Veteran Trader Predicts Bitcoin Price Peak in August 2025

Veteran Trader Predicts Bitcoin Price Peak in August 2025

Bitcoin price trajectories often become the focus of intense speculation, but certain historical patterns provide insights into its potential future movements. One such pattern revolves around Bitcoin halving events—crucial moments in the Bitcoin cycle that halve mining rewards and have historically triggered significant market movements.

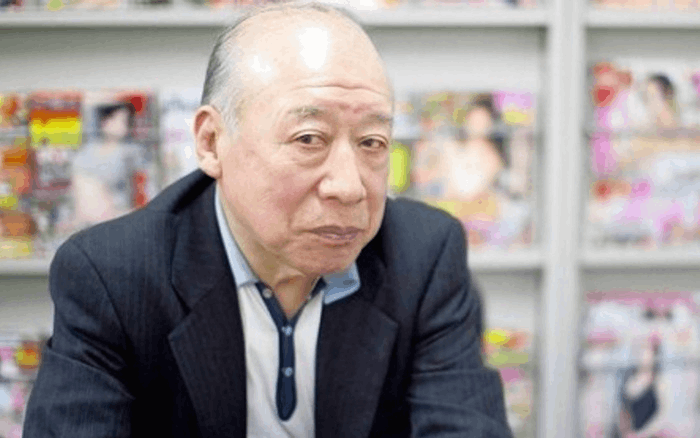

Veteran trader Peter Brandt released a comprehensive analysis titled “The Beautiful Symmetry of Past Bitcoin Bull Market Cycles,” identifying consistent patterns in Bitcoin's pricing strategy around halving events.

In his analysis on June 2, 2024, Brandt noted that Bitcoin halving dates typically fall midway between the start of a bullish market and its peak. This indicates that halving events act as catalysts or turning points in the broader market cycle. He pointed out that the last bull market began about 16 months before the most recent halving on May 11, 2020, and the cycle ended roughly 18 months after the halving.

Brandt also observed similar patterns for the halvings on July 9, 2016, and November 28, 2012, suggesting consistent Bitcoin behavior across different cycles. Based on these patterns, Brandt predicts that if this sequence continues as it has in the past, the next bull market peak could occur in late August or early September 2025, potentially reaching a price range of $130,000 to $150,000.

Bitcoin Price Projections Still Have Potential for Error

Despite the optimistic outlook, Brandt remains cautious. He acknowledges a 25% chance that Bitcoin has already peaked in this cycle and advises traders to monitor the market closely. If Bitcoin fails to reach a new all-time high and falls below $55,000, it is likely that investors are witnessing what Brandt calls “exponential decay” in market gains compared to previous cycles.

While predictive models like Brandt's offer valuable insights, they are not always reliable. Investors should consider this analysis as part of a broader strategy, taking into account other market forces and their personal risk tolerance.

Conclusion

Peter Brandt's analysis of Bitcoin's historical price patterns around halving events provides a compelling forecast for the future, predicting a potential peak between $130,000 and $150,000 in late August or early September 2025. While the consistency observed in past cycles lends credibility to this projection, Brandt advises caution, acknowledging the inherent uncertainties and the possibility of Bitcoin having already reached its peak in the current cycle. Investors should view this analysis as one piece of a larger strategy, considering other market dynamics and their own risk tolerance to make informed decisions.

Read Too : Bitcoin Option Investors Optimistic About BTC Reaching $70K by End of May

*Disclaimer:

This content aims to enrich reader information. Always conduct independent research and use disposable income before investing. All buying, selling, and crypto asset investment activities are the reader's responsibility.