Is There a 'Best' Time to Trade Crypto? Here’s What the Data Says

Is There a 'Best' Time to Trade Crypto? Here’s What the Data Says

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/BFZESAL5LBHA7LHVGFDPLKU3ZE.jpg)

Investing

Is There a 'Best' Time to Trade Crypto? Here’s What the Data Says

Unlike traditional markets, cryptocurrency markets remain open 24/7, even during public holidays.

Intermediate

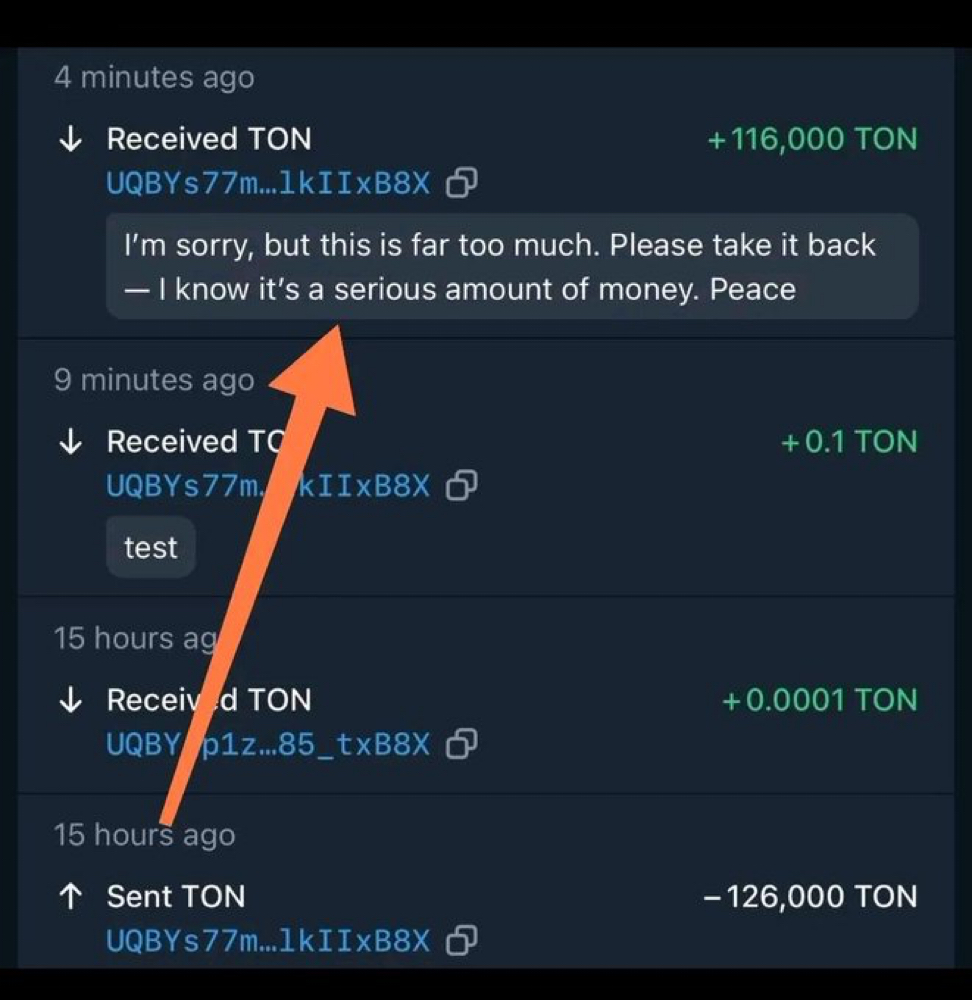

The global and ceaseless nature of cryptocurrency trading poses a number of challenges for traders, one of which is finding the best time to trade.

Those looking to execute large buy and sell orders will need to identify times when there’s maximum liquidity (availability of counterparties at any given time for you to exit or enter a trade) and trading volume (how many times a coin changes hands at a given time). That's just like a grocer with vast quantities of produce to sell will ideally want to set up his stall at the busiest market with the most visitors.Unmute

Sign up for CoinDesk’s Learn Crypto Investing Course.

For novice traders, or those looking to place smaller trades, liquidity is less of a concern. However, they may still want to trade on more established platforms because prices on those apps tend to be less affected by large orders or manipulation.

Finding the right hours to conduct trades is not just a challenge for spot traders (people who buy and sell with immediate delivery of assets,), but also for investors in decentralized finance (DeFi) tokens.

Blockchain transaction fees, such as Ethereum gas fees, can change dramatically from one hour to the next, and so it’s especially important for beginners with small portfolios to pay attention to those prices because gas fees are responsive to network congestion rather than to the size of a trade.

For example, someone looking to trade $100 worth of cryptocurrency may end up paying twice that amount in gas fees if he plans to execute the trade at a busy time.

CoinDesk asked crypto metrics firms, market analysts and professional traders to help illuminate the mysteries around crypto trading and why time matters.

Continental shift

Crypto trading had fairly straightforward patterns before its mainstream adoption began in earnest in mid-2020. Western institutions avoided crypto at all costs, and trading, along with other crypto activities like mining, was concentrated in Asia.

Until 2021, the Asian impact was so significant that bitcoin bulls would fear the Chinese New Year in February when miners would dump bitcoin en masse and send prices tumbling.

But those patterns changed.

“During the 2017 rally, the sunrise in Japan was a big deal for bitcoin prices,” Mati Greenspan, founder and CEO of investment advisory group Quantum Economics, said. “Now that Wall Street is more intimately involved, a lot of the action has shifted west.

“These days the early Asian session is so thin that we suspect some traders may be using it to manipulate the price,” he added.

There’s ample data to suggest that crypto trading activity coincides with traditional market hours in the U.S., illustrating that crypto investment largely shifted from the East to the West.

"Bitcoin spot volume tends to peak during U.S. stock market hours, especially at the opening bell,” William Johnson, an analyst at crypto analytics firm Coin Metrics, said.

According to a Coin Metrics chart shared with CoinDesk, the correlation with the U.S. trading hours was most pronounced in the first quarter of 2022, suggesting a clear evolving trend.:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/QRPYGXJU55CTTF5ZNEPDVDGXHE.png) Bitcoin's spot volume over three years

Bitcoin's spot volume over three years

“Never trust the weekends”

Crypto doesn’t rest on weekends, but the U.S. equity traders are asleep. So what to make of the weekend trading activity?

“Simply put, the weekends have a drop-off in participation by smarter money,” Cantering Clark, a pseudonymous crypto trader and market analyst, said, referring to capital controlled by institutions and professional traders. He explained that there’s a high volume of activity by algorithmic trading bots and market makers (or liquidity providers) during weekends. “The market is less compelling to trade,” he said.

According to a "realized volatility" chart from Genesis Volatility, there's less volatility on weekends. Generally, traders seek volatility because it opens up opportunities for lucrative trades.:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JYZJFKQEENFDVK4NX37MIP6YWU.png) Realized volatility (Genesis Volatility)

Realized volatility (Genesis Volatility)

“Weekends in legacy markets such as forex were always known to be thinner. Knowing this, banks would push the market around to force movements. The same thing can be seen in crypto, so for the longest time the idea was that any weekend activity was ‘wrong’ and worth fading,” Clark said.

If bitcoin rises on a weekend, the expectation among traders is often that the market would move down over the week, Clark explained. “‘Never trust the weekend’ is a good thing to remind yourself.”

Best time for trading DeFi tokens

There’s a great deal of trading activity in DeFi, where traders can tinker with tokens that haven’t been listed by centralized exchanges. But when’s the best time to trade on DeFi, particularly Ethereum?

Transactions on Ethereum cost gas fees, which go up or down in price depending on network use. So that can be a significant factor in optimizing the trade time for traders with smaller portfolios.:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/E27IDJZDMBCQ3IKR6G6RXPHFNI.png) EtherScan display of Ethereum gas fees on October 10, 2022

EtherScan display of Ethereum gas fees on October 10, 2022

In April, 2022, Connor Higgins, a data scientist at Flipside Crypto, told CoinDesk, “If we break down fees by the hour we can see fewer but larger transactions around midnight ET, and more activity around 5 p.m. ET, which used to be the most expensive time to transact.”

“It looks like people have been trying to be clever and transact less around the most active hours of the day. But that just made the less active hours more active and therefore more expensive,” Higgins said, sharing the chart below.:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/O6BB2LXMY5DWRGJV76VYIYSL3M.png) Hourly ETH fees

Hourly ETH fees

As of October, 2022, a heatmap from Anyblock Analytics shows there's still a dip in transactions and therefore gas fees on weekends and that the most expensive time is when the U.S. wakes up to trade. This can be seen below as things start to get darker red (more expensive) around 13:00 UTC, which is 9 a.m. in New York.:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EWWPLXAHXFGFHCVRPD2MGSXL6Y.png) Hourly gas prices by day, averaged over 8 weeks (Anyblock Analytics)

Hourly gas prices by day, averaged over 8 weeks (Anyblock Analytics)

So if you're looking to save on gas fees and your trade isn't time-sensitive, waiting to complete the transaction outside of the hours when the U.S. markets are open is smart.

Centralized and decentralized exchange activity

Because Ethereum runs on a public blockchain, data analytics firms are able to label wallets and track their activities. That also allows them to observe Ethereum-related activity across many centralized exchanges.:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EIRN3QE7LRC5HAPGEH252MRFLY.png) Nansen’s top 20 gas spender chart displayed in British summer time

Nansen’s top 20 gas spender chart displayed in British summer time

According to a top 20 gas spender chart from Nansen, a blockchain analytics firm, trading activity starts to ramp up on both Coinbase and Binance, the two largest centralized exchanges in the world, during the morning hours in the U.S. and peaks at the typical close of business, or early evening.

Yet Nansen’s data journalist Martin Lee pointed out there’s a mirroring trend on the top 20 gas consumer chart that tracks smart contracts in DeFi. Uniswap, the largest decentralized exchange, shows similar time patterns as centralized exchanges.

Although centralized and decentralized exchanges have radically different features (e.g., open order book system versus automated marker makers), they appear to converge around the same time pattern as U.S. trading hours rule them all.

.