Analysts Predict Ethereum Will Outperform Bitcoin: Here’s Why!

Analysts Predict Ethereum Will Outperform Bitcoin: Here’s Why!

A recent forecast from K33 Research suggests that Ethereum's price performance is set to surpass Bitcoin in the weeks following the launch of the Ethereum spot Exchange-Traded Fund (ETF) in the United States.

Growing Excitement for Ethereum Spot ETF

Excitement around the upcoming Ethereum spot ETF has been building, with speculation pointing to its launch on July 8. This product is expected to attract a wave of new institutional investors interested in Ether.

Analysts from K33 Research, Ventle Lunde and David Zimmerman, project that the Ethereum ETF could absorb between 0.75% to 1% of the total circulating supply of Ether within the first five months of its market debut.

While the launch of the ETF might trigger a short-term “sell the news” event for Ether, the analysts believe that Ethereum’s favorable supply dynamics will provide it with relative strength over the following months.

Comparing Bitcoin's and Ethereum's ETF Launch Impacts

Bitcoin’s price also faced short-term weakness after the launch of its spot ETF in January 2024, before experiencing significant inflows by March. In contrast, Bitcoin is expected to encounter selling pressure from the distribution of over 141,000 Bitcoins to Mt. Gox creditors starting in early July.

Ethereum's Underperformance and Potential for Recovery

Ether has underperformed Bitcoin over the past year, with Bitcoin gaining the most in the crypto market due to massive inflows—reaching up to $14 billion—into Bitcoin spot ETF products this year.

Lunde argues that the Ethereum ETF will be a strong catalyst for the price performance of the second-largest cryptocurrency throughout the U.S. summer. He also sees the current ETH/BTC price correlation as a “great opportunity for patient traders.”

Market Sentiment and Trading Dynamics

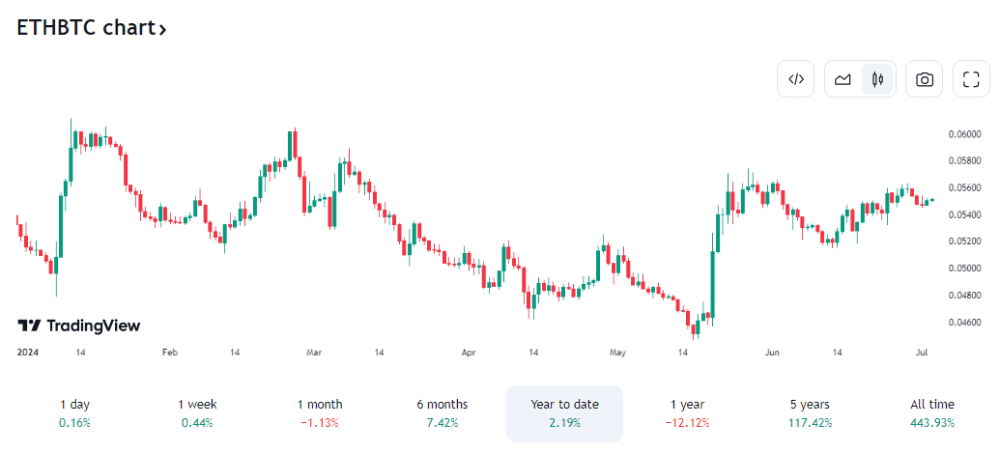

However, the K33 Research analysts note that market participants remain skeptical, pointing to Ether futures trading at a discount relative to Bitcoin futures and the price ratio of 1 ETH being 0.055 BTC according to TradingView data.

This prediction underscores the potential for Ethereum to gain traction and possibly outperform Bitcoin in the near future, driven by institutional interest and the strategic impact of the new Ethereum spot ETF.

Conclusion

The anticipated launch of the Ethereum spot ETF in the U.S. represents a pivotal moment for Ethereum, potentially propelling its price performance above Bitcoin's in the near future. As institutional interest in Ether intensifies, the expected absorption of a significant portion of its circulating supply by the ETF could drive its value higher. While short-term volatility is likely around the launch, Ethereum’s favorable supply dynamics and strong market fundamentals suggest a robust outlook over the coming months.

Moreover, the contrasting impacts of Bitcoin’s ETF launch earlier this year and the looming distribution of Mt. Gox’s Bitcoins underscore the unique dynamics at play in the cryptocurrency market. Ethereum's potential to capitalize on these factors, coupled with the promising catalyst of the ETF, highlights a significant opportunity for traders and investors. This development could mark the beginning of a new chapter in Ethereum's journey, positioning it for substantial gains and a strengthened market presence.

Read too : 3iQ Proposes Canada's First Solana ETF

*Disclaimer:

This content aims to enrich reader information. Always conduct independent research and use disposable income before investing. All buying, selling, and crypto asset investment activities are the reader's responsibility.

![[Honest Review] The 2026 Faucet Redlist: Why I'm Blacklisting Cointiply & Where I’m Moving My BCH](https://cdn.bulbapp.io/frontend/images/4b90c949-f023-424f-9331-42c28b565ab0/1)