What is Jupiter? How does it drive DeFi adoption on Solana?

Jupiter is a decentralized exchange (DEX) liquidity aggregator on the Solana blockchain, designed to help users discover the "best price." It also incorporates advanced features to enhance accessibility, such as limit orders and Dollar-Cost Averaging (DCA).

Solana supports several decentralized exchanges that provide direct asset swapping services using liquidity pools and automated market makers (AMM). However, liquidity conditions vary between different asset pairs on these exchanges. As a result, the price of the same asset can differ significantly, and liquidity conditions may lead to higher price slippage on some of these exchanges.

Launched in 2021, Jupiter is a platform specifically catered to DeFi enthusiasts on the Solana network. The project claims to save costs, encourage the optimal use of protocols on the network, and promote the adoption of the Solana blockchain in the decentralized finance space.

Jupiter: A DEX Liquidity Aggregator on Solana

According to browser data, Jupiter is one of the most widely used applications on the Solana blockchain. The platform claims to handle a daily transaction volume exceeding $350 million from over 100,000 unique wallets.

Jupiter is a DEX liquidity aggregator tool that connects to various decentralized exchanges (DEXs), providing users with a unified interface to interact with these exchanges. Through these connections, Jupiter can gather essential data such as liquidity conditions between asset pairs, asset prices, and liquidity provider fees. Utilizing this data, Jupiter selects the optimal trading route for users.

Depending on real-world conditions, transactions may be routed through multiple liquidity pools. Each movement is referred to as a "Hop," and a swap transaction may go through up to 3 Hops.

Jupiter claims that its system allows traders to use the tool effortlessly, enhancing efficiency and optimizing resources for each transaction. Its liquidity aggregator tool connects to over 20 DEXs and automated market makers (AMMs) on the Solana network.

However, Jupiter's utility extends beyond direct asset swapping across multiple exchanges. The platform offers several advanced features to enhance the user experience.

Key Features of Jupiter

Let's explore some of the advanced features and what they bring to Jupiter users, as highlighted by Bitcoin Magazine.

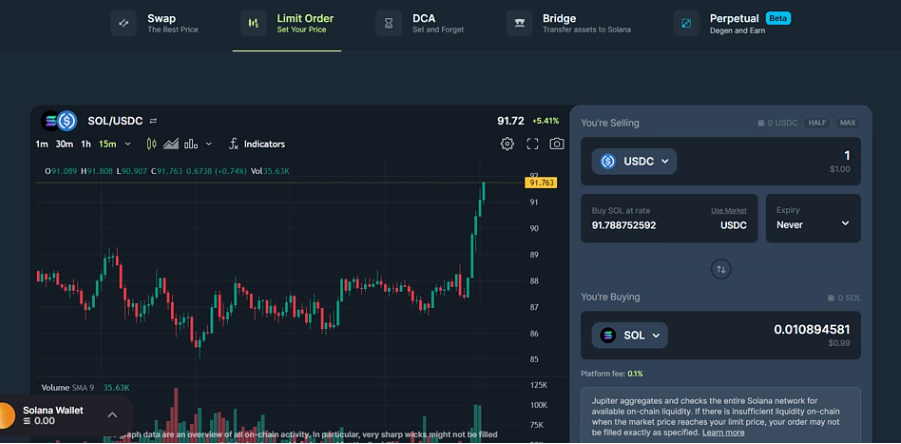

Limit Orders

Centralized exchanges often offer limit orders, allowing traders to set up trades that execute only when certain conditions are met. This system operates seamlessly on centralized exchanges as they utilize order books, recording buy and sell requests for an asset pair. For decentralized exchanges, this is a bit more complex due to the nature of Automated Market Makers (AMMs) and liquidity pools.

On Jupiter, when users place a limit order, the protocol holds the order details, including specified parameters (buy/sell price and quantity), within the protocol. The protocol then fetches prices from supported decentralized exchanges and monitors these changes. When the market price reaches the level set by the trader, it executes the trade. In cases where on-chain liquidity is insufficient, the platform executes the trade in smaller increments until the order is completed.

Jupiter claims that its decentralized limit order feature operates with similar efficiency to centralized exchanges. The only difference lies in the absence of market makers, order books, and centralized control systems.

On average, USD Cost Averaging (DCA) fees are not explicitly mentioned in the provided information.

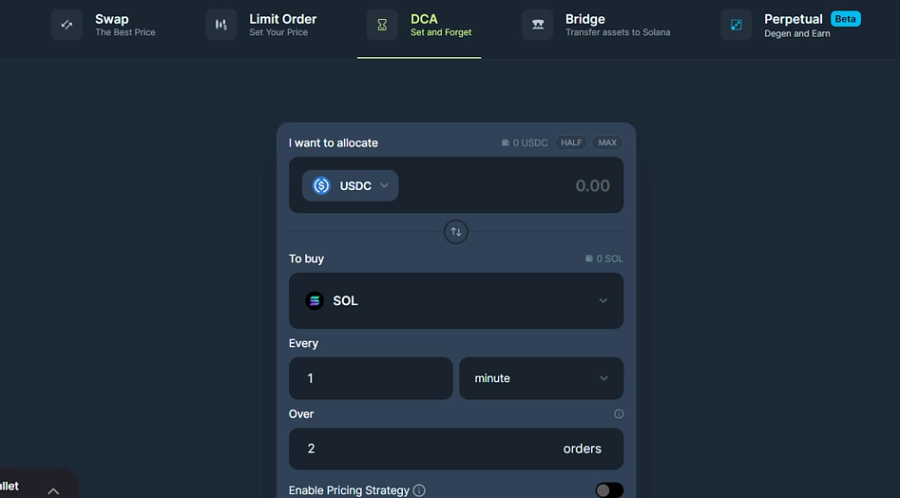

USD Cost Averaging (DCA)

The average USD Cost Averaging (DCA) is a popular method for immediate asset purchases. In this approach, traders divide their buy or sell transactions for an asset over different time intervals. The idea is to increase the trader's chances of capturing highs (for selling) and lows (for buying) rather than executing all trades at once at a single price point.

By using Jupiter's DCA feature, a trader specifies different price levels (or ranges) they wish to buy, along with the amount and time frame for the transaction.

For example, a trader may decide to purchase $1,000 worth of Solana (SOL) over ten days (note that this time frame can be flexible), with $100 each day at specific price levels. The protocol will allocate $1,000 to the DCA program, held in the cash reserve. As each transaction is executed, the assets will be transferred to the trader's wallet. For assets other than SOL, the trader must create an Associated Token Account (ATA) to enable the automatic transfer of purchased tokens to their wallet.

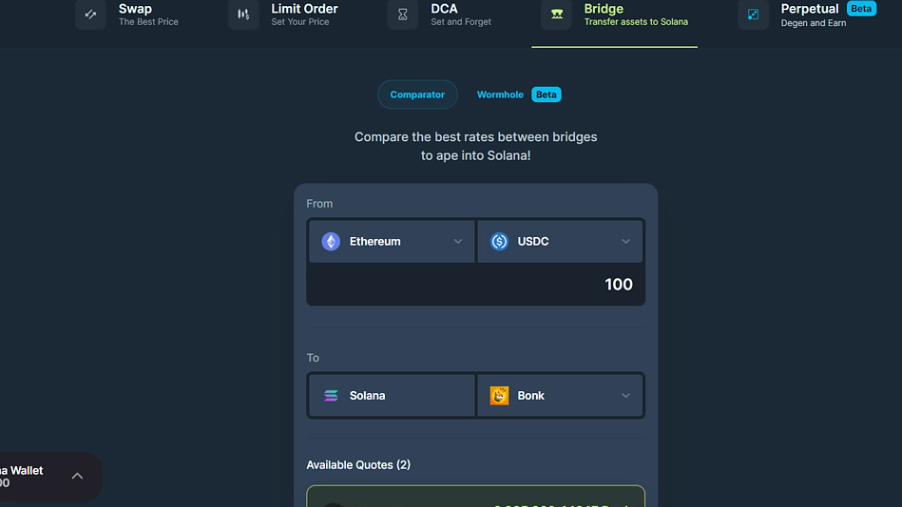

Bridge

Jupiter also functions as a liquidity aggregator for bridges. Operating similarly to the liquidity aggregator for DEX, it cross-references data from supported bridges and provides users with a trading route for assets based on real market conditions. After selecting a route, users are redirected to their preferred bridge to complete the transaction. The bridges supported by Jupiter include Mayan Finance and Debridge.

Jupiter also supports Wormhole for asset bridging. Wormhole is an inter-blockchain messaging protocol that enables communication between blockchains. Currently, Jupiter's bridges are supported by Wormhole, facilitating asset connections between the Ethereum and Solana blockchains.

Permanent Contracts

Traders in the perpetual market permanently bet on the future price of an asset. Jupiter has a decentralized perpetual trading platform where users can open long or short positions with leverage up to 100x. Users can participate as traders or liquidity providers (LP).

Liquidity providers on the derivative trading platform lock their assets into the perpetual cash reserve and earn profits when traders use this capital for their trades. The perpetual cash reserve currently supports 5 types of assets: WBTC, USDT, USDC, SOL, and ETH.

Traders use collateralized assets and receive funds from the perpetual cash reserve based on their collateralized assets and chosen leverage. For example, if a trader uses 5x leverage on collateralized assets valued at $20, the trading capital will be: 20 x 5 = $100.

The perpetual trading platform operates similarly to other centralized derivative trading platforms. However, the leverage funds come from liquidity providers. According to Jupiter, the perpetual trading platform ensures no impact on price, no price slippage, and deep liquidity by utilizing liquidity from LP pools and Pyth network oracles for price data.

Jupiter LFG: Launchpad for Solana Projects

On January 23, 2024, Jupiter announced the launch of LFG, a launchpad for Solana projects.

According to the announcement, LFG will serve as a platform guiding new projects to the market. Jupiter states that the LFG launchpad will receive support from the community and will have no encouraging terms or price discovery systems. Jupiter DAO will oversee the core aspects of the launchpad, including approving projects through community voting.

Approved projects will receive technological support from the Jupiter platform, including a custom launchpool, aggregated liquidity pool, and integration with the bot network that projects can utilize. With the launchpad, Jupiter aims to support new projects and protect buyers from manipulation, FOMO, and rug pulls.

Guide to Swapping on Jupiter

To use Jupiter, visit the platform's official website.

Click on Connect Wallet to link your wallet to the platform.

Users can perform direct swaps, place limit orders, or use the DCA feature for their swap transactions on Jupiter.

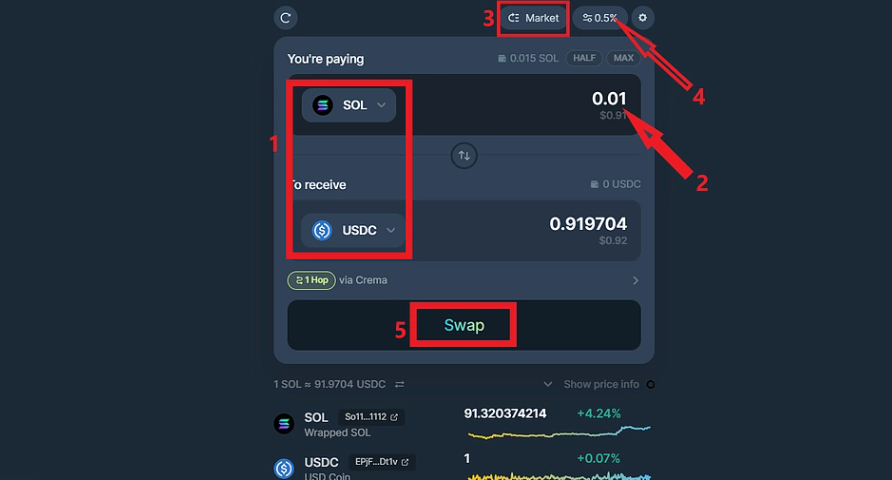

Direct Swap on Jupiter

To execute a direct swap, navigate to the Swap section.

- Select the asset you want to swap.

- Enter the amount you want to swap

3.Click on the Market section on the interface and set the priority level for the transaction.

To expedite the transaction, users can set a higher priority level with a higher fee.

Jupiter Token (JUP)

The Jupiter development team has shared plans for the launch of JUP, the native token of the platform. JUP will not only be integrated into projects but also aims to establish relationships between the development team, initial supporters, and the community.

Through a post on X, the Jupiter development team revealed that the total token supply of JUP will be set at 10 billion and will be evenly distributed between the project team and the community.

The update states that 10% of the total token supply will be used to provide initial liquidity for JUP. The remaining portion of the supply allocated to the development team will be distributed to the 'strategic reserve' and core team members. The development team's tokens will be unlocked after 1 year and distributed over a period of 2 years.

50% dedicated to the community will be committed to reward programs, including airdrops for early supporters and community grants. Upon launch, 15-20% of the total token supply will be put into circulation, with 10% from the upcoming first airdrop and 5% for liquidity provision. According to the development team, this is planned for January 2024.

Jupiter Token Airdrop

The Jupiter team has also shared additional information regarding the community airdrop program. The tokenomics of JUP include a reserve of 40% for community reward programs. According to the development team, there will be multiple airdrop phases, starting with an airdrop of 1 billion JUP tokens in the first phase expected in January 2024.

20% of the airdrop token supply will be evenly distributed to all eligible wallets. Community members active on media platforms will receive a 10% share of the airdrop, while the remaining portion (70%) will be allocated to eligible wallets based on trading volume on the platform.

Users can interact directly with the Jupiter platform or through related platforms to meet the criteria for participating in the airdrop. The development team suggests that token allocation for each wallet will be considered based on the frequency of interaction and total trading volume.

Additionally, there is an OG Bonus program for users who generate at least $10 in trades on Jupiter before the end of March 2022.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)