BERACHAIN (RAISED $42 M)

What is Berachain? 🐻 ⛓️

Berachain is a high-performance EVM-compatible blockchain built on Proof-of-Liquidity consensus. Proof-of-Liquidity is a novel consensus mechanism that aims to align network incentives, creating strong synergy between Berachain validators and the ecosystem of projects. Berachain's technology is built on Polaris, a high-performance blockchain framework for building EVM-compatible chains on-top of the CometBFT consensus engine.

What is Proof-of-Liquidity?

The Berachain economic model is a cutting-edge approach to blockchain governance that aims to address the critical challenges faced by decentralized networks. The model focuses on three high-level objectives:

- Systemically build Liquidity

- Solve stake centralization

- Align protocols and validators

What's the difference between Proof of Stake and Proof of Liquidity?

Proof of Stake

Proof of Stake (PoS) is a consensus mechanism used in blockchain technology that aims to balance security, speed, and decentralization. In this model, all token holders have the chance to be chosen to validate transactions and create new blocks based on the amount of cryptocurrency they hold and are willing to 'stake' as collateral.

Instead of Proof of Stake, most networks use a variation known as Delegated Proof of Stake (DPos). The delegation feature enables network participants to vote to elect nodes, often known as 'delegates', to validate transactions and produce new blocks on the blockchain.

DPoS is an alternative to Proof-of-Work (PoW) and Proof-of-Stake (PoS) models and was designed to be more efficient and democratic, promoting more active user involvement in the network's functioning.

Downsides to Proof of Stake

- Improving the security of the chain leads to a reduction of liquidity on the chain for actions such as transactions, LP pools, etc.

- Stake becomes centralized due to newly minted tokens always going to the same network participants

- Protocols have little opportunity to improve the security of the chain they're building on

- Validators receive little upside from the protocols that they are ultimately running infrastructure for

Proof of Liquidity

Proof of Liquidity (PoL) builds on-top of the concept of Proof of Stake in order to address these downsides. Let's walk through it.

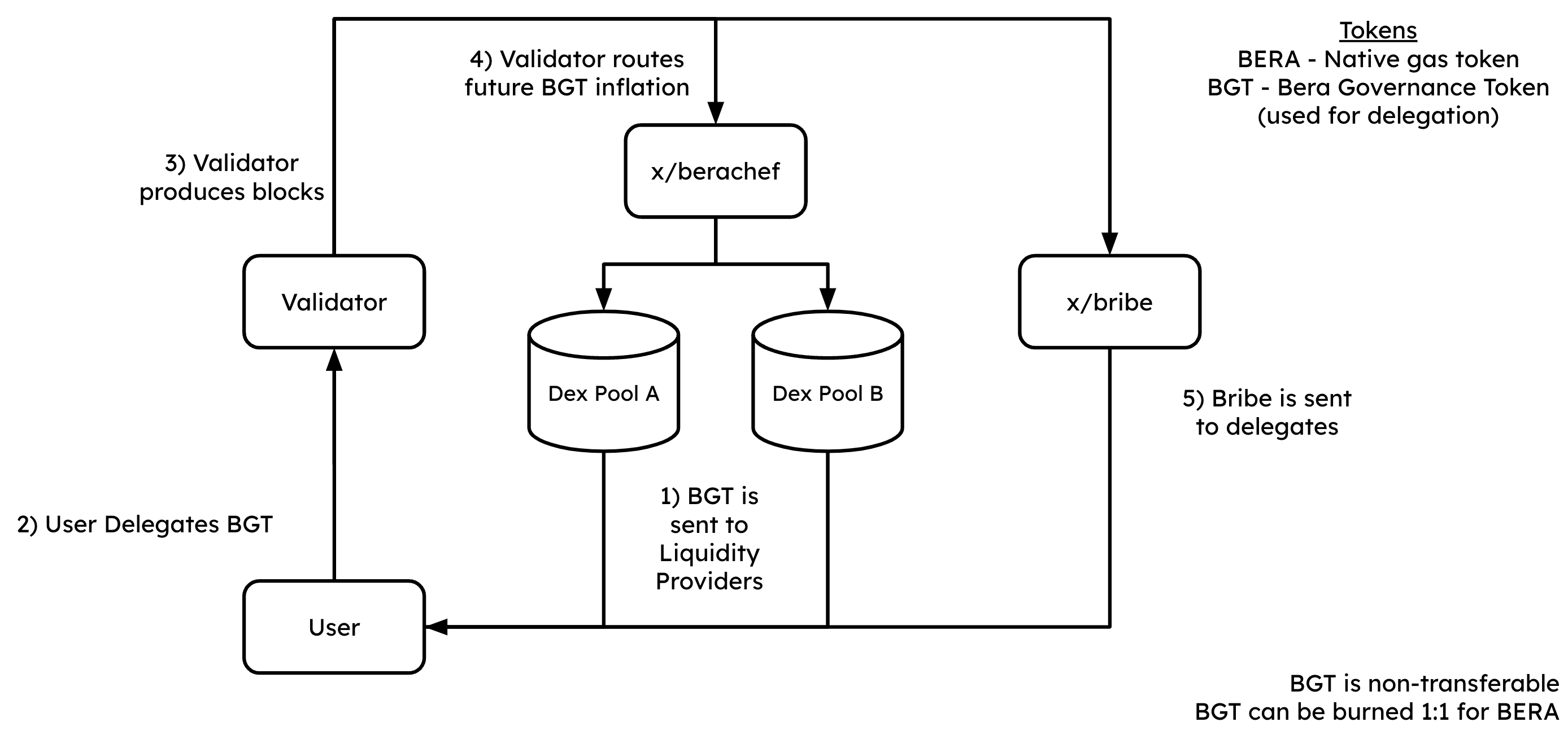

- By providing liquidity to the BEX liquidity pools, users earn BGT, the Bera Governance Token used for delegating in Proof of Liquidity

- Users delegate their BGT to validator(s)

- Validators produce blocks based on their proportional weight of BGT delegated to them. Delegators & Validators in turn receive rewards from the chain

- Validators vote on future BGT inflation across any number of liquidity pools

- Bribes are distributed from validators to their delegators (if the validator has created them)

Increasing Security by Increasing Liquidity

As shown above, Proof of Liquidity addresses the first issue with Proof of Stake through two mechanisms:

- The delegation token (BGT) is separated from the gas token of the chain (BERA)

- The only way to earn new BGT is by providing liquidity to the BEX

This means that the token used for staking is no longer the same token used for many on-chain actions. Additionally, further liquidity is incentivized by that being the only mechanism to earn new governance tokens.

Decentralizing Inflation

Emitting new BGT to liquidity providers is also what allows Proof of Liquidity to address the second issue with Proof of Stake, that being stake centralization. Now that stake is not going directly back to the stakers, but instead is given to separate market participants, who are performing common on-chain actions, the new inflation of tokens is more fairly distributed than in traditional Proof of Stake networks.

Aligning Protocols and Validators

Lastly, the third and fourth issues with Proof of Stake are addressed simultaneously as Proof of Liquidity incentivizes protocols and validators to work together in order to:

- Have validators incentivize a protocol's LP pool via BGT

- Have protocols help those validators accumulate BGT stake via bribes

The Berachain Protocol is an EVM-compatible blockchain, built on top of Polaris EVM, that allows for Smart Contracts compiled from Solidity or Vyper to bytecode, its consensus to adopt CometBFT, and because its built upon the Cosmos SDK allows for it to be modular for different clients, data layers, and more.

TOKENS

BERA Token

BERA is the network token used to send transactions on the blockchain, which is why it's sometimes called the "gas token." It's what pays for the transaction's gas.

BGT Token

Proof of Stake blockchains have a governance token that is used to secure the network through staking with validators. The economic value of all the tokens staked in the network adds up to form the security of the chain. Oftentimes, this is the main network token.

Honey Stablecoin

Many protocols depend on more stability in the price of their tokens than standard cryptocurrencies provide. This led to the concept of stablecoins, coins which are pegged to the real dollar value of fiat currency.

In Berachain, this coin is HONEY, a stablecoin that aims to approximate 1 USDC

Ticker: BERA

Token type: COSMOS NETWORK

Role of Token: UTILITY

Berachain Native Oracle

Berachain provides a fully integrated, general-purpose price oracle built-in to the chain. This oracle has an associated Cosmos module and precompile through which applications and users can interact with.

Using Skip’s oracle solution that leverages Vote Extensions from ABCI++ (part of CometBFT’s v0.38 release), Berachain validators can contribute to the oracle by contributing prices for pairs on every block; validators can choose to use the default providers or their own providers for prices.

The Berachain Oracle relies of a series of price data feeds to update the current price of a token in relation to USD. These feeds contribute to the Oracle Precompile Contract, which allows developers to easily integrate into their work and get the most accurate pricing.

The goal will be to add more providers as the network gets closer to Mainnet.

FREE TESTNET AIRDROP

Detailed Airdrop information will be shared on the next article. Please follow the articles and try to participate to this free airdrop.

You can kindly connect me on comment section if you want any support about airdrops. You can also request a new topics to text on BULB. I would like to explain Airdrops you want.