Bitcoin Miners Experience Exodus of Assets Ahead of Halving!

What's the halving?

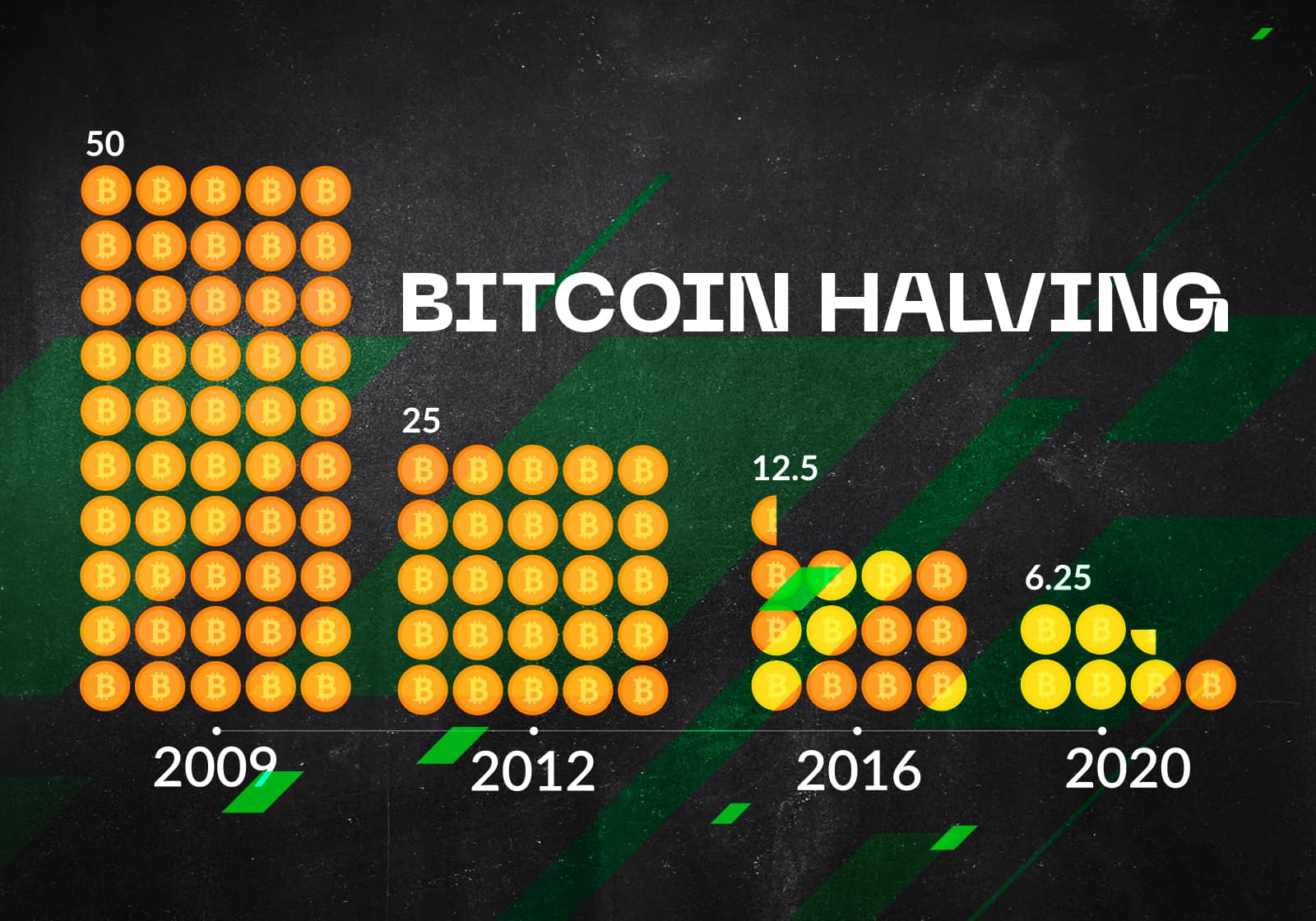

The Bitcoin halving is a pre-programmed event where the reward for mining new blocks and validating transactions is reduced by 50%, causing miners to earn only half of the BTC amount per mined block. Scheduled to occur approximately every four years or every 210,000 blocks, Bitcoin halvings persist until the network produces the maximum total supply of 21 million BTC.

What happens after halving?

When Bitcoin undergoes a halving, the mining reward for a new block is reduced by half. This effectively lowers the rate of new BTC production, thereby decreasing the cryptocurrency's inflation rate. The halving event occurs approximately every four years and is part of Bitcoin's controlled supply mechanism, aiming to limit the total BTC count to 21 million.

The occurrences of Bitcoin halving events draw attention to the cryptocurrency market, including Altcoins. Investors may become more optimistic about the potential price increases of other cryptocurrencies. This excitement can lead to increased investments in Altcoins, consequently driving up their prices. Additionally, as Bitcoin's mining rewards decrease, some miners may shift towards mining Altcoins that offer better rewards.

When the next Halving?

The next Bitcoin halving is anticipated to occur in April 2024. As it is contingent on the block height, providing an exact date is not possible. Given that it happens approximately every 210,000 blocks, the next Bitcoin halving is expected to take place in April 2024, when the block height reaches 840,000.

WHY THAT HAPPENING?

The asset outflows initiated by miners have reached the highest levels in recent years, surpassing 1 billion dollars in value, as tens of thousands of bitcoins (BTC) are transferred to exchanges. CryptoQuant data indicates that the majority of Bitcoin has been moved from the mining company F2Pool. Company analyst Bradley Park states in a Telegram message sent to CoinDesk that the movement is attributed to miners facing increasing costs.

CryptoQuant data indicates that the majority of Bitcoin has been moved from the mining company F2Pool. Company analyst Bradley Park states in a Telegram message sent to CoinDesk that the movement is attributed to miners facing increasing costs. Park points out that the increased internal costs following F2Pool's move to Kazakhstan and the need for miners to upgrade to Bitmain's latest Antminer T21 ahead of the halving are driving these movements.

Park points out that the increased internal costs following F2Pool's move to Kazakhstan and the need for miners to upgrade to Bitmain's latest Antminer T21 ahead of the halving are driving these movements.

F2Pool's hash rate has already begun to increase, indicating that it has started to enhance its capacity. Hashrate is a measure of the computing power of a blockchain, group, or individual.

Miners are organizations that utilize extensive computational resources to verify transactions and secure proof-of-work networks like Bitcoin. The majority of their income is typically derived from rewards automatically given by the networks they mine in the form of tokens.

Historically, miners transferring assets to exchanges has often been observed before price declines, making it a potential indicator. However, this is not always the case, and the correlation's certainty is not guaranteed. For instance, situations can arise where despite increased outflows, Bitcoin price continues to rise, as was the case in August 2019. Currently, analysts note that they do not perceive an extreme bearish signal, attributing the current outflows to the overshadowing effect of the listing of the first U.S. Bitcoin ETFs.

For instance, situations can arise where despite increased outflows, Bitcoin price continues to rise, as was the case in August 2019. Currently, analysts note that they do not perceive an extreme bearish signal, attributing the current outflows to the overshadowing effect of the listing of the first U.S. Bitcoin ETFs.

Accessibility and Contact:

If you wish to learn more, share your thoughts and suggestions, or simply engage in conversation, feel free to reach out to me through the following channels:

Twitter: khubatt.apt

Discord: khubatt

I'm always available on these platforms. Don't hesitate to get in touch. I look forward to answering your questions and interacting with you!

Reference:

TradingView. (2024, Ocak 13). Madencilerin gerçekleştirdiği varlık çıkışları, değeri 1 milyar doları aşan on binlerce bitcoin'in (BTC) borsalara taşınmasıyla son yılların en yüksek seviyesine ulaştı. . https://tr.tradingview.com/news/coindeskturkiye:b3677ce08d9e8:0/

#BitcoinMining #CryptoOutflows #HashrateIncrease #BitcoinETF #MarketAnalysis #BlockchainSecurity #MinersMove #CryptocurrencyTrends #CryptocurrencyInvesting #RiskManagement #CryptocurrencySkepticism #FidelityInvestments #VanguardGroup #FinancialInnovation

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)