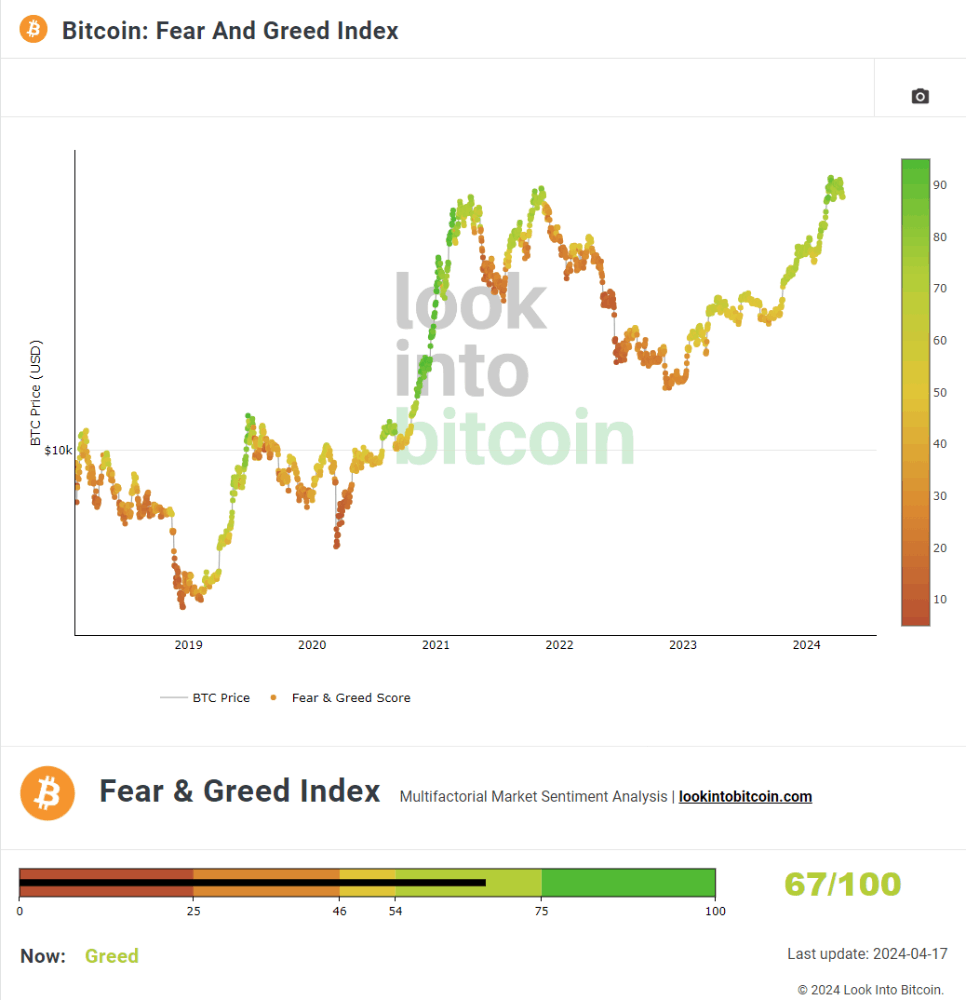

Bitcoin Fear and Greed Index

A Measure of Market Sentiment

The Bitcoin Fear and Greed Index is a popular sentiment indicator that provides insights into the emotional state of investors in the Bitcoin market. Developed by alternative.me, the index measures the prevailing sentiment among market participants, ranging from extreme fear to extreme greed. In this article, we will explore the Bitcoin Fear and Greed Index, how it works, and its implications for Bitcoin investors and traders.

What is the Bitcoin Fear and Greed Index?

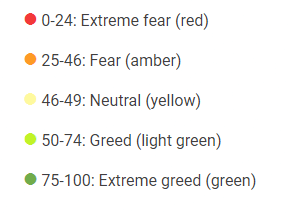

The Bitcoin Fear and Greed Index is a sentiment gauge that aggregates various data points and metrics to assess the overall sentiment of investors in the Bitcoin market. The index uses a scale from 0 to 100, where a value of 0 indicates extreme fear, and a value of 100 indicates extreme greed. The index is updated on a daily basis and provides a snapshot of market sentiment at any given time.

How Does the Bitcoin Fear and Greed Index Work?

The Bitcoin Fear and Greed Index is calculated using several indicators and metrics, including:

- Volatility: Measures the magnitude of price fluctuations in the Bitcoin market.

- Market Momentum: Analyzes the pace of price movements and trend reversals.

- Social Media Sentiment: Monitors discussions and sentiments on social media platforms such as Twitter and Reddit.

- Surveys: Collects data from surveys and polls to gauge investor sentiment and expectations.

- Dominance: Tracks Bitcoin's dominance relative to other cryptocurrencies in the market.

These indicators are weighted and combined to generate a single score, representing the overall fear or greed level in the Bitcoin market. The index is designed to provide a simple and intuitive measure of investor sentiment, helping traders and investors gauge market sentiment and make informed decisions.

Implications for Bitcoin Investors and Traders:

The Bitcoin Fear and Greed Index can be a valuable tool for investors and traders in several ways:

- Contrarian Indicator: Extreme fear or greed levels in the Bitcoin market may signal potential buying or selling opportunities. For example, when the index reaches extreme fear levels, it may indicate oversold conditions and a potential buying opportunity. Conversely, extreme greed levels may suggest overbought conditions and a potential selling opportunity.

- Market Sentiment Analysis: The index provides insights into the prevailing sentiment among Bitcoin investors and traders. By monitoring changes in sentiment over time, investors can gain a better understanding of market dynamics and potential shifts in trend.

- Risk Management: The Bitcoin Fear and Greed Index can help investors manage risk by providing a gauge of market sentiment. For example, high levels of greed may signal excessive optimism and complacency, increasing the likelihood of a market correction. In such cases, investors may consider adopting a more cautious approach and implementing risk management strategies.

The Bitcoin Fear and Greed Index is a valuable sentiment indicator that provides insights into the emotional state of investors in the Bitcoin market. By monitoring changes in sentiment and interpreting extreme fear or greed levels, investors and traders can make more informed decisions and better navigate the dynamic and often volatile cryptocurrency market. While the index is not a foolproof predictor of market movements, it serves as a useful tool for assessing market sentiment and identifying potential opportunities and risks in the Bitcoin market.

Thank you for reading!

Find useful articles to read: HERE

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)