Bitcoin Halving History Chart Analysis

Bitcoin Halving History Chart Analysis

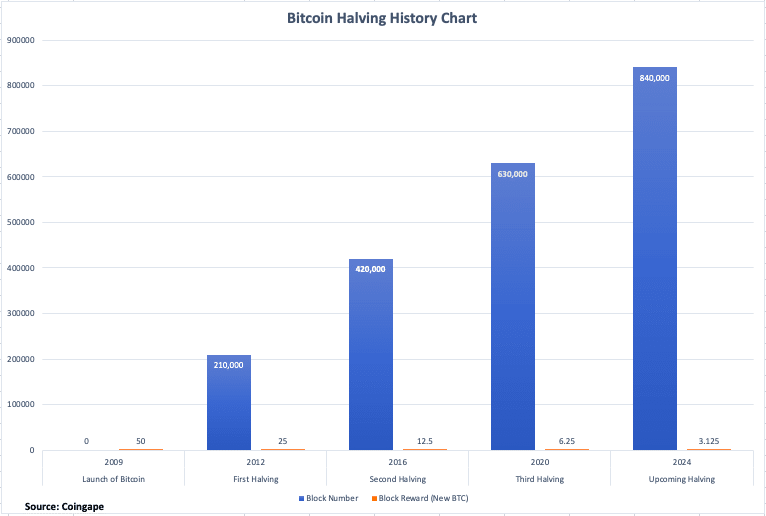

Let's explore the Bitcoin Halving History Chart - a visual representation illustrating halving events and their impact. From there, we can gain a better understanding of Bitcoin's supply cycle model. Table of Contents

Table of Contents

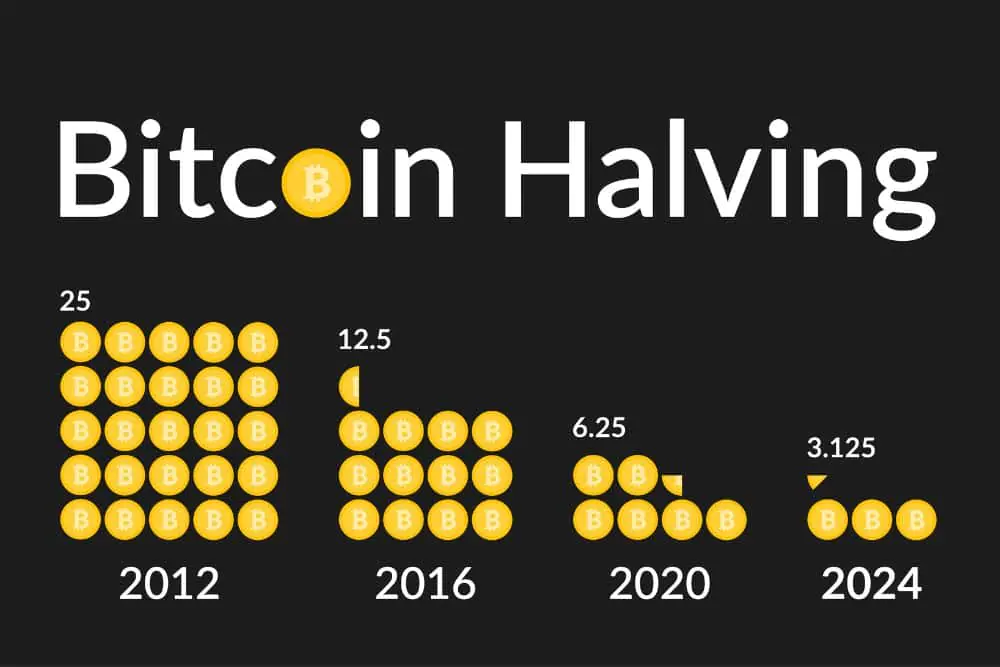

Every four years, the amount of new bitcoins produced is halved on a halving day. This means that during a Bitcoin halving event, the rewards for network defenders are reduced by 50%, directly impacting the rate of new bitcoins entering circulation. The day when the reward is halved is called the halving day. This is a significant event in the cryptocurrency market and has occurred three times since Bitcoin’s inception. Let’s explore the historical halving chart of Bitcoin to understand it better.

What is the Bitcoin Halving History Chart?

The Bitcoin halving history chart visually illustrates the timeline of halving events and their impact. Typically, it displays the halving dates, changes in mining rewards, and often includes the price movement of Bitcoin throughout history. These charts help understand the Bitcoin supply cycle and its market implications. Now, let’s review how the halving days have unfolded over time. Bitcoin Halving

Bitcoin Halving

First Halving – 28/11/2012

Bitcoin’s first halving occurred after the network confirmed 210,000 blocks. Miners’ rewards were reduced from 50 bitcoins to 25 bitcoins per block. At the time of halving, the market price of Bitcoin was $12.20. Following the halving, a bull run ensued, driving the price of Bitcoin to $1,000 by the end of 2013.

Second Halving – 09/07/2016

After four years, the second halving event took place in 2016 upon reaching 420,000 blocks. This led to a reduction in mining rewards from 25 to 12.5 bitcoins per block. Before the halving, there was much volatility in Bitcoin’s price. However, BTC was trading at $650.3 at the time and reached a peak of around $19,188 in December 2017.

Third Halving – 11/05/2020

The third halving event occurred after processing 630,000 blocks. Miners’ rewards decreased from 12.5 to 6.25 bitcoins per block. This event was keenly felt as the leading cryptocurrency increasingly penetrated the financial sector. BTC started at $8,821.42 before quickly rising to $10,943 within 150 days. It reached a record high of $69,000 in November 2021.

The third halving event occurred after processing 630,000 blocks. Miners’ rewards decreased from 12.5 to 6.25 bitcoins per block. This event was keenly felt as the leading cryptocurrency increasingly penetrated the financial sector. BTC started at $8,821.42 before quickly rising to $10,943 within 150 days. It reached a record high of $69,000 in November 2021.

Upcoming Fourth Halving – 2024

According to CoinMarketCap’s prediction, the next halving will occur after processing 840,000 blocks, on April 17, 2024. Miners are expected to see their rewards reduced from 6.25 to 3.125 bitcoins per block. There is much speculation from enthusiasts and investors about how this halving event will impact the market, leading to significant expectations.

Related: Bitcoin History Indicates a Potential Upward Surge Ahead

Conclusion

Historically, each Bitcoin halving has led to an increase in BTC’s value, although there have been differences in magnitude and timing. Halving reduces the rate of new bitcoin creation, leading to a decreased supply that can trigger price appreciation in the market. However, the ultimate outcome may be influenced by various factors such as market psychology, investor behavior, and global financial conditions.