My ChatGPT-Generated Trading Strategies are DEMOLISHING the Market.

When I launched my experiment to test the efficacy of ChatGPT-generated portfolios, I honestly didn’t expect much. ChatGPT is a language model, trained to essentially predict the next word in a sentence, and fine-tuned using reinforcement learning. Moreover, the strategy that ChatGPT generated was extremely simple, involving one buying rule and one selling rule. Imagine my surprise one month later when I saw that my ChatGPT-generated strategies are beating the market. By a lot. The optimized ChatGPT-generated portfolio has a staggering 15% gain in one month.

The optimized ChatGPT-generated portfolio has a staggering 15% gain in one month.

To be clear, these results are not backtest results — they are real-time results obtained from paper-trading. This article will summarize the experiment and give the current, unaltered results as they stand. For a detailed list of all of the articles in the series, check out this article: Recap: The Path to Building A Next Generation Algorithmic Trading Platform.

NexusTrade

AI-Powered Finance. The fastest, most configurable, no-code platform to exist. Express, evaluate, and optimize your…

nexustrade.io

Experimental Overview

The purpose of this experiment was never to prove ChatGPT is secretely a Wall Street trading prodigy. It has always been to showcase the efficiency of generating a portfolio using ChatGPT and deploying it live to the market with the click of a button. Based on the feedback the initial article received, I thought it would be a fun experiment to launch the portfolios and see how they performed. I never expected them to do so well.

The experiment involved 3 very easy steps:

- Log onto NexusTrade and create a free account.

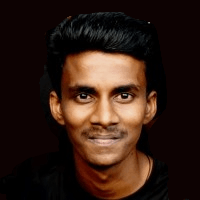

- Generate a portfolio using the GPT-Powered Chat interface

- Optimize the portfolio using Genetic Algorithms directly in the UI.

Creating a trading strategy with AI has never been easier

Creating a trading strategy with AI has never been easier

During this experiment, we wanted to test several different ideas to see how good each of them would do in the market. This included:

- An “un-optimized” ChatGPT generated portfolio

- A ChatGPT-generated portfolio that was optimized at the start of the experiment

- Two ChatGPT-generated portfolios that are re-optimized periodically in slightly different ways.

- A portfolio with “Buy and Hold SPY” as the baseline

During the last update, the portfolios had just started being profitable. Currently, as of November 15th, all optimized portfolios are beyond profitable, and are vastly outperforming the Buy and Hold strategy. Let’s talk about each of these portfolios in detail.

Aside: The New and Improved AI-Powered Chat

Undeniably, NexusTrade’s most powerful feature is its AI-Powered Chat. The chat interface is a lot more interesting than connecting the user to a customer support agent. It allows users to perform financial research, generate trading strategies, and evaluate those strategies using past historical data. Here’s how it works:

- A request comes into the chat

- The request is classified appropriately

- The prompt most relevant to the user’s intent is used to respond to the user

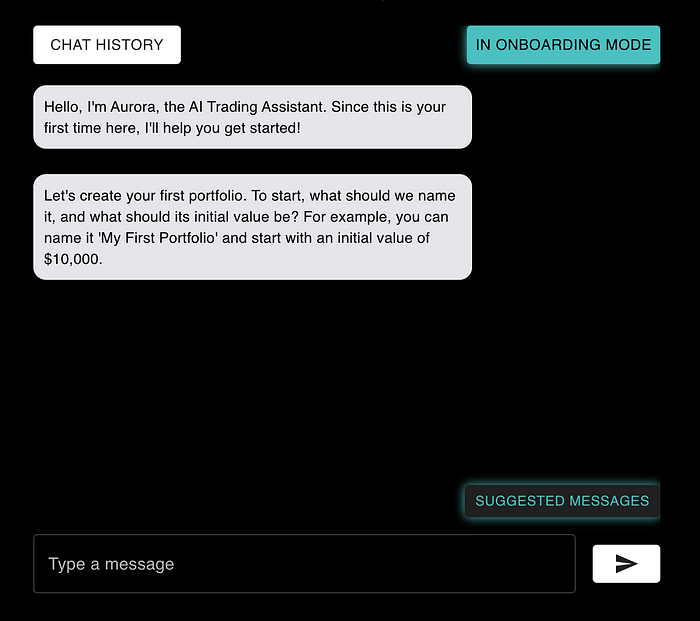

Traditionally, maintaining these prompts have been very difficult. They require code changes, which in the industry, often requires SDLC approval, a long BUILD cycle, and a highly technical user to configure and update. Moreover, many prompts interact with each other, and testing the connectivity between them is problematic. That’s why I’ve started development of a Next-Generation AI Configuration Platform — NexusGenAI. Viewing the NexusTrade application in NexusGenAI

Viewing the NexusTrade application in NexusGenAI

Unlike OpenAI Assistants, which are opaque and abstract a lot of details from the user, NexusGenAI is designed to give users maximum control over their AI Applications. It is a no-code configuration platform that makes it possible for users to create and externalize powerful AI applications. It fully powers the AI interface in NexusTrade.

To get updates for NexusGenAI, subscribe to the newsletter below! A public launch is coming soon!

NexusGenAI

Next Generation Generative AI Configuration. Build your AI Application with no code.

www.nexusgenai.io

Buy and Hold Baseline Portfolio

Buy and Hold Strategy increased 3.5% in the past month

Buy and Hold Strategy increased 3.5% in the past month

The Buy and Hold Strategy is the gold-standard of trading strategies. It’s simple, effective, and outperforms the vast majority of hedge funds in the long-term.

As we can see, this strategy had a modest 3.5% gain over the course of a month. For a purely stock-trading strategy, this is pretty good. But it pales in comparison to every single one of the optimized AI-Generated Portfolios.

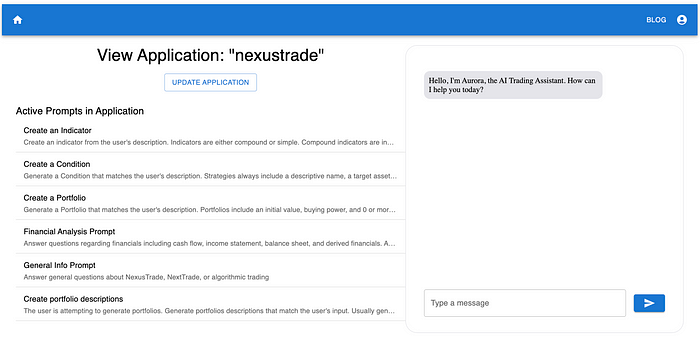

Unoptimized ChatGPT-Generated Portfolio

Pure GPT-Generated Portfolio is underperforming

Pure GPT-Generated Portfolio is underperforming

Boringly, just like in every other past update, the GPT-Generated Portfolio hasn’t made any trades.

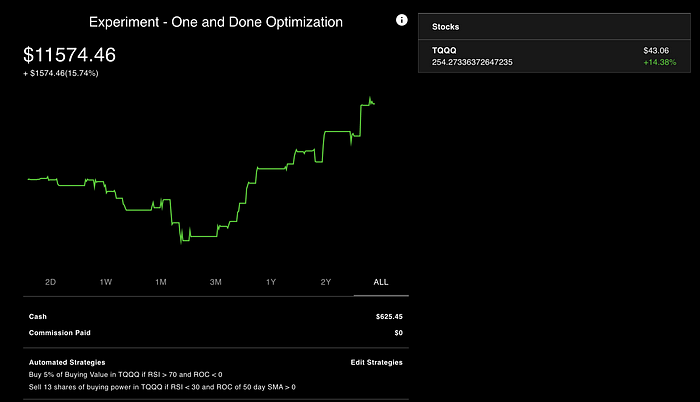

One and Done Optimized Portfolio

The One and Done Optimized Portfolio is performing the best

The One and Done Optimized Portfolio is performing the best

The One and Done Optimized Portfolio was optimized at the beginning of the experiment and never re-optimized. Currently, it has the best performance by far, increasing the value of the portfolio by a staggering 15.7% in the past month. This is over 4 times better than the Buy and Hold Strategy.

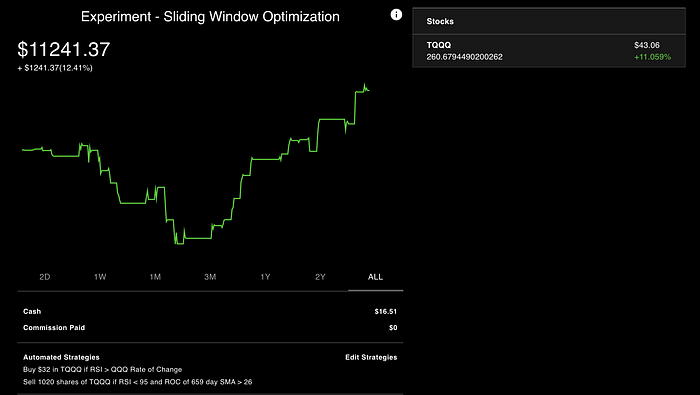

Sliding Window Optimized Portfolio

The Sliding Window Optimized Portfolio is outperforming the market

The Sliding Window Optimized Portfolio is outperforming the market

The Sliding Window Optimized Portfolio was optimized at the onset of the experiment, and is re-optimized every 1–2 weeks. During each re-optimization, both the start date and the end date are incremented so that the model learns to make decisions on the most recent data. The idea is that by re-optimized the portfolio will help the model learn and adapt to an ever-changing environment.

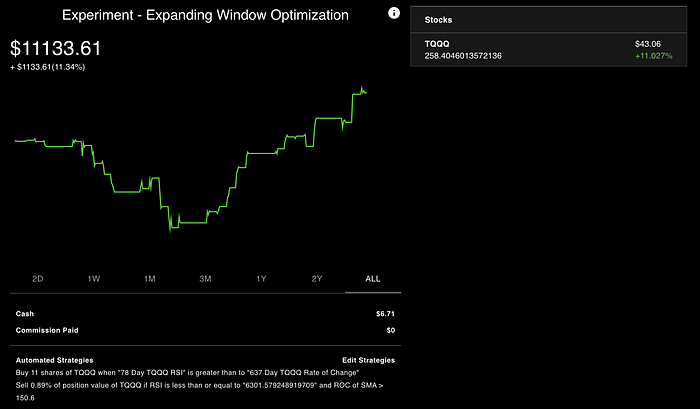

Expanding Window Optimized Portfolio

The Expanding Window Optimized Portfolio is outperforming the market

The Expanding Window Optimized Portfolio is outperforming the market

The Expanding Window Optimized Portfolio was optimized at the onset of the experiment, and is re-optimized every 1–2 weeks. During each re-optimization, only the end date is incremented so that the model learns to make decisions on all available data in the history. The idea is that all past experience in the market matters and the model should try to remember that.

Discussion

As the results above suggest, the optimized ChatGPT-portfolios are currently doing amazing. They are vastly outperforming expectations by a significant margin during real-time paper trading.

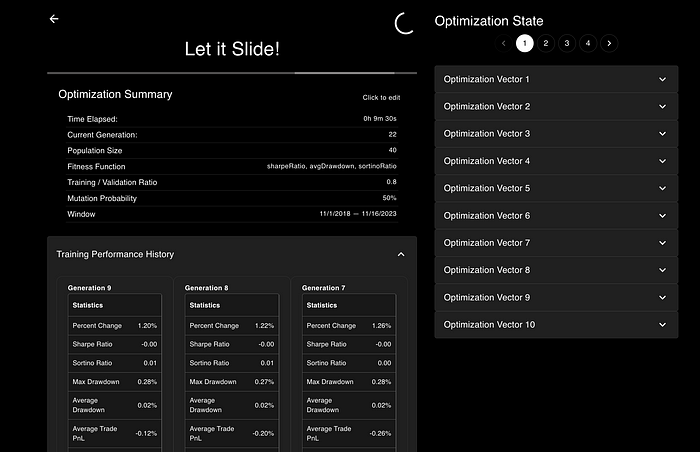

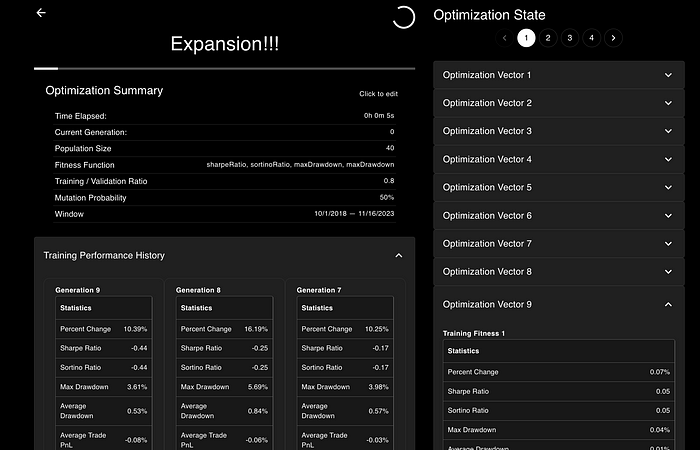

Like in the previous articles, we have to re-optimize the Sliding Window and Expanding Window Optimized portfolios. Because of how well the portfolios are doing, my goal is to try to aim for minimizing the drawdown of the current portfolio. For the optimization settings, this looks like the following: Adjusting the window for the sliding window portfolio

Adjusting the window for the sliding window portfolio

Notice how the fitness functions are the sharpe ratio, average drawdown, and sortino ratio. I’m purposely excluding percent gain in the fitness function in an attempt to convince the model to make less risky decisions. It’ll be interesting to see how this plays out.

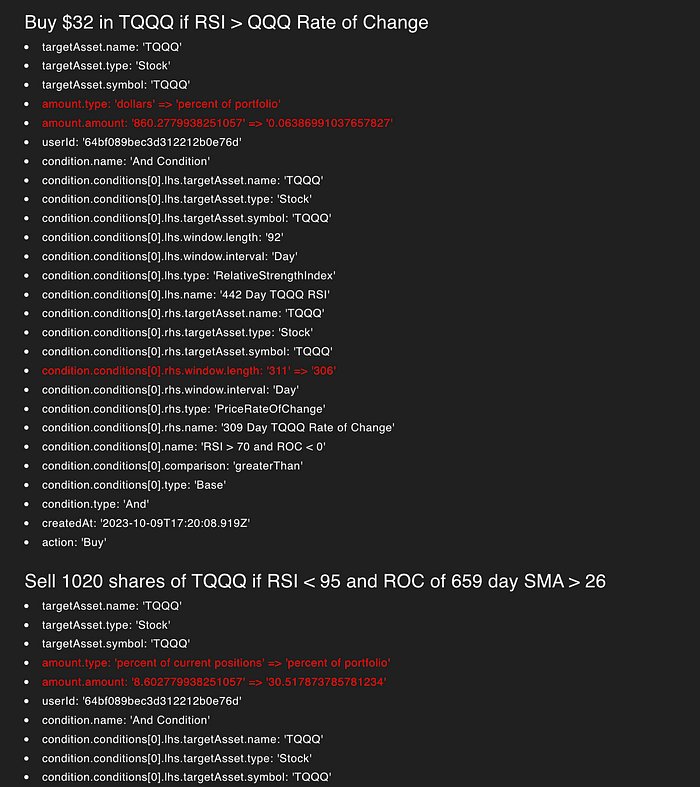

Some of the parameters of the portfolio changed to the following: The change in some of the strategy’s configuration

The change in some of the strategy’s configuration

Similar to the Sliding Window Portfolio, when optimizing the Expanding Window Optimized Portfolio, the goal is minimizing risk in an already successful portfolio. The optimization settings look like the following: Incrementing the end date and attempting to minimize risk in the next optimization

Incrementing the end date and attempting to minimize risk in the next optimization

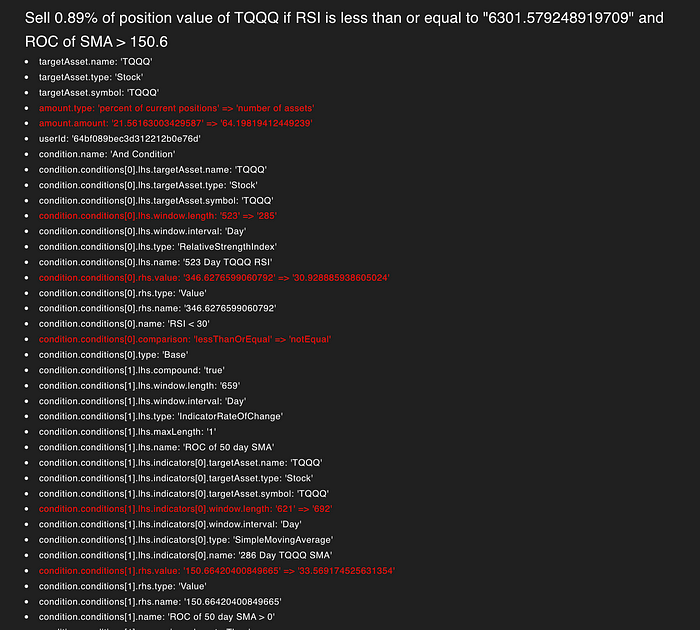

In the end, the genetic optimization process generated the following new portfolio: The change in some of the strategy’s configurations

The change in some of the strategy’s configurations

The advantages of continuous optimization have become clear — if our investment objectives change, then how we choose to optimize our portfolio also changes. On some weeks, we can aim for raw gains and in other weeks, we can try to minimize our risk.

NexusTrade

AI-Powered Finance. The fastest, most configurable, no-code platform to exist. Express, evaluate, and optimize your…

nexustrade.io

Conclusion

AI will revolutionize every industry and finance is no exception. This experiment proves that, at the very least, AI can help augment your trading decisions. It’s too early to conclude that purely AI-generated portfolios are inherently superior, but the mind-blowing thing about this experiment is that these portfolios were generated in just minutes.

Imagine if we paired AI with an expert trader. The trader can generate different strategies across hundreds of lowly-correlated assets. Testing, iterating, and improving their strategies becomes trivial, and the gap between traders using AI and traders not using AI will widen significantly. There’s no way a human-being can match the speed and efficiency of a super-intelligent agent. The world of finance will soon change forever.

Thank you for reading! Stay tuned for our next update on these portfolios. Interested in applying AI to finance? Subscribe to Aurora’s Insights! Want to try out the AI-Chat for yourself? Create an account on NexusTrade today!

NexusGenAI

Next Generation Generative AI Configuration. Build your AI Application with no code.

www.nexusgenai.io

Aurora's Insights

Get the latest information about the AI, Finance, and the intersection between the two.

nexustrade.io

Subscribe to DDIntel Here.

Have a unique story to share? Submit to DDIntel here.

Join our creator ecosystem here.

DDIntel captures the more notable pieces from our main site and our popular DDI Medium publication. Check us out for more insightful work from our community.

DDI Official Telegram Channel: https://t.me/+tafUp6ecEys4YjQ1

Follow us on LinkedIn, Twitter, YouTube, and Facebook.