A Comprehensive Guide to Investing

Demystifying the Maze: A Comprehensive Guide to Investing

Investing can seem like an intimidating world, shrouded in complex jargon and volatile markets. But fear not, aspiring investor! This article aims to be your friendly compass, guiding you through the fundamentals and empowering you to make informed financial decisions.

Unveiling the Investment Landscape:

Understanding Different Asset Classes

Assets

Assets

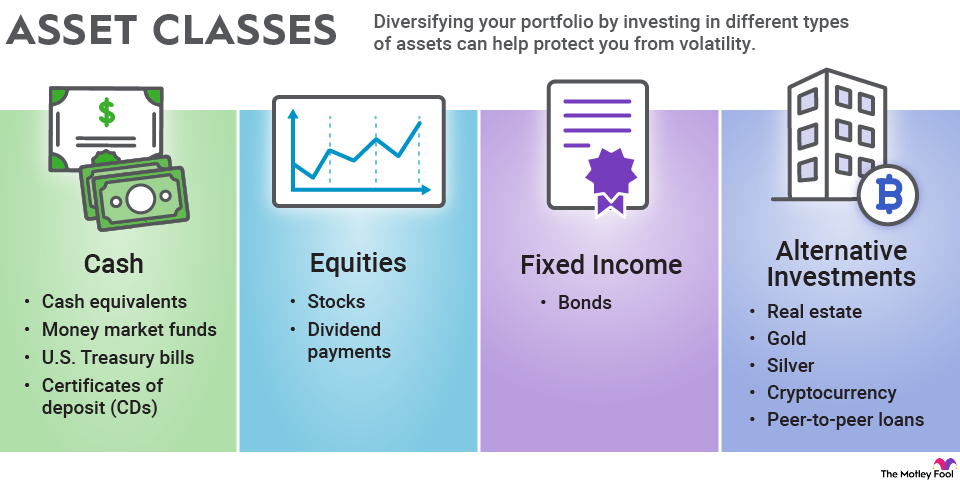

The first step involves navigating the diverse terrain of investment options. Here are some of the most prominent:

- Stocks: Ownership shares in companies, offering potential for capital appreciation through dividend payouts and stock price increases.

:max_bytes(150000):strip_icc()/Primary-Image-how-to-invest-in-web-3-0-in-2023-7480982-787d9b953b4944f9b8ed25a284228269.jpg)

- Bonds: Loans you make to governments or corporations, earning fixed interest payments over a set period.

- Mutual Funds: Pooled investments managed by professionals, diversifying your portfolio across various assets.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but trade like stocks on exchanges, offering lower fees and greater transparency.

:max_bytes(150000):strip_icc()/EFT_final-45a9ca8cf7e948608a3b8dae38b66393.png)

- Real Estate: Investing in physical properties, generating rental income or capital gains through appreciation.

:max_bytes(150000):strip_icc()/realestate.asp-final-5a41bc7692924def8ef81fbf4b6b409a.jpg)

- Commodities: Natural resources like gold, oil, and wheat, subject to price fluctuations based on supply and demand.

:max_bytes(150000):strip_icc()/commodity-4199120-1-911855241479465fb4e4f2f9d9d25c8a.jpg)

Commodities

Each asset class boasts unique risk-reward profiles. Understanding your risk tolerance and financial goals is crucial before diving in.

Charting Your Course: Setting Investment Goals and Risk Tolerance

Before embarking on your investment journey, ask yourself:

- What are my financial goals? (Retirement, education, down payment, etc.)

- What is my investment horizon? (Short-term, medium-term, long-term)

- What is my risk tolerance? (Comfortable with high volatility, seeking stability, etc.)

Your answers will guide your asset allocation, determining the proportion of each asset class in your portfolio. For example, a young investor with a high-risk tolerance might allocate more towards stocks, while someone nearing retirement might prioritize stability with bonds.

Mastering the Tools: Essential Investment Strategies

:max_bytes(150000):strip_icc()/top-investing-strategies-2466844-FINAL-33a6c4fecfc14360837d5daa36c079a7.png) Strategy Examples

Strategy Examples

Now, let's explore some key strategies to optimize your investment experience:

- Diversification: Don't put all your eggs in one basket! Spread your investments across different asset classes and sectors to mitigate risk.

- Dollar-Cost Averaging: Invest a fixed amount at regular intervals (weekly, monthly), regardless of price fluctuations, to benefit from market volatility.

- Rebalancing: Periodically re-adjust your portfolio allocation to maintain your desired risk profile as market conditions change.

- Compounding: Let your returns reinvest and grow over time, maximizing the power of compound interest.

- Long-Term Focus: Avoid knee-jerk reactions to market dips. Remember, investing is a marathon, not a sprint.

Embarking on Your Investment Journey: Resources and Recommendations

Remember, knowledge is power in the investment arena. Here are some valuable resources to equip you:

- Investment books and websites: Educate yourself through credible sources like Investopedia, The Motley Fool, and books by Benjamin Graham or Burton Malkiel.

- Financial advisors: Consider seeking professional guidance, especially for complex investment decisions.

- Online investment platforms: Utilize user-friendly platforms like Robinhood, Vanguard, or Fidelity to manage your portfolio conveniently.

Remember, responsible investing requires discipline, patience, and continuous learning. Start small, stay informed, and don't hesitate to seek professional advice when needed. With dedication and these guiding principles, you'll be well on your way to navigating the investment landscape and securing your financial future.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)