto exchange collapse, retail investors have been buying bitcoin aggressively, resulting in the highest number of addresses holding at least one BTC ever. On the other hand, the biggest institutional investors have been offloading. This suggests that the institutional investors agree with our analysis.

Where we’re heading

There are those who argue that bitcoin is a bubble and that ultimately cryptocurrencies are worthless. That’s a separate debate for another day. If we assume there is a future for blockchains, which are the online ledgers that enable cryptocurrencies, the key question is when bitcoin will reach the accumulation phase that typically ends a bear phase in any market.

Known as Wyckoff accumulation, this is where the price of the asset repeatedly tests two areas: the upper bound where traders previously sold heavily enough for the price to stop rising (known as resistance), and the lower bound where traders bought heavily enough that the price stopped going down (known as support).

At the point where institutional investors decide the lower bound has proved to be sufficiently resilient – in other words, they think the price is cheap at that level – they will start buying the asset again. That moment is only likely to come after there has been a capitulation.

Of course, history does not repeat itself exactly. It may be this is the first time that retail investors have outsmarted the large institutions, and that the only way is now up.

More likely, however, there is more pain on the way. With a recession on the cards, unprecedented job layoffs and weak retail data coming out of the US, it doesn’t point to the kind of optimism that tends to move markets higher. It would therefore make sense to brace yourself for another plunge in the price of bitcoin and the rest of the crypto market. This chart shows all wallets that hold at least 1,000 BTC. Glassnode

This chart shows all wallets that hold at least 1,000 BTC. Glassnode

Institutional investor behaviour pt 2 This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This shows that since the FTX scandal back in November, which led to the world’s second-largest crypto exchange collapse, retail investors have been buying bitcoin aggressively, resulting in the highest number of addresses holding at least one BTC ever. On the other hand, the biggest institutional investors have been offloading. This suggests that the institutional investors agree with our analysis.

Where we’re heading

There are those who argue that bitcoin is a bubble and that ultimately cryptocurrencies are worthless. That’s a separate debate for another day. If we assume there is a future for blockchains, which are the online ledgers that enable cryptocurrencies, the key question is when bitcoin will reach the accumulation phase that typically ends a bear phase in any market.

Known as Wyckoff accumulation, this is where the price of the asset repeatedly tests two areas: the upper bound where traders previously sold heavily enough for the price to stop rising (known as resistance), and the lower bound where traders bought heavily enough that the price stopped going down (known as support).

At the point where institutional investors decide the lower bound has proved to be sufficiently resilient – in other words, they think the price is cheap at that level – they will start buying the asset again. That moment is only likely to come after there has been a capitulation.

Of course, history does not repeat itself exactly. It may be this is the first time that retail investors have outsmarted the large institutions, and that the only way is now up.

More likely, however, there is more pain on the way. With a recession on the cards, unprecedented job layoffs and weak retail data coming out of the US, it doesn’t point to the kind of optimism that tends to move markets higher. It would therefore make sense to brace yourself for another plunge in the price of bitcoin and the rest of the crypto market. This chart shows all wallets that hold at least 1,000 BTC. Glassnode

This chart shows all wallets that hold at least 1,000 BTC. Glassnode

Institutional investor behaviour pt 2 This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This shows that since the FTX scandal back in November, which led to the world’s second-largest crypto exchange collapse, retail investors have been buying bitcoin aggressively, resulting in the highest number of addresses holding at least one BTC ever. On the other hand, the biggest institutional investors have been offloading. This suggests that the institutional investors agree with our analysis.

Where we’re heading

There are those who argue that bitcoin is a bubble and that ultimately cryptocurrencies are worthless. That’s a separate debate for another day. If we assume there is a future for blockchains, which are the online ledgers that enable cryptocurrencies, the key question is when bitcoin will reach the accumulation phase that typically ends a bear phase in any market.

Known as Wyckoff accumulation, this is where the price of the asset repeatedly tests two areas: the upper bound where traders previously sold heavily enough for the price to stop rising (known as resistance), and the lower bound where traders bought heavily enough that the price stopped going down (known as support).

At the point where institutional investors decide the lower bound has proved to be sufficiently resilient – in other words, they think the price is cheap at that level – they will start buying the asset again. That moment is only likely to come after there has been a capitulation.

Of course, history does not repeat itself exactly. It may be this is the first time that retail investors have outsmarted the large institutions, and that the only way is now up.

More likely, however, there is more pain on the way. With a recession on the cards, unprecedented job layoffs and weak retail data coming out of the US, it doesn’t point to the kind of optimism that tends to move markets higher. It would therefore make sense to brace yourself for another plunge in the price of bitcoin and the rest of the crypto market. This chart shows all wallets that hold at least 1,000 BTC. Glassnode

This chart shows all wallets that hold at least 1,000 BTC. Glassnode

Institutional investor behaviour pt 2 This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This shows that since the FTX scandal back in November, which led to the world’s second-largest crypto exchange collapse, retail investors have been buying bitcoin aggressively, resulting in the highest number of addresses holding at least one BTC ever. On the other hand, the biggest institutional investors have been offloading. This suggests that the institutional investors agree with our analysis.

Where we’re heading

There are those who argue that bitcoin is a bubble and that ultimately cryptocurrencies are worthless. That’s a separate debate for another day. If we assume there is a future for blockchains, which are the online ledgers that enable cryptocurrencies, the key question is when bitcoin will reach the accumulation phase that typically ends a bear phase in any market.

Known as Wyckoff accumulation, this is where the price of the asset repeatedly tests two areas: the upper bound where traders previously sold heavily enough for the price to stop rising (known as resistance), and the lower bound where traders bought heavily enough that the price stopped going down (known as support).

At the point where institutional investors decide the lower bound has proved to be sufficiently resilient – in other words, they think the price is cheap at that level – they will start buying the asset again. That moment is only likely to come after there has been a capitulation.

Of course, history does not repeat itself exactly. It may be this is the first time that retail investors have outsmarted the large institutions, and that the only way is now up.

More likely, however, there is more pain on the way. With a recession on the cards, unprecedented job layoffs and weak retail data coming out of the US, it doesn’t point to the kind of optimism that tends to move markets higher. It would therefore make sense to brace yourself for another plunge in the price of bitcoin and the rest of the crypto market. This chart shows all wallets that hold at least 1,000 BTC. Glassnode

This chart shows all wallets that hold at least 1,000 BTC. Glassnode

Institutional investor behaviour pt 2 This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This shows that since the FTX scandal back in November, which led to the world’s second-largest crypto exchange collapse, retail investors have been buying bitcoin aggressively, resulting in the highest number of addresses holding at least one BTC ever. On the other hand, the biggest institutional investors have been offloading. This suggests that the institutional investors agree with our analysis.

Where we’re heading

There are those who argue that bitcoin is a bubble and that ultimately cryptocurrencies are worthless. That’s a separate debate for another day. If we assume there is a future for blockchains, which are the online ledgers that enable cryptocurrencies, the key question is when bitcoin will reach the accumulation phase that typically ends a bear phase in any market.

Known as Wyckoff accumulation, this is where the price of the asset repeatedly tests two areas: the upper bound where traders previously sold heavily enough for the price to stop rising (known as resistance), and the lower bound where traders bought heavily enough that the price stopped going down (known as support).

At the point where institutional investors decide the lower bound has proved to be sufficiently resilient – in other words, they think the price is cheap at that level – they will start buying the asset again. That moment is only likely to come after there has been a capitulation.

Of course, history does not repeat itself exactly. It may be this is the first time that retail investors have outsmarted the large institutions, and that the only way is now up.

More likely, however, there is more pain on the way. With a recession on the cards, unprecedented job layoffs and weak retail data coming out of the US, it doesn’t point to the kind of optimism that tends to move markets higher. It would therefore make sense to brace yourself for another plunge in the price of bitcoin and the rest of the crypto market. This chart shows all wallets that hold at least 1,000 BTC. Glassnode

This chart shows all wallets that hold at least 1,000 BTC. Glassnode

Institutional investor behaviour pt 2 This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This shows that since the FTX scandal back in November, which led to the world’s second-largest crypto exchange collapse, retail investors have been buying bitcoin aggressively, resulting in the highest number of addresses holding at least one BTC ever. On the other hand, the biggest institutional investors have been offloading. This suggests that the institutional investors agree with our analysis.

Where we’re heading

There are those who argue that bitcoin is a bubble and that ultimately cryptocurrencies are worthless. That’s a separate debate for another day. If we assume there is a future for blockchains, which are the online ledgers that enable cryptocurrencies, the key question is when bitcoin will reach the accumulation phase that typically ends a bear phase in any market.

Known as Wyckoff accumulation, this is where the price of the asset repeatedly tests two areas: the upper bound where traders previously sold heavily enough for the price to stop rising (known as resistance), and the lower bound where traders bought heavily enough that the price stopped going down (known as support).

At the point where institutional investors decide the lower bound has proved to be sufficiently resilient – in other words, they think the price is cheap at that level – they will start buying the asset again. That moment is only likely to come after there has been a capitulation.

Of course, history does not repeat itself exactly. It may be this is the first time that retail investors have outsmarted the large institutions, and that the only way is now up.

More likely, however, there is more pain on the way. With a recession on the cards, unprecedented job layoffs and weak retail data coming out of the US, it doesn’t point to the kind of optimism that tends to move markets higher. It would therefore make sense to brace yourself for another plunge in the price of bitcoin and the rest of the crypto market. This chart shows all wallets that hold at least 1,000 BTC. Glassnode

This chart shows all wallets that hold at least 1,000 BTC. Glassnode

Institutional investor behaviour pt 2 This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This chart shows all wallets that hold at least 10,000 BTC. Glassnode

This shows that since the FTX scandal back in November, which led to the world’s second-largest crypto exchange collapse, retail investors have been buying bitcoin aggressively, resulting in the highest number of addresses holding at least one BTC ever. On the other hand, the biggest institutional investors have been offloading. This suggests that the institutional investors agree with our analysis.

Where we’re heading

There are those who argue that bitcoin is a bubble and that ultimately cryptocurrencies are worthless. That’s a separate debate for another day. If we assume there is a future for blockchains, which are the online ledgers that enable cryptocurrencies, the key question is when bitcoin will reach the accumulation phase that typically ends a bear phase in any market.

Known as Wyckoff accumulation, this is where the price of the asset repeatedly tests two areas: the upper bound where traders previously sold heavily enough for the price to stop rising (known as resistance), and the lower bound where traders bought heavily enough that the price stopped going down (known as support).

At the point where institutional investors decide the lower bound has proved to be sufficiently resilient – in other words, they think the price is cheap at that level – they will start buying the asset again. That moment is only likely to come after there has been a capitulation.

Of course, history does not repeat itself exactly. It may be this is the first time that retail investors have outsmarted the large institutions, and that the only way is now up.

More likely, however, there is more pain on the way. With a recession on the cards, unprecedented job layoffs and weak retail data coming out of the US, it doesn’t point to the kind of optimism that tends to move markets higher. It would therefore make sense to brace yourself for another plunge in the price of bitcoin and the rest of the crypto market.

.

.

![[LIVE] Engage2Earn: Shayne Neumann MP Blair boost](https://cdn.bulbapp.io/frontend/images/d0ae7174-2ceb-4eed-9844-e1c262a4013e/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)