Trading Psychology: How to Trade Without Emotions

What Is Trading Psychology?

Trading psychology delves into the mental and emotional aspects that influence a trader's decisions and ultimately, their success in the financial markets. It's essentially the mindset part of trading.

Here are some key points to understand:

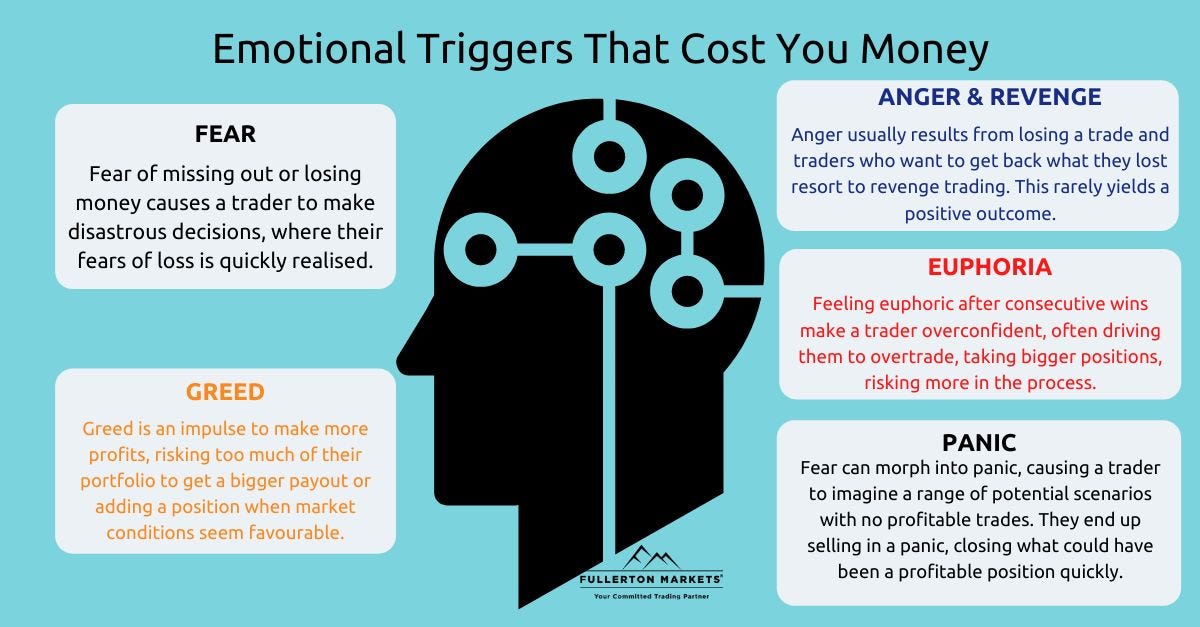

Impact of Emotions: Greed and fear are two powerful emotions that can cloud judgment and lead to impulsive, irrational decisions. Trading psychology helps you recognize and manage these emotions to make sound choices based on logic and strategy, not gut feelings.

Developing the Right Mindset: Discipline, patience, and emotional control are crucial for consistent success. Trading psychology equips you with tools to build a winning mindset that prioritizes risk management, sticking to your plan, and learning from both wins and losses.

Understanding Biases: Humans are prone to cognitive biases, like overconfidence or chasing past winners. Trading psychology helps you identify and overcome these biases to make more objective and rational decisions.

Importance of Self-Awareness: Reflecting on your strengths, weaknesses, and emotional triggers is crucial. Trading psychology fosters self-awareness so you can understand how your mind works and adapt your approach accordingly.

Resources for Improvement: Numerous resources are available, including books, courses, and coaching, to help you develop your trading psychology. Remember, it's a continuous learning process.

If you're interested in learning more, I can recommend some specific resources based on your experience level and trading goals. Just let me know!

Why It’s Important To Understand Your Mindset When Trading

Understanding your mindset is critically important for success in trading for several reasons:

1. Emotions Impact Decisions: Greed, fear, and other emotions can cloud your judgment and lead to impulsive trades that go against your strategy. Recognizing and managing these emotions allows you to make rational, objective decisions based on market analysis and your trading plan.

2. Discipline and Mindset Go Hand-in-Hand: Trading involves sticking to your plan even when the market fluctuates or emotions stir. A strong mindset helps you build the discipline needed to execute your trades calmly and avoid emotional reactions that could lead to losses.

3. Avoiding Biases: Everyone has cognitive biases that can distort their thinking. Understanding your individual biases, like overconfidence or anchoring, helps you make more objective decisions and avoid predictable mistakes.

4. Realistic Expectations and Acceptance: The market has ups and downs, and losses are inevitable. A healthy mindset lets you accept losses as part of the learning process, manage risk effectively, and avoid chasing unrealistic returns that lead to reckless trading.

5. Continuous Learning and Improvement: Trading is a journey, not a destination. Understanding your mindset helps you identify areas for improvement in your emotional control, discipline, and decision-making, leading to continuous learning and growth as a trader.

Overall, understanding your mindset in trading is like understanding the engine in your car. If you know how it works, you can control it, fine-tune it, and avoid breakdowns. The same applies to your mind in the market – by understanding your thoughts and emotions, you can navigate the financial world with greater clarity, control, and ultimately, success.

How to Use Trading Psychology to Become a Better Trader

Mastering your trading psychology can be a game-changer for your financial endeavors. Here are some key strategies to get you started:

1. Self-Awareness:

- Journal: Regularly reflect on your thoughts, emotions, and actions during trading sessions. Identify emotional triggers and patterns affecting your decisions.

- Meditation: Practice mindfulness techniques to become more aware of your emotional state and manage impulsive reactions.

- Stress Management: Find healthy ways to de-stress and stay calm, like exercise, deep breathing, or spending time in nature.

2. Building a Winning Mindset:

- Develop a Trading Plan: Define your risk tolerance, entry and exit points, and money management strategies. Stick to the plan with discipline, even during volatile markets.

- Visualize Success: Imagine yourself achieving your trading goals and visualize the process leading to them.

- Positive Affirmations: Use positive self-talk to counter negative thoughts and build confidence in your abilities.

3. Managing Emotions:

- Recognize Emotional Triggers: Identify situations or market movements that trigger fear, greed, or other emotions.

- Develop Coping Mechanisms: Have specific strategies to manage these emotions, like taking a break, seeking support, or reminding yourself of your trading plan.

- Celebrate Wins and Learn from Losses: Don't get overexcited by wins or dwell on losses. Learn from each experience and adjust your approach accordingly.

4. Overcoming Biases:

- Educate Yourself: Learn about common cognitive biases that affect traders, like overconfidence, anchoring, and confirmation bias.

- Seek Outside Perspective: Get feedback on your trades from mentors, coaches, or trusted friends.

- Use Backtesting and Simulation: Test your trading strategies using historical data to identify and address potential biases.

5. Continuous Learning:

- Read Books and Articles: Stay updated on trading psychology principles and techniques.

- Seek Coaching or Mentorship: Work with experienced traders to gain insights and refine your approach.

- Join Trading Communities: Connect with other traders to share experiences and learn from each other.

Remember, mastering trading psychology takes time and effort. Be patient, consistent, and celebrate your progress. With dedication and the right mindset, you can significantly improve your trading performance and achieve your financial goals.

Is Trading Psychology Different In Crypto?

While the core principles of trading psychology apply regardless of the asset class, there are some unique aspects to consider when trading cryptocurrencies:

Increased Volatility: Crypto markets are known for their dramatic ups and downs, which can amplify emotional responses like fear and greed. This requires even stricter emotion management and discipline to avoid impulsive decisions.

FOMO (Fear of Missing Out): The rapid price movements in crypto can create a strong fear of missing out (FOMO), leading to rushed trades without proper analysis. Understanding this specific trigger and developing coping mechanisms is crucial.

Speculative nature: Many cryptocurrencies have strong communities and passionate supporters, sometimes leading to emotional attachment to certain projects. It's important to separate emotions from sound investment analysis and maintain objectivity.

Information Overload: The crypto space is constantly evolving with new projects, news, and opinions. Filtering information overload and focusing on reliable sources are essential to avoid basing decisions on hype or misinformation.

Regulation and Uncertainty: The regulatory landscape surrounding crypto is still evolving, adding an element of uncertainty to the market. Maintaining a rational and adaptable approach is key to navigating this uncertainty.

Scams and Manipulation: The crypto space is unfortunately susceptible to scams and market manipulation. Developing a critical and skeptical mindset is crucial to protect yourself from falling victim to these unethical practices.

Community and Support: The crypto community offers a wealth of information, support, and learning opportunities. Engaging with experienced traders and mentors can be a valuable resource for developing your trading psychology skills.

In conclusion, while the core principles of trading psychology remain essential, being mindful of the unique aspects of the crypto market can give you an edge. By understanding and managing your emotions, navigating FOMO, staying objective, and staying informed, you can develop a robust trading mindset that leads to success in this dynamic and evolving environment.

I hope this information has been helpful on your trading journey. If you have any further questions or need more specific advice, feel free to ask!

Check Out My Latest Blogs:

1- Don't Get Hooked:Crypto Phishing Scams (Great)

2- Demystifying the Portal to Web3: Your Guide to Web3 Wallets (Great)

3- A beginner-friendly guide to sidechains: Everything you need to know about it (Brilliant)

4- How to Grow Your Savings (Brilliant)

5- Trump's CBDC Blockade (Brilliant)

6- Tips to Secure Your Cryptocurrency Holdings (Brilliant)

7- Demystifying NFT Loans: Risks, Rewards, and How They Work (Brilliant)

8- What Is a Hardware Wallet and Why You Should Use It (Brilliant)

![[LIVE] Engage2Earn: Doubling down on Dickson](https://cdn.bulbapp.io/frontend/images/0dea4715-4791-404e-acff-82013adb11e1/1)