SOL Breaks Out as Solana Gives Report on Recent Outage

KEY POINTS:

- SOL climbed to $100 after breaching a crucial resistance on February 9.

- If buying pressure remains present, SOL could extend its gains to $126.40.

- Analysts predict a short and long-term bullish outlook for SOL.

The Chinese New Year which was marked on February 9, came with good tiding for crypto prices and Solana (SOL) was not exempted. SOL’s price at press time was $110 after its previous attempts to hit the region were rejected.

The increase meant that the token had increased by 10.12% in the last 24 hours, CoinMarketCap data showed. Interestingly, this recovery came on the same day the Solana development team gave its report on what caused the 5-hour outage during the week.

Solana Publishes Outage Report

On Tuesday, February 6, Solana experienced a blackout that restricted users from making successful transactions on the blockchain. Coin Edition’s report also showed that the price of SOL plunged during the period.

In the recent revelation, Solana noted that the LoadedPrograms hit the infinite loop during replay on the network. This caused validators to stall on one block, thereby, making it difficult to process other transactions.

For context, an infinite loop is a sequence of instructions that continuously execute programs without termination. “Since at the time of the outage, more than 95% of cluster stake was running 1.17, nearly all validators were stalled on this block”, Solana explained.

SOL to Keep Running Northward

On the 4-hour chart, increased buying pressure saw SOL break past the $101.76 resistance. If SOL keeps up with the buying momentum, the token might extend its gains to $120 in the short term.

But that would only be the case if the bulls can defend the downward support at $95.11. The position of the Relative Strength Index (RSI) at 69.20 suggested increased buying momentum. It also implied that there is more room for growth.

However, if the RSI crosses 70.00, SOL might be considered overbought. In this instance, the price could pull back to $97.74. But if bulls continue to load up buy orders, SOL’s price might recover northward.

Furthermore, the Moving Average Convergence Divergence (MACD) positioned in the positive region. Also, the 12- EMA (blue) was above the 26 EMA (orange), reinforcing the clear upside potential SOL had. Coin Edition

Coin Edition

If bulls continue to dictate the token’s direction, SOL might hit $126.40— which was last seen on Christmas day. But if traders decide to book profits in the meantime, the price might drop below $100.

Market Players Are Bullish

Meanwhile, recent predictions from different analysts suggested a bullish outlook for the L1 token. For instance, CryptoJelleNL, an investor, posted on X, that SOL might repeat what Ethereum (ETH) did in 2022 when the price moved from $350 to $3500 within a few months.

Should SOL do the same, then the price could hit $1000 before this year ends. Matthew Dixon, CEO of crypto rating platform, Evia, was more conservative and gave his prediction for the short term.

According to Dixon, the recent technical glitch might not stop SOL’s rally, and he expects the price to move much higher going forward.

Matthew Dixon – CEO Evai

@mdtrade

$SOL 120 could be a fair upside target for #Solana where the c wave = a wave (making up a larger B wave) before we get a further downside correction.

Therefore short term and long term positive with a medium term correction on the cards pic.twitter.com/uVYC3OTC5m

Feb 09, 2024

Based on the chart he shared, SOL might surpass $132 in the short term. But after a while, the token could face correction which takes it to $92 before another upside.

Coin Edition

Crypto

Read more from Coin Edition

Solana Network Endures Outage and Shows Resilience

In Brief

- Solana faced a 5-hour outage last Monday, sparking debate.

- Despite skepticism, Solana's ecosystem continues to grow and develop.

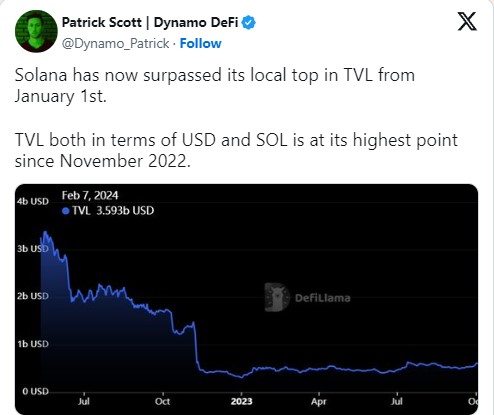

- TVL measurements in USD and SOL reached their highest since November 2022.

- Technology, science, ai, gaming, business and finance news: Newslinker.co

COINTURK NEWS

COINTURK NEWS

Published 10 February, 2024 - 11:50 am

Share SHARE

SHARE

Last Monday, a 5-hour outage in the Solana (SOL) network, which raised significant concerns, led to a heated debate among those doubting the network’s future and ecosystem.

Contents

Current State of Solana

Comments on Solana and Its Social Status

Current State of Solana

Despite the skepticism that has emerged, the Solana ecosystem appears to maintain its resilience and continues to evolve. Recent data shows that since January 1st, Solana has surpassed its previous total value locked (TVL) record.

According to the latest review, the TVL measurement, both in USD and SOL, has reached its highest level since November 2022, demonstrating strong performance despite recent challenges.

This increase in TVL and the broken record not only contribute to the positive outlook of the network’s financial strength but also position Solana for potential growth and expansion.

Comments on Solana and Its Social Status

Despite the growth in TVL, the general sentiment around Solana seems to continue its decline. This situation reveals ongoing negative comments in the social sphere about the network.

The negative atmosphere could have significant effects on investors with high expectations for Solana. The pessimistic view may lead investors to be cautious on the platform, potentially reducing investments and prompting the withdrawal of existing funds.

Moreover, the drop in trust among users due to adverse conditions could deter new users from joining the ecosystem and cause existing users to question their participation.

On the other hand, weakening community support and reluctance among developers to use Solana could harm its vibrant ecosystem and negatively impact its ability to incentivize developers.

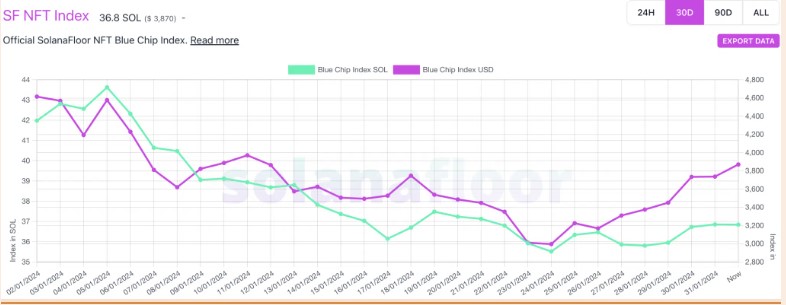

The decline in sentiment also had a negative effect on Solana’s NFT sales. This resulted in a significant drop in the value of blue-chip collections on Solana last month.

Additionally, during this period, there was a noticeable decrease in the floor prices of NFTs. A decline in interest in NFTs, one of the cornerstones of Solana, could lead to more adverse conditions and pave the way for a negative outlook on SOL’s price.

Despite all this, there was a noticeable increase in SOL’s price. Parallel to the rise in Bitcoin, SOL saw an increase of over 3% at the time of writing, with the price finding buyers at $109.64. The trading volume also increased by 25% during this period, rising to $2.9 billion.

Solana Surpasses Bitcoin in Recent Market Surge

In Brief

- Crypto market sees 3.5% increase in 24 hours, Solana gains.

- Solana (SOL) price up 6.58%, market value at $44.4 billion.

- On-chain data shows Solana's notable performance over Bitcoin.

- Technology, science, ai, gaming, business and finance news: Newslinker.co

SHARE

SHARE

Following last night’s surge in the cryptocurrency market, there was a 3.5% increase in 24 hours, leading to a remarkable recovery. During this period, Solana surpassed the $100 level, achieving significant gains. As of the time of writing, the SOL price has increased by 6.58% and is currently finding buyers at the level of $101.73 with a market value of $44.4 billion.

Contents

Solana Outperforms Bitcoin

SOL Price Prediction

Solana Outperforms Bitcoin

According to on-chain data provided by Santiment, Solana (SOL) has displayed one of the most striking performances among altcoins in the last four days and has seen a noticeable rise compared to Bitcoin. SOL has risen above the $102 level during this period, triggering an increase in investor confidence.

In the past 36 hours, the SOL/BTC trading pair has experienced a significant increase of 4.5%, which has been positively received by SOL investors. This increase occurred after a network outage earlier in the week that had caused concern among traders.

While all this was happening, what was initially interpreted as a concerning situation for Solana, the fear, uncertainty, and doubt (FUD) surrounding the outage reflected on the charts as a trigger for the subsequent price recovery and became a periodic low.

In recent days (Tuesday, February 6), the Solana blockchain network faced a 5-hour outage that unsettled its investors. Later, developers released an upgrade to v1.17.20, and after the issue was resolved by validator operators, the network was restarted and the blockchain continued production.

The outage was the result of a problem with the Berkeley Packet Filter (BPF) loader, which is responsible for deploying, upgrading, and executing programs on the Solana network. During the resolution process, updates were made to the BPF-related codes on the development network.

SOL Price Prediction

On January 31, the Solana blockchain reached the highest number of active addresses in its layer-1 network since its inception in 2020, with this number indicating 875,940 users. Additionally, according to data provided by Token Terminal, there was a slight decline in network activity in the first week of February.

Moreover, network activity may have been somewhat affected during the outage event. In the event of an upward movement, the main resistance level for Solana is seen at $110. If SOL can potentially surpass this level, a further 50% rally up to $170 could emerge.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕖𝕒𝕟𝕚𝕖 𝔹𝕒𝕓𝕚𝕖𝕤 - Have Fun Staying Poor](https://cdn.bulbapp.io/frontend/images/17e87f53-0225-4de1-995f-9f66198cb037/1)