CHAPTER II: understanding currency pairs in forex trading

All transactions in the forex market are based on the purchase of one currency for the sale of another currency. So you are trading or exchanging the 2 currencies simultaneously for one another, hence known as ‘currency pairs’.

For example: EUR/USD (Euro & the US Dollar), NGN/USD (Nigerian Nairas & the US Dollar) etc.

There are 100s of currency pairs, including the so called Majors, minors & exotic. It is really important to understand what currency pairs, and how they work before you can start trading Forex.

In this chapter, you will learn everything you need to know about Currency pairs. Let's start!

Types of Currency Pairs

Currency pairs are mainly classified into 3 types:

1) Major Currency pairs: These are the currency pairs that include US Dollar as one of currency in the pair. Almost 85% of the global trading volume is traded in the majors.

Majors include 7 currency pairs: EUR/USD (Euro/US Dollar), GBP/USD (Pound/US Dollar), USD/JPY (US DOllar/Japanese Yen), AUD/USD (Australian Dollar/US Dollar), USD/CHF (US Dollar/Swiss Franc), NZD/USD (New Zealand Dollar/ US Dollar) and USD/CAD (US Dollar/Canadian Dollar).

Since most of the trading is done in majors, so they are highly liquid & it is easier to get in & out of trades. The opportunities to make profits are higher.

EUR/USD (Euro/U.S. Dollar)

- The EUR/USD pair is the most traded pair in the forex market, representing the two largest economies in the world. The Euro is the currency of the European Union, while the U.S. Dollar is the currency of the United States.

USD/JPY (U.S. Dollar/Japanese Yen)

- The USD/JPY pair is the second most traded pair in the forex market. The U.S. Dollar is the world’s reserve currency, while the Japanese Yen is the third most traded currency in the world.

GBP/USD (British Pound/U.S. Dollar)

- The GBP/USD pair is also known as the “cable” and it represents the currencies of the United Kingdom and the United States. The British Pound is the fourth most traded currency in the world.

USD/CHF (U.S. Dollar/Swiss Franc)

- The USD/CHF pair represents the currencies of the United States and Switzerland. The Swiss Franc is often considered a safe haven currency, and it is used as a hedge against inflation and currency fluctuations.

AUD/USD (Australian Dollar/U.S. Dollar)

- The AUD/USD pair represents the currencies of Australia and the United States. The Australian Dollar is often used as a proxy for commodities, and it is heavily influenced by the price of gold and other raw materials.

USD/CAD (U.S. Dollar/Canadian Dollar)

- The USD/CAD pair represents the currencies of the United States and Canada. The Canadian Dollar is often called the “loonie” and it is heavily influenced by the price of oil.

NZD/USD (New Zealand Dollar/U.S. Dollar)

- The NZD/USD pair represents the currencies of New Zealand and the United States. The New Zealand Dollar is often used as a proxy for dairy prices, as New Zealand is one of the world’s largest dairy exporters.

2) Minor Currency Pairs: Minors, also called the cross curreny pairs, contain all the currencies in the major pairs except for US dollar. These include EUR (Euro), GBP (Pound), JPY (Japanese Yen) etc.

Examples: EUR/GBP, EUR/JPY, GBP/JPY etc. As you may have noticed that these are the crosses of all the major currencies excluding US Dollar.

The liquidity & volume are lower than majors, so trading opportunities may be lower than with majors. The volatility also can be higher compared to majors.

3) Exotic Currency Pairs: Exotic Currency Pairs are made from one of the currency from major pairs and other one from the emerging economies like: Brazil, South Africa, Mexico, Russia etc. Examples of such pairs include: USD/BRL (United States Dollar/Brazilian Real), USD/HKD (United States Dollar/Hong Kong Dollar), USD/ZAR (US Dollar/South African Rand), USD/RUB (US Dollar/Russian Ruble) etc.

Exotic Pairs usually don't have high liquidity & trading volume but they have high volatility plus they have high spreads as compared to Major & Minor Pairs.

When choosing which currency pair to trade, you should understand the volatility & the factors which move that pair. For example, a currency pair like EUR/AUD can become very volatile during commodity bull cycles, and also volatile on the other side during global recession fears.

As a beginner Forex Trader, you need to stick to major pairs only as it offers high liquidity and predictable market movements. And your position size should be adjusted according to your account size & the volatility of the underlying pair that you are trading.

Currency Pairs Lingo

While trading forex, you would come across these common terms. We will be explaining all the important terms here.

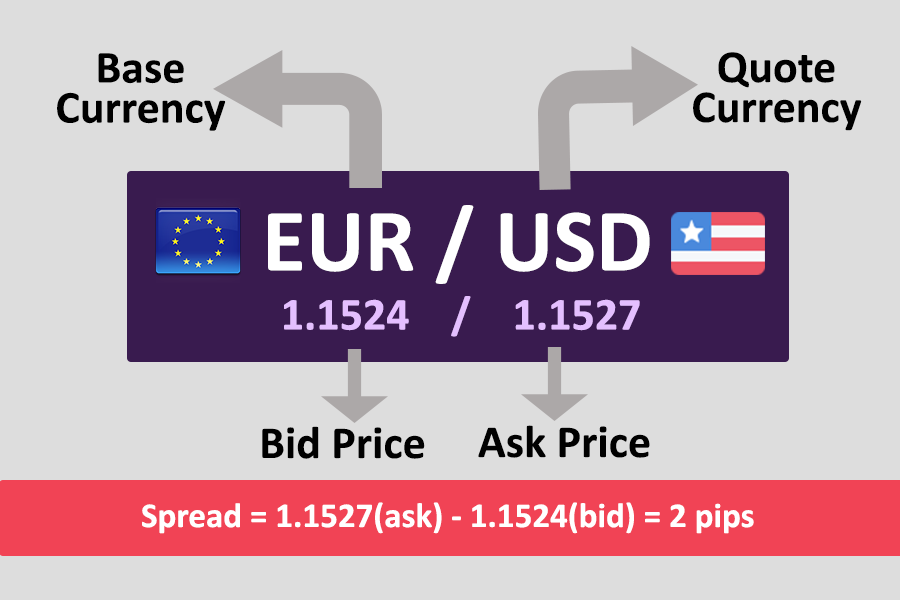

1) Quote by the broker: When you open a trading account with a Forex Broker, they tell you the Bid/Ask price to buy & sell the currency. It will be quoted like this example: EUR/USD 1.2812/15. This price is the quote by the broker.

1) Quote by the broker: When you open a trading account with a Forex Broker, they tell you the Bid/Ask price to buy & sell the currency. It will be quoted like this example: EUR/USD 1.2812/15. This price is the quote by the broker.

2) Pip: Pip is the smallest unit in the currency quote (given by the Broker). It is the last decimal in the price. For Example: In the quote 1.2811 moves to 1.2812, the movement in the last decimal is 1 pip.

3) Bid Price: Bid price is the price at which the broker is willing to buy a currency pair from you. At this price, you can sell base currency in the pair. This price is shown on the left side in the quote ticker by the Broker.

For Example: If you see the quote as EUR/USD 1.2812/15, then 1.2812 is the quote price, and it means that you can sell 1 Euro for 1.2812 US Dollars.

4) Ask Price: Ask price is the price, at which the broker is willing to sell a currency pair to you. At this price, you can buy the base currency mentioned in the pair. It is shown on the right side of the quote ticker by the Broker.

For Example: When you see the same quote as above it had 2 values in it: EUR/USD 1.2812/15, the second value tells you about the Ask price, it means you can buy 1 EUR for 1.2815 Dollars.

5) Spread: Spread is the difference between the Bid & Ask Price quoted to you by the broker. So in above example: in which quote is EUR/USD 1.2812/15, the difference between 1.2815 minus 1.2812 i.e. 0.0003 or 3 pips, is the spread. Spread is the fees charged by forex brokers, so it is essential to choose a forex broker that has lower spread (you should also check the overall fees).

5) Lot Size or Position Sizing: Currencies are traded in the number of units that you want to buy or sell. 1000 units are called 'Micro Lot', 10,000 units are called 'Mini Lot' & 100,000 units are called Standard Lot. For example, if you are trading 20,000 units of Buy EUR/USD, you are trading 2 Mini Lots.

Generally, the broker will mention the minimum lot size for an instrument on their Intrument details page (Trading Specifications). For example, if the minimum contract size for EUR/USD is mentioned as 0.01 lots, this generally means that you can trade 1 Micro lot or 1000 units. Generally, brokers classify 1 Lot as 1 Standard lot, so any decimal is adjusted accordingly.

Margin & Leverage: Forex brokers allow traders to trade on margin. This generally is borrowed money from your broker (in easy term). If your broker offers you 1:1000 leverage for trading currencies, this means, for every $100 in your account, you can trade upto $100,000 of position size.

The margin is derived from the leverage. For example, if the leverage is 1:100, then the margin required to open a position is 1%. It is important to note that this is the margin required to open a position, but if the margin drops below a certain level, then your broker would ask you to deposit more funds to your account to keep your positions open.

But if you still don't deposit the funds, the broker would close all your active positions once the margin drops below a certain level.

So, there are major risks for traders trading forex on margin. We explain this more in the risks section at the end of this guide.